The Report Bonds and Climate Change - the State of the Market in 2012 is an in depth analysis of the climate-themed bonds market's size. The report:

- Outlines what are investments related to climate change.

- Explores the key investments themes and regional markets.

- Identifies three key ways to accelerate market expansion.

Download the full Report "Bonds and Climate Change"

Download the PowerPoint presentation "Bonds and Climate Change"

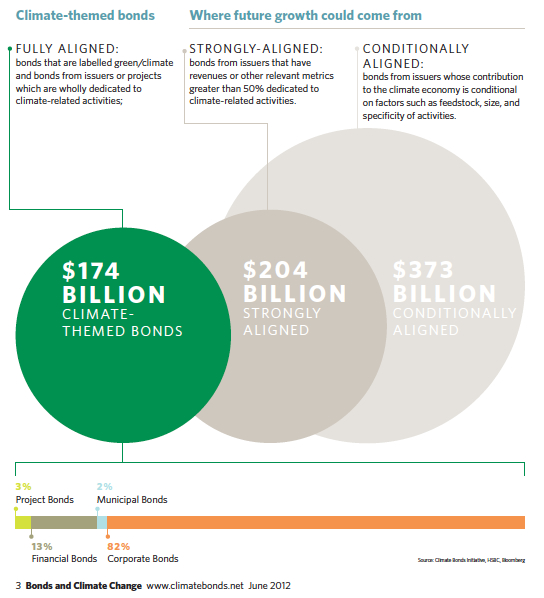

The Report found that there are $174bn of bonds fully aligned with the climate economy.

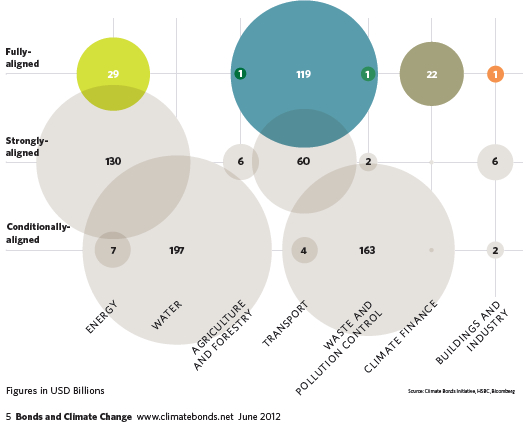

The global climate-themed bonds market has been divided into seven major areas:

- Transport. This is mainly rail, but we expect to see other mass transit, electric vehicles and the like.

- Energy. Largely renewable energy bonds of various sorts.

- Water (adaptation related).

- Agriculture and forestry. Includes paper and wood product manufacturers, forest management companies and organic seeds and fertilizers.

- Waste and pollution control.

- Climate finance. These are mainly from Development Banks. We see potential from a host of financial sector players, especially banks, insurers and public sector financing agencies.

- Building and industry.

Transport and Energy sectors dominate the climate-themed bonds universe - accounting for 85% of the total market.

The Report highlights that 67% of the market is originated in Europe, followed by USA (17%), Russia, Canada and China all at 3% each. UK institutions have issued the largest amount of climate-themed bond with 23% of the global total.

We expect further growth in the climate-themed bond market over the coming year. However, investor engagement is currently hampered by a number of factors - and we identify three key ways of accelerating market expansion.

- Standardise and certify: third-party certification of climate-themed bonds based on agreed standards could both reduce repetitional risks and enable market liquidity.

- Aggregate to scale and index: institutional investment market requires suitable deal flow with sizes over $500mn. Aggregation vehicles therefore are required in order to refinance the climate economy.

- Structure to investment-grade: policy risk is a major constraint to investment in the climate economy. Governments and public finance could adopt measures to counter this problem.