Resources:

1. Forestry, Land Conservation and Restoration Brochure

2. Forestry Land Conservation and Restoration Criteria

3. Forestry, Land Conservation and Restoration Criteria Background Paper

4. Forestry, Land Conservation and Restoration Criteria Summary slides

5. Disclosure Table and checklist for Criteria

Timeline of Development:

Nov 2018: Criteria released for Certification

June 2018: Forestry and Land Cnsvtn Restrtn Criteria open for public consultation

August 2017: TWG convened with greater focus on commercial forestry

May 2016: Land Use TWG reconvened

Sep 2015: Draft Land Use Criteria launched for public consultation

Oct 2014: Land Use TWG established

Certifications

Nov 2019: First bond issued using Forestry Criteria, relating to plantation forestry

To see the whole list of Forestry, Land Conservation and Restoration Climate Bonds, visit our Database of Certified Bonds

Status: The Forestry, Land Conservation and Restoration Criteria is available for use in certifications. Get in contact with certification@climatebonds.netto start the certification process of your green bond.

Bonds and loans linked to these eligible assets and projects will be aligned with the Paris Agreement 1.5oC limit.

We held 2 live Webinars on the Forestry Criteria in June and July 2018. The recording of this webinar, may be a useful introduction to the criteria requirements.

What are the Forestry, Land Conservation and Restoration Criteria?

For many countries and regions, land conservation and restoration is important both environmentally and economically. These habitats and thus their related investments can form a significant part of the capital assets of these countries. The UNFCCC has estimated that financial flows required to meet natural ecosystem protection needs are estimated at an increase in annual expenditure of USD 12–22 billion[1]. A clear understanding of what sorts of investments are consistent with improving the climate resilience of conserved or restored land assets will help bond investors quickly determine the environmental credentials of green bonds related to land conservation and restoration.

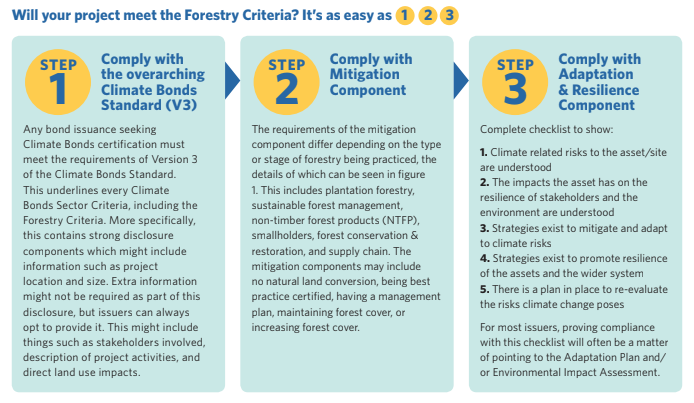

The Land Conservation & Restoration requirements of the Forestry Criteria lay out the requirements that land conservation and restoration assets and/or projects must meet to be eligible for inclusion in a Certified Climate Bond. The bond must also meet the reporting and transparency requirements of the overarching Climate Bonds Standard in order to receive Certification.

The scope of the Criteria includes any natural, non-commercial landscape, including wetland, peatland, grassland (and savannahs), and desert landscapes

Forestry is an integral industry for many developed and developing countries and forestry-related investments thus form a huge part of the capital assets of these countries. The UNFCCC has estimated that, globally, an additional USD 14 billion in financial flows will be required to address climate impacts in agriculture, forestry, and fisheries in 2030[1]. For forestry more specifically, UNEP estimates that USD 17-33 billion per year is required to achieve a 50% reduction in deforestation by 2030. A clear understanding of what sorts of investments are consistent with improving the climate resilience of forestry assets will allow bond investors to quickly determine the environmental credentials of forest-related green bonds.

These Criteria lay out the requirements that assets or projects must meet to be eligible for inclusion in a Certified Climate Bond. The bond must also meet the reporting and transparency requirements of the overarching Climate Bonds Standard in order to receive Certification.

Scope of Criteria

The type of projects which can receive Certification are:

Development of Forestry, Land Conservation and Restoration Criteria

Development of the Criteria originally began through scoping and testing criteria for wider Land Use. However, it was decided that to improve the ambition of each the Criteria, the land sector should be tackled by several separate criteria. Development of the Forestry, Land Conservation and Restoration Criteria with a separate Criteria for Agriculture followed.

To create the Criteria, we convened a Technical Working Groups (TWG) and an Industry Working Group (IWG) with representatives from investors, public entities, environmental and forestry NGOs and international policy bodies from around the world.

Forestry Criteria Technical Working Group Members

Lead Specialist

|

Versant Vision |

|

Eco System Service Limited Stuart Clenaghan |

Agrobanco Torsten Boettcher |

University of Oxford Sergio Collaço de Carvalho |

Forest Trends Rupert Edwards |

|

|||

|

World Wildlife Fund (WWF) |

Clarmondial Tanja Havemann |

FAO |

Abt Associates |

|

The Center for People and Forests (RECOFTC) |

Members of the Forestry Industry Working Group

• Michael Anderson, ERM

• Sophie Beckham, International Paper

• Jean-Dominique Bescond, World Bank

• Brian Kernohan, Hancock Natural Resources Group

• Sami Lundfren & Tim Lehesvrta, UPM

• Lars Mac Key, DanskeBank

• Jacob Michelsen, Nordea

• Beth Nelson & Pip Best, EY

• Mark Robinson, DNV.GL

Members of the Original Land Use Industry Working Group

• John Tobin & Fabian Huwyler, Credit Suisse

• Hans Biemans & Justin Sherrard, Rabobank

• Marc Sadler, World Bank

• Brian Kernohan, Hancock Natural Resources Group

• Ali bin Mohamed, Hassad Foods

• Howard-Yana Shapiro, Mars / UC Davis

• Oli Haltia, Dasos Capital

• Tim McGavin, Laguna Bay

• Karla Canavan

• Esben Brandi, Quantum Global

• Marcos Mancini, Banorte

• Cristiano Oliveria, Fibria

• Mads Asprem, Green Resources

• Chris Brown, Olam

• Andrew Voysey, Cambridge Institute for Sustainable Leadership

• Jason Green, ECOM Trading

• Lara Yacob, The Nature Conservancy

• John Simpson, Duxton Asset Management

• Katalin Solymosi, IADB

• Timm Tennigkeit, UNIQUE

• Michael Hendriksz, ADM

• Stephen McDowell, Barclays

• Rishi Madlani, Royal Bank of Scotland

• Caroline Cruickshank, Emma Wilkes & Jamie Bartlett, Bank of New York Mellon