Reports

-

中国转型金融研究报告:债务工具支持电力行业低碳转型2022

气候债券倡议组织(CBI),华夏理财有限责任公司和香港中文大学(深圳)联合发布《中国转型金融研究报告:债务工具支持电力行业低碳转型》。本报告聚焦电力行业,分析了中国国内电力行业低碳转型过程中的机遇与挑战,梳理了支持电力行业转型相关的融资模式发展,重点关注转型债务工具的市场的发展和市场的现状,并对如何通过可信的转型框架为中国电力行业低碳转型提供融资支持给出了相关建议。

-

Japan Green Finance State of the Market - 2021

The Institute for Global Environmental Strategies (IGES) and the Climate Bonds Initiative (CBI) has published the 'Japan Green Finance State of the Market - 2021'. The following is a summary of the report.

-

3 in every $4 dollars of green bonds issuance meets standards

This first-of-its-kind report reveals onne out of every four dollars of labelled debt priced in 2022 is excluded from the Climate Bonds Green Bond Database (GBDB) and one in 17 is excluded from the Climate Bonds Social and Sustainability Database (SSBDB), Climate Bonds Initiative reveals.

-

A Fork in the Road for the global steel sector

The global steel sector has reached a fork in the road. Before 2030, 71% of existing coal-based blast furnaces (1090 Mt) will reach the end of its lifetime and require major reinvestment. As the next investment cycle won’t happen for another two decades, this means that this decade provides the critical opportunity for steel to transition to a more sustainable sector.

This policy paper included as part of the Climate Bonds Steel Package provides guidance to policymakers and regulators about how to guide industry and investors onto a climate-aligned pathway for steel.

-

全球可持续债券市场2022年第三季度概览

据气候债券倡议组织(CBI)统计,截至2022年9月30日,全球绿色、社会责任、可持续发展、可持续发展挂钩和转型债券(GSS+债券)的累计发行量已达3.5万亿美元;其中,符合CBI 定义的绿色债券累计发行量已突破2万亿。GSS+债券市场已拓展至全球,遍布98个国家和地区。 本季度报告梳理了各标签市场的进展, 并聚焦中东和非洲地区。

-

5 passos para 5 trilhoes

O mercado de títulos verdes expandiu rapidamente e até o final do terceiro trimestre de 2022 ultrapassou 2 trilhões de dólares. Entretanto, para haver uma contribuição substantiva para enfrentar os riscos severos das mudanças climáticas, precisamos ver pelo menos 5 trilhões de dólares de emissões anuais a partir de 2025. Temos o capital global adequado disponível, e o rápido crescimento do mercado até o momento demonstrou o apetite para movimentar este capital. A Climate Bonds Initiative vê cinco ações coletivas para alcançar os 5 trilhões por ano.

-

5 passos para 5 bilhoes

El mercado de bonos verdes se ha expandido rápidamente hasta superar los 2 billones de dólares a finales del tercer trimestre de 2022. Sin embargo, para contribuir de forma substancial a hacer frente a los graves riesgos del cambio climático, necesitamos conseguir al menos 5 billones de dólares por año de emisión anual a partir de 2025. Disponemos de suficiente capital global, y el rápido crecimiento del mercado hasta la fecha ha demostrado el apetito por mover capital. Climate Bonds Initiative contempla cinco acciones colectivas para alcanzar los 5 billones anuales.

-

Guidelines for Financing a Credible Coal Transition

Over the past months, Climate Bonds has been working with our partners at CPI and RMI to create guidelines for credible coal phase out projects in an effort to facilitate the rapid transition to clean energy globally. The draft guidelines are now available for public consultation now

-

5 steps to $5trillion by 2025

The green bond market has quickly expanded to pass USD2tn by the end of Q3 2022. However, to make a substantive contribution to addressing the stark risks of climate change we need to see at least USD5tn a year of annual issuance from 2025. We have adequate global capital available, and the rapid market growth to date has demonstrated the appetite for capital to move. Climate Bonds sees five collective actions to reach the annual USD5tn per annum. We need to expand, step-up, implement and move rapidly on the points listed in this manifesto.

-

Companies and Climate Change Report

Launched in September 2020, the AIIB - Amundi Climate Change Investment Framework (CCIF) equips investors with a benchmark for assessing investments against climate change-related financial risks and opportunities.

The CCIF translates the three objectives of the Paris Agreement into fundamental metrics that enable investors to assess an issuer’s level of alignment with climate change mitigation, adaptation and resilience, and low-carbon transition objectives.

-

Q3 2022 Market Summary

Climate Bonds’ Market Intelligence returns with another iteration in its quarterly review series. Climate Bonds screens self-labelled bonds issued globally and only includes bond issuance demonstrating climate ambition aligned with the Paris Agreement in its

-

101 sustainable finance policies for 1.5°C

Policymakers can grasp the opportunities posed by the net-zero transition. They can direct capital to meet sustainable development needs and deliver the most urgent mitigation and adaptation projects.

-

5 Passos Para 5 Trilhoes

El mercado de bonos verdes se ha expandido rápidamente hasta superar los 2 billones de dólares a finales del tercer trimestre de 2022. Sin embargo, para contribuir de forma substancial a hacer frente a los graves riesgos del cambio climático, necesitamos conseguir al menos 5 billones de dólares por año de emisión anual a partir de 2025. Disponemos de suficiente capital global, y el rápido crecimiento del mercado hasta la fecha ha demostrado el apetito por mover capital. Climate Bonds Initiative contempla cinco acciones colectivas para alcanzar los 5 billones anuales.

-

Green Bond Pricing in the Primary Market H1 2022

The Green Bond Pricing in the Primary Market H1 2022 Report, this is the 14th report in our pricing series, in which we observe how green bonds perform in the primary markets. This report includes green bonds issued in the first six months of 2022 (H1 2022) and in a first time analysis we saw greenium emerge for Sustainability-Linked Bonds (SLBs), covered in the spotlight section of this report.

Webinar:

-

Estado del Mercado de Finanzas Sostenibles en Perú 2022

'Estado del mercado de finanzas sostenibles en Perú 2022: los bonos verdes, sociales, sostenibles y relacionados con la sostenibilidad (GSS+) que se originaron en Perú aumentaron en 2021 y alcanzaron los USD 4800 millones, según el último reporte de Climate Bonds Initiative, producido en asociación con LAGreen Fund. El informe identifica oportunidades de inversión verde y sostenible en el país y trae las últimas cifras del mercado sobre la forma y el tamaño del mercado de deuda GSS+ peruano.

-

Peru Sustainable Finance State of The Market 2022

Peru Sustainable Finance State of The Market: Green, social and sustainability and sustainability-linked (GSS+)

-

Social & Sustainability Bond Database Methodology

Climate Bonds is expanding its data analysis capabilities with the launch of a Social and Sustainability Bond Database (SnS DB), in keeping with the diversifying labelled bond market. The new database will complement the existing Climate Bonds Green Bonds Database, an internationally authoritative source of best practice green debt product data.

-

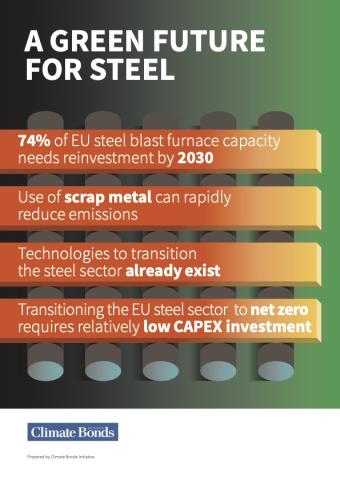

A Green Future for Steel

Download the steel policy paper here.

To achieve the Paris Agreement goals, all sectors of the economy must rapidly decarbonise. Greater attention is now being paid to the so-called hard-to-abate sectors such as steel. This paper examines the policies required to accelerate the EU steel industry transition to net zero.

-

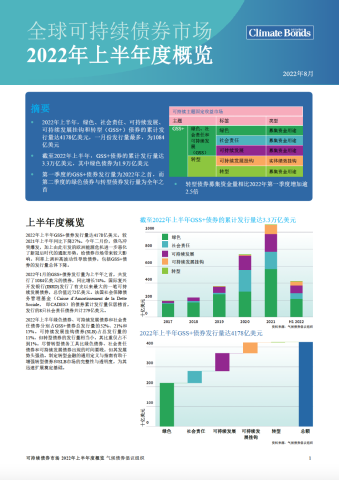

2022年上半年全球可持续债务市场进展报告

2022年上半年全球可持续债务市场进展报告

-

Hoja de Ruta para una Taxonomía en Chile

Hoja de Ruta para una Taxonomía en Chile

-

Taxonomy Roadmap for Chile

Taxonomy Roadmap for Chile

-

Sustainable Debt Market Summary H1 2022

Our latest market update shows that Green, social, sustainability, sustainability-linked, and transition (GSS+) labelled debt reached a combined volume of USD417.8bn in the first half of 2022 (H1 2022), representing a year-on-year (YoY) decrease of 27% against H1 2021. However, signs of a revival emerged as green issuance picked up in Q2, increasing by 25% on Q1 volumes with a total of USD121.3bn.

-

Discussion Paper: Certification of Short-Term Debt

Green finance has typically been the realm of the global bond, loans, and other long-term markets, amassing almost $2trillion in volume to date. However, to direct larger capital flows towards climate solutions, investors must be able to easily identify all types of green finance instruments. The estimated USD55trillion value of global short-term debt markets offers an enormous pool of capital, on top of the global bond market, in which green finance can expand.

-

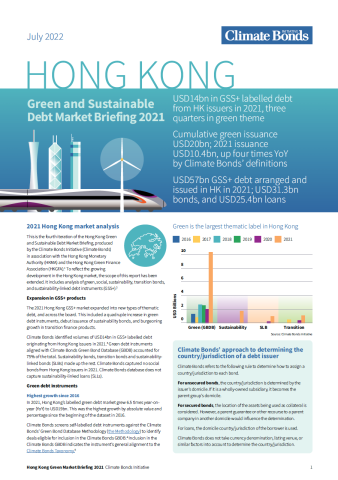

Hong Kong Green and Sustainable Debt Market Briefing 2021

The Climate Bonds Initiative, in partnership with HSBC, and supported by HKMA and HKGFA, presents the Hong Kong Green and Sustainable Debt Market Briefing 2021.

The briefing offers leading analysis of green, social, sustainability, transition bonds, and sustainability-linked debt instruments (GSS+) in the region.

Download your copy NOW!

-

中国绿色债券市场报告2021

中国在2030年前实现碳达峰是可行的。2021年,中国绿色债券发行量的迅猛增长有力地印证了其加快碳减排工作的雄心; 而实现中国宏大的 “双碳” 目标还需要加快绿色和可持续的投资并进一步壮大其规模。

气候债券倡议组织(CBI)与中央国债登记结算有限责任公司中债研发中心在汇丰银行的鼎力支持下联合发布《中国绿色债券市场年度报告2021》。本报告旨在总结截至到2021年底中国绿色债券市场的发展亮点,并对市场发展趋势做出展望。

-

China Green Bond Market Report 2021

China is very likely to reach its carbon peaking goal before 2030. The momentum seen in its 2021 green bond issuance will continue to support that. However, green and sustainable financing in China needs to further accelerate on a larger scale to provide the funding required to reach the 30·60 targets.

Learn more about the Green Bond market development in China in this new report produced by Climate Bonds Initiative and China Central Depository & Clearing Co. Ltd Research Centre (CCDC Research), with the support of HSBC.

Download your copy NOW!

-

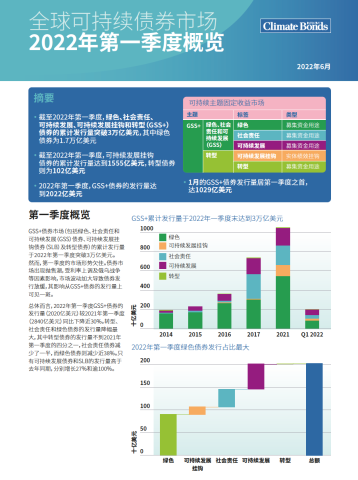

全球可持续债券市场 2022年第一季度概览

2022年第一季度,全球GSS+债券市场(包括绿色、

社会责任和可持续发展债券,可持续发展挂钩债券以及转型债券) 的发行量超过2000亿美元。GSS+债券累计发行量于第一季度 末突破3万亿美元大关。受利率上调及俄乌战争等因素影响, 第一季度发行量同比有所放缓。但长远来看, 贴标债券市场规模将继续壮大。 摘要:

* 截至2022年第一季度,GSS+债券的累计发行量突破3万

亿美元,其中绿色债券为1.7万亿美元 * 截至2022年第一季度, 可持续发展挂钩债券的累计发行量达到1555亿美元,转型债券为

102亿美元 * 2022年第一季度,GSS+债券的发行量达到2022亿美

元

* 1月的GSS+债券发行量居第一季度之首,达1029亿美元 -

Linking Global Finance to Small-Scale Clean Energy

This report discusses the potential of financial aggregation in enabling global capital markets to finance distributed renewable energy (for residential and other uses) in developing countries. It explores the state of small-scale, low-carbon energy in developing countries as well as the barriers to financial aggregation, along with some proposed solutions and key considerations for market practitioners.

-

ASEAN Sustainable Debt Market 2021

The sustainable debt market in the 6 largest ASEAN economies continued to grow rapidly in 2021 with record issuance of green, social, and sustainability (GSS) debt totaling USD24bn compared to USD13.6bn in 2020. This growth reflects the regions’ enthusiasm to allocate capital for the response to the COVID-19 pandemic along with facilitating long-term, low carbon, and climate-resilient economic growth.

Learn more about the ASEAN sustainable debt market in 2021 in our latest report. Now available for download.

-

Promoting Local Currency Sustainable Finance in ASEAN+3

The Promoting Local Currency Sustainable Finance in ASEAN+3 report is a regional update on the green, social, sustainable, sustainability-linked and transition bond market, with a particular focus on local currency (LCY) sustainable bond markets in ASEAN+3.

-

India Sustainable Debt Market State of the Market 2021 report

The India sustainable debt market continued to grow in 2021 with issuance of green, social, and sustainability (GSS) debt totaling USD7.5bn, a six-fold (+585%) increase compared to 2020 figures. These and other findings are brought by the India Sustainable Debt Market State of the Market 2021 report, launched today by the Climate Bonds Initiative.

-

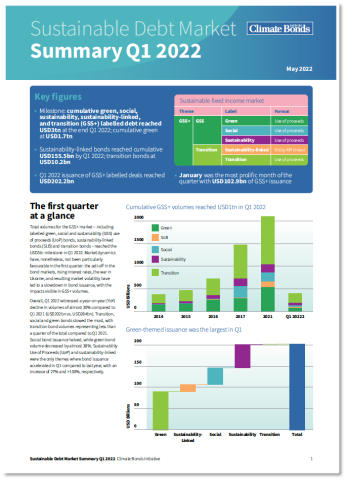

Sustainable Debt Market Summary Q1 2022

The labelled bond market topped $200bn in the first quarter of 2022, despite unfavourable conditions for fixed income securities. The green, social, sustainable, and other labelled (GSS+) bond charge was threatened by market volatility as the Ukraine war and rising interest rates sprung upon the opening months of the year. Despite this, the market demonstrated resilience and amassed a strong volume which is expected to rise over the coming months.

-

ASEAN economies exposure to climate transition risks

This report examines ASEAN exposure to transition risks. The report describes the major channels by which these risks will be transmitted through to the financial economy and examines possible local and global sources of transition risk.Sources of transition risk vulnerability are revealed through analysis of ASEAN bond and loan data, with a particular focus on Indonesia, the Philippines and Viet Nam. -

中国绿色金融政策分析报告2021

气候债券倡议组织和商道融绿共同发布《中国绿色金融政策分析报告2021》,本报告得到了英国加速气候转型合作伙伴计划(UK PACT)的支持。

报告面向国内和全球范围内关注中国快速发展的绿色金融市场最新动态的利益相关方,探讨了中国绿色金融和绿色债券市场相关政策发展的四个要素:

-

中国绿色金融政策聚焦碳中和的相关进展;

-

-

China Green Finance Policy Analysis Report 2021

With the support of UK PACT (Partnering for Accelerated Climate Transition), the Climate Bonds Initiative and SynTao Green Finance launched China Green Finance Policy Analysis Report 2021. The report assesses China's latest green finance policies and provides an overview of its green bond market development.

-

中国绿色债券 投资者调查 2022

中国绿色债券 投资者调查 2022气候债券倡议组织和商道融绿在香港交易及结算所有限公司和法国外贸银行的支持下,于今天发布了《中国绿色债券投资者调查报告2022》。 报告中的问卷参与对象(42家机构)均来自中国银行间市场交易商协会发布的中国主要绿色债券投资者名单,以及活跃在中国绿色债券市场的国际投资人。该调查显示绿色资质和信用基本面是进一步提高中国市场绿色债券吸引力的关键。欢迎下载阅读! -

Post-Issuance Reporting in China's Green Bond Market 2022

This is Climate Bonds’ first study of post-issuance disclosure practices of green bonds in China, produced in partnership with SynTao Green Finance. Available in both English and Chinese, it builds on the series of global studies on this topic that Climate Bonds has conducted over the last few years.

-

Sustainable Debt Global State of the Market 2021

Climate Bonds’ flagship global State of the Market Report details the size and substance of green and other labelled bond markets. This, the 11th iteration, has been extended and now includes analysis of the green, social and sustainability (GSS) markets, plus sustainability-linked bonds (SLBs), and transition bonds. The publication represents the most extensive analysis available in the labelled finance space with features on taxonomies and sovereign bonds.

-

Green Bond China Investor Survey 2022

Climate Bonds Initiative and SynTao Green Finance, with the support of Hong Kong Exchanges and Clearing Limited (HKEX) and Natixis Corporation and Investment Banking (Natixis CIB) present the Green Bond China Investor Survey 2022 report. Conducted with 42 investment institutions among largest domestic and international green bond investors, the survey reveals that satisfactory green credentials and credit fundamentals are top priorities for furthering the appeal of green bonds coming from China. Download your copy now!

-

Green Bond Pricing in the Primary Market H2 2021

The Report is the 13th iteration of a leading series analysing pricing dynamics of green bonds, examining how these instruments offer pricing advantages for investors and issuers alike.

-

Identifying, managing and disclosing climate-related financial risks: options for the Reserve Bank of India

India has committed to becoming a net-zero economy by 2070. This means a five fold increase in investment in green energy by 2030. But Indian banks are already heavy lenders to the power sector.In this report the authors quantify the extent of lending by Indian banks to fossil fuel assets including power stations, coal, oil and gas extraction and heavy industry. This loans pose potential risks to Indian financial systems capacity to transition to decarbonise. -

Green Infrastructure Investment Opportunity (GIIO) Indonesia: Green Recovery 2022 Report

The Climate Bonds Initiative is pleased to present the Green Infrastructure Investment Opportunities Indonesia: Green Recovery report, which identifies and analyses multiple green infrastructure projects open for potential investment and development in the country. Indonesia GIIO has been produced with the support of the Asian Development Bank (ADB), the ADB-managed ASEAN Catalytic Green Finance Facility (ACGF), and PT Sarana Multi Infrastruktur (PT SMI).

-

全球绿色分类标准制定、统一及实施进展研究报告

气候债券倡议组织(Climate Bonds Initiative)与英国加速气候转型合作伙伴计划(UK PACT)合作,发布了全球绿色分类标准制定、统一及实施进展研究报告,该报告重点介绍了绿色分类标准发展的最新趋势及对可持续金融市场的影响。

该报告将欧盟和中国的绿色分类标准作为案例研究,比较了它们的指导原则和技术筛选标准,及中欧推出的《共同分类目录》中考虑的相关要素。此外,该报告讨论了绿色分类标准在绿色金融市场的应用,包括产品开发、风险管理、品牌推广和信息披露方面。

该报告现已提供中文和英文版本下载。 -

Global Green Taxonomy Development, Alignment and Implementation

The Climate Bonds Initiative (Climate Bonds), in collaboration with the UK PACT programme, presents the Global Green Taxonomy Development, Alignment and Implementation report which highlights the latest trends around taxonomy development and their the subsequent implications for the future of the sustainable finance market.

-

Transition Finance in China: latest development and future outlook

The Climate Bonds Initiative and CECEP Hundred Technical Service (Beijing) Co., Ltd. (CECEP), with the support of UK PACT, presents the Transition Finance in China: latest development and future outlook report. Taking the Chinese steel sector as a case study, this report reviews the latest development of transition finance in China and discusses recommendations to enable a credible transition.

-

中国转型金融研究报告

《中国转型金融研究报告》是由气候债券倡议组织和中节能衡准科技服务(北京)有限公司共同撰写,并由英国加速气候转型合作伙伴计划(UK PACT)资助。本报告梳理了当前转型金融的最新进展,提出实现可信转型应遵守的原则,并以中国钢铁行业为例,讨论如何应用转型金融。

-

Green Infrastructure Investment Opportunities Thailand

The Green Infrastructure Investment Opportunities Thailand (Thai GIIO) report identifies and analyses green infrastructure projects open for potential investment and highlights avenues for further pipeline development. This report has been produced with the support of the

-

中国可持续债券市场盘点报告

《中国可持续债券市场盘点报告》分析了中国可持续债券市场截至2021年上半年的发展情况,重点关注现有可持续债券品种的定义、监管框架和市场发展,并将视角拓展到市场标准和激励/约束政策的最新发展。这份报告由气候债券倡议组织和兴业研究联合推出,感谢英国加速气候转型合作伙伴计划(UK PACT)的支持。

-

China’s Growing Sustainable Debt Market

China's Growing Sustainable Debt Market report analyses the development of China sustainable debt market up to the first half of 2021, focusing on the definitions, regulatory frameworks, and market development of existing sustainable labels, and takes an additional lens into the latest developments in market standards and policy incentives/constraints. The report was produced in partnership with CIB Economic Research and Consulting Co., Ltd. (CIB Research), with the support of UK PACT (Partnering for Accelerated Climate Transition).