China’s green bond market, with clear rules, active market players, and supportive investors and policymakers, offers a great opportunity for foreign green bond issuers.

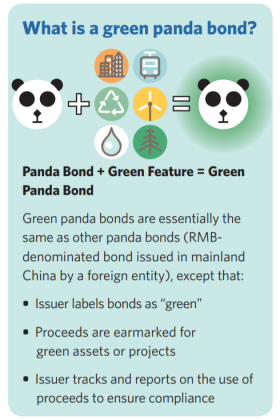

Green panda bonds could be a source of capital for overseas green bond issuers who are looking to diversify their investor base. Domestic investor appetite for green assets could help fund the investment needs of Latin America’s transition to a low carbon and climate resilient economy.

To support and facilitate international issuers entrance into the Chinese green bonds market, the Climate Bonds Initiative in partnership with the Inter-American Development Bank (IDB) have published the ‘Green Panda Bond Handbook’. It seeks to provide an overview of RMB-denominated green bond (green panda bond) issuance process and facilitate overseas issuers’ participation in the Chinese domestic green bond market. It provides a step-by-step guide for prospective issuers and an overview of Chinese regulators and actors. Chinese policymakers are keen on facilitating investment in green assets and the Handbook launch is supported by the People’s Bank of China Shanghai.

Leia o manual em Português.

Lea el manual en Español.