To operate in a lower carbon economy, most sectors must undergo a major transformation

Resources:

- Summary note: Financing Credible Transitions

-

Original Press Release from Sept 2020

- Transition Feature: Inclusive

- Transition Feature: Ambition

- Transition Feature: Flexible

News:

Building a market for green transitions, 30th Nov 2020

Major economic sectors vary in how aligned they are with net zero by 2050 goal of the Paris Agreement. The transformation of the electricity utilities in the energy sector is well underway but it is clear that most sectors will have a lot of work to do.

Source: TPI state of Transition Report 2021

Finance will play a pivotal role in funding the required transformation

Where work needs to be done, finance will be needed and will therefore play a key role.

According to OECD estimates, the investment required to deliver on the Paris Agreement is about USD5-7tn per annum across the highest carbon emitting sectors.

Significant portion of emissions mitigation can be funded by green/sustainable debt

Green or sustainable bonds are a good start for financing green activities, but a way needs to be found for all sectors to be ‘green’. It’s not possible to be green overnight (or net zero) and to move in that direction will involve a transition period. The changes required can be financed from the bond market and commitments from industries starting to shift and transform to climate-aligned pathways.

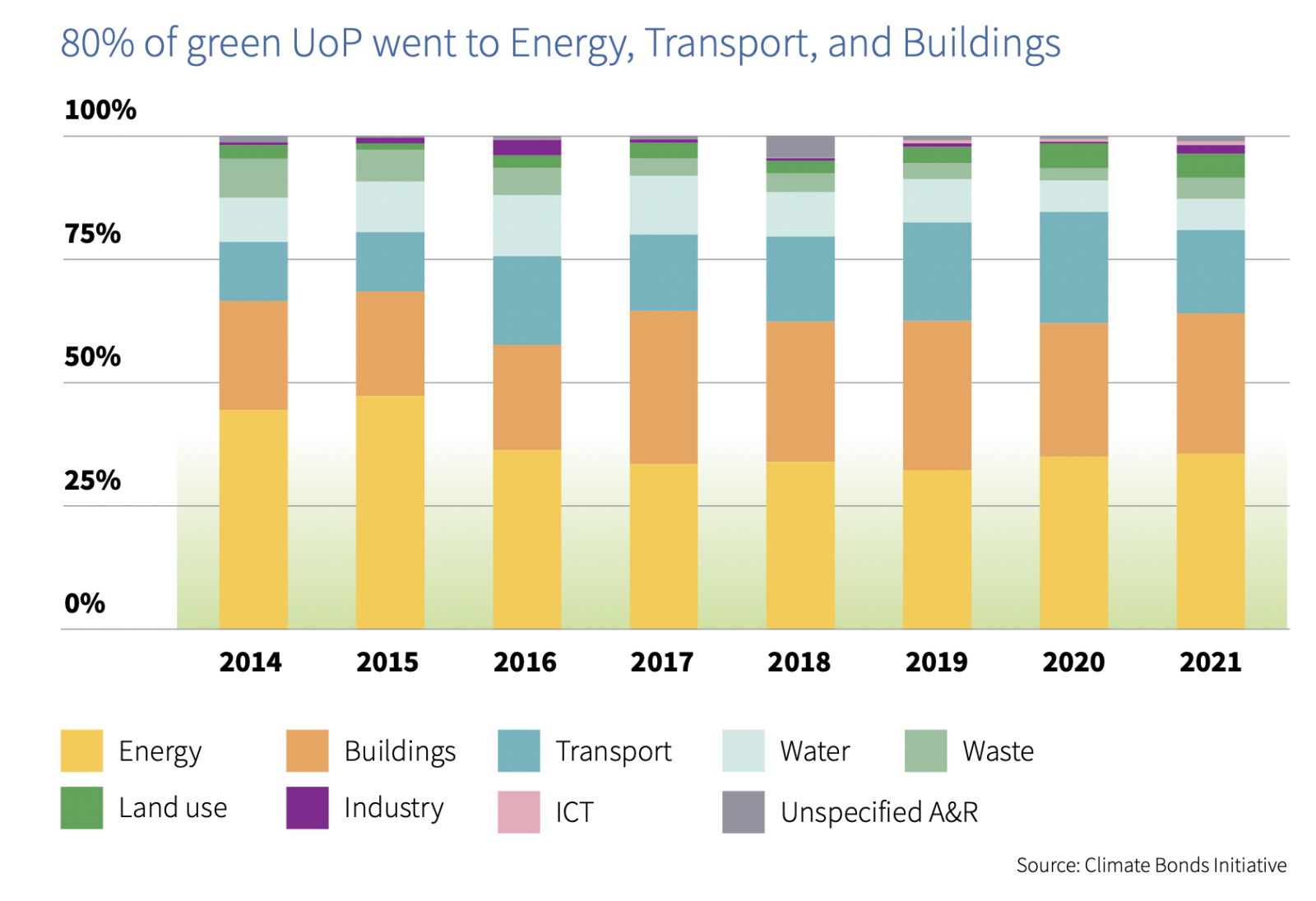

The Energy, Buildings, Industry and Transport sectors alone account for 85% of global emissions. In 2021, Energy, Buildings, and Transport were the three largest UoP categories, collectively contributing 81% of the 2021 total green issuance. Although the share remains low when compared to the full volume of unlabelled bond issuance, this share is growing rapidly.

Transition instruments are growing

These industries are starting from a low base and are now starting to make commitments to transition; expressing this through the transition bond market. The transition bond market is increasing, especially with SLB’s: that have seen huge interest and rapid growth in the last few years.