5 Principles for an ambitious transition

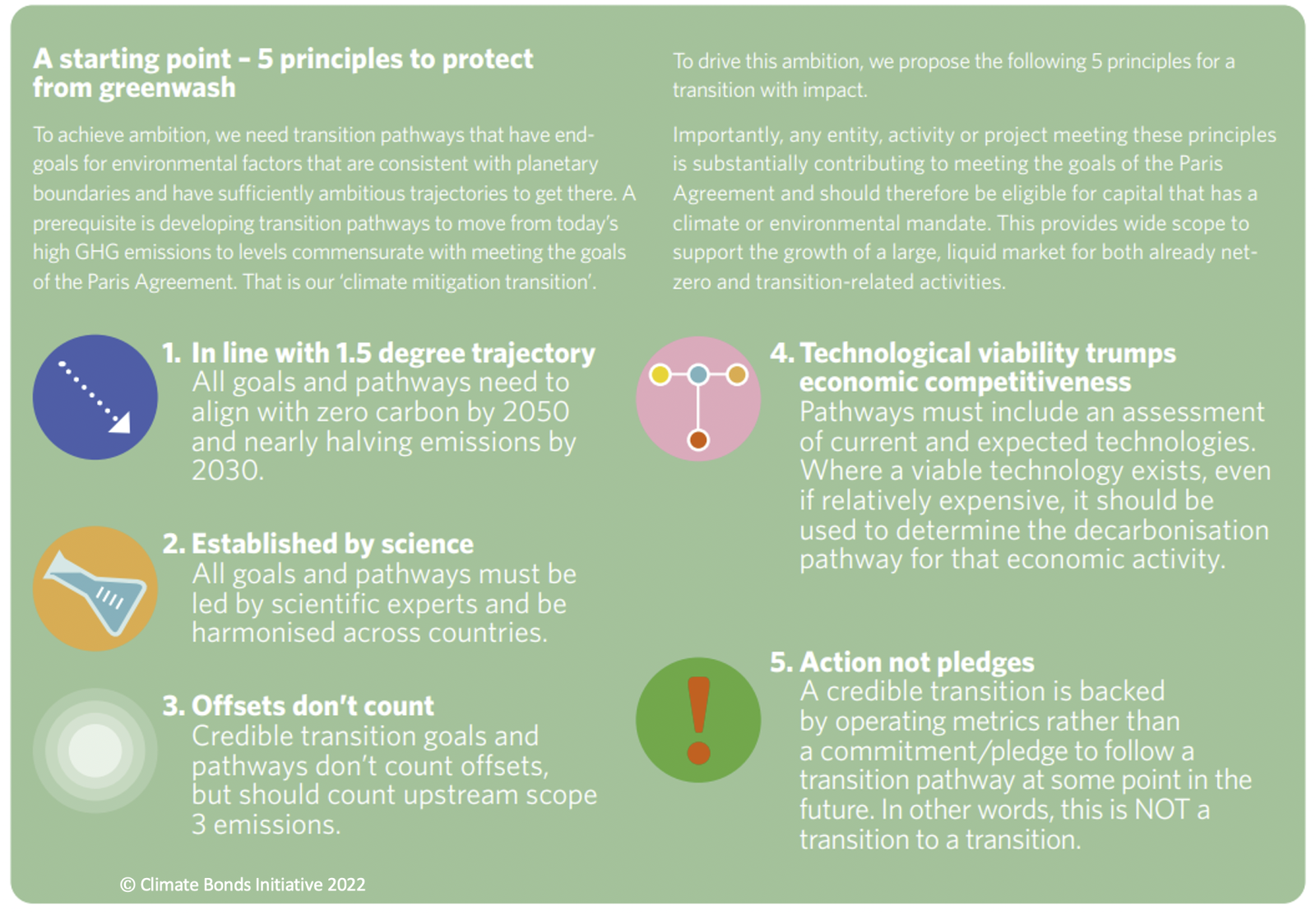

Whilst change can be delivered in a number of ways, a robust framework needs principles that signal the credibility of transition. The paper Financing Credible Transitions, launched in September with Credit Suisse, is the very first body of work that establishes five Core Principles for Transition.

Resources:

News:

Latest Webinar, 30th Nov: Building a market for green transitions

Event speakers: Adam Matthews, Church of England Pensions Board; Anna Creed, Climate Bonds; Marissa Drew, Credit Suisse; Stephen Liberatore, Nuveen & Sean Kidney, Climate Bonds.

These Principles lay the groundwork for a Transition label that will move investment decisively and enable investors to easily find climate-proof investments (and avert potential criticism of greenwashing).

Climate Bonds aims to develop criteria that define credible and ambitious transitions.

All goals and pathways need to:

- Align with zero carbon by 2050 and nearly halving emissions by 2030;

- Be led by scientific experts and not be entity- or country-specific;

- Be sure that credible transition goals and pathways don’t count offsets;

- Include an assessment of current and expected technologies which can be used to determine a decarbonisation pathway;

- Be backed by operating metrics rather than a commitment or pledge.