For this years Climate Bonds 2017 Annual Conference, we produced a number of briefing papers on issues we think are critical to unlocking the full potential of the global green bond market:

|

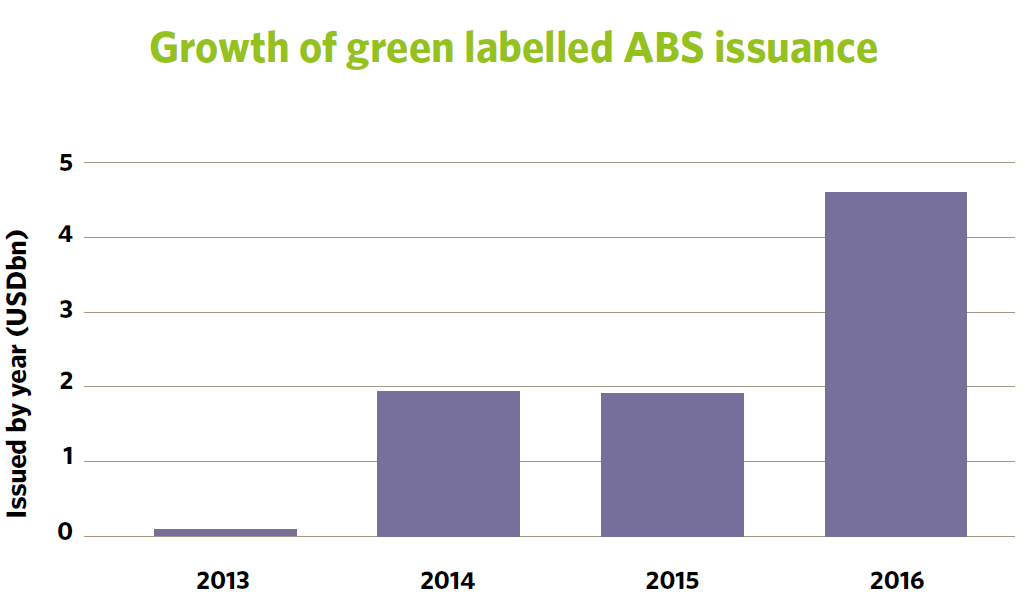

Green Securitisation: unlocking finance for small-scale low carbon projects

|

|

| Green securitisation can help unlock finance in debt capital markets for smaller scale low carbon and climate-resilient assets. The public sector has a key role to play to scale up securitisation markets for green assets. | |

|

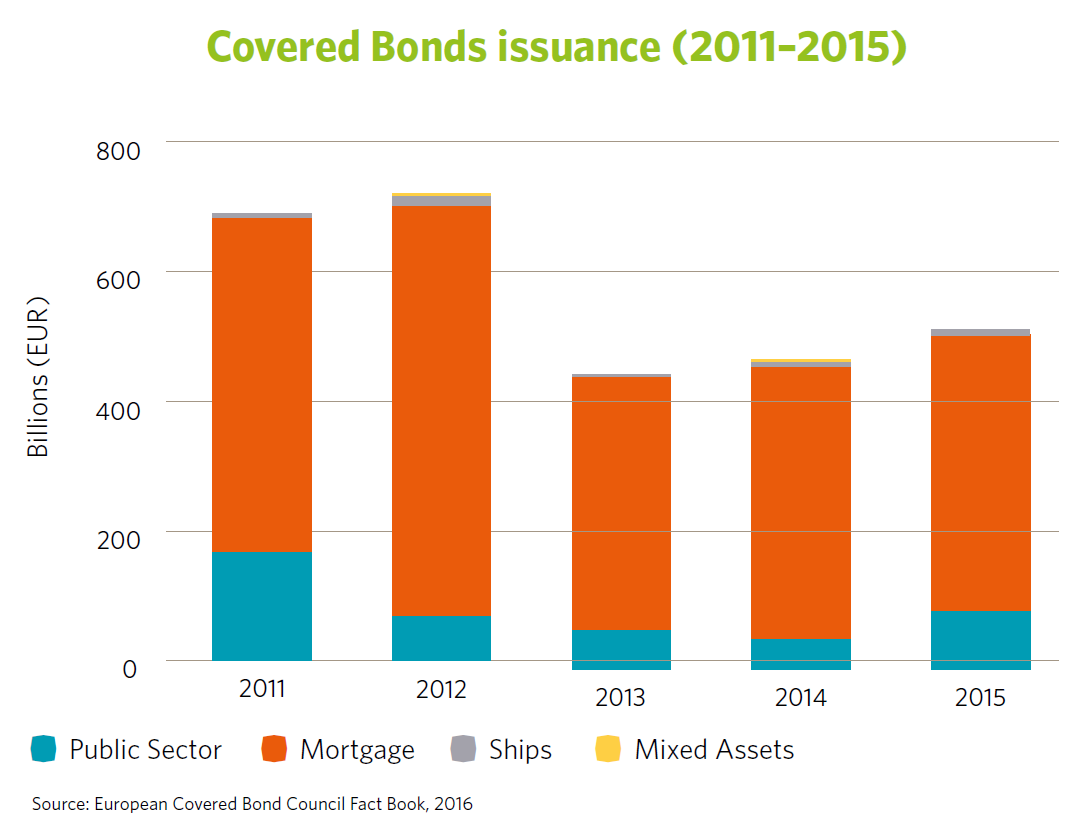

Green Covered Bonds: building green cover pools

|

|

| Covered bonds are an ideal tool to finance low carbon infrastructure, having been used in other public priority areas. Identifying existing green cover pools and developing frameworks for other low carbon assets will help scale up investment. | |

|

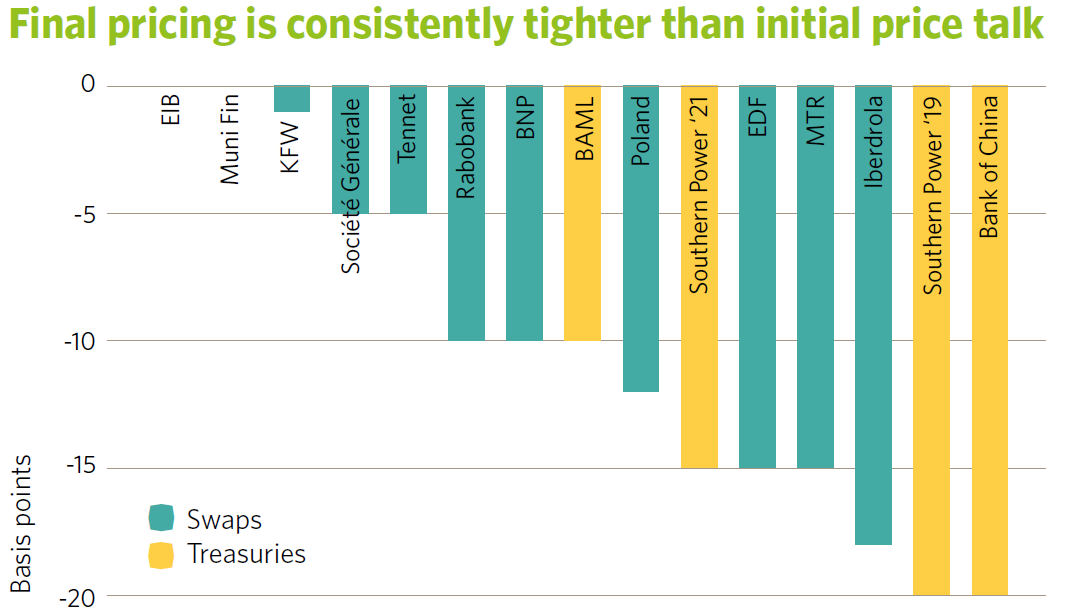

Green Bond Pricing in the Primary Market: Q4 2016 snapshot

|

|

|

|

Initial findings indicate that there is over-subscription and tighter pricing of USD and EUR denominated green bonds in the primary market. |

|

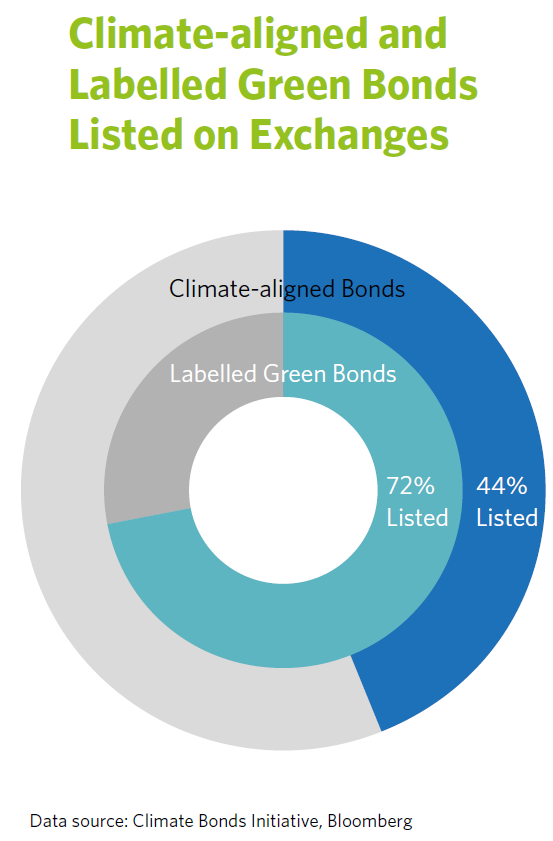

The Role of Exchanges in accelerating the growth of the Green Bonds Market

|

|

|

|

There is a clear potential for exchanges to create dedicated green bond segments, develop indices and support market education to facilitate investor decisions towards climate-aligned investments and enhance the market’s liquidity. |

|

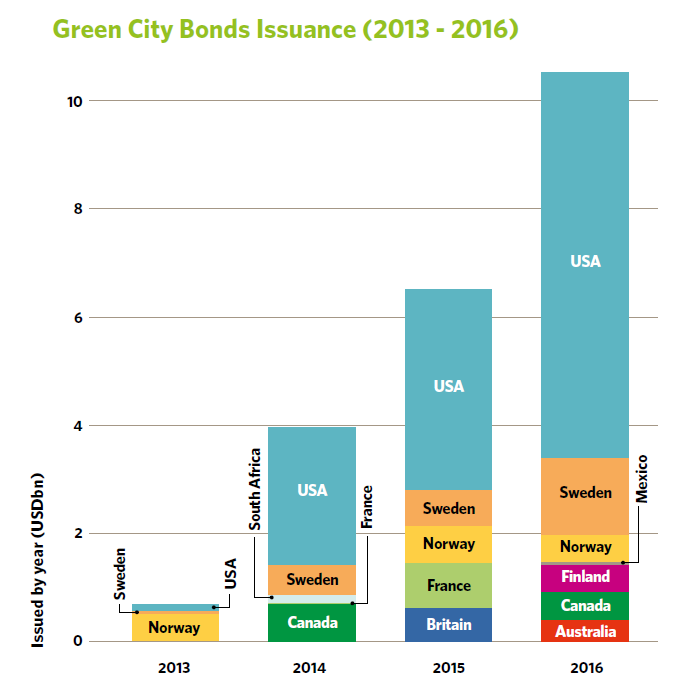

Green City Bonds: financing low carbon urban infrastructure

|

|

| Green City Bonds are increasingly used by municipalities and other city-affiliated entities, such as utilities and transport companies, to finance climate-aligned infrastructure. |