Join us for an interactive session on the Food Value Chain Criteria, currently open for Public Consultation. -- - Learn how the Criteria aims to align the global food system with a 1.5°C pathway. - Ask questions directly to the experts behind its development - Share your feedback to help shape the final version of the Criteria - Speakers: - Aishwarya Sankar, Sustainability Analyst, Climate Bonds Initiative - Marian Alejandra Rodriguez, Head of Standards, Climate Bonds Initiative - Ruth Rennie, Technical Lead, Independent Consultant

Climate Bonds Connected: Webinar Programme

Previous Webinars - with Recordings and Presentation Slides

@Climate Bonds Community

@Climate Bonds Community

Join us on April 2nd for a Climate Bonds webinar, discussing and dissecting new recommendations on transparency and reporting in the GSS bond market. The Transparency & Reporting in the GSS Bond Market Report is a comprehensive study of post-issuance reporting in the GSS bond market, aimed at enabling a healthy and transparent market. Climate Bonds have suggested a list of recommendations for high-quality and standardised reporting, but propose these four elements as a minimum:

1: Scope – report allocations and impact.

2: Bond identification – clearly state the scope of reports in terms of instruments and period covered, percentage of proceeds allocated and impact. 3: Accessibility to disclosure.

4: Frequency and timing. Our host Clodagh Muldoon, Head of Research at Climate Bonds Initiative and our esteemed panellists will assess the key details from this USD1.4 trillion sample and what this means for future market reportage.

@Climate Bonds Community

In 2023, a common concern in our meetings with the financial community was confusion over the many transition assessment methodologies, each claiming to be better. This issue is now central to most of our 2024 discussions, especially with corporates feeling torn between competing approaches. Mike Coffin’s note, using the Oil & Gas sector as a case study, addresses key questions: • What are transition plans? • Why mandate them? • How do they differ across sectors? • How should they impact investment decisions? • Is there too much focus on emissions? It offers practical markers and metrics for portfolio managers to assess transition risks and provides tools for engagement with investment teams and corporates. We hope this guide will also assist financial regulators and policymakers in clarifying the intent behind transition plan requests.

@Climate Bonds Community

February's Lunch 'n Learn, brought to you by the Climate Bonds Initiative focusses on "The Greenhouse Gas and Environmental Impact of liquified natural gas (LNG): Methane Leaks and Climate Implications”. Methane emissions, LNG vs coal, plus "cleaner" energy options. Join us as we walk you through this vital topic. Featuring key findings from our special guest: Professor Robert W. Howarth, Ph.D., Professor of Ecology & Environmental Biology, Cornell University, USA; Co-Editor in Chief, Ocean-Land-Atmosphere Research (OLAR) Moderated by: Rachel Hemingway, Head of Transition Programmes, Climate Bonds Initiative

@Climate Bonds Community

Join the Climate Bonds Initiative for an insightful webinar on the Alternative Proteins Criteria, currently under development. This session offers a unique opportunity to hear directly from experts, ask your questions, and gain the insights needed to provide robust feedback during the ongoing Public Consultation. Our expert panel will: - Unpack the Alternative Proteins Criteria and their purpose. - Discuss how these Criteria align with a 1.5°C transition - Guide participants in preparing thoughtful and inclusive feedback. Speakers: - India Langley, Sustainability Analyst, Climate Bonds Initiative - Reyes Tirado, Agri-Food Lead, Climate Bonds Initiative - Aditi Mukherji, Director, Climate Change Impact Platform, CGIAR - Tom Chapman, Food Systems Impact Advisor, GFI This webinar is essential for food industry professionals and sustainable finance experts committed to transforming food systems and contributing to a low-carbon future. We look forward to your participation!

@Climate Bonds Community

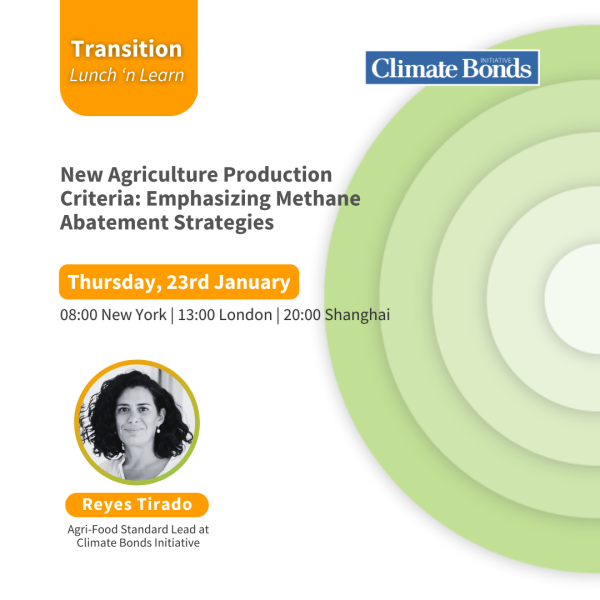

The Climate Bonds Initiative invites you to a Lunch & Learn session featuring the newly developed Agriculture Production (Crop and Livestock) Criteria, now available for certification under the Climate Bonds Standard. This engaging event will provide an in-depth overview of the criteria, which offer a comprehensive framework for reducing emissions in agriculture, one of the most emission-intensive sectors globally. We will explore how these criteria support sustainable practices across key areas such as deforestation prevention, biodiversity protection, and improvements in water use and animal welfare. Join us to learn how the criteria align with global sustainability frameworks like the Paris Agreement and the Global Methane Pledge, and how they can help accelerate the transition to a low-carbon, sustainable agricultural future.

@Climate Bonds Community

The climate transition requires large-scale mobilisation of private capital to transition energy systems, build resilient infrastructure, and develop sustainable communities. Some of the greatest sustainable investment challenges Iie in developing the market conditions, the de-risking provisions, and the financial structures needed to enable private capital to flow to crucial transition investments. Development finance institutions are a key player in this, maximising their mobilisation capabilities could hugely accelerate sustainable investment flows across the world. If all DFIs were to double the current best efforts on mobilisation, levels would increase to EUR740bn per year, having a major impact on global climate finance levels, which currently stand at just over EUR1tn/year. Climate Bonds’ recent report outlines a wide range of ways that DFIs, their shareholders, and policymakers can increase private capital mobilisation for green. In this webinar we’ll be unpacking these recommendations and hearing from experts from BII, BIO [and EBRD] on their experiences in mobilising capital.

イベント概要

日本政府は、2050年までのカーボン・ニュートラルと2030年までに2013年比で46%の排出削減、さらに50%の高みを目指すという中間目標を掲げています。政府はグリーントランスフォーメーション(GX)を実現するために、今後10年間で20兆円規模の政府の先行投資、150兆円を超える官民のGX投資を目指しており、その足がかりとして2024年2月、5月にクライメート・トランジション利付国債を発行しました。

こうした投資の流れをさらに加速させ、あらゆるステークホルダーが一丸となってトランジション(着実な脱炭素化に向けた移行)を推し進めていくためには、1.5℃目標と科学的根拠に基づく信頼性の高いトランジション計画の策定、開示、評価が求められます。

本ウェビナーでは、IGESとClimate Bonds Initiativeが共同で7月にリリースした「トランジション戦略ツールキット」のガイダンスと原則に学びながら、日本の企業の日々のトランジション推進で活用されることを目指して、政策立案者、投資家、NGOの視点から、強固で信頼できるトランジション戦略とは何かを議論します。そして、そうした戦略の策定・運用・評価の方法、適切な情報開示を実践するために必要なことは何かを深堀りします。

対象者

本ウェビナーは、サステナブルファイナンスに一定の関心を持ち、債券市場について基礎的な知識を有する方々を対象として想定しています。トランジションファイナンスやトランジション計画の策定・評価に関わる投資家や企業の担当者に向けた内容です。

ウェビナーの形式と概要

・ウェビナー形式:1時間のオンラインセミナー(Zoomによるバーチャル形式)

16:00-16:40 プレゼンテーション

16:40-17:00 質疑応答

イベントの詳細

・日時:2024年7月29日(月) 16:00~17:00(日本時間)

・会場:オンライン(Zoom)

・共催:

クライメート・ボンド・イニシアチブ(Climate Bonds Initiative)

・使用言語:日本語

・参加申し込み:https://crm.iges.or.jp/public/application/add/4718

・コンタクト:IGES ファイナンスタスクフォース セミナー事務局

Email: fin-info@iges.or.jp

プログラム

トランジション戦略ツールキット発表ウェビナー「1.5℃目標に整合したトランジション計画とアセスメント」

司会進行:Climate Bonds Initiative ジャパン・シニアビジネスディベロップメント・アナリスト 細谷優希

高田英樹 GX推進機構(脱炭素成長型経済構造移行推進機構)理事

宮本泰俊 日本生命保険相互会社 財務企画部 責任投融資推進室 室長

森尚樹 IGES ファイナンスタスクフォースプログラムディレクター

森下麻衣子 Climate Bonds Initiative ジャパン プログラムマネージャー

@Climate Bonds Community

On the agenda: - The progress made on climate targets. - What to expect with policy change in the next decade. -The Inevitable Policy Response & decarbonisation pathways. https://ipr.transitionmonitor.com/ - Much, much more...

Join us for an engaging and insightful Lunch & Learn session focusing on "Financial Crimes and Land Conversion: Uncovering Risk for Financial Institutions - Commodity Supply Chain Risks." This event is an excellent opportunity for professionals in the financial sector, sustainability advocates, and anyone interested in understanding the intricate risks associated with commodity supply chains.

Guest Speakers:

- Olivia Dakeyne, Associate Director, Insight at Themis

- Carel Van Randwyck, Senior Advisor at Themis

- John Dodsworth, Drivers Initiative Lead at WWF-UK

Why Attend?

Gain Insight: Understand the complex landscape of financial crimes linked to land conversion and how they affect commodity supply chains.

Identify Risks: Learn how to uncover and mitigate risks associated with financial crimes in the context of sustainability and land use.

Expert Perspective: Benefit from Olivia Dakeyne's expertise and Themis' comprehensive approach to risk management.

Network and Learn: Connect with like-minded professionals, share experiences, and discuss strategies to manage and mitigate these risks effectively.

Key Takeaways:

An overview of the intersection between financial crimes, land conversion, and commodity supply chains.

Insight into the latest trends and emerging risks in this domain.

Practical approaches for financial institutions to identify and manage these risks.

Case studies highlighting real-world scenarios and solutions.

This session is part of our ongoing effort to provide valuable learning opportunities that contribute to the broader understanding of transition finance.

Register to stay informed and up-to-date on the latest developments in green bonds and climate finance by subscribing to our mailing list. We value your privacy and are committed to keeping your data secure, for more see our Privacy Policy (https://www.climatebonds.net/privacy)

Discover the transformative Electrical Utilities Criteria, now integral to the Climate Bonds Standard for entity certification, in our upcoming webinar. This new framework marks a vital expansion, targeting the electricity sector's significant contribution to global greenhouse gas emissions and its journey towards net-zero.

We'll cover how these criteria offer a robust, science-based approach for electrical utilities to align their financing—with a keen focus on bonds, loans, and sustainability-linked debt—with stringent climate objectives. Designed to limit global temperature rises and enhance energy resilience, this certification plays a crucial role in meeting the Paris Agreement's ambitious targets.

Hear from experts on the importance of Mitigation and Adaptation Requirements and the impact of certification in steering the sector towards a sustainable future. Ideal for stakeholders in the electrical utilities sector, investors, and those interested in climate finance, this session promises essential insights into accelerating the transition to a low-carbon economy. Join us to learn how your entity can contribute to a sustainable future through strategic climate action.

Join us for a first look at the Climate Bonds Agri-Foods Deforestation & Conversion Free Sourcing Criteria which serve as a procurement guide for aligning food sourcing strategies with 1.5°C climate goals, helping to green the financial sector.

This criteria includes the establishment of clear dates to limit the timeframe of deforested-links products entering global supply chains and strong guidance on traceability and disclosure requirements, in coherence with new policy regulations driving changes in the market. In particular, the new criteria ensures consistency with EU Deforestation-free Regulation (EUDR) and guide those aiming for the EU market for early awareness and adherence. Cut-off date established is 31 December 2020, supply chain of certifiable entities should be free from deforestation of natural forest and conversion of natural ecosystem.

The criteria have a clear focus on climate and biodiversity impacts, and safeguarding social equity, including human rights and the rights of indigenous peoples. The criteria is informed by other standards in the market and recent policy developments, with an aim to facilitate much needed progress towards food supply chains protective of climate and biodiversity.

The DCF Sourcing Criteria is targeted at entities: Companies operating within the food value chain which source agriculture commodities that are land-based and whose production might involve land use change from natural ecosystems (e.g. forests, peatlands, savannas). Assets, Use of Proceeds, Entities and Sustainability-Linked Debt instruments that enable or service the goal of deforestation and natural ecosystem conversion free sourcing (e.g. entities operating in the land-use change monitoring or traceability system space) can be certified under Climate Bonds Standard as 1.5ºC Aligned for eligible activities.

@Climate Bonds Community

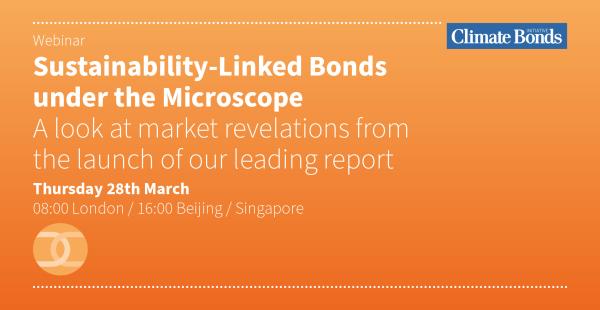

We deep dive into the rise of sustainability-linked bonds (SLBs) in recent years, explore why this debt structure has been so popular, why its come under criticism for climate practice and how the SLBs climate credentials have had a huge boost in the last year.

Join our panel of market experts as they unpack first-of-its kind data on the SLB market. Climate Bonds released its SLB Methodology in 2023, this new tool to measure if an SLB is meeting best practice climate standards. The results show an unflattering opening few years for SLBs' climate credentials, but also a huge leap forward since the release of the SLB Methodology.

Our panel will deliberate on how we go on building a high-quality SLB market, don't miss out!

- Zalina Shamsudin (Head of Technical Assistance and Capacity Building, Climate Bonds Initiative)

- Miguel Almeida (Report author & Research Manager, Climate Bonds Initiative)

- Joanne Teo (Vice President, Listing Policy & Product Admission, Singapore Exchange Regulation)

- Norbert Ling (Fixed Income ESG Portfolio Manager, Invesco)

- Prabodha Acharya (Chief Sustainability Officer, JSW Steel)

@Climate Bonds Community

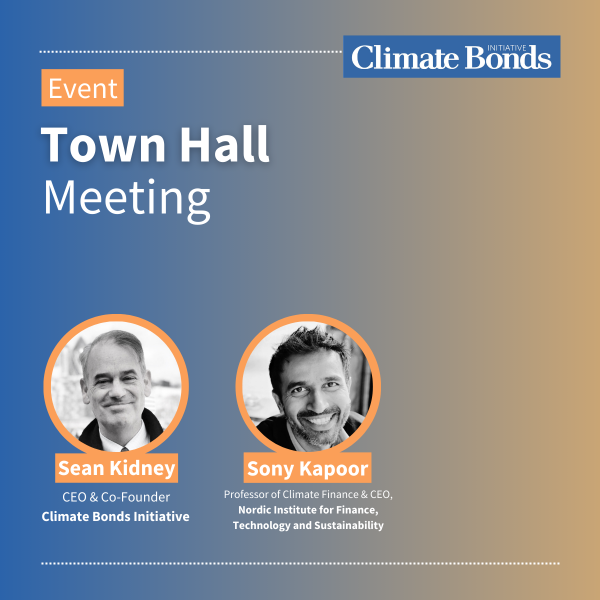

A town hall to bring together a wide array of stakeholders to discuss, in an informal and unscripted manner, how to accelerate the growth of the green bonds market.

A town hall to bring together a wide array of stakeholders to discuss, in an informal and unscripted manner, how to accelerate the growth of the green bonds market.

India's G20 Presidency positioned sustainable finance as a key pillar of action and prioritised the mobilising of capital flows at scale and speed for climate and sustainability. COP28 echoed this agenda.

As India progresses towards its 2070 net-zero targets, its success hinges on how well it can mobilise capital from international and domestic sources.

Climate Bonds Initiative and MUFG, with their long standing commitment to climate investments, are coming together to engage stakeholders across Asia and align their sustainability and decarbonisation goals with the region's broader energy transition and developmental agendas.

Join us in an exclusive dialogue in Mumbai, on 23 February.

Hosted as part of the MUFG NOW (Net Zero World) and CLIMATE BONDS CONNECT series of thought leadership events, the session will gather business leaders, investors, policy-makers and industry experts. The dialogue will focus on the latest industry trends, regulatory shifts and market expectations to unleash new sustainable investment opportunities.

India's G20 Presidency positioned sustainable finance as a key pillar of action and prioritised the mobilising of capital flows at scale and speed for climate and sustainability. COP28 echoed this agenda.

As India progresses towards its 2070 net-zero targets, its success hinges on how well it can mobilise capital from international and domestic sources.

Climate Bonds Initiative and MUFG, with their long standing commitment to climate investments, are coming together to engage stakeholders across Asia and align their sustainability and decarbonisation goals with the region's broader energy transition and developmental agendas.

Join us in an exclusive dialogue in Mumbai, on 23 February.

Hosted as part of the MUFG NOW (Net Zero World) and CLIMATE BONDS CONNECT series of thought leadership events, the session will gather business leaders, investors, policy-makers and industry experts. The dialogue will focus on the latest industry trends, regulatory shifts and market expectations to unleash new sustainable investment opportunities.

Discover the crucial role of the EU Deforestation-Free Products Regulation (EUDR) in our upcoming webinar.

With the FAO reporting a loss of over 420 million hectares of forest from 1990 to 2020, and the IPCC linking 23% of greenhouse gas emissions to land use changes, this regulation is a key step in combating deforestation.

The EUDR not only aligns with EU corporate sustainability and due diligence requirements but also poses significant challenges for supply chains, cost management, and global trade dynamics. Join us to explore how this regulation impacts companies and the global effort towards sustainable, deforestation-free supply chains.

The hydrogen production criteria were launched in November 2022 using an emissions intensity approach to define low-carbon hydrogen. These criteria were focused on projects, measures and infrastructure relating to hydrogen production. Now, the Climate Bonds expands the criteria to certify hydrogen delivery projects.

The Hydrogen Criteria apply to eligible assets, projects, decarbonisation measures, and entities relating to the production, conditioning, conversion, transportation, and storage of low-carbon hydrogen. It covers activities across the hydrogen value chain, except for end-uses, which are part of each end-use sector criteria.

The development of Hydrogen Criteria by the Climate Bonds Initiative marks a significant step towards fostering credible and sustainable hydrogen-related investments. By integrating scientific rigor with market usability, these criteria bridge the gap between technical precision and practical implementation.

Join us as the global community strives to transition to a low-carbon economy, and know more about how the Hydrogen Criteria provide investors, organizations, and policymakers with a robust framework to channel investments into projects that are not only environmentally sound but also economically viable. REGISTER NOW!

Speakers:

- Sean Kidney, CEO, Climate Bonds Initiative

- Bridget Boulle, Director of Technical Development, Climate Bonds Initiative

- Marian Rodriguez, Senior Sustainability Analyst, Climate Bonds Initiative

- Emre Gencer, Principal Research Scientist, MIT

- Marta Lovisolo, Senior Policy Advisor on Renewable Energy Systems, Bellona Europa

REGISTER NOW!

The hydrogen production criteria were launched in November 2022 using an emissions intensity approach to define low-carbon hydrogen. These criteria were focused on projects, measures and infrastructure relating to hydrogen production. Now, the Climate Bonds expands the criteria to certify hydrogen delivery projects.

The Hydrogen Criteria apply to eligible assets, projects, decarbonisation measures, and entities relating to the production, conditioning, conversion, transportation, and storage of low-carbon hydrogen. It covers activities across the hydrogen value chain, except for end-uses, which are part of each end-use sector criteria.

The development of Hydrogen Criteria by the Climate Bonds Initiative marks a significant step towards fostering credible and sustainable hydrogen-related investments. By integrating scientific rigor with market usability, these criteria bridge the gap between technical precision and practical implementation.

Join us as the global community strives to transition to a low-carbon economy, and know more about how the Hydrogen Criteria provide investors, organizations, and policymakers with a robust framework to channel investments into projects that are not only environmentally sound but also economically viable. REGISTER NOW!

Speakers:

- Sean Kidney, CEO, Climate Bonds Initiative

- Bridget Boulle, Director of Technical Development, Climate Bonds Initiative

- Marian Rodriguez, Senior Sustainability Analyst, Climate Bonds Initiative

- Emre Gencer, Principal Research Scientist, MIT

- Marta Lovisolo, Senior Policy Advisor on Renewable Energy Systems, Bellona Europa

REGISTER NOW!

Join us in unveiling a new chapter in green building investment with the introduction of Climate Bonds Buildings Criteria 2.1 for Climate Bonds Certification.

Building on our 2012 foundations, this updated criteria emphasises embodied emissions and incorporates the EU Taxonomy, taking green buildings investment a step further.

Introducing an expanded set of criteria for New Buildings represents a significant step change for the current buildings criteria and will have several advantages, including:

- Enhanced Clarity: It provides increased clarity regarding the utilisation of criteria for new buildings, simplifying comprehension and adherence to these critical sustainability standards.

- Harnessing Technological Advancements: By encompassing New Buildings, these criteria leverage the latest technological capabilities available in the construction industry, thereby promoting innovation and sustainability.

- Addressing Typological Gaps: Addresses the fact that not all building typologies are currently addressed in the Climate Bonds Criteria.

We call on investors, stakeholders, and industry leaders to delve into expansive opportunities in this paramount green investment sector. With certifications now available, let's collaboratively shape a sustainable, resilient future for the buildings industry, echoing our shared dedication to an eco-friendlier world.

Climate Bonds and the European Bank for Reconsutruction and Development (EBRD) organise the launch of “Financing the corporate climate transition with bonds: a practical guide”. The Guide helps corporate issuers to take advantage of sustainable finance markets in advancing the appropriate climate transition journey. The event features the launch of the Guide along with interactive sharing and reflections on market opportunities and challenges.

The Green Climate Fund funded the production and release of the guide.

Agenda

09:30 – 10:00 AM - Registration

10.00 – 10.15 AM - Welcoming by Victoria Zinchuk, Director, Head of Romania, EBRD and Sean Kidney, CEO of Climate Bonds

10.15 -10. 30 AM - Transition Finance Bond Guide by Sabine Laurent, Author, Climate Bonds

10.30 – 10.40 - Credible transition finance tools by Sean Kidney, CEO of Climate Bonds

10.40 – 10.50 - Products and market challenges, Dimitri Koufos, Head of Sustainable Business, EBRD

10.50 – 11.00 - Q&A

11. 00 – 11.15 - Coffee break

11:15 – 12:15 - Moderated panels

Green bonds and sustainability-linked bonds in the corporate sector - moderated by Victoria Zinchuk, Director, Head of Romania, EBRD

Magdalena Caramilea, Director of Sustainability, Autonom Group

Iuliana Tiba, Director Environment Social and Positive Impact Financing Division, BRD Groupe Société Générale

Manas Gizhduaniyev, Deputy Chief Executive Officer, Astana International Financial Centre

Energy solutions and financing frameworks for the climate transition - moderated by Sean Kidney, CEO, Climate Bonds

Razvan Popescu, General Director (CEO), Romgaz SA

Alexandru Chirita, General Director (Acting), Electrica SA

Georg Hotar, CEO, Photon Energy Group

Dubravko Karacic, CEO, Zagreb Holding

12.15 – 12.30 – Conclusions by Massimiliano Riva, Principal, Green Climate Fund, EBRD

12.30 – 13.30 Light refreshments and networking

Anna Creed

Director of Environmental Impact & Thought Leadership, Climate Bonds Initiative

Rachel Hemingway

Head of Transition Programmes, Climate Bonds Initiative

Climate Bonds' “Guidance for Assessing Corporate Transition Plans" is a new tool to help financial institutions, investors, and corporates understand how to assess the credibility and ambition of transition plans. This tool is a complement to Climate Bonds Certification Scheme.

This webinar will bring together financial institutions, investors, and policymakers to discuss how transition plans can facilitate the decarbonisation projects necessary to meet global climate targets.

What You Will Gain:

- Exclusive Access to a Revolutionary Toolkit: Get a first look at Climate Bonds' new "Guidance for Assessing Corporate Transition Plans," designed to turn climate ambitions into a concrete roadmap.

- Actionable Insights from Industry Leaders: Hear from eminent voices in finance, policy, and climate action, and discover the strategies they are using to guide sustainable transformations.

The Speakers:

Berit Lindholdt Lauridsen from the International Finance Corporation (IFC) will share how international finance is refocusing towards climate-aligned investments.

Nazmeera Moola of Ninety-One will delve into the intricacies of sustainable investment strategies that offer both impact and ROI.

Rachel Hemingway & Anna Creed from Climate Bonds Initiative will provide an insider's view into the new guidelines designed to transform corporate sustainability.

Why You Can't Afford to Miss This:

This is your opportunity to join the architects of the next wave of sustainable finance. Explore scalable strategies, tactical approaches, and inspiring case studies that will help us not just envision but enact a 1.5°C-compatible future.

Register now to become part of the solution. We're not waiting for the future; we're building it today.

@Climate Bonds Community

Ana Diaz

Global Energy Transition Lead, Climate Bonds Initiative

Sean Kidney

CEO, Climate Bonds Initiative

IPR’s new Bio Energy Forecast assesses both policy directions & emissions impacts to 2030 & 2050. Climate Bonds has established Bio Energy Certification Criteria to help drive standards & investment in the sector.

This event will combine analysis of the key IPR Bio-Energy findings for industry, land use and emissions with Climate Bonds outlook on global investment directions and sustainable agriculture developments.

Aimed at investors, asset managers and analysts this event will be a unique opportunity to hear from expert voices the future interplay of energy and land use trends on a sector of growing importance in the climate transition.

Speakers:

Sean Kidney, CEO, Climate Bonds Initiative

Ana Diaz, Global Energy Transition Lead, Climate Bonds Initiative

Mark Fulton, Founder, Inevitable Policy Response, IPR

Tanya Khotin, Land Use Specialist, IPR

Edward Lees, Co-CIO Environmental Strategies Group, BNP Paribas,

Lee Gordon, Equity Analyst, BNP Paribas

Jason Eis, Director, Vivid Economics

Maria Alejandra Pulido

EU Sustainable Agri Lead, Climate Bonds Initiative

Rachel Hemingway

Head of Transition Programmes, Climate Bonds Initiative

Unlocking the Power of Regenerative Agriculture

A Collaborative Pathway to Global Food Security, Biodiversity Conservation, and Net-Zero Agri-Food Transition

Discover the collaborative pathway to achieving global food security, biodiversity conservation, and a net-zero agri-food transition. This webinar brings together thought leaders, researchers, policymakers, and industry experts to explore innovative frameworks that enable food systems to simultaneously address climate change, biodiversity loss, and food security challenges.

Key Discussion Points:

- The potential of regenerative agriculture in meeting global goals on climate, biodiversity, health & wellbeing, and food security.

- Shifting focus from practices to outcomes: Why alignment around desired results is crucial.

- Developing comprehensive frameworks to assess transition strategies, encompassing environmental and social ambitions in the agri-food sector.

- The role of the private sector in driving the transition to regenerative food systems.

Speakers:

o Theodora Ewer, Program Manager of Regen10 Frameworks Hub

o Rachel Hemingway, Head of Transitions – Climate Bonds

o Stefania Avanzini Director, One Planet Business for Biodiversity (OP2B) WBCSD

o Luiza Volpe, Advocacy, Policy and Partnerships Practice Lead WFO

---------------

By registering to this webinar you are signing up Climate Bonds Initiative's Privacy Policy, please follow the link for details: https://www.climatebonds.net/privacy

Ana Diaz

Global Energy Transition Lead, Climate Bonds Initiative

Anna Creed

Director of Environmental Impact & Thought Leadership, Climate Bonds Initiative

Leo Donnachie

Sustainable Finance Lead, IIGCC

Rachel Hemingway

Head of Transition Programmes, Climate Bonds Initiative

Ronan Hodge

Technical Lead, GFANZ

Our experts will touch upon how to get green finance for clean energy projects, credible transition financing tools, setting methodologies, tools and guidance for electricity utility, credible transition plans, opportunities that the capital market can unlock, and what investors need to be assured the decarbonisation is credible and aligned with the 1.5°C pathway.

We will present electricity utility science-based criteria for investment that are consistent with the goals of the Paris Climate Agreement to limit warming to 1.5 degrees.

Agenda:

Agenda:

2.00 CEST---- Introduction

Rachel Hemingway, Head of Transition Programmes, Climate Bonds Initiative

2.05 CEST---- Exploring 1.5 Paris Pathways for Corporates under Climate Bonds Standard and Certification Scheme

Anna Creed, Director of Environmental Impact & Thought Leadership, Climate Bonds Initiative

2.15 CEST---- Electricity Utilities criteria for the low carbon transition

Ana Diaz, Global Energy Transition Lead, Climate Bonds Initiative

2.25 CEST---- Translate net-zero commitments into ambitious, actionable, science-based transition plans

Ronan Hodge, Technical Lead for the Glasgow Financial Alliance for Net Zero (GFANZ)

2.35 CEST---- Sustainable finance tools

Leo Donnachie, Sustainable Finance Lead at Institutional Investors Group on Climate Change (IIGCC)

2.50 CEST---- From Green to Transition Finance - Competitiveness around the clean tech subsidy race

Tsvetelina Kuzmanova, Senior Policy Advisor Sustainable Finance, Third Generation Environmentalism (E3G)

3.00 – 3.25 ---- Discussions and Q&A

3.25 – 3.30 ---- Close

---------------

By registering to this webinar you are signing up Climate Bonds Initiative's Privacy Policy, please follow the link for details: https://www.climatebonds.net/privacy

Francesca Nugnes

Capacity Development & Private Sector Specialist, PARM

Iris van der Velden

Director of Learning & Innovation, IDH (Sustainable Trade Initiative)

Maria Alejandra Pulido

EU Sustainable Agri Lead, Climate Bonds Initiative

Reyes Tirado

The webinar aims to raise awareness on accelerating sustainable investments by developing science-based and consensus-driven transition pathways for the agri-food system and will identify the lessons learned from assisting countries in mainstreaming risk management practices into mid-term development strategies and investments.

The webinar is co-hosted by FARM-D and Climate Bonds Initiative for their first collaboration.

---------------

By registering to this webinar you are signing up Climate Bonds Initiative's Privacy Policy, please follow the link for details: https://www.climatebonds.net/privacy

@Climate Bonds Community

Miguel Almeida

Research Manager and Lead Author, Climate Bonds

Zalina Shamsudin

General Manager, Capital Markets Malaysia

Launch webinar of the ASEAN Sustainable Finance State of the Market 2022 report, along with a discussion of trends and opportunities in ASEAN thematic finance from local experts.

Climate Bonds is launching the fifth iteration of the ASEAN State of the Market report series, in collaboration with HSBC. The report scope has expanded and now describes the shape and size of the full thematic (or GSS+) debt universe: green, social, and sustainability (GSS) bond and loan markets, plus sustainability-linked bonds (SLBs) and sustainability-linked loans (SLLs) and transition bonds. The report also includes a summary and discussion of related topics covered in the spotlight sections, namely taxonomies, transition finance, and policy.

The presentation of key report findings will be followed by a panel discussion with local experts on ASEAN sustainable finance experience so far, and the opportunities ahead.

Join us!

Bridget Boulle

Head of Taxonomies, Climate Bonds Initiative

Kavita Srinivasan

Senior Manager, Vivid Economics

Mark Fulton

Program Director, Inevitable Policy Response (IPR)

-What does the latest policy momentum point to?

-What alternative pathways including Carbon Removals are available?

-What are investors doing right now? What is their challenge?

This event will assess the latest on policy, investment and economic transition.

Speakers will be sharing their views on climate policy progress against 1.5C. and implications for investors, transition finance.

Hear green finance, climate policy and investor voices looking ahead on 2023.

Moderator:

Bridget Boulle - Director of Technical Development, Climate Bonds Initiative

Speakers:

Mark Fulton – Founder, Inevitable Policy Response (IPR)

Brian Hensley – Partner, Kaya Advisory

Alex Bernhardt – Global Head of Sustainability Research, BNP Paribas AM

Kavita Srinivasan– Senior Engagement Manager, Vivid Economics

Lily Burge

Policy Research Analyst, Climate Bonds Initiative

Sean Kidney

CEO, Climate Bonds Initiative

In this webinar, we will explore Climate Bonds’ new flagship policy report '101 Sustainable Finance Policies for 1.5°C’.

There is sufficient global capital to close the climate investment gap but investment is not moving fast enough.

This report provides global decisionmakers across government, central banks and regulators, with guidance on how they can direct capital to deliver the net-zero transition and meet development priorities.

Register in advance for this webinar:

https://climatebonds.zoom.us/webinar/register/WN_eECGaTL-TkeCTE34ytMdmw

Sean Kidney

CEO, Climate Bonds Initiative

Join Climate Bonds experts and guests at the launch of the 12th iteration of the flagship research paper Sustainable Debt Global State of the Market 2022. Following the webinar, stick around to hear the winners of the 8th Climate Bonds Awards.

Moderator: Bridget Boulle

Speakers:

Caroline Harrison, Head of Market Intelligence Research

Philip Brown, Managing Director, Global Sustainable Debt Capital Markets, CITI

Camila Silva, Technical Assistance Manager, LAGreen Fund

Markus Stix, Managing Director Markets, OEBFA

Vivek Pathak, Global Head and Director of Climate Business, International Finance Corporation

Download the Sustainable Debt Global State of the Market 2022

Anna Creed

Director Thought Leadership, Climate Bonds Initiative

Sean Kidney

CEO, Climate Bonds Initiative

Join us for an exclusive webinar exploring the new Climate Bonds Standard and Certification Scheme, which offers Company-level Certification to signal to investors that the corporate is on a Paris-aligned pathway of 1.5-degrees.

We will discuss the key aspects needed to demonstrate a credible transition for debt instruments such as Sustainability Linked Bonds, as well as how the Certification can extend to deeper company-level assessments and provide assurance on climate credentials of the corporate entity.

Our panel of experts will also explain how this new Certification goes beyond labelled debt to the wider general-purpose debt and equity investment.

Moderator: Sean Kidney, CEO, Climate Bonds Initiative

Speakers:

Anna Creed, Director Thought Leadership, Climate Bonds Initiative

Don't miss this opportunity to learn more about this new Certification and how it can help your company transition to a more sustainable future.

Assessing the credibility of a company’s decarbonisation begins with the rigour and ambition of a Transition Plan. We bring together experts who can draw insights on where to begin with Transition planning, what is the current state of guidance in the market and what do investors need to be assured the decarbonisation is credible and aligned with 1.5ºC pathway.

Moderator:

- Rachel Hemingway, Head of Transition Programmes, Transitions Climate Bonds Initiative

Speakers:

- Sylvester Bamkole, CDP, Home - CDP

- Laura Draucker, Ceres, Ceres | Sustainability is the bottom line.

- Dan Gardiner, IIGCC, IIGCC – The Institutional Investors Group on Climate Change

- Manshu Deng, Deputy Head - China Programme, China, Climate Bonds Initiative

- Matthew MacGeoch, Transition Analyst, Market Intelligence, Climate Bonds Initiative

Agenda:

- Introduction / Welcome

- Climate Bonds presentation – Manshu Deng & Matthew MacGeoch – Climate Bonds Initiative work on Transitions Plans

- CDP presentation- Sylvester Bamkole -Transition Plan’s disclosure framework

- Ceres presentation - Laura Draucker - Assessing the existing transition plan guidance and developing a consensus-driven definition of what a comprehensive Climate Transition Action Plan should include

- IIGCC presentation - Dan Gardiner - Guidance on Transition Plans

- Q&A and Discussion

Bridget Boulle

Head of Taxonomies, Climate Bonds Initiative

Nadia Humphries

Co-Rapporteur Platform for Sustainable Finance, European Commission

Sean Kidney

CEO, Climate Bonds Initiative

Climate Bonds invites you to join us for a webinar on the future of the EU Taxonomy – Wednesday 22nd March. The European Taxonomy has been key to driving finance to sustainable projects aiming to address the climate crisis. This webinar offers insights into the future of the EU Taxonomy and its implications for taxonomies around the world. Experts from Climate Bonds, the European Parliament, and partner organisations will discuss the future of the EU Taxonomy and its interoperability with other regional taxonomies. Ultimately, the objective is to clear the path for credible investments and optimise the EU Taxonomy uptake.

Barbara Buchner

Global Managing Director, Climate Policy Initiative

Koben Calhoun

Principal, RMI

Ronan Hodge

Technical Lead, Glasgow Financial Alliance for Net Zero (GFANZ)

Sean Kidney

CEO, Climate Bonds Initiative

Tyeler Matsuo

Manager, RMI

Please join Climate Bonds Initiative (CBI), Climate Policy Initiative (CPI), and RMI for a webinar on their recently released working paper, Guidelines for Financing a Credible Coal Transition. These guidelines, developed in consultation with stakeholders and experts from public, private, and civil society institutions, provide a framework for assessing the climate and social credibility of financial transactions that aim to accelerate a managed phaseout of coal-fired power plants.

During the webinar, you’ll hear from a representative from the Glasgow Financial Alliance for Net Zero on the credibility risks of financing a coal transition, and CBI, CPI, and RMI will provide an overview of how the guidelines can help manage these risks. As we recognize that transition finance for the coal-to-clean transition is a new and rapidly evolving space, we look forward to hearing additional feedback, perspectives, and questions that can shape the future direction of this work.

Speakers:

- Barbara Buchner, Global Managing Director, Climate Policy Initiative (CPI)

- Koben Calhoun, Principal, RMI

- Ronan Hodge, Technical Lead, Glasgow Financial Alliance for Net Zero (GFANZ)

- Sean Kidney, CEO, Climate Bonds Initiative

- Tyeler Matsuo, Manager, RMI

- Zofia Wetmanska, Senior Taxonomy Analyst, Climate Bonds Initiative

Leisa Souza

Agriculture Programme Coordinator

Sean Kidney

CEO, Climate Bonds Initiative

Climate change is exacerbating the challenges of global food security, and the need for agriculture and food systems transition has been reached consensus. Capital markets have a vital role in supporting the evolution of agriculture and food systems towards more efficient, low-carbon, resilient and sustainable. This seminar will focus on the role of green and transition finance and will discuss the prospects of opportunities, transition pathways and practical experiences of financial institutions entities in investing and financing green development and transition in agriculture.

Host:LONG Yuqing, ESG Product Manager, SynTao Green Finance

Agenda

16:00-16:10

Opening Remark

Sean KIDNEY, CEO and Co-founder of Climate Bonds Initiative

GUO Peiyuan, Chairman, China Sustainable Investment Forum

16:10-16:50

Keynote speech

CHEN Ying, Director of Cereals and Oils Department, China Chamber of Commerce for Import and Export of Foodstuffs, Native Produce and Livestock

XIE Wenhong, Head of China, Climate Bonds Initiative

FU Xiaotian, Director, Food and Natural Resources Program, WRI China

16:50-17:35

Agricultural Standards Roundtable Discussion

Moderator: XU Xiuling, Senior Vice President at CreditEase and Member of China SIF Board of Directors

Speaker:

RAO Shuling,

Deputy Secretary-General of the Beijing Green Finance Association

Senior Researcher of Institute of Finance and Sustainability

Leisa SOUZA, Head of Latin America of Climate Bonds Initiative

LAN Xing, Vice President, Green & Sustainable Hub, Asia Pacific, Natixis Corporate and Investment Banking

SHEN Lina, Director of Institutional Business, SynTao Green Finance

17:35-18:20

Agricultural Commodity Investment Roundtable Discussion

How can green and transformational finance be mobilised by developing sustainable value chains?

Moderator: LI Shaoxin, China Agriculture Transition Lead, Climate Bonds Initiative

Speaker:

DU Hongxia, Senior Program Manager, Energy Transition & Climate Finance, WWF

Erika SUSANTO, Research & Data Director of FAIRR Initiative

QIN Jun, Deputy General Manager of Muyuan Foods

18:20-18:30

Launch|Agri-food Transition Principles

LI Shaoxin, China Agriculture Transition Lead, Climate Bonds Initiative

Caroline Harrison

Green Bonds Pricing Analyst, Climate Bonds Initiative

Christian Engelen

Head of Unit in the Directorate-General for Budget (DG BUDG), European Commission

George Thimont

Head of ESG Syndicate, Global Debt Markets, Credit Agricole CIB

Heather Wootten

Director, Corporate Social Responsibility & ESG, Tradeweb

Lizi Nicol

Multi-Sector Indexed Fixed Income Portfolio Manager, BlackRock

How have green bonds performed at issuance in the challenging market environment of 2022?

Climate Bonds Initiative will share the findings of our fourteenth report in our pricing series, in which we observe how green bonds perform in the primary markets. The 'Green Bond Pricing in the Primary Market April – H1 2022' report includes green bonds issued in the first six months of 2022 (H1 2022). Join us for this amazing expert panel of investors & issuers go behind the numbers.

Speakers:

- Christian Engelen, Head of Unit in the Directorate-General for Budget (DG BUDG), European Commission

- Lizi Nicol, Multi-Sector Indexed Fixed Income Portfolio Manager, BlackRock

-George Thimont, Head of ESG Syndicate, Global Debt Markets, Credit Agricole CIB

- Heather Wootten, Director, Corporate Social Responsibility & ESG, Tradeweb

- Caroline Harrison, Head of Market Intelligence Research, Climate Bonds Initiative

- Moderator: Elisabeth Vishnevskaja, CFA, Head of Partnerships, Climate Bonds Initiative

Camila Silva

Technical Assistance Facility, LAGreen Fund

Carlos Linares

Presidente del Directorio, COFIDE

Iraís Vázquez

Senior Technical Analyst, Climate Bonds Initiative

Mariella Cordova Vargas

Gerente Comercial Gran y Mediana Empresa Bolsa de Valores de Lima

Sandra Carrillo

Gerente General, Pacific Corporate Sustainability (PCS)

Climate Bonds Initiative y LAGreen Fund están encantados de invitarle a asistir al lanzamiento híbrido del reporte: Estado del mercado de las finanzas sostenibles en Perú 2022.

El informe identifica oportunidades de inversión verde y sostenible en Perú, incluida la forma en que los instrumentos verdes y etiquetados pueden atraer inversiones al país. También describe el estado y el tamaño del mercado de deuda sostenible peruano y una descripción general de los desarrollos e hitos de políticas de apoyo durante la última década.

Antje Schneeweiß

EKD's Church Investors Working Group

Nathan Fabian

PRI & Chair of the EU Platform

Sean Kidney

CEO, Climate Bonds

Listen first hand from EU Platform experts!

Moderator: Nathan Fabian, Chief Responsible Investment Officer at PRI; Chairperson at European Platform on Sustainable Finance.

Speakers:

- Sean Kidney, CEO, Climate bonds Initiative

- Antje Schneeweiss, General secretary of the church investors group Germany and rapporteur of social taxonomy subgroup

- Signe Andreasen Lysgaard, Strategic advisor, The Danish Institute for Human Rights

- Wolfgang Kuhn, Consultant for GRI

-️ Date: 11 July

⏰ Time: 15:00 CET (14:00 GMT)

Radio talk show format in English plus Q&A.

REGISTER NOW!

Kenneth Hui

Head of Market Development, HKMA

Luying Gan

Head of Sustainable Bonds, Debt Capital Markets, Asia-Pacific Global Banking, HSBC

Manshu Deng

Research Manager of the China Programme, Climate Bonds Initiative

Sean Kidney

CEO, Climate Bonds Initiative

Tracy Wong Harris

Vice President and Deputy Secretary General, HKGFA

Climate Bonds Initiative, the Hong Kong Monetary Authority (HKMA), HSBC and the Hong Kong Green Finance Association (HKGFA) cordially invite you to the webinar to launch the Hong Kong Green and Sustainable Debt Market Briefing 2021.

The 2021 Hong Kong green and sustainable debt market experienced an expansion into new types of thematic debt, and across the board. This included surging increase in green debt instruments, debut issuance of sustainability bonds, and burgeoning growth in transition finance products.

The event will provide insights and outlook on key development in the Hong Kong green and sustainable debt market, covering topics such as the HKSAR Government Green Bond Programme, the adoption of the Common Ground Taxonomy and credible transition finance.

The Hong Kong Green and Sustainable Debt Market Briefing 2021 is produced in partnership with HSBC and is supported by the HKMA and the HKGFA.

Moderator: Sean Kidney, CEO, Climate Bonds Initiative

Report Briefing: Manshu Deng, Research Manager, China Programme, Climate Bonds Initiative

Panel discussion:

- Kenneth Hui, Head of Market Development Division, HKMA

- Luying Gan, Head of Sustainable Bonds, Debt Capital Markets, Asia-Pacific, HSBC

- Tracy Wong Harris, Vice President and Deputy Secretary General, HKGFA

Liu Fan

Deputy General Manager, China Central Depository & Clearing Company

Luying Gan

Head of Sustainable Bonds, Debt Capital Markets, Asia-Pacific Global Banking, HSBC

Manshu Deng

Research Manager of the China Programme, Climate Bonds Initiative

Sean Kidney

CEO, Climate Bonds Initiative

Shi Yi

Deputy Director, China Central Depository & Clearing Research Centre

Christine Eibs Singer

Energy Access Advocate (Independent)

Daniel McGree

Senior Research Analyst and Lead Author, Climate Bonds Initiative

Eduardo Appleyard

CAP Project Coordinator, UNDP

Shamini Selvaratnam

Energy Partnerships, Sustainable Energy Hub UNDP

Stefanie Held

Director Sustainable Energy Hub, UNDP

UNDP and Climate Bonds Initiative invite you to join the launch webinar for their new report: Linking Global Finance to Small-Scale Clean Energy: Financial Aggregation for Distributed Renewable Energy in Developing Countries

The report focuses on the potential of financial aggregation in enabling global capital markets to finance distributed renewable energy (for residential and other uses) in developing countries. It explores the state of small-scale, low-carbon energy in developing countries as well as the barriers to financial aggregation, along with some proposed solutions and key considerations for market practitioners. The focus is predominantly on Sub-Saharan Africa, but the findings are broadly applicable to all developing regions, especially those with underdeveloped financial markets.

The report results from a collaboration between UNDP and Climate Bonds Initiative in the context of the UNDP's Climate Aggregation Platform – a Global Environment Facility (GEF)-funded project to promote the scale-up of financial aggregation for small-scale clean energy in developing countries. It is based on an extensive literature review and dozens of interviews with relevant stakeholders, both from the product (sell) and finance (buy) sides.

Confirmed speakers:

- Eduardo Appleyard, CAP Project Coordinator, UNDP

- Daniel McGree, Senior Research Analyst and Lead Author, Climate Bonds Initiative

- Krista Tukiainen, Head of Market Intelligence, Climate Bonds Initiative

- Stefanie Held, Director, UNDP Energy Hub

- Christine Eibs Singer, Energy Access Advocate (Independent)

Ali Hasanbeigi

Founder and CEO, Global Efficiency Intelligence, Steel criteria Technical Consultant

Anna Creed

Director Thought Leadership, Climate Bonds Initiative

Erik van Doezum

Director and Steel Lead, Metals, Mining & Fertilizers EMEA Division at ING

Fabiana Contreras

Industry Transition Analyst, Climate Bonds Initiative

Max Åhman

Associate Professor and Head of Division, Environmental and Energy Systems Studies at Lund University

Climate Bonds Initiative is delighted to invite you to a webinar which will give investors an exclusive look at Climate Bonds’ new draft criteria for the steel sector. Speakers will share important insights as we continue our expansion in hard to abate industries and also provide context for the public consultation process that will be kicked off at the same time.

The Steel Criteria will form part of the Climate Bonds Standard and provide a succinct set of decision rules for determining when steel projects and assets are compatible with a low carbon, climate resilient economy, and are eligible for Certification under the Climate Bonds Standard.

Steel production is responsible for 7-9% of global CO2 emissions and the demand for steel is expected to increase 40% by 2050. The financial sector will play a critical role in financing credible efforts to decarbonise the steel sector and bring it in line with 1.5°C pathways.

Speakers:

- Fabiana Contreras, Industry Transition Analyst, Climate Bonds Initiative

- Ali Hasanbeigi, Founder and CEO, Global Efficiency Intelligence, Steel criteria Technical Consultant.

- Max Åhman, Associate Professor and Head of Division, Environmental and Energy Systems Studies at Lund University

- Erik van Doezum, Director and Steel Lead, Metals, Mining & Fertilizers EMEA Division at ING.

- Anna Creed, Head of Standards, Climate Bonds Initiative

- Sean Kidney, CEO, Climate Bonds Initiative

Ecaterina Bigos

CIO Core Investment, Asia Ex-Japan, Axa Investment Managers

Kelvin Tan

Head of Sustainable Finance and Investments, ASEAN at HSBC

Krista Tukiainen

Head of Research and Reporting, Market Intelligence, Climate Bonds

Paroche Hutachareon

Director - Strategic Risk Management Group at Public Debt Management Office, Thailand

Thu Ha Chow

Head of Fixed Income Asia, Robeco

Join us for the launch of the ASEAN Sustainable Debt State of the Market 2021 Report, produced with the support of HSBC.

Market and investor interest is increasingly being focused on the role that green bonds, green loans, social and sustainability bonds can play in sustainable development, infrastructure investment and low carbon growth paths.

The report provides definitive data and analysis of the shape & size of the green, social, and sustainable debt market in the region.

Join us for insights on key trends and developments for the sustainable finance market in ASEAN in 2021, and what we may expect to see in 2022 for sustainable finance in ASEAN.

The major factors driving green investment and market directions in 2022/2023 will be discussed by the expert panel. A one-off opportunity to explore an extraordinary year in green finance and growth tends in coming years.

Aude Rajonson

Head of Fixed Income Origination, London Stock Exchange Group

Candace Partridge

Social and Sustainability Bond Data Manager, Climate Bonds Initiative.

Emily Robare

Head of Muni ESG Research, Pimco

Mike Brown

Environmental Finance Manager, San Francisco Public Utilities Commission

Nancy Kummer

Chief Business Development Officer / Managing Director, BLX Group

The US Municipal market is seeing an increased focus on Green, Social and Sustainable bonds, both from the point of view of issuers, as well as from investors. However, given the scale of the Muni market, there is opportunity for the market to develop much further.

To mobilise institutional money, and dedicated mandates which could help to drive policy change and shift capital at scale, the market needs more benchmark deals from the full range of economic sectors.

The purpose of the webinar, hosted by CBI and sponsored by the London Stock Exchange, is to provide an overview of the Green Muni Bond opportunity, targeting primarily issuers and investors in this market segment.

Speakers:

o Mike Brown, Environmental Finance Manager, San Francisco Public Utilities Commission

o Emily Robare, Head of Muni ESG Research, Pimco

o Aude Rajonson, Head of Fixed Income Origination, London Stock Exchange Group

o Candice Partridge, Social and Sustainability Bond Data Manager, Climate Bonds Initiative.

Moderator: Nancy Kummer, Chief Business Development Officer / Managing Director, BLX Group

Ivy Lau

Head of Sustainable Finance, Mizuho Securities Asia Limited, Hong Kong, China

Kosintr Puongsophol

Asian Development Bank (ADB)

Satoru Yamadera

Advisor, Asian Development Bank

Sean Kidney

CEO, Climate Bonds Initiative

Zalina Shamsudin

General Manager, Capital Markets Malaysia

The Climate Bonds Market Intelligence Team completed a report on the ASEAN member countries +3 that provided an overview of the sustainable finance landscape in each market that included the regulatory framework and market developments in terms of product innovation and range of financing/funding instruments utilized.

We would like to encourage a conversation with ASEAN central banks, regulator and financial market about the report’s findings between policy makers, investors, intermediaries and issuers on how to move forward to enable breadth and depth of the sustainable finance market in ASEAN+3.

Speakers:

- Sean Kidney, CEO & Founder, Climate Bonds Initiative

- Satoru Yamadera, Advisor, Asian Development Bank

- Daniel McGree, Senior Research Analyst, Climate Bonds Initiative

- Kelvin Lee, Commissioner, Securities and Exchange Commission, Philippines

- Jason Mortimer, Head of Sustainable Investment – Fixed Income and Senior Portfolio Manager at Nomura Asset Management, Japan

- Ivy Lau, Head of Sustainable Finance, Mizuho Securities Asia Limited, Hong Kong, China

- Kosintr Puongsophol, Financial Sector Specialist, Asian Development Bank

Moderator: Zalina Shamsudin, Head of International Programmes - Asia Pacific, Climate Bonds Initiative

Caroline Harrison

Green Bonds Pricing Analyst, Climate Bonds Initiative

Meyyappan Nagappan

Leader, Digital Tax and Social Finance at Nishith Desai Associates

Rakesh Jha

Director, Sustainability, Management Consulting Division at Fichtner Consulting Engineers Ltd

Sandeep Bhattacharya

India Project Manager, Climate Bonds Initiative

Shailendra Singh

Founder & CEO, SustainMantra

- Caroline Harrison, Senior Research Analyst, Climate Bonds Initiative

- Neha Kumar, India Programme Manager, Climate Bonds Initiative

- Dhruba Purkayatha, Director, Climate Policy Initiative

- Rakesh Jha, Director, Sustainability, Management Consulting Division at Fichtner Consulting Engineers (India) Pvt. Ltd

- Anurag Bajpai, Director, Green Tree Global

- Meyyappan Nagappan, Leader, Digital Tax and Social Finance at Nishith Desai Associates

- Sanjoy Ghosh, Vice President, Business development and Climate Change (NABCONS)

- Shailendra Singh, Founder & CEO, SustainMantra

Moderator: Sandeep Bhattacharya, India Project Manager, Climate Bonds Initiative

Alan Denenberg

Partner, Corporate Department, Davis Polk & Wardwell LLP

Amber Chi

Senior VP & Assistant Treasurer, Salesforce

Aude Rajonson

Head of Fixed Income Origination, London Stock Exchange Group

Emily Weng

Vice President, Global Fixed Income ESG Investment, BlackRock

Marilyn Ceci

Managing Director and Senior Advisor to the Center for Carbon Transition, J.P. Morgan

London Stock Exchange and Climate Bonds Initiative invite you to join them for an insightful industry webinar delving into the development of the US green and sustainability bond market. This session will provide tangible insights relevant to market stakeholders, corporate treasurers and sustainability officers embarking on a sustainability journey.

The panelists will share their experiences, address key challenges and showcase green and sustainable bond issuance processes in the US.

The panel will comprise of a corporate bond issuer already on the sustainability journey, an institutional investor, an underwriter, a law firm, an international stock exchange and an international standard setting organization with extensive market intelligence.

Speakers:

- Sean Kidney, CEO & Founder, Climate Bonds Initiative

- Amber Chi, Senior VP & Assistant Treasurer, Salesforce

- Marilyn Ceci, Managing Director and Senior Advisor to the Center for Carbon Transition, J.P. Morgan

- Emily Weng, Vice President, BlackRock Global Fixed Income ESG Investment, BlackRock

- Alan Denenberg, Partner, Corporate Department, Davis Polk & Wardwell LLP

Moderator: Aude Rajonson, Head of Fixed Income Origination, London Stock Exchange Group

Christina Ng

Research & Stakeholder Engagement Leader, Debt Markets, Institute for Energy Economics and Financial Analysis (IEEFA)

Lily Burge

Policy Research Analyst, Climate Bonds Initiative

Luanne Sieh

Head, Group Sustainability, CIMB Group

Lyn Javier

Assistant Governor, Bangko Sentral ng Pilipinas

Sean Kidney

CEO, Climate Bonds Initiative

The Climate Bonds' Policy Team completed a report examining ASEAN central banks’ exposure to climate transition risks with a particular focus on Indonesia, the Philippines and Vietnam.

How the report reflected on these risks was by doing an analysis of combined data from credit filings by banks to the central bank supervisory section, bonds data collected by Asia Bond Monitor and “bottom-up” deal level data extracted from commercial databases of lending and bond issuance.

The primary recommendation from the data analysis was on how the taxonomies under development could be used to ensure banks are able to track their climate transition risks exposure through their portfolios.

We would like to encourage a conversation about the report’s findings on challenges to the financial sector in re-directing lending from fossil fuel to renewables and potential actions central banks might take to support the transition.

Apurba Mitra

Associate Partner at KPMG India Lt. Col.

Barbara Calvi

Executive Director, Sustainable Investing, Fixed Income Investment Management , Morgan Stanley

Gaurav Bhagat

India at MUFG

Karthik Iyer

Director of Programmes, Climate Bonds Initiative

Monish Ahuja

Promoter and Managing Director, Punjab Renewable Energy Systems Private Limited.

This webinar looks at issues facing the hard to abate industries in India, its journey towards a low carbon world - and financing the journey towards the same.

Speakers:

- Mr. Vishal Bahvsar, Head - Corporate Sustainability Head - Corporate Sustainability ,UltraTech Cement

- Mr. Gaurav Sarup, Director - ESG, Carbon & Social Performance at Vedanta Resources Limited.

- Ms. Apurba Mitra, Associate Partner at KPMG India Lt. Col.

- Monish Ahuja - Promoter and Managing Director , Punjab Renewable Energy Systems Private Limited.

- Barbara Calvi - Executive Director, Sustainable Investing, Fixed Income Investment Management , Morgan Stanley

Moderator: Karthik Iyer, Director of Programmes, Climate Bonds Initiative

Berit Lindholdt-Lauridsen

Senior Operations Officer International Finance Corporation

Jessica Pulay

Co-Head of Policy and Markets, United Kingdom Debt Management Office

Jesús Martínez

Head of Financing and Treasury, Iberdrola

Krista Tukiainen

Head of Research and Reporting, Market Intelligence, Climate Bonds

Paul O'Connor

Head of EMEA ESG Debt Capital Markets, J.P. Morgan

Climate Bonds is preparing to publish the 11th iteration of its flagship research paper Sustainable Debt Global State of the Market 2021. The scope of the paper has been extended to include green, social, sustainability, sustainability-linked, and transition bonds which we describe as GSS+ debt.

Following a short presentation summarizing the findings of the research, Sean Kidney will moderate a panel discussion including issuers, and champions of climate action. Panelists will be invited to share insights and experiences and discuss expectations and drivers of market growth for 2022 and beyond.

Moderator: Sean Kidney, CEO, Climate Bonds Initiative

Panelists:

- Jessica Pulay, Co-Head of Policy and Markets, United Kingdom Debt Management Office

- Paul O'Connor, Head of EMEA ESG Debt Capital Markets, J.P. Morgan

- Berit Lindholdt-Lauridsen, Senior Operations Officer, International Finance Corporation

- Krista Tukiainen, head of Market Intelligence, Climate Bonds Initiative

- Jesús Martínez, Head of Financing and Treasury, Iberdrola

Laura Ruiz

Asesora del Despacho del Viceministro Técnico, Ministerio de Hacienda y Crédito Público

Luis Gabriel Morcillo

Socio de los equipos de Mercado de Valores y Corporativo / M&A de Brigard Urrutia

Paca Zuleta

Directora Escuela de Gobierno Alberto Lleras Camargo de la Universidad de los Andes

Sean Kidney

CEO, Climate Bonds Initiative

Yolanda Fadul

Sócia de Metrix Finanzas

Colombia ha avanzado en su agenda ambiental y de desarrollo sostenible, esto se refleja en la firma del Acuerdo de París, por medio de sus Contribuciones Nacionalmente Determinadas (NDCs), la alineación con los Objetivos de Desarrollo Sostenible (ODS), así como en el desarrollo de instrumentos de política de cambio climático.

Existe una gran brecha entre el financiamiento verde requerido y el efectivamente movilizado ante lo cual es necesario el involucramiento de sectores público y privado que permita desarrollar un ecosistema atractivo para el financiamiento de proyectos climáticos y ambientales.

Reunir a la comunidad de inversores con los encargados de formular políticas y los desarrolladores de proyectos, puede ayudar a desarrollar enfoques innovadores y compartidos para abordar los desafíos financieros en sectores claves para los objetivos climáticos.

Bajo este contexto, este Webinar pretende compartir conocimiento e intercambiar experiencias de diferentes instrumentos financieros como lo son los fondos para la canalización de recursos públicos, privados y mixtos, con el propósito de analizar sus prácticas y ayudar en la

estructuración de nuevos mecanismos de financiamiento con enfoque sostenible en Colombia.

Panelistas:

Moderadora: Yolanda Fadul, Asociada de Metrix Finanzas.

- Sean Kidney, CEO, Climate Bonds Initiative

- María Margarita Zuleta, Directora Escuela de Gobierno Alberto Lleras Camargo de la Universidad de los Andes

- Laura Ruiz, Asesora del Despacho del Viceministro Técnico

- Luis Gabriel Morcillo, socio de los equipos de Mercado de Valores y Corporativo / M&A de Brigard Urrutia

Chloe Su

Credit Analyst, BlackRock

Guo Peiyuan

Chairman, Syntao Green Finance

Ken Chiu

Senior Vice President, Emerging Business Development, Hong Kong Exchanges and Clearing Limited

Manshu Deng

Research Manager of the China Programme, Climate Bonds Initiative

Wenhong Xie

Head of China, Climate Bonds Initiative

实现中国的“双碳”目标需要大量的资金和金融支持。绿色债券作为一种公认的广泛标准化的金融工具,可以引导资本流向绿色、低碳的资产与项目,助力中国实现“双碳”目标。

本次研讨会将分享由气候债券组织和商道融绿共同开展的针对中国绿色债券市场投资者的调研结果。该调研旨在评估投资者对中国绿色债券的态度,确定市场进一步壮大及稳步发展所需的条件。研讨会嘉宾将从交易所、投资人、发行人、绿色金融服务机构等角度讨论中国绿色债券市场的机遇与挑战。

致谢:

香港交易所(HKEX)以及法国外贸银行(Natixis CIB)为本次调研提供了支持和赞助

主持人:

谢文泓

气候债券倡议组织中国区负责人

调查报告简报:

邓曼姝

气候债券倡议组织中国区研究主管

研讨会嘉宾:

赵健能

香港交易及结算所有限公司新兴业务发展部高级副总裁

兰星

法国外贸银行亚太区绿色与可持续金融业务副总裁

郭沛源博士

商道纵横总经理

苏念

贝莱德基金管理有限公司信用分析师

Guo Peiyuan

Chairman, Syntao Green Finance

Julien Martin

Managing Director, Head of Emerging Business Development Markets, Hong Kong Exchanges and Clearing Limited

Manshu Deng

Research Manager of the China Programme, Climate Bonds Initiative

Norbert Ling

ESG Credit Portfolio Manager, Invesco Fixed Income Asia Pacific

Olivier Ménard

Head of Green & Sustainable Hub – Asia Pacific, Natixis Corporate & Investment Banking

China has set ambitious targets of reaching carbon peaking by 2030 and carbon neutrality by 2060, and meeting these objectives requires large scale of capital. Green bonds are an accepted and broadly standardized tool that can help direct capital flows to low carbon assets and projects, and contribute to meeting China’s climate goals.

This webinar will highlight key takeaways from the China Investor Survey, conducted by Climates Bonds Initiative and SynTao Green Finance to determine investor attitudes to green bonds and establish what is needed for the Chinese market to develop further.

Please join us for a live interactive webinar, where speakers will provide their views on challenges and opportunities in scaling up the Chinese green and sustainable bond market. The panel brings together different perspectives from exchanges, investors, issuers and service providers.

Moderator: Sean Kidney, CEO, Climate Bonds Initiative

Guest speakers:

- Julien Martin, Managing Director, Head of Emerging Business Development Markets, Hong Kong Exchanges and Clearing Limited

- Olivier Ménard, Head of Green & Sustainable Hub – Asia Pacific, Natixis Corporate & Investment Banking

- Dr. Peiyuan Guo, CEO, SynTao

- Norbert Ling, ESG Credit Portfolio Manager, Invesco Fixed Income Asia Pacific

- Manshu Deng, Research Manager of the China Programme, Climate Bonds Initiative

Elias Martínez

Technical Lead Basic Chemicals Criteria

Fredric Bauer

Associate senior lecturer in Technology and society; Researcher at the division on Environmental and Energy Systems Studies, Lut University

Kristin Marshall

Senior Research Associate, Lux Research

Marian Rodriguez

Sustainability Analyst, Climate Bonds Initiative

Sean Kidney

CEO, Climate Bonds Initiative

The Basic Chemicals Criteria lay out the requirements that Basic Chemicals production asset, projects must meet to be eligible for inclusion in a Certified Climate Bond and for companies on a credible transition path to issue transition labelled debt. The Criteria contain Mitigation Requirements, Adaptation & Resilience Requirements and Transition Requirements. Bonds and loans linked to these eligible assets and projects will be aligned with the Paris Agreement 1.5 degree celsius limit.

Public consultation is scheduled for launch with this webinar and will last for 60 days.

Moderator: Sean Kidney, CEO, Climate Bonds Initiative

Speakers:

- Marian Rodriguez, Sustainability Analyst, Climate Bonds Initiative

- Elias Martínez, Technical Lead Basic Chemicals Criteria

- Fredric Bauer, Associate senior lecturer in Technology and society; Researcher at the division on Environmental and Energy Systems Studies, Lund University.

- Kristin Marshall, Senior Research Associate at Lux Research

Bo Lidegaard

Co-founder & Partner, Kaya Group

Catharina Hillenbrand von der Neyen

Head of Research, Carbon Tracker

Kavita Srinivasan

Senior Manager, Vivid Economics

Mark Fulton

Program Director, Inevitable Policy Response (IPR)

Sean Kidney

CEO, Climate Bonds Initiative

The Russia Ukraine war has triggered both a policy shift towards clean energy independence and debate around a longer life span for fossil fuels in the global energy mix. Will the crisis extend fossil fuel dependency? Or will policy makers double down on energy security through renewables?

A Special Webinar Event from Global NGOs.

Using IPR forecast policy scenarios (FPS), Carbon Tracker oil and gas industry analysis and Climate Bonds market data this special webinar event for investors and policy makers will assess the current uncertainties and political responses against long term trends in climate policy, green finance and energy transition.

Moderator:

Kavita Srinivasan, Senior Manager, Vivid Economics

Speakers:

Mark Fulton, Project Director, Inevitable Policy Response (IPR)

Catharina Hillenbrand von der Neyen, Head of Research, Carbon Tracker

Bo Lidegaard, Co-founder & Partner Kaya Group

Sean Kidney , CEO, Climate Bonds Initiative

Asdrúbal de Benito

Senior Advisor, Spanish Treasury

Caroline Harrison

Green Bonds Pricing Analyst, Climate Bonds Initiative

David Furey

Head of Fixed Income Strategists EMEA, SSGA

Emer Murnane

Assistant Group Treasurer, Smurfit Kappa Group

Francois Millet

ETF, Index, and Quant Fund Development, Lyxor

We will present the findings of this latest paper that follows with a panel discussion of issuers such as the Spanish Treasury and Smurfit Kappa Group and investors like Lyxor ETF, Amundi Group of their experience of issuing green bonds, market performance and pricing benefits as reported in this research.

Moderator: David Furey, Head of Fixed Income Strategists EMEA, SSGA

Panelists:

- Francois Millet, Head of Strategy and ESG, Lyxor ETF, Amundi Group

- Emer Murnane, Assistant Group Treasurer, Smurfit Kappa Group

- Javier Asdrúbal de Benito Cháfer, Senior Adivisor, Spanish Treasury

- Caroline Harrison, Senior research analyst, Climate Bonds Initiative

Acknowledgements:

Support and funding for this paper were provided by Lyxor, IFC, and SSGA

Ben Allen

Director of Research, Institute for European Environmental Policy

Linda Romanovska

Independent Expert member, EU Platform on Sustainable Finance

Marzia Traverso

Rapporteur of Technical Working Group for the EU Platform on Sustainable Finance

Michiel De Smet

Sustainable Investment Expert, National Bank of Belgium

Nathan Fabian

PRI & Chair of the EU Platform

The EU Platform on Sustainable Finance presents the New criteria for all six taxonomy objectives. This webinar is supported by the European Investment Bank and the Climate Bonds Initiative.

This report brings forwards New Criteria for the remaining four environmental objectives of the EU Taxonomy. These criteria address objectives for biodiversity, pollution, circular economy and water, and further extend the scope of the taxonomy beyond just climate and to a wider set of economic activities.

Speakers:

- Nathan Fabian - Chairperson at European Platform on Sustainable Finance

- Ben Allen - Director of Research, Institute for European Environmental Policy

- Marzia Traverso - Rapporteur of Technical Working Group for the EU Platform on Sustainable Finance

- Michiel De Smet - Sustainable Investment Expert at the National Bank of Belgium

- Linda Romanovska - Independent Expert member, EU Platform on Sustainable Finance

Guo Peiyuan

Chairman, Syntao Green Finance

Lihua Qian

Chief Green Finance Researcher, Executive Director, CIB Research

Lu Zhengwei

Chief Economist, China Industrial Bank

Valentina Wu

Programme Manager, Syntao Finance

Wenhong Xie

Head of China, Climate Bonds Initiative

The Climate Bonds Initiative and CIB Research, with the support of UK PACT, will co-host an online webinar on sustainable debt market development in China on Monday, March 28, 2022, from 15:00 to 17:00 BST.

The webinar will focus on green bonds and sustainable bond standards, and the following reports will be launched at the webinar:

- China’s Growing Sustainable Debt Market - RAPID GROWTH DELIVERS IMPACTS

- The Green Finance Case for China’s Low Carbon Infrastructure Transition

- China Green Finance Policy Analysis Report 2021

- China Green Bond Market Post-issuance Reporting

Speakers:

1.Sean Kidney, CEO Climate Bonds Initiative

2.Peiyuan Guo, CEO Syntao

3.Zhengwei LU, Chief Economist, China Industrial Bank

4.Lihua Qian, Chief Green Finance Researcher, Executive Director, CIB Research

5.Bolu Wang, Green Finance Research Centre, National Institute of Finance, Tsinghua University

6.Valentina Wu, SynTao Finance

7.Miguel Almeida, Research Manager, Climate Bonds Initiative

8.Wenhong Xie, Head of China Programmes, Climate Bonds Initiative

The event will be held in both Chinese and English, with simultaneous English and Chinese translation.

Helena Viñes Fiestas

Commissioner of the Spanish Financial Markets Authority, Rapporteur of the EU Platform on Sustainable Finance

Jörg Ladwein

Regional Chief Investment Officer, Allianz Group

Nancy Saich

European Investment Bank

Nathan Fabian

PRI & Chair of the EU Platform

The EU Platform on Sustainable Finance presents the Extended Environmental Taxonomy (SG3), previously known as the "Significant Harm Taxonomy". This webinar is supported by the European Investment Bank and the Climate Bonds Initiative.

Speakers:

- Nathan Fabian - Chair of EU platform on Sustainable Finance - Principles for Responsible Investment

- Nancy Saich - Rapporteur of Platform Subgroup 3 - European Investment Bank

- Helena Viñes Fiestas - Commissioner of the Spanish Financial Markets’ Authority

- Jörg Ladwein - Regional Chief investment office bei Allianz Group

Bridget Boulle

Head of Taxonomies, Climate Bonds Initiative

Iraís Vázquez

Senior Technical Analyst, Climate Bonds Initiative

The objective of this webinar is to investigate the particularities of the development of various green and social taxonomies around the world, including Latin America. The webinar will be in Spanish and translated to English.

Eduardo Atehortua

Head of LATAM, Principles for Responsible Investment (UNPRI)

Gianleo Frisari

Senior Climate Economist, Inter-American Development Bank (IDB)

Isabelle Braly-Cartillier

Senior Sector Specialist of Financial Markets, Inter-American Development Bank (IDB)

Janine Dow

Senior Director of Sustainable Finance, Fitch Ratings

Valeria Dagnino Contreras

Programme Assistant Latina America, Climate Bonds Initiative

Latin America and Caribbean (LAC): State of The Market 2021 is the second detailed analysis of the LAC green finance market, the first one was launched in 2019. The report was supported by the Inter-American Development Bank (IDB) and the International Finance Corporation (IFC). Download the report here.

Antje Schneeweiß

EKD's Church Investors Working Group

Jan Noterdaeme

Senior Advisor, CSR Europe

Marcel Roy

Secretary General, European Association of Public Banks

Marco Cilento

Head of Institutional Policy, European Trade Union Confederation,

Nathan Fabian

PRI & Chair of the EU Platform

The proposed EU Social Taxonomy will be crucial in helping the finance sector to make best-practice investment decisions with regard to social values.

The development of EU standards for climate change and mitigation are well progressed, and as environmental, social and governance (ESG) gradually come to the fore of investment decision making, a similar guidance for social activities is also needed.

The social taxonomy recommendation is pioneering in its efforts to embed internationally agreed norms like the international bill of human rights, the UN Guiding Principles on Business and Human Rights, and the UN Sustainable Development Goals (SDGs) in European investment guidance.

This exciting webinar is brought to you by the EU Platform on Sustainable Finance. For over a year and a half the group has worked on the social taxonomy and is presenting its report findings on the 28th of February 2022. The panel is decorated with experts from the financial industry, trade unions and the corporate sector: