What's new in Standard 4.0?

The structural expansion of the Climate Bonds Standard and Certification Scheme now allows for certification of non-financial corporates (i.e., Corporates providing goods and services in the real economy), assets and sustainability-linked debt instruments.

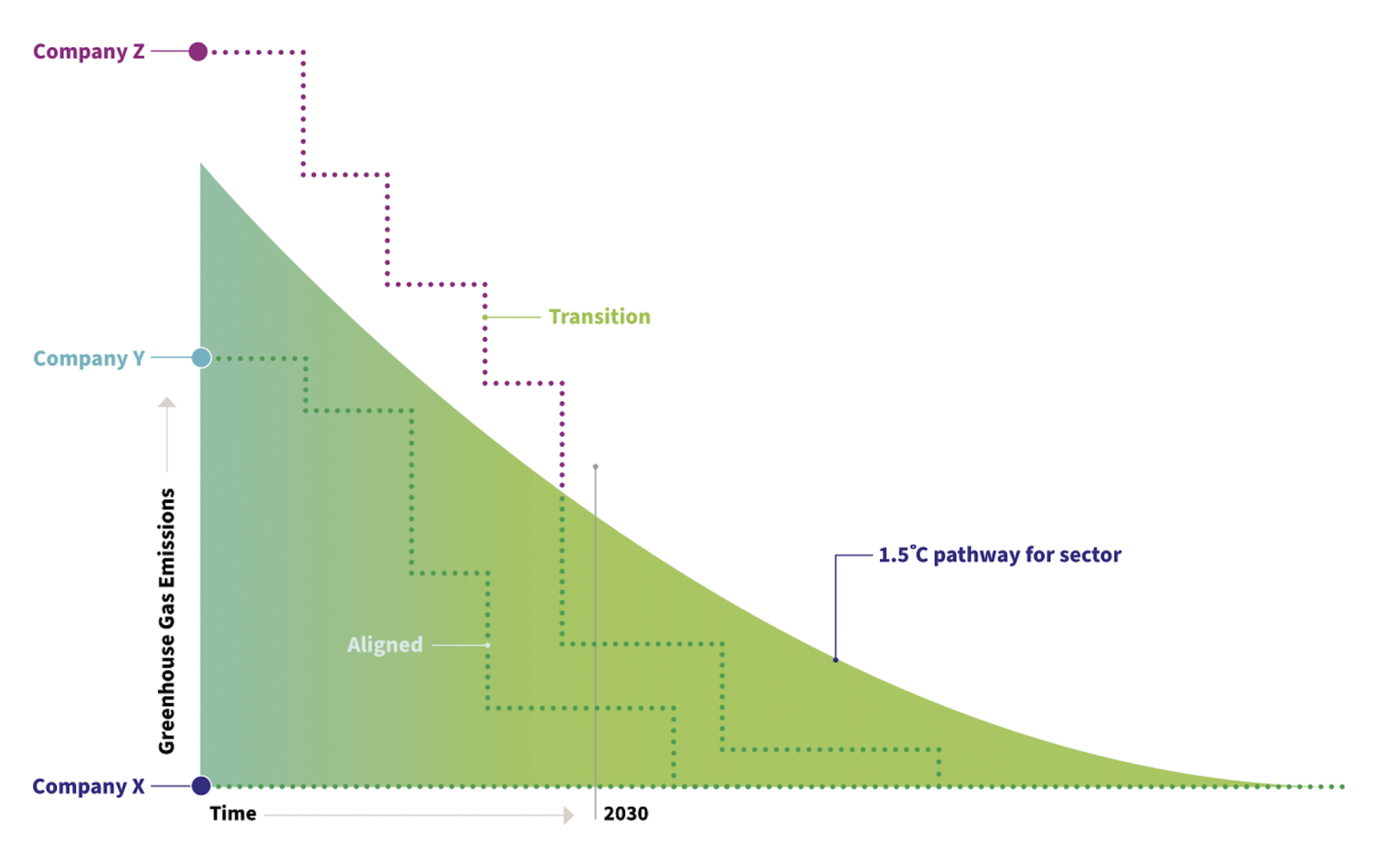

Essentially, those corporates that are aligned with 1.5-degree pathways or will be by 2030 will be eligible for certification.

This includes those whose emissions are already ‘near zero’ and those that are not, so long as the corporate has suitably Ambitious Performance Targets and Credible Transition Plans for the delivery of those Targets, i.e., it is undergoing an ambitious and credible Transition.

That is, although this work originated from our focus on ensuring credible transitions, and ‘no greenwashing’ as the transition concept and label emerged, these new certification offerings are applicable more broadly than just transitioning corporates and Sustainability-linked debt instruments.

Key features of the Entity and Sustainability-linked debt instrument certification

Ambition: The goal of transition is to deliver no more than 1.5-degree global warming. This is a key test for eligibility for certification.

Inclusivity: The collective goal of global net zero emissions will not be met without decarbonising the highest emitters as well as building up low or zero carbon alternatives. Certification is designed to support all transition, provided the goals, the path and the pace are suitably ambitious.

For this reason:

- Corporates and SLDs from all sectors will be eligible for Certification (once relevant sector-specific criteria are available).

- Corporates and SLDs from those already on 1.5-degree pathways are eligible for certification as are those who will align with those pathways by 2030 at the latest (so long as they can demonstrate the ambition of their future Performance Targets and the credibility of their Transition Plan to deliver on those Targets).

- Granular simplicity: Bridges the gap between existing market guidance tailored specifically to SLDs which have good uptake but are lighter touch in detail and the deeper company-level assessment frameworks available that are more comprehensive but perhaps too complex for wide market uptake.

New Certification Labels

Our expanded Standard and Certification Scheme offers two levels of Certification (Aligned and Transition):

Level 1 (Aligned)

Entities, Debt instruments or Assets that are already aligned with 1.5 degree pathways. This category includes both those already near net-zero and those above net-zero but within sectoral 1.5 degree pathways and transition plans that predict alignment with those pathways going forward.

Level 2 (Transition)

Entities or Sustainability-linked debt whose transition plans predict that they will be aligned with 1.5 degree pathways by 2030.

Sustainability-linked debt instruments/Entity Certifications that need a transition plan

Sectors that can be Certified

The basic pillars for all types of certifications under the Standard are a standardised rule set of sector level eligibility of projects, transparency, and external review by a Climate Bonds Approved Verifier. Climate Bonds will be expanding the range of available sectors for all the certification types.

See the Sector Criteria here: https://www.climatebonds.net/standard/available

Below are the available sectors:

These proposals are built on the foundations of Climate Bonds’ Transition Principles, Transition Categories and Credible Transition Hallmarks detailed in our two papers:

They have also been informed by a review of all similar frameworks and initiatives tackling the requirements in a credible Transition Targets and Transition Plan, including but not limited to, GFANZ, TCFD, ACT, SBTI, UK one, EU Platform for Sustainable Finance, ICMA’s SLD Principles and Climate Finance Transition Handbook.