Reports

-

Overview of Public Incentives for Methane Abatement Practices in Brazilian Agriculture

This brief will present a comprehensive analysis of the panorama of public incentives related to agricultural methane abatement currently in force in Brazil.

-

Agrifood Transition Plan Assessment Framework

The agrifood sector sits at the heart of both the climate crisis and the pathway to a livable future. Agriculture is a massive global emitter, but also one of the first sectors to feel the heat. From droughts to floods, farmers are already feeling the effects of a changing climate. In order to preserve global agrifood systems, the sector will need to transition to more sustainable and resilient practices.

-

Guidelines for the issuance of thematic labelled financial instruments

The Guidelines for the Issuance of Thematic Labelled Financial Instruments, developed by Latinex in collaboration with the Climate Bonds Initiative and IDB Invest, provide a framework for issuing green, social, sustainable, and sustainability-linked (GSS+) financial instruments in Latin America. By aligning with international standards like the Green Bond Principles (GBP) and the Climate Bonds Standard, the Guidelines aim to enhance market integrity and investor confidence.

-

Transparency & Reporting in the GSS Bond Market

The Transparency & Reporting in the GSS Bond Market Report is a comprehensive study of post-issuance reporting in the GSS bond market, aimed at enabling a healthy and transparent market.

With support from the Inter-American Development Bank (IDB), International Finance Corporation (IFC), Singapore Exchange (SGX Group), The Global Methane Hub and reviewed by S&P Global Ratings. The report assesses GSS deals priced from 2020-2023, totalling USD1.4tn issued.

-

The Transition to Net Zero: Banks Can Do Better

The Transition to Net Zero: Banks Can Do Better

Banks have a pivotal role to play in the net-zero transition. As financial intermediaries, they can steer their customers to plan and implement their own transition by financing and facilitating today for investment in the future. Hence, banks are at the centre of the transition of the economy to net zero.

-

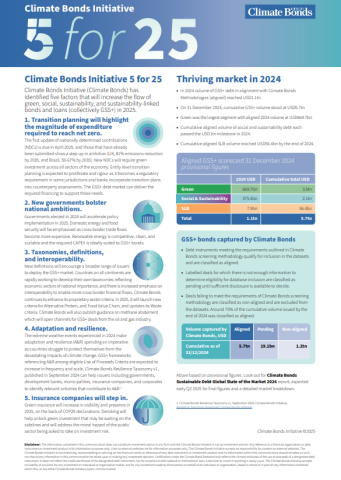

Climate Bonds Initiative 5 for 25

Climate Bonds Initiative (Climate Bonds) has identified five factors that will increase the flow of green, social, sustainability, and sustainability-linked bonds and loans (collectively GSS+) in 2025.

-

A new year's reflection on GX Green Transformation: Three Opportunities in Japan

Japan has demonstrated global leadership through its GX Transformation Plan, a comprehensive strategy addressing climate challenges and promoting sustainable growth. However, as geopolitical tensions rise and the need for domestic regional revitalization grows, it is crucial for Japan’s leadership to outline the next steps to advance this mission.

-

グリーントランスフォーメーション (GX)に関する新年の展望 2025年に向けた日本 の3つの主要な機会

グリーントランスフォーメーション(GX)実現に向けた基本方針によって、日本はグローバルなリーダーシップを確立してきた。新たなリーダーシップは、地政学的リスクの高まりや国内の地方創生 への課題に対応しつつ、このミッションの次なるステップを計画する必要がある。また、LNG(液化天然ガス)のメタン漏洩に関する研究では、輸入に依存し続けることのリスクが高まっていることを示している。このような状況を踏まえ、クライメート・ボンド・イニシアチブ(以下Climate Bonds)は2025年に向けて3 つの政策機会を提示するとともに、LNGに関する科学的な概説を本報告書にまとめた。

-

Repurposing EU Subsides for an Effective Agrifood System Transition to Net Zero

When it comes to climate change, agriculture is one of the biggest elephants in the room. It is a massive emitter – responsible for 11% of the EU’s GHG emissions – but also one of the first sectors to feel the heat. From droughts to floods, farmers are already seeing the effects of a changing climate. The good news? With the right policies and investments, agriculture can go from being part of the problem to a huge part of the solution. That is the message of the latest Climate Bonds policy paper, "Repurposing EU Subsidies for an Effective Agrifood System Transition to Net Zero."

-

Accelerating Green Bonds for Municipalities in South East Asia

With cities on the frontline of climate change, this report analyzes how green, social, and sustainable bonds (GSS+) can help Southeast Asia’s municipalities raise capital to finance climate-resilient infrastructure and drive green, inclusive growth.

-

Sustainable Debt Market Summary Q3 2024

The latest in a leading series of market research reports. By the end of Q3 2024, the Climate Bonds Initiative (Climate Bonds) had recorded cumulative volume of USD5.4tn of green, social, sustainability, and sustainability linked (GSS+) debt in alignment with its screening methodologies. All the key findings are detailed in the Sustainable Debt Market Summary Q3 2024 accompanied by a full breakdown of labelled bond markets.

-

The Role of DFIs in Accelerating the Mobilisation of Green Capital

Meeting global climate and sustainability goals requires significant investment.

The climate transition requires large-scale mobilisation of private capital to transition energy systems, build resilient infrastructure, and develop sustainable communities. By most estimates, global climate finance needs to increase from USD1.3tn to around USD4-7tn by 2030 in order to maintain a 1.5°C pathway.

-

Accelerating Green Capital Mobilisation is Central to the Function of Development Finance Institutions

Meeting global climate and sustainability goals requires substantial investment

The Role of Development Finance Institutions in Accelerating the Mobilisation of Green Capital is a new Climate Bonds report, informed by expert interviews with European DFIs and associated organisations.

Estimates of the annual global climate investment gap vary between USD2.5tn and USD4tn.

-

Financing the climate transition in China’s agri-food systems

The urgency of China’s agri-food system to transition towards net zero and climate resilience is unquestionable. Agri-food systems are responsible for about 21%-37% of global total GHG emissions but also face considerable climate risks which make them a critical factor in both climate change mitigation and adaptation efforts. Furthermore, aligning the climate transition of the agri-food system with the Sustainable Development Goals (SDGs) is crucial to ensure justice and inclusivity especially given the role of the sector as a major employer in rural areas.

-

金融支持中国农食系统气候转型

在全球气候变化挑战日益严峻的背景下,农业与食物系统(简称“农食系统”)作为减缓与适应气候变化、确保粮食安全的关键领域,其重要性愈发凸显。然而,随着气候变化的加剧,农食系统面临着前所未有的挑战,尤其是众多小微主体,如小农户、食品加工商等,他们不仅在生产经营中承受着较高的气候风险,还在资金、技术等方面存在诸多困难。

-

GSS Reporting: Consolidating Credibility

The aligned green, social, and sustainability along with sustainability-linked bonds (GSS+) bond market is on track to break the record USD1tn annual issuance level set in 2021, if achieved aligned cumulative issuance would be comfortably above USD5.5tn by year-end. The evolution of the market both in size and reach increases the importance of ensuring a robust, credible and durable market environment. Climate Bonds Initiative has recently conducted an analysis of post-issuance reporting across the GSS bond market landscape and will soon publish a report, but here are some key findings.

-

Financing the decarbonisation of China’s steel industry: Technology, policy and instruments | 中国钢铁行业脱碳融资:技术、政策和金融工具

This decade is pivotal for the transition of the steel sector towards the targets set out in the Paris Agreement. In China, 78% (730.8 Mt/yr) of the existing coal-based blast furnace capacity will need reinvestment by 2030, demonstrating the magnitude of investment needed to develop and roll out low-carbon steelmaking technologies to transform the sector. Therefore, financial flows must be aligned with a Paris-compatible scenario to avoid lock-in, and be in place for the next investment cycle, given the longevity of steel assets.

-

中国钢铁行业脱碳融资:技术、政策和金融工具 | Financing the decarbonisation of China’s steel industry: technology, policy and instruments

对钢铁行业而言,2020至2030是实现《巴黎协定》气候目标的关键十年。中国现有的煤基高炉产能中,78%(约每年7.308亿吨)需在2030年前进行再投资。为实现低碳转型,钢铁行业需要大规模投资来开发和推广低碳钢铁生产技术。鉴于钢铁资产的寿命较长,这一轮投资周期需避免“碳锁定”效应,即资金流动需与《巴黎协定》气候目标保持一致。

本报告探讨了加速钢铁行业脱碳的技术路径,并阐述了转型金融如何支持钢铁行业脱碳。Financing the decarbonisation of China’s steel industry: Technology, policy and instruments

-

The Treatment of Physical Climate Risks by Central Banks - Insights for the Reserve Bank of India

This paper outlines the initiatives taken by central banks and financial authorities to address climate risk within the financial sector. It highlights the efforts of the Reserve Bank of India (RBI) to engage with regulated entities (REs) on climate risk assessment and disclosure. Drawing on interviews with central banks and literature reviews, the paper discusses challenges such as lack of technical skills, data limitations, and assumptions in climate modelling.

-

Assessing Climate Transition Risks Using Scenario Analysis and Stress Testing - Insights for the Reserve Bank of India

This paper explores the challenges and methods for assessing the financial risks posed by the global transition to a green economy, particularly in the context of India. While decarbonisation is essential to meet the Paris Agreement targets, it could destabilise the economy by causing financial losses to carbon-intensive companies, potentially impacting banks' capital and their ability to lend. The Indian government’s decarbonisation targets, such as achieving net zero by 2070 and increasing non-fossil fuel power, expose Indian banks to transition risks.

-

Mexico Sustainable Debt State of the Market Report 2023

This report aims to analyse and recommend strategies to boost the sustainable finance market in Mexico. It includes an overview of key policies, trends, and investment opportunities in sustainable finance, focusing on thematic bond issuance to fund sustainable projects. The report covers green, social, and sustainability bonds, along with sustainability-linked bonds (GSS+), aligned with Climate Bonds methodologies. It provides a snapshot of the GSS+ debt market as of December 31, 2023.

-

Sustainable Debt Market Summary H1 2024

The latest in a leading series of market research reports has recorded a cumulative volume of USD5.1tn in green, social, sustainability, sustainability-linked bonds (SLBs), and transition bonds (collectively GSS+) as of 30 June this year. Aligned with Climate Bonds dataset methodologies and best practice, these findings are detailed in the Sustainable Debt Market Summary H1 2024 accompanied by a full breakdown of labelled bond markets.

-

The role of policymakers in mobilising private finance to ensure a credible and just transition in steel and cement

This is the decade of change for steel and cement, which as the two largest industrial emitters globally are crucial to the net- zero transition. Steel and cement are pivotal to meeting the Paris Agreement objectives but while fuel substitution can help address emissions from steelmaking, it cannot fully address those from cement.

This paper, prepared for the G20 Sustainable Finance Working Group, examines how policymakers can speed, steer, and simplify the transition of the steel and cement industries to net zero.

-

Developing a Sustainable Finance Taxonomy for Aotearoa New Zealand

This report provides a set of recommendations for the design and development of a Sustainable Finance Taxonomy for Aotearoa New Zealand (‘NZ’ hereafter) developed by an Independent Technical Advisory Group (ITAG) convened by the Centre for Sustainable Finance: Toitū Tahua (CSF). The Climate Bonds Initiative (Climate Bonds) served as a delivery partner for the project and provided technical assistance to the ITAG for the formulation of the recommendations based on the organisation’s experience with other benchmark taxonomies.

-

Fiscal Policy and Sustainable Finance: Enhancing the Role of the Financial Sector in Achieving the Sustainable Development Goals

Authored by Climate Bonds Initiative, the report outlines the approach to integrate climate action into fiscal policies that can be considered by governments to trigger the growth of sustainable finance, highlighting successful measures implemented by the Association of Southeast Asian Nations plus three (ASEAN+3) countries. Amongst the suggestions include developing sustainable finance roadmaps to demonstrate how policies that prioritise climate action connect with real economic activities, and encouraging countries to adopt multi-pronged strategies to drive change.

-

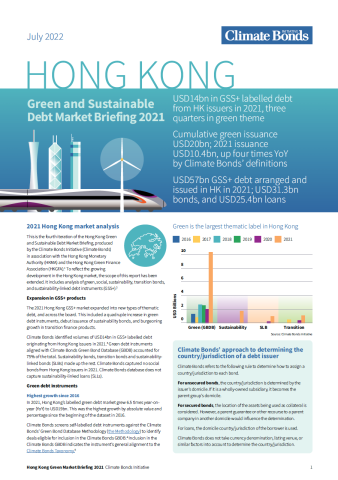

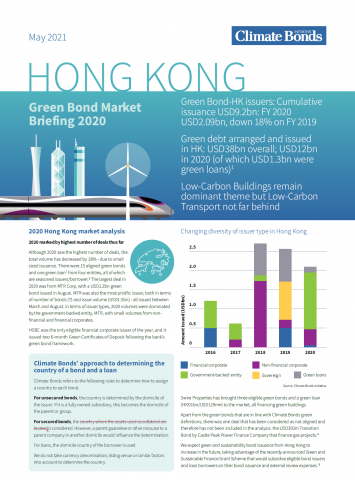

Hong Kong Sustainable Debt Market Briefing 2023

This is the sixth iteration of the Climate Bonds Hong Kong Sustainable Debt Market Briefing, produced by the Climate Bonds Initiative (Climate Bonds), in association with the Hong Kong Monetary Authority (HKMA) and Hong Kong Green Finance Association (HKGFA), and with support from Standard Chartered Bank. Using Climate Bonds’ green, social, sustainability, (GSS) and sustainability-linked bond (SLB) (collectively GSS+) datasets based on place of risk, this series of reports provides a comprehensive overview of Hong Kong’s sustainable debt market at the end of 2023.

-

Quarterly Market Update (Q1 2024)

The latest Quarterly Market Report reveals the first quarter of 2024 was the most prolific on record for sustainable finance volumes. USD272.7bn of aligned green, social, sustainability, sustainability-linked and transition (GSS+) bond volume was added in the Q1 of 2024, 15% more than the USD237.2bn recorded in Q1 2023, and 41% more than the USD193bn from Q4 2023.

-

Transition in Action Agri-Food

This report examines the current state of the AFOLU (Agriculture, Forestry, and Other Land Use) sustainable debt market and identifies key areas for further development to drive systemic change. It delves into how corporates of all sizes along the supply chain can leverage sustainable debt. The report illustrates the application of the latest international disclosure initiatives and guidance from Climate Bonds Sector Criteria, showcasing examples of metrics beyond scope 3 GHG emissions that can be used for green and sustainable debt reporting or for sustainability-linked KPIs.

-

Navigating Corporate Transitions | 企业转型投资指南

Building on the foundational work launched last year, Climate Bonds Initiative, together with International Investor Group on Climate Change (IIGCC), Sustainable Markets Initiative (SMI), and Climate Arc, have released, "Navigating Corporate Transitions: a tool for financial institutions". This paper presents a methodology for a tool designed to aid financial institutions in assessing and categorising corporates by their transition credibility and maturity.

-

2023年中国可持续债券市场报告 | China Sustainable Debt State of the Market Report 2023

本次报告是气候债券倡议组织(CBI)和合作机构共同编写的第八份中国可持续债券市场年度报告,盘点了2023年中国绿色及可持续主题债券市场的发展状况,涵盖了绿色、社会责任和可持续发展债券(GSS)市场以及可持续发展挂钩债券(SLB)市场(统称为GSS+市场)等范围。与仅涵盖绿色债券市场的早期版本相比,本次报告的覆盖范围扩展到了更广泛的GSS+市场,反映了利用中国资本市场为环境和社会举措、项目提供融资支持的市场趋势。

本报告由气候债券倡议组织(CBI)和兴业经济研究咨询股份有限公司(兴业研究)共同编写,并得到渣打银行的鼎力支持。

-

Global State of the Market Report 2023

Climate Bonds’ flagship Global State of the Market Report details the size and substance of green and other labelled bond markets. This, the 13th iteration, includes analysis of the green, social and sustainability (GSS) markets, plus sustainability-linked bonds (SLBs).

-

20 Policy Levers to Decarbonise Buildings in Europe

Over a third of the energy-related emissions reductions needed globally by 2050 are in the built environment. Europe is a beacon for driving sustainability in the built environment, but EU institutions must now focus on making the sustainable finance agenda workable for investors, asset owners and bond issuers.

-

Sustainability-Linked Bonds: Building a High-Quality Market

Climate Bonds releases a full-length report on Sustainability-Linked Bonds (SLBs), which assesses the profile, structural features, KPI performance, and transition plans of SLB issuance, and makes recommendations aimed at growing a credible SLB market. This first of-its-kind report reveals that the sustainability credentials of many SLBs have been weak and require improvement and introduces a best practice checklist for high-quality SLB issuance.

-

Companies and Climate Change

The Climate Change Investment Framework (CCIF) was designed by the Asian Infrastructure Investment Bank (AIIB) and Amundi to tailor investment portfolios that actively consider alignment with the Paris Agreement. The CCIF considers the three dimensions of climate change mitigation and adaptation, and contribution to the transition to net zero. BMI, a Fitch Solutions Company, and the Climate Bonds Initiative (Climate Bonds) have applied the CCIF at a country and sector level (BMI), and an entity level (Climate Bonds).

-

Comparison Study of Chinese and Brazilian Agriculture Criteria: Harmonising Green Standards in the Agricultural Sector

China and Brazil, as prominent global players in agriculture, boast robust collaborations and strategic partnerships in the agricultural trade sector. Both nations, featuring prominently among the top five producers and exporters of agricultural products, face challenges in sustainability and climate-related risks. Recognizing the economic significance of agriculture, China and Brazil have prioritized the development of policies supporting sustainable practices. -

日本のクライメート・ トランジション・ボンド

日本のクライメート・トランジション・ボンド(クライメート・トランジション 利付国債(第1回)。以下、初回債)が厳格なクライメートボンド基準のも とで認証を取得した。これは日本のトランジションファイナンス市場に大 きな発展をもたらすだけでなく、グローバル基準のベストプラクティスを 世界に示すものだ。

ソブリン債で世界初のトランジションボンドとなる初回債の資金使途は、 すでに確立されているグリーン領域のみならず、グリーン・トランスフォー メーションで触媒的な役割を果たす重要な技術開発の領域を網羅して いる。

初回債はクライメート・ボンド・イニシアチブ(以下、Climate Bonds)の認 証を取得し、サステナブル投資に求められる透明性とアカウンタビリティ を満たすものとして、我々のグリーンボンド・データベースに登録される

-

Japan's Climate Transition Bond

Japan is set to issue the first tranche of its ¥1.6 trillion (USD 11 billion) Climate Transition Bond on the 15th and 28th of February. This is a

-

EU Regulation on Deforestation-Free Products: A potential game changer for commodity driven deforestation (Paper II)

The EUDR, in line with EU sustainability and due diligence standards, presents challenges for supply chains, cost control, and trade. Our new report delves into these regulations, offering key insights for investment in this sector.

-

可持续发展挂钩债券数据库 方法论

气候债券倡议组织(Climate Bonds Initiative, CBI)是一个致力于调动全球资本以应对气候变化的国际非营利性组织。

-

Agriculture Sustainable Finance State of the Market 2023 - Brazil Briefing

The report emphasizes the critical role of the agriculture sector in Brazil's transition to a net-zero emissions economy, both in terms of climate change mitigation and adaptation. It underscores the significance of sustainable finance and the commitment of Brazilian entities to invest in sustainable practices.

-

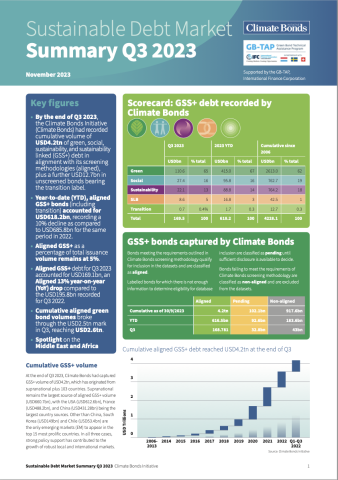

State of the Market Q3 2023

By the end of Q3 2023, the Climate Bonds Initiative (Climate Bonds) had recorded cumulative volume of USD4.2tn of green, social, sustainability, and sustainability linked (GSS+) debt in alignment with its screening methodologies (aligned), plus a further USD12.7bn in unscreened bonds bearing the transition label. Bonds meeting the requirements outlined in Climate Bonds screening methodology qualify for inclusion in the datasets and are classified as aligned.

-

Financing the Corporate Climate Transition with Bonds

The Guide helps corporate issuers to take advantage of sustainable finance markets in advancing the appropriate climate transition journey.

-

Fossil Gas in Taxonomies: What Lies Beneath

In 2023, global methane emission levels in the atmosphere reached record highs, at more than two and a half times their pre-industrial level. One of the major causes identified was the increased extraction, transportation, and utilisation of fossil gas, which cause unintended and often significant leakages of methane (fugitive emissions) across the supply chain.

-

トランジション計画の評価ガイダンス

トランジション計画の評価ガイダンスレポートの日本語版を発行しました。

排出量を削減し、科学的根拠に基づくネット・ゼロへの道筋を達成するためには、強固で追跡可能な戦略とロードマップが不可欠です。

-

European Union Chemical Sector Transition

To build a net zero economy, the world needs to build a net zero chemicals industry. Chemicals are present in over 90% of manufactured goods, and account for a large portion of global emissions.

-

Investment Opportunities: Agri-food sector in Brazil

This report demonstrates how investors can use Climate Bonds Initiative transition frameworks and guidance to scrutinise corporate strategy and identify credible investment opportunities. The focus of the paper is entities operating in the agriculture sector.

-

Cementing the Global Net Zero Transition

Cement production accounts for around 7% of global emissions and it is the second largest global industrial emitter after steel.4 Achieving the goals of the Paris Agreement will be impossible without decarbonising sectors such as cement and yet, the carbon intensity of global cement production has only slightly decreased in recent decades, and it is significantly behind a Paris-aligned pathway.

-

The role of fossil fuels in taxonomies: Canada case study

While the debate over the future content of the Canadian Taxonomy continues in the press, the main stumbling block remains the inclusion of fossil fuels, particularly fossil gas where Canada is the world’s fifth-largest producer. The controversy centers on whether fossil gas should contribute to a decarbonization pathway as an interim or a transitional fuel, or be phased out completely.

-

Japan Policies to Grow Credible Transition Finance

"Japan: Policies to Grow Credible Transition Finance" explores Japan's commitment to delivering the goals of the Paris Climate Agreement and provides policy guidance for Japan’s transition to a net zero future.

-

日本:信頼できるトランジション・ファイナンス発展のための政策

"Japan: Policies to Grow Credible Transition Finance" explores Japan's commitment to delivering the goals of the Paris Climate Agreement and provides policy guidance for Japan’s transition to a net zero future.

-

EU Regulation on Deforestation-Free Products: Guidance and recommendations for corporates and financial institutions (Paper I)

Navigating the complex terrain of deforestation and supply chains, the European Union's Deforestation Regulation (EUDR) can serve as a watershed policy directive. This regulation not only addresses deforestation associated with both legally and illegally sourced commodities but also sets a new benchmark for global sustainability practices.

-

The role of the Chief Financial Officer in driving low-carbon transition

The report is based on interviews with over 30 CFOs representing companies with a combined market capitalisation of USD930bn and reveals that CFOs can play a pivotal role in driving the low-carbon transition. The study is a collaborative effort between the Climate Bonds Initiative and the CFO coalition of the UN Global Compact. Interviews were conducted in the first half of 2023 to gain insights into the intersection of finance and sustainability.

-

Guidance to Assess Transition Plans

A transition plan is a time-bound and trackable strategy and roadmap presenting the plans and actions for reducing emissions with a science-based pathway to net zero.

This paper is designed to provide a complementary and introductory guide to assist stakeholders understand the basic markers of a credible transition plan, however it cannot replace independent in-depth verification and certification.

-

Green Bond Pricing Paper (H1 2023)

The Green Bond Pricing in the Primary Market H1 2023 report is the 16th iteration of a leading series analysing the pricing dynamics of green bonds, examining how these instruments offer pricing advantages for issuers and investors.

-

H1 Market Report 2023

A market update from the Climate Bonds Initiative (Climate Bonds) has revealed that aligned Green, Social, Sustainability, Sustainability-Linked and Transition (collectively GSS+) finance volumes passed the $4trillion mark in H1 2023, reaching a combined $4.2trillion.

-

Latin America and the Caribbean Sustainable Debt State of the Market 2022

This is the third iteration of Climate Bonds Initiative’s State of the Market series for the LAC region. The report describes the shape and size of labelled GSS+ debt issued by LAC domiciled entities to the end of December 2022. The market analysis is enhanced by an overview of key policy developments, trends, guidance, and growth opportunities for sustainable finance in LAC.

-

气候债券标准4.0中文版本

气候债券标准和认证计划已拓展到为非金融企业(在经济中提供货物和服务的企业

-

12 Policies to Unlock Deep Decarbonisation

The decarbonisation of hard-to-abate sectors requires targeted policy support to ensure rapid emissions reduction, avoid stranded asset risks, and develop transition opportunities.

Effective policy support will help to overcome market failures and problems of inertia, increase the green asset pipeline and channel funding to transition the whole economy. Transition policy development will enable countries to develop new green industries, conserve their natural resources, and ensure sustainable growth.

-

Comparison Study Between the Colombian and EU Taxonomies

The purpose of this report is to provide a comparison between the EU and Colombian Green Taxonomy to bring clarity and transparency to EU and international investors about investments that could be considered green in both the EU and Colombia. This will help reduce transaction and research costs for international and EU investors, which will facilitate cross-border financial flows between the EU and Colombia to help achieve a green and sustainable transition.

-

Resilience Taxonomy White Paper

This white paper presents a blueprint for the development of a climate resilience classification framework (hereafter referred to as the climate resilience framework or “the Framework”), with the primary objective of promoting and facilitating the much-needed investment in climate resilience through capital markets.

-

China Sustainable Debt State of the Market Report 2022

This is the seventh iteration of the China Sustainable Debt State of the Market Report.

-

2022年中国可持续债券市场报告

本次报告主要盘点了截至2022年末中国绿色及可持续主题债券市场的发展状况,涵盖了绿色、社会责任和可持续发展债券(GSS)市场以及可持续发展挂钩债券(SLB)和转型债券市场(统称为GSS+ 市场)等范围。

-

Hong Kong Green Sustainable Debt Market Briefing 2022

This is the fifth iteration of the Hong Kong Green Sustainable Debt Market Briefing, produced by the Climate Bonds Initiative (Climate Bonds) in association with the Hon

-

Property Certification Opportunities in Tokyo

One of the most pressing challenges facing Tokyo is its energy consumption. The city is heavily dependent on fossil fuels, which contribute to greenhouse gas emissions and exacerbate the impacts of climate change. To reduce its carbon footprint and minimise pollution, Tokyo needs to invest in sustainable infrastructure. This will not only reduce the city’s carbon emissions, but also create new opportunities for local businesses and job growth.

-

ガス火力発電の隠れた排出量 - True Story of Methane in Japanese

天然ガス(温室効果ガスのメタンを主成分とする化石燃料)への投資には大きなリスクがあり、パリ協定の目標達成の脅威となっている。ガス火力発電による温室効果ガス(GHG)排出量が、これまで認識されていたよりもはるかに石炭火力発電の排出量に近いことが明らかになっている。化石ガスの成分の大部分はメタンで、メタンはCO2の84倍の温室効果を有する温室効果ガスである。そのため、ガスシステム全体でのメタン漏洩が、気候目標達成の大きな脅威となっている。

-

1.5℃目標に向けた持続可能な金融政策 - Executive Summary in Japanese

このガイドは、政府、規制当局、中央銀行の政策立案者がネット・ゼロへの移行を促進するために利用できる 101 の政策手段のツールキットを提供します。

-

Q1 2023 Market Update: Sustainable debt shows recovery

Climate Bonds Initiative recorded green, social sustainability, sustainability-linked, and transition (collectively GSS+) debt of USD204.8bn for Q1 2023, a 17% increase compared to the prior quarter, but a 21% YOY drop against Q1 2022. By the end of March 2023, the Climate Bonds had recorded lifetime GSS+ of USD3.9tn since market inception in 2007, as recorded in a new report.

-

Concrete policies to underpin the cement transition

The cement industry contributes significantly to CO2 emissions. It is the second-largest industrial emitter, accounting for approximately 7% of global CO2 emissions, and demand for cement is predicted to increase over the coming decades. Cement is a critical input for many activities, including buildings and infrastructure, and is a key material in the net-zero transition.

-

Colombia Sustainable Finance State of the Market 2022

This report identifies sustainable investment opportunities in Colombia in accordance with the Colombian Green Taxonomy and the potential for green and other thematic instruments to attract investment to the country. The report describes the shape and size of the local green, social, sustainability, and sustainability-linked (GSS+) debt market. It overviews supporting policy developments and milestones over the last decade.

-

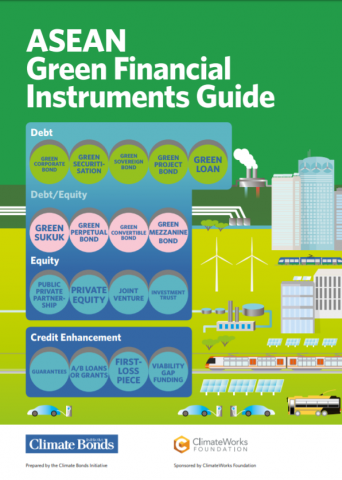

ASEAN Sustainable Finance State of the Market 2022

As the sustainable debt market has grown, the scope of this report has expanded, and now includes analysis of the green, social, and sustainability (GSS) bond and loan markets, plus sustainability-linked bonds (SLBs) and sustainability-linked loans (SLLs) and transition bonds, collectively described as thematic or GSS+ debt.

-

Global State of the Market Report 2022

Climate Bonds’ flagship global State of the Market Report details the size and substance of green and other labelled bond markets. This, the 12th iteration, has been extended and now includes analysis of the green, social and sustainability (GSS) markets, plus sustainability-linked bonds (SLBs), and transition bonds. The publication represents the most extensive analysis available in the labelled finance space with features on taxonomies and sovereign bonds.

-

Brazil Sustainable Securitisation State of the market Q3 2022

The report aims to provide an overview of the Brazilian sustainable asset-backed securities (ABS) market, its regulatory foundations and case studies, as well as highlighting opportunities to channel investment in

-

气候债券倡议组织 绿色债券数据库 方法论

Climate Bonds Initiative screens self-labelled debt instruments to identify bonds and similar debt instruments as eligible for inclusion in the Climate Bonds Initiative Green Bond Database (the Database).

The screening references the Climate Bonds Taxonomy, albeit using a modified sector list rather than the taxonomy indicators. This document provides information on the approach and the database maintenance process.

-

Companies and Climate Change

This report presents the research application of the Asian Infrastructure Investment Bank (AIIB) - Amundi Climate Change Investment Framework (CCIF). The CCIF aims to provide investors with a benchmark tool for assessing an investment, at the issuer-level, in relation to climate change-related financial risks and opportunities.

-

101 Sustainable Finance Policies for 1.5°C

This guide provides a toolkit of 101 policy levers available to government, regulator, and central bank policy makers to facilitate the transition to net zero.

The climate transition challenge is encapsulated by 1.5°C. Behind the number is a wealth of clear scientific evidence that shows it is a goal we cannot miss.

-

Green Bond Pricing in the Primary Market: H2 2022

The Green Bond Pricing in the Primary Market H2 2022 report is the 15th iteration of a leading series analysing the pricing dynamics of green bonds, examining how these instruments offer pricing advantages for issuers and investors.

-

Scaling Credible Transition Finance - ASEAN Edition

To reach net-zero greenhouse gas (GHG) emissions by 2050, entities operating in most sectors must undergo a major transformation. The key tool that will enable this transformation is the development of a transition plan that is science based, coherent, comprehensive, transparent and covers all material scopes of emissions and business activities.

-

Sustainable Agriculture Brief

Agriculture is a dynamic and complex system, composed of countless particular characteristics that defy standardization and common definitions. Hundreds of cultivated crops and a wide array of systems and practices are employed in different geographical locations with diverse social, environmental and economic landscapes.

-

中国转型金融研究报告:债务工具支持电力行业低碳转型2022

气候债券倡议组织(CBI),华夏理财有限责任公司和香港中文大学(深圳)联合发布《中国转型金融研究报告:债务工具支持电力行业低碳转型》。本报告聚焦电力行业,分析了中国国内电力行业低碳转型过程中的机遇与挑战,梳理了支持电力行业转型相关的融资模式发展,重点关注转型债务工具的市场的发展和市场的现状,并对如何通过可信的转型框架为中国电力行业低碳转型提供融资支持给出了相关建议。

-

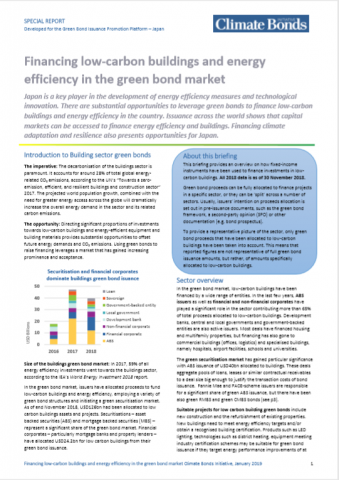

Japan Green Finance State of the Market - 2021

The Institute for Global Environmental Strategies (IGES) and the Climate Bonds Initiative (CBI) has published the 'Japan Green Finance State of the Market - 2021'. The following is a summary of the report.

-

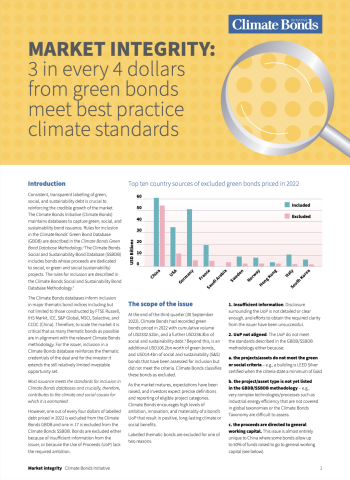

3 in every $4 dollars of green bonds issuance meets standards

This first-of-its-kind report reveals onne out of every four dollars of labelled debt priced in 2022 is excluded from the Climate Bonds Green Bond Database (GBDB) and one in 17 is excluded from the Climate Bonds Social and Sustainability Database (SSBDB), Climate Bonds Initiative reveals.

-

A Fork in the Road for the global steel sector

The global steel sector has reached a fork in the road. Before 2030, 71% of existing coal-based blast furnaces (1090 Mt) will reach the end of its lifetime and require major reinvestment. As the next investment cycle won’t happen for another two decades, this means that this decade provides the critical opportunity for steel to transition to a more sustainable sector.

This policy paper included as part of the Climate Bonds Steel Package provides guidance to policymakers and regulators about how to guide industry and investors onto a climate-aligned pathway for steel.

-

全球可持续债券市场2022年第三季度概览

据气候债券倡议组织(CBI)统计,截至2022年9月30日,全球绿色、社会责任、可持续发展、可持续发展挂钩和转型债券(GSS+债券)的累计发行量已达3.5万亿美元;其中,符合CBI 定义的绿色债券累计发行量已突破2万亿。GSS+债券市场已拓展至全球,遍布98个国家和地区。 本季度报告梳理了各标签市场的进展, 并聚焦中东和非洲地区。

-

5 passos para 5 trilhoes

O mercado de títulos verdes expandiu rapidamente e até o final do terceiro trimestre de 2022 ultrapassou 2 trilhões de dólares. Entretanto, para haver uma contribuição substantiva para enfrentar os riscos severos das mudanças climáticas, precisamos ver pelo menos 5 trilhões de dólares de emissões anuais a partir de 2025. Temos o capital global adequado disponível, e o rápido crescimento do mercado até o momento demonstrou o apetite para movimentar este capital. A Climate Bonds Initiative vê cinco ações coletivas para alcançar os 5 trilhões por ano.

-

5 passos para 5 bilhoes

El mercado de bonos verdes se ha expandido rápidamente hasta superar los 2 billones de dólares a finales del tercer trimestre de 2022. Sin embargo, para contribuir de forma substancial a hacer frente a los graves riesgos del cambio climático, necesitamos conseguir al menos 5 billones de dólares por año de emisión anual a partir de 2025. Disponemos de suficiente capital global, y el rápido crecimiento del mercado hasta la fecha ha demostrado el apetito por mover capital. Climate Bonds Initiative contempla cinco acciones colectivas para alcanzar los 5 billones anuales.

-

Guidelines for Financing a Credible Coal Transition

Over the past months, Climate Bonds has been working with our partners at CPI and RMI to create guidelines for credible coal phase out projects in an effort to facilitate the rapid transition to clean energy globally. The draft guidelines are now available for public consultation now

-

5 steps to $5trillion by 2025

The green bond market has quickly expanded to pass USD2tn by the end of Q3 2022. However, to make a substantive contribution to addressing the stark risks of climate change we need to see at least USD5tn a year of annual issuance from 2025. We have adequate global capital available, and the rapid market growth to date has demonstrated the appetite for capital to move. Climate Bonds sees five collective actions to reach the annual USD5tn per annum. We need to expand, step-up, implement and move rapidly on the points listed in this manifesto.

-

Q3 2022 Market Summary

Climate Bonds’ Market Intelligence returns with another iteration in its quarterly review series. Climate Bonds screens self-labelled bonds issued globally and only includes bond issuance demonstrating climate ambition aligned with the Paris Agreement in its

-

Companies and Climate Change Report

Launched in September 2020, the AIIB - Amundi Climate Change Investment Framework (CCIF) equips investors with a benchmark for assessing investments against climate change-related financial risks and opportunities.

The CCIF translates the three objectives of the Paris Agreement into fundamental metrics that enable investors to assess an issuer’s level of alignment with climate change mitigation, adaptation and resilience, and low-carbon transition objectives.

-

101 sustainable finance policies for 1.5°C

Policymakers can grasp the opportunities posed by the net-zero transition. They can direct capital to meet sustainable development needs and deliver the most urgent mitigation and adaptation projects.

-

5 Passos Para 5 Trilhoes

El mercado de bonos verdes se ha expandido rápidamente hasta superar los 2 billones de dólares a finales del tercer trimestre de 2022. Sin embargo, para contribuir de forma substancial a hacer frente a los graves riesgos del cambio climático, necesitamos conseguir al menos 5 billones de dólares por año de emisión anual a partir de 2025. Disponemos de suficiente capital global, y el rápido crecimiento del mercado hasta la fecha ha demostrado el apetito por mover capital. Climate Bonds Initiative contempla cinco acciones colectivas para alcanzar los 5 billones anuales.

-

Green Bond Pricing in the Primary Market H1 2022

The Green Bond Pricing in the Primary Market H1 2022 Report, this is the 14th report in our pricing series, in which we observe how green bonds perform in the primary markets. This report includes green bonds issued in the first six months of 2022 (H1 2022) and in a first time analysis we saw greenium emerge for Sustainability-Linked Bonds (SLBs), covered in the spotlight section of this report.

Webinar:

-

Peru Sustainable Finance State of The Market 2022

Peru Sustainable Finance State of The Market: Green, social and sustainability and sustainability-linked (GSS+)

-

Estado del Mercado de Finanzas Sostenibles en Perú 2022

'Estado del mercado de finanzas sostenibles en Perú 2022: los bonos verdes, sociales, sostenibles y relacionados con la sostenibilidad (GSS+) que se originaron en Perú aumentaron en 2021 y alcanzaron los USD 4800 millones, según el último reporte de Climate Bonds Initiative, producido en asociación con LAGreen Fund. El informe identifica oportunidades de inversión verde y sostenible en el país y trae las últimas cifras del mercado sobre la forma y el tamaño del mercado de deuda GSS+ peruano.

-

Social & Sustainability Bond Database Methodology

Climate Bonds is expanding its data analysis capabilities with the launch of a Social and Sustainability Bond Database (SnS DB), in keeping with the diversifying labelled bond market. The new database will complement the existing Climate Bonds Green Bonds Database, an internationally authoritative source of best practice green debt product data.

-

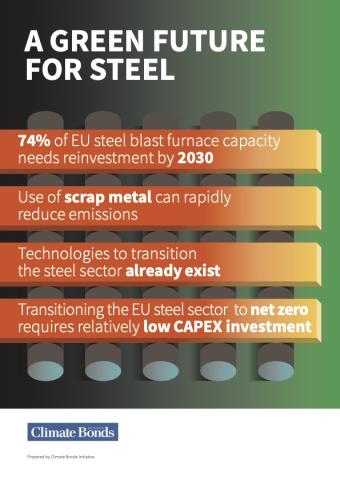

A Green Future for Steel

Download the steel policy paper here.

To achieve the Paris Agreement goals, all sectors of the economy must rapidly decarbonise. Greater attention is now being paid to the so-called hard-to-abate sectors such as steel. This paper examines the policies required to accelerate the EU steel industry transition to net zero.

-

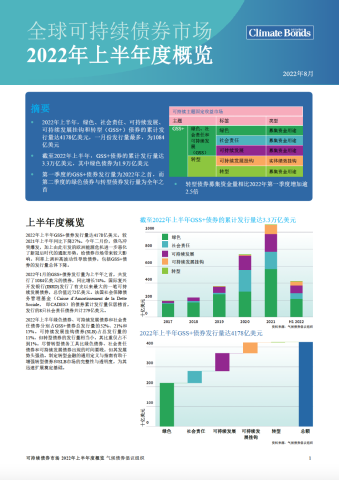

2022年上半年全球可持续债务市场进展报告

2022年上半年全球可持续债务市场进展报告

-

Taxonomy Roadmap for Chile

Taxonomy Roadmap for Chile

-

Hoja de Ruta para una Taxonomía en Chile

Hoja de Ruta para una Taxonomía en Chile

-

Sustainable Debt Market Summary H1 2022

Our latest market update shows that Green, social, sustainability, sustainability-linked, and transition (GSS+) labelled debt reached a combined volume of USD417.8bn in the first half of 2022 (H1 2022), representing a year-on-year (YoY) decrease of 27% against H1 2021. However, signs of a revival emerged as green issuance picked up in Q2, increasing by 25% on Q1 volumes with a total of USD121.3bn.

-

Discussion Paper: Certification of Short-Term Debt

Green finance has typically been the realm of the global bond, loans, and other long-term markets, amassing almost $2trillion in volume to date. However, to direct larger capital flows towards climate solutions, investors must be able to easily identify all types of green finance instruments. The estimated USD55trillion value of global short-term debt markets offers an enormous pool of capital, on top of the global bond market, in which green finance can expand.

-

Hong Kong Green and Sustainable Debt Market Briefing 2021

The Climate Bonds Initiative, in partnership with HSBC, and supported by HKMA and HKGFA, presents the Hong Kong Green and Sustainable Debt Market Briefing 2021.

The briefing offers leading analysis of green, social, sustainability, transition bonds, and sustainability-linked debt instruments (GSS+) in the region.

Download your copy NOW!

-

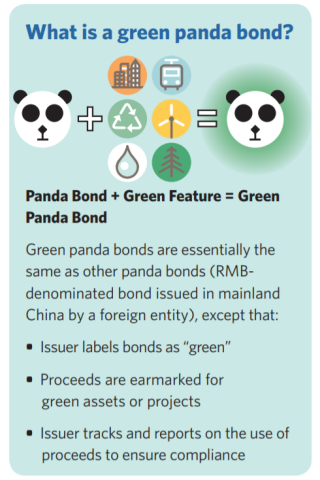

China Green Bond Market Report 2021

China is very likely to reach its carbon peaking goal before 2030. The momentum seen in its 2021 green bond issuance will continue to support that. However, green and sustainable financing in China needs to further accelerate on a larger scale to provide the funding required to reach the 30·60 targets.

Learn more about the Green Bond market development in China in this new report produced by Climate Bonds Initiative and China Central Depository & Clearing Co. Ltd Research Centre (CCDC Research), with the support of HSBC.

Download your copy NOW!

-

中国绿色债券市场报告2021

中国在2030年前实现碳达峰是可行的。2021年,中国绿色债券发行量的迅猛增长有力地印证了其加快碳减排工作的雄心; 而实现中国宏大的 “双碳” 目标还需要加快绿色和可持续的投资并进一步壮大其规模。

气候债券倡议组织(CBI)与中央国债登记结算有限责任公司中债研发中心在汇丰银行的鼎力支持下联合发布《中国绿色债券市场年度报告2021》。本报告旨在总结截至到2021年底中国绿色债券市场的发展亮点,并对市场发展趋势做出展望。

-

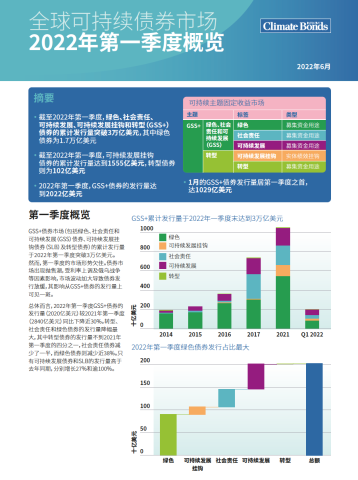

全球可持续债券市场 2022年第一季度概览

2022年第一季度,全球GSS+债券市场(包括绿色、

社会责任和可持续发展债券,可持续发展挂钩债券以及转型债券) 的发行量超过2000亿美元。GSS+债券累计发行量于第一季度 末突破3万亿美元大关。受利率上调及俄乌战争等因素影响, 第一季度发行量同比有所放缓。但长远来看, 贴标债券市场规模将继续壮大。 摘要:

* 截至2022年第一季度,GSS+债券的累计发行量突破3万

亿美元,其中绿色债券为1.7万亿美元 * 截至2022年第一季度, 可持续发展挂钩债券的累计发行量达到1555亿美元,转型债券为

102亿美元 * 2022年第一季度,GSS+债券的发行量达到2022亿美

元

* 1月的GSS+债券发行量居第一季度之首,达1029亿美元 -

Linking Global Finance to Small-Scale Clean Energy

This report discusses the potential of financial aggregation in enabling global capital markets to finance distributed renewable energy (for residential and other uses) in developing countries. It explores the state of small-scale, low-carbon energy in developing countries as well as the barriers to financial aggregation, along with some proposed solutions and key considerations for market practitioners.

-

ASEAN Sustainable Debt Market 2021

The sustainable debt market in the 6 largest ASEAN economies continued to grow rapidly in 2021 with record issuance of green, social, and sustainability (GSS) debt totaling USD24bn compared to USD13.6bn in 2020. This growth reflects the regions’ enthusiasm to allocate capital for the response to the COVID-19 pandemic along with facilitating long-term, low carbon, and climate-resilient economic growth.

Learn more about the ASEAN sustainable debt market in 2021 in our latest report. Now available for download.

-

Promoting Local Currency Sustainable Finance in ASEAN+3

The Promoting Local Currency Sustainable Finance in ASEAN+3 report is a regional update on the green, social, sustainable, sustainability-linked and transition bond market, with a particular focus on local currency (LCY) sustainable bond markets in ASEAN+3.

-

India Sustainable Debt Market State of the Market 2021 report

The India sustainable debt market continued to grow in 2021 with issuance of green, social, and sustainability (GSS) debt totaling USD7.5bn, a six-fold (+585%) increase compared to 2020 figures. These and other findings are brought by the India Sustainable Debt Market State of the Market 2021 report, launched today by the Climate Bonds Initiative.

-

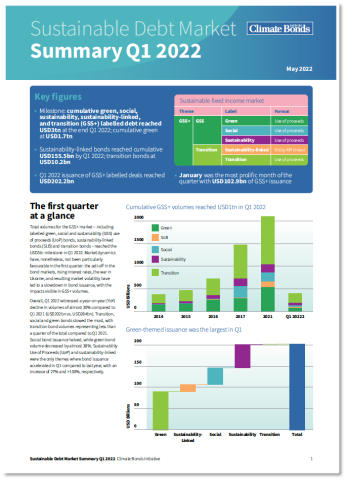

Sustainable Debt Market Summary Q1 2022

The labelled bond market topped $200bn in the first quarter of 2022, despite unfavourable conditions for fixed income securities. The green, social, sustainable, and other labelled (GSS+) bond charge was threatened by market volatility as the Ukraine war and rising interest rates sprung upon the opening months of the year. Despite this, the market demonstrated resilience and amassed a strong volume which is expected to rise over the coming months.

-

China Green Finance Policy Analysis Report 2021

With the support of UK PACT (Partnering for Accelerated Climate Transition), the Climate Bonds Initiative and SynTao Green Finance launched China Green Finance Policy Analysis Report 2021. The report assesses China's latest green finance policies and provides an overview of its green bond market development.

-

中国绿色金融政策分析报告2021

气候债券倡议组织和商道融绿共同发布《中国绿色金融政策分析报告2021》,本报告得到了英国加速气候转型合作伙伴计划(UK PACT)的支持。

报告面向国内和全球范围内关注中国快速发展的绿色金融市场最新动态的利益相关方,探讨了中国绿色金融和绿色债券市场相关政策发展的四个要素:

-

中国绿色金融政策聚焦碳中和的相关进展;

-

-

ASEAN economies exposure to climate transition risks

This report examines ASEAN exposure to transition risks. The report describes the major channels by which these risks will be transmitted through to the financial economy and examines possible local and global sources of transition risk.Sources of transition risk vulnerability are revealed through analysis of ASEAN bond and loan data, with a particular focus on Indonesia, the Philippines and Viet Nam. -

中国绿色债券 投资者调查 2022

中国绿色债券 投资者调查 2022气候债券倡议组织和商道融绿在香港交易及结算所有限公司和法国外贸银行的支持下,于今天发布了《中国绿色债券投资者调查报告2022》。 报告中的问卷参与对象(42家机构)均来自中国银行间市场交易商协会发布的中国主要绿色债券投资者名单,以及活跃在中国绿色债券市场的国际投资人。该调查显示绿色资质和信用基本面是进一步提高中国市场绿色债券吸引力的关键。欢迎下载阅读! -

Post-Issuance Reporting in China's Green Bond Market 2022

This is Climate Bonds’ first study of post-issuance disclosure practices of green bonds in China, produced in partnership with SynTao Green Finance. Available in both English and Chinese, it builds on the series of global studies on this topic that Climate Bonds has conducted over the last few years.

-

Sustainable Debt Global State of the Market 2021

Climate Bonds’ flagship global State of the Market Report details the size and substance of green and other labelled bond markets. This, the 11th iteration, has been extended and now includes analysis of the green, social and sustainability (GSS) markets, plus sustainability-linked bonds (SLBs), and transition bonds. The publication represents the most extensive analysis available in the labelled finance space with features on taxonomies and sovereign bonds.

-

Green Bond China Investor Survey 2022

Climate Bonds Initiative and SynTao Green Finance, with the support of Hong Kong Exchanges and Clearing Limited (HKEX) and Natixis Corporation and Investment Banking (Natixis CIB) present the Green Bond China Investor Survey 2022 report. Conducted with 42 investment institutions among largest domestic and international green bond investors, the survey reveals that satisfactory green credentials and credit fundamentals are top priorities for furthering the appeal of green bonds coming from China. Download your copy now!

-

Green Bond Pricing in the Primary Market H2 2021

The Report is the 13th iteration of a leading series analysing pricing dynamics of green bonds, examining how these instruments offer pricing advantages for investors and issuers alike.

-

Identifying, managing and disclosing climate-related financial risks: options for the Reserve Bank of India

India has committed to becoming a net-zero economy by 2070. This means a five fold increase in investment in green energy by 2030. But Indian banks are already heavy lenders to the power sector.In this report the authors quantify the extent of lending by Indian banks to fossil fuel assets including power stations, coal, oil and gas extraction and heavy industry. This loans pose potential risks to Indian financial systems capacity to transition to decarbonise. -

Green Infrastructure Investment Opportunity (GIIO) Indonesia: Green Recovery 2022 Report

The Climate Bonds Initiative is pleased to present the Green Infrastructure Investment Opportunities Indonesia: Green Recovery report, which identifies and analyses multiple green infrastructure projects open for potential investment and development in the country. Indonesia GIIO has been produced with the support of the Asian Development Bank (ADB), the ADB-managed ASEAN Catalytic Green Finance Facility (ACGF), and PT Sarana Multi Infrastruktur (PT SMI).

-

Global Green Taxonomy Development, Alignment and Implementation

The Climate Bonds Initiative (Climate Bonds), in collaboration with the UK PACT programme, presents the Global Green Taxonomy Development, Alignment and Implementation report which highlights the latest trends around taxonomy development and their the subsequent implications for the future of the sustainable finance market.

-

全球绿色分类标准制定、统一及实施进展研究报告

气候债券倡议组织(Climate Bonds Initiative)与英国加速气候转型合作伙伴计划(UK PACT)合作,发布了全球绿色分类标准制定、统一及实施进展研究报告,该报告重点介绍了绿色分类标准发展的最新趋势及对可持续金融市场的影响。

该报告将欧盟和中国的绿色分类标准作为案例研究,比较了它们的指导原则和技术筛选标准,及中欧推出的《共同分类目录》中考虑的相关要素。此外,该报告讨论了绿色分类标准在绿色金融市场的应用,包括产品开发、风险管理、品牌推广和信息披露方面。

该报告现已提供中文和英文版本下载。 -

Transition Finance in China: latest development and future outlook

The Climate Bonds Initiative and CECEP Hundred Technical Service (Beijing) Co., Ltd. (CECEP), with the support of UK PACT, presents the Transition Finance in China: latest development and future outlook report. Taking the Chinese steel sector as a case study, this report reviews the latest development of transition finance in China and discusses recommendations to enable a credible transition.

-

中国转型金融研究报告

《中国转型金融研究报告》是由气候债券倡议组织和中节能衡准科技服务(北京)有限公司共同撰写,并由英国加速气候转型合作伙伴计划(UK PACT)资助。本报告梳理了当前转型金融的最新进展,提出实现可信转型应遵守的原则,并以中国钢铁行业为例,讨论如何应用转型金融。

-

Green Infrastructure Investment Opportunities Thailand

The Green Infrastructure Investment Opportunities Thailand (Thai GIIO) report identifies and analyses green infrastructure projects open for potential investment and highlights avenues for further pipeline development. This report has been produced with the support of the

-

中国可持续债券市场盘点报告

《中国可持续债券市场盘点报告》分析了中国可持续债券市场截至2021年上半年的发展情况,重点关注现有可持续债券品种的定义、监管框架和市场发展,并将视角拓展到市场标准和激励/约束政策的最新发展。这份报告由气候债券倡议组织和兴业研究联合推出,感谢英国加速气候转型合作伙伴计划(UK PACT)的支持。

-

China’s Growing Sustainable Debt Market

China's Growing Sustainable Debt Market report analyses the development of China sustainable debt market up to the first half of 2021, focusing on the definitions, regulatory frameworks, and market development of existing sustainable labels, and takes an additional lens into the latest developments in market standards and policy incentives/constraints. The report was produced in partnership with CIB Economic Research and Consulting Co., Ltd. (CIB Research), with the support of UK PACT (Partnering for Accelerated Climate Transition).

-

金融支持农业绿色发展的共同语言 --农业绿色发展分类方案和评估方法

推進農業綠色發展,是統籌推進經濟、政治、文化、社會、生態發展的具體體現,是農業供給側結構性改革的重點。

為中國農業部門的綠色轉型融資在很多方面都很重要。它不僅鼓勵對農業產業綠色發展的投資,而且提高農業經營主體的成本、市場和風險意識,促進農業綠色發展的產業、生產和管理體系的發展。

下載我們的最新報告,了解更多關於中國在當地農業綠色轉型之路上的信息。

-

全球气候相关债券市场与发行人报告2020年

CBI《2020年全球气候相关债券市场与发行人报告》提供了全

球非贴标气候相关债券市场的最新进展和全面分析, 揭示了贴标债券市场以外的可持续投资机会。 非贴标气候相关债券市场(climate-aligned bonds universe)

是气候债券倡议组织通过特别开发的方法论长期追踪的市场, 强调了那些未被发行人明确标记为“绿色”的投资机会。 通过追踪这一部分债券市场, 可进一步引导全球资本投向与气候相关资产和活动。 目前,绿色、

社会和可持续贴标债券是气候相关债券发行人在资本市场上为其业务 运营进行再融资的主要工具。CBI的数据分析发现, 贴标债券发行人往往拥有更广泛的投资者基础, 并从绿色标签提供的额外可见度和负溢价中获益。 -

Common Language on Financially-Supported Agricultural Green Development Report

Promoting the green development of agriculture sector is a concrete manifestation of the overall plan for promoting economic, political, cultural, social, and ecological development, and the focus of supply-side structural reform in agriculture.

-

Análise do Mercado na América Latina e Caribe

O relatório "Análise do Mercado na América Latina e Caribe", publicado com o apoio do Banco Interamericano de Desenvolvimento (BID) e da Corporação Financeira Internacional (IFC), mostra que a região estabeleceu um recorde de emissão de títulos verdes em 2020 e está a caminho de atingir números semelhantes em 2021. A emissão de títulos verdes cresceu de US$ 13,6 bilhões em setembro de 2019 para US$ 30,2 bilhões no final de junho de 2021, em menos de dois anos.

-

Estado del Mercado en América Latina y El Caribe

El informe "Estado del Mercado en América Latina y El Caribe", publicado por la Climate Bonds Initiative, contó con el apoyo del Banco Interamericano de Desarrollo (BID) y la Corporación Financiera Internacional (IFC). El informe revela que la región estableció un récord de emisión de bonos verdes en 2020 y está en camino de obtener cifras similares en 2021. La emisión de bonos verdes creció de $13.6 mil millones de dólares en septiembre de 2019 a $30.2 mil millones a fines de junio de 2021, en menos de dos años. Para obtener más información, descargue el informe de forma gratuita.

-

Sustainable Debt Summary Q3 2021

Total volumes for the sustainable debt market – including labelled Green, Social and Sustainability (GSS) bonds, Sustainability-linked bonds (SLB) and Transition bonds – are well on their way to an annual trillion, reaching USD779.2bn in the first three quarters of 2021.

Key Highlights

-

Transition Finance in China’s Guangdong Hong Kong-Macau Greater Bay Area | 粤港澳大湾区转型金融展望

The Transition Finance in China’s Guangdong Hong Kong-Macau Greater Bay Area report discusses the principles that credible transition finance should adhere to and takes Guangdong-Hong Kong-Macao (GBA) Greater Bay Area – an important economic powerhouse for China – as a case for studying the application of transition finance concerning the low-carbon transition.

-

Encuesta de bonos soberanos verdes, sociales y sostenibles

Los bonos soberanos verdes, sociales y sostenibles (VSS) contribuyen a iniciativas gubernamentales estratégicas en torno al clima, catalizando los mercados financieros verdes locales y atrayendo nuevos inversores. Estos y otros hallazgos están contenidos en una primera encuesta de este tipo realizada por Climate Bonds.

-

China Green Securitization State of the Market 2020 report

The China Green Securitization State of the Market 2020 report brings an analysis of China’s green ABS market growth for both international and domestic investors. Supported by UK PACT China, the report reviews the policy initiatives that are guiding the market development in the country, while analyzing the market data and best practices.

-

Policy Brief: Modelagem Financeira de Gestão Consorciada: Oportunidade para o Brasil financiar infraestrutura subnacional sustentável

O Policy Brief Modelagem Financeira de Gestão Consorciada: Oportunidade para o Brasil financiar infraestrutura subnacional sustentável identifica a oportunidade que o Brasil tem para estruturar Mecanismos Finance

-

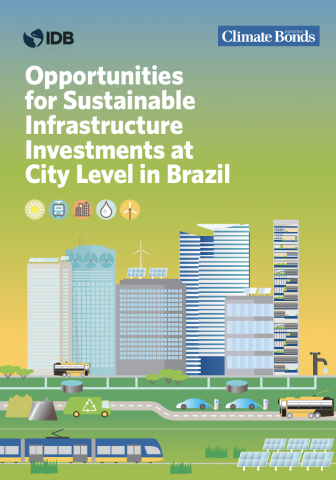

Pooled Finance: Brazil’s Opportunity to finance subnational sustainable infrastructure

The Pooled Finance: Brazil’s Opportunity to finance subnational sustainable infrastructure Policy Brief identifies Brazil’s opportunity to structure Pooled Finance Mechanisms-PFMs to fund and implement subnational sustainable infrastructure projects.

-

Latin America & Caribbean: Sustainable Finance State of the Market 2021

Latin America and Caribbean (LAC): State of The Market 2021

-

China State of the Market 2020 Report

Climate Bonds Initiative (CBI) & China Central Depository & Clearing Co. Ltd Research Centre (CCDC Research), with the support of HSBC, are pleased to present you the fith iteration of our flagship China Green Bond Market 2020 Research Report.

-

Green Bond Pricing in the Primary Market H1 2021

Green Bond Pricing in the Primary Market H1 2021 is the 12th iteration in the series and monitors the performance of 56 EUR and 19 USD denominated benchmark size green bonds with a total value of USD75.9bn issued between January and June 2021.

Highlights from Q1-Q2 2021

-

Sustainable Debt Highlights H1 2021

Total volumes for labelled Green, Social and Sustainability (GSS) bonds, Sustainability-linked bonds (SLB) and Transition bonds reached nearly half a trillion (USD496.1bn) in the first half of 2021.

This amount represents 59% year-on-year growth in the GSS market from the equivalent period in 2020. It also sets the labelled sustainable debt market on track to reach another record high by end December.

Cumulative labelled issuance now stands at USD2.1tn at end H1 2021.

-

Green Bonds in South Africa: How green bonds can support South Africa's energy transition

South Africa has a huge opportunity - to be the first coal-based economy in the global south to make a successful transition to a low carbon economy, particularly in the energy sector. With its aging fleet of coalfired power stations , it must build more energy generation capacity both to offset coal closures and to meet the growing demand for energy.

-

Sustainable Debt: North America State of the Market 2021

This report is Climate Bonds’ first stand-alone State of the Market report for North America, encompassing established green markets and the expanding social and sustainability labels.

-

Climate Investment Opportunities: Climate-Aligned Bonds & Issuers 2020

Climate Investment Opportunities: Climate-Aligned Bonds & Issuers 2020 report provides a comprehensive analysis of the global unlabelled climate-aligned bond market, which consists of investment opportunities that extend beyond the thematic bond market. These instruments are identified via a proprietary methodology developed by Climate Bonds.

-

Análise do Mercado de Financiamento Sustentável da Agricultura no Brasil

O relatório Análise do Mercado de Financiamento Sustentável da Agricultura no Brasil traz uma análise de como títulos rotulados são atualmente utilizados para financiar projetos, ativos e atividades de agricultura sustentável no país. De acordo com o estudo, os títulos verdes respondem por 84% do mercado de dívida sustentável brasileira, com um total acumulado de USD 9 bilhões emitidos até fevereiro de 2021. Em seguida, estão os títulos sustentáveis com USD 1,6 bilhão representando 15% do volume total.

-

Brazil Briefing: Agriculture Sustainable Finance State of The Market

The Brazil briefing on the Agriculture Sustainable Finance State of The Market provides an analysis of how labeled bonds are currently used to finance sustainable agriculture projects, assets and activities in the country. According to the study, green bonds account for 84% of the Brazilian sustainable debt market, with a cumulative total of USD 9 billion issued by February 2021. Next are sustainability bonds with USD 1.6 billion representing 15% of the total volume. And finally, social bonds with USD 111 million, equivalent to 1% of the market.

-

Greater Bay Area - Green Infrastructure Investment Opportunities (GIIO) | 粤港澳大湾区绿色基础设施投资机遇报告

This report highlights green infrastructure investment opportunities in the Guangdong-Hong Kong-Macao Greater Bay Area (the GBA) which consists of nine cities in the Guangdong Province, and two special administrative regions, i.e., Hong Kong and Macao, and is one of the economic growth engines and leading green finance regions in China.

-

Post-Issuance Reporting in the Green Bond Market 2021

This is the 3rd iteration of our Post-Issuance Reporting in the Green Bond Market Series.

Post-issuance reporting on the use of proceeds (UoP) is a core component of the Green Bond Principles (GBP), the Green Loan Principles (GLP) and the Climate Bonds Standard (CBS). Issuers that are effectively reporting on the environmental impacts of funded projects ensure the transparency and accountability underpins the credibility of the green bonds and loans.

-

Embedding Sustainability into the COVID recovery: A Primer for ASEAN Central Banks

This Policy Brief examines the possible role ASEAN central banks could play in ‘building back better’ from the COVID-19 pandemic, drawing on international examples of innovative action in both COVID-19 recovery and greening central bank activities.

This report synthesises best practice on the ‘greening’ of prudential and monetary policies and contextualises these into lessons that can be drawn on by ASEAN Central Banks as they rebuild from the economic impacts of COVID-19.

-

Hong Kong Green Bond Market Briefing 2020

This is the third iteration of the Hong Kong Briefing Paper, examining a range of green bond and loan deals from domestic issuers and the growing suite of sustainable finance product offerings.

-

ASEAN Sustainable Finance State of the Market 2020

The ASEAN sustainable finance market maintains rapid growth despite the negative impact of COVID-19, focusing the attention on the need for a sustainable economic recovery.

The report outlines regional and national developments covering three overarching debt themes, Green, Social, and Sustainability. Also covered are key policy developments that are anticipated to drive ASEAN’s sustainable finance market.

Regional highlights

-

Sustainable Debt: Global State of the Market 2020

Sustainable Debt-Global State of the Market report assesses the scale and depth of the green, social, and sustainability (GSS) debt markets as of the end of 2020. This report is the tenth iteration in our flagship State of the Market series, encompassing established green markets and the expanding social and sustainability labels.

-

Nordic Sustainable Debt State of the Market 2020

Nordic Sustainable Debt is the newest in our State of the Market (SotM) series providing an in-depth analysis of Green, Social and Sustainability (GSS) investment in Sweden, Norway, Finland, Denmark and Iceland.

The Nordic sustainable bond market has more than quintupled from USD16.5bn since the inaugural Climate Bonds Nordic report of 2018, and including sovereign, NIB and national issuance reached a cumulative USD 88.2bn at the end of 2020.

-

Green Finance Opportunities in Central America & the Caribbean 2021 / Oportunidades de Financiamiento Verde en Centroamérica y el Caribe 2021

Sponsored by the Central American Bank for Economic Integration (CABEI), the Green Finance Opportunities in Central America & the Caribbean 2021 report aims to support green investment in the region by facilitating greater engagement between asset owners, investors and developers, as well as to help issuers come to market.

-

Japan: Green Finance State of the Market 2020

Climate Bonds continues its collaboration with Japan’s Green Bond Issuance Promotion Platform, with the release of the third edition of the Japan Green Finance State of the Market report. The report provides an in-depth overview of the Japanese green bond market and the broader labelled universe, while highlighting opportunities to boost green finance with unlabelled climate-aligned bonds and new policy developments.

-

Green Bond Pricing in the Primary Market H2 2020

Green Bond Pricing in the Primary Market H2 2020 reveals increasing signs of greenium in both public and private sector bond issuance in the second half of the year including performance of the inaugural German sovereign green Bund of September 2020.

-

Green Infrastructure Investment Opportunities Malaysia

This report highlights green infrastructure investment opportunities in Malaysia. It has been prepared to help meet the growing demand for green investment opportunities and to support the country’s transition to a low carbon economy.

It aims to facilitate greater engagement on this topic between project owners and developers, and institutional investors. Green infrastructure and corresponding green finance instruments are explored in the report, with sector-by-sector investment options presented.

-

Financiando el transporte sustentable en México

Financiando el transporte sustentable en México

El Informe Financiando el transporte sustentable en México ofrece una visión general del mercado en crecimiento y oportunidades para canalizar inversiones hacia el transporte bajo en carbono en México y acciones de mitigación que podrían financiarse con bonos etiquetados.

-

Financing low-carbon transport in Mexico

The Financing low-carbon transport in Mexico brief provides an overview of the growing market and opportunities for channeling investments towards sustainable transport in Mexico and mitigation actions that could be financed with labelled bonds.

-

Sovereign Green, Social, and Sustainability Bond Survey

Sovereign Green, Social & Sustainability (GSS) bonds contribute to strategic government initiatives surrounding climate, catalyzing local green finance markets and attracting new investors. These and other findings are contained in a first of its kind survey undertaken by Climate Bonds.

-

绿色、社会和可 持续主权债券: 发展贴标债券市 场的中坚力量

基于与19个主权债券发行人的对话, 气候债券倡议组织(以下简称“气候债 券”)撰写了全球首份针对绿色、社会及 可持续主权债券(Sovereign green, social, and sustainability (GSS) bond,以下简称“贴标主权债券”)的调 查报告。

-

Financing low-carbon buildings in Mexico

The Financing low-carbon building in Mexico brief provides an overview of the growing market and opportunities for channelling investments towards sustainable buildings in Mexico through a range of financial instruments. -

Financiando la construcción sustentable en México

El briefing de Financiamiento de edificios con bajas emisiones de carbono en México ofrece una descripción general del mercado en crecimiento y las oportunidades para canalizar inversiones hacia edificios sostenibles en México a través de una variedad de instrumentos financieros. -

Green Infrastructure Investment Opportunities Philippines

The Inaugural Green Infrastructure Investment Opportunities (GIIO) Philippines report brings the key trends and developments for green infrastructure and energy in the Philippines.

Twenty (20) green projects in renewable energy, low carbon transport, water infrastructure and waste management are showcased and a sample pipeline of over seventy (70) projects in low carbon transport, renewable energy, sustainable water and sustainable waste management are identified.

-

Green bonds market summary - Q3 2020

The green bond market reached a new record as Q3 2020 issuance peaked at USD64.9bn - the highest volume in any third quarter period since market inception and the second highest recorded amount in any individual quarter (following Q2 2019 at USD73.1bn), and 21% more than Q2 2020. Cumulative issuance volume since inception reached USD948bn.

Other key figures for the quarter included:

-

中国的绿色债券发行与机遇报告

全球范围内,绿色基础设施建设正带来巨大的投资机遇。为了实现《巴黎协定》中提出的减排目标,从现在起至2030年,全球预计将产生价值约100万亿美元1( 707万亿人民币)的气候适应型基础设施需求。但目前该领域仍然缺乏可识别、可投资、可盈利的相关项目。同时,对于符合绿色金融条件的资产和项目类型也缺乏明确的界定。

为应对这一挑战,本报告旨在明确并展示中国的绿色投资机会,倡导增进对于绿色定义和投资方向的认知,并助力作为绿色基础设施融资手段的绿色债券的发行。本报告还有助于满足对于绿色投资机会持续增长的需求,并支持中国向低碳经济的转型过渡。报告致力于促进项目所有者、开发商以及机构

投资者间针对这一主题进行的更多参与。报告中探讨了绿色投资机会和相应的绿色金融工具,并展示了各领域的投资选择。 -

China’s Green Bond Issuance and Investment Opportunity

Green infrastructure presents a huge investment opportunity globally. However, there remains a lack of identifiable, investment-ready and bankable projects as well as a lack of understanding of what types of assets and projects qualify for green financing. This report aims to highlight green investment opportunities in China.It aims to facilitate greater engagement on this topic between project owners and developers, and institutional investors.

-

Sustainable Debt Global State of the Market H1 2020

Climate Bonds has released the Sustainable Debt Global report, capturing COVID19 pandemic response for H1 2020 from various issuers who have utilised the sustainable debt market to address this major crisis. This report is part of our series of the State of the Market. -

Green Loans Australia & New Zealand

This report covers the labelled green corporate loan market in Australia and New Zealand. It explores what has happened so far, best practice in labelling a green loan, and what should be done to channel loan markets for climate change investment.

-

Green Bond Pricing in Primary Market : H1 (Q1-Q2) 2020

This is the 10th iteration of "Green Bond Pricing in the Primary Market” covering January to June 2020.

The report monitors the performance of 38 EUR and eight USD denominated benchmark size green bonds with a total value of USD37bn issued during H1 2020.

The full series of Pricing reports is available here.

-

Financing Credible Transitions: Summary Note

The Whitepaper presents a framework for identifying credible transitions aligned with the Paris Agreement.

This document is the 4 Page Summary Note.

Climate Bonds jointly produced this work with Credit Suisse.

Find the full "Financing Credible Transitions (White Paper)" here.

-

Financing Credible Transitions (White Paper)

This Whitepaper presents a framework for identifying credible transitions aligned with the Paris Agreement.

Climate Bonds jointly produced this work with Credit Suisse.

This paper has two purposes:

1. Define transition as a concept by presenting a starting point for the market to see a credible brown to green transition as ambitious, inclusive and aligned with the Paris Agreement (thereby avoiding greenwash).

-

Green bonds market summary - H1 2020

The Green Bonds Market Summary – H1 2020 focuses on the latest market developments in labelled green bonds and loans.

The summary highlights issuance trends and significant data points for a period significantly impacted by the global COVID-19 pandemic.

-

Green Bonds Global State of the Market 2019

The global Green Bonds State of the Market 2019 report, the first in a new annual series analysing each calendar year's market developments in detail including global trends in green bond, loan and sukuk issuance and avenues for market growth.

The figures are as of the end of CY 2019, and have slightly increased since our 2019 Green Bond Market Summary posted in February due to additional transactions being included.

-

China Green Bond Market 2019 Research Report

China Green Bond Market 2019 Research Report analyses the key developments in the world’s largest source of labelled green bonds.

-

中国绿色债券市场 2019 研究报告

本报告总结了中国作为2019年全球最大贴标绿色债券来源的重要发展,聚焦绿色债券发行情况、相关政

-

Unlocking Brazil’s Green Investment Potential for Agriculture

The Unlocking Brazil’s Green Investment Potential for Agriculture identifies a large pipeline of projects and assets eligible for green financing and reveals that the investment potential for Agriculture in Brazil reaches USD 163 billion (BRL 692 billion) until 2030.

-

Energy efficient home improvements and the green stimulus

Coronavirus economic stimulus packages need to consider all facets of sustainable development, otherwise we risk creating even greater disasters for ourselves in the future.

-

Securitisation as an enabler of green asset finance in India

This report discusses the role green asset backed securities (ABS) can play in helping India finance its green infrastructure and improve the lives of the poor and disadvantaged. However, we acknowledge that securitisation requires specialised structuring expertise, complex credit analysis and a specialised investor base.

-

Financing waste management, resource efficiency and circular economy in the green bond market

Financing Waste Management, Resource Efficiency and Circular Economy is a briefing prepared specifically for the Green Bond Issuance Promotion Platform administered by the Ministry of Environment in Japan (MoEJ).

-

Hong Kong Green Bond Market Briefing 2019

Produced in partnership with HSBC, and supported by the Hong Kong Monetary Authority (HKMA) and the Hong Kong Green Finance Association (HKGFA), Climate Bonds Initiative’s second Hong Kong Briefing Paper examines a range of green bond deals from domestic issuers, and for the first time assesses their post-issuance disclosure.

-

Japan - Green Finance State of the Market 2019

Japan – Green Finance State of the Market 2019 presents an updated in-depth overview of the Japanese green bond market, highlighting developments since the inaugural 2018 publication. With USD17bn in cumulative issuance at the end of 2019, Japan reached 9th place in global country rankings and 2nd in Asia-Pacific, after China.

-

Green Infrastructure Investment Opportunities (GIIO) Vietnam

The Inaugural Green Infrastructure Investment Opportunities (GIIO) Vietnam report brings the key trends and developments for green infrastructure and energy in Vietnam.

Vietnam GIIO is available in English and Vietnamese has been prepared to help meet the growing demand for green investment opportunities and to support the country’s transition to a low carbon economy.

-

Cơ hội Đầu tư vào Cơ sở Hạ tầng Xanh VIỆT NAM

Báo cáo Cơ hội đầu tư vào cơ sở hạ tầng xanh (GIIO) Việt Nam mang đến thông tin về những xu hướng và sự phát triển chính cho cơ sở hạ tầng và năng lượng xanh tại Việt Nam.

Báo cáo GIIO Việt Nam được lập bằng tiếng Anh và được dịch ra tiếng Việt nhằm đáp ứng nhu cầu ngày càng tăng về các cơ hội đầu tư xanh và hỗ trợ Việt Nam chuyển đổi sang nền kinh tế ít các-bon.

-

Green Bond Treasurer Survey 2020

Green Bond Treasurer Survey 2020 is a first of its kind, unique interrogation of market experience to identify core benefits and challenges of issuing green bonds and provides guidance to potential newcomers into green financial markets.

-

ASEAN Green Finance State of the Market 2019

ASEAN Green Finance State of the Market 2019 report is an analysis of the issuance of green bonds and green loans in Southeast Asia. Following Climate Bonds Initiative’s (CBI) first ASEAN Green Finance State of the Market 2018, this 2019 report reviews the progress made across the regional green finance landscape and emerging opportunities for more green bonds, loans and sukuk amongst ASEAN nations.

-

Green Bond Pricing in the Primary Market: H2 (Q3-Q4) 2019

The report monitors the performance of 36 EUR and 13 USD denominated benchmark size green bonds with a total value of USD36bn issued during H2 2019.

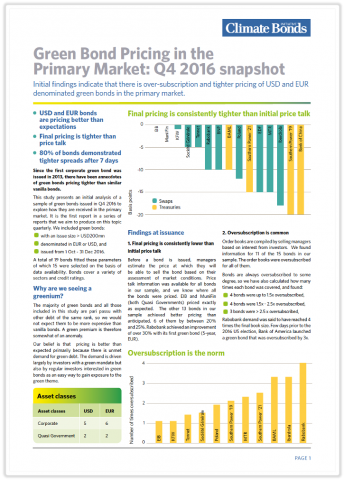

This is the 9th report, and the fourth semi-annual report, marking the period July-December 2019. Prior to 2018, reports were released every quarter, the first one being the Q4 2016 Snapshot.

-

EuroPACE 2.4 - Feasibility study for a financial instrument and a review of existing retrofit loan schemes

“EuroPACE” is a project funded by the European Commission which seeks to boost energy efficiency investments for buildings in Europe. The project has been developed by a number of NGOs and organisations known as the EuroPACE Consortium. As a member of the EuroPACE Consortium, the Climate Bonds Initiative has worked on a series of deliverables designed to support the uptake of the programme.

-

EuroPACE 2.3 - Refinancing EuroPACE loans in the European Fixed Income Market

“EuroPACE” is a project funded by the European Commission which seeks to boost energy efficiency investments for buildings in Europe. The project has been developed by a number of NGOs and organisations known as the EuroPACE Consortium. As a member of the EuroPACE Consortium, the Climate Bonds Initiative has worked on a series of deliverables designed to support the uptake of the programme.

-

2019 Green Bond Market Summary

Green Bonds Market Summary 2019 -

Unlocking green bonds in Indonesia: a guide for issuers, regulators and investors

Indonesia is the fourth most populous country in the world and one of the fastest growing emerging markets. It aims to deliver USD400bn worth of new public-works projects in the transportation, energy, water and waste sectors over five years.

-

Green Infrastructure Investment Opportunities Indonesia, Update Report

This report builds on the inaugural Green Infrastructure Investment Opportunities, Indonesia report released in May 2018. It provides updated content to help meet the growing demand for green investment opportunities, including green bonds, as well as to support the country’s transition to a low-carbon economy.

-

Nigeria - State of the Market

Nigeria was the first nation to issue a Sovereign Certified Climate Bond back in 2017.

-

Green Bond European Investor Survey 2019

This is Climate Bonds Initiative’s first green bond investor survey in a planned series. We talked with 48 of the largest Europe-based investment managers. Total assets under management (AUM) of respondents was EUR13.7tn, and their total fixed income AUM EUR4.3tn, with an average of EUR90bn and median of EUR34bn.

-

Green Infrastructure Investment Opportunities Brazil 2019

O relatório Oportunidades de Investimento em Infraestrutura Verde — Brasil 2019 relaciona o atual estado do mercado brasileiro de finanças sustentáveis e o progresso de projetos de infraestrutura verde no Brasil.

-

Green bonds market summary - Q3 2019