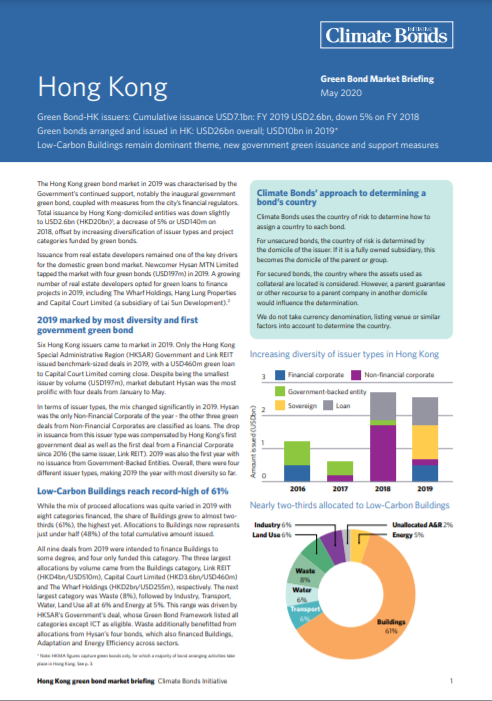

2019 highlights:

- Green bonds from Hong Kong issuers in 2019 totalled USD2.6bn from 6 issuers, down 5% from 2018 volume

- Cumulative issuance has reached USD7.1bn overall

- Market saw the HKSAR Government’s inaugural green bond issuance and most diverse use of proceeds

- Low-carbon buildings dominated use of proceeds at record high of 61% of green issuance

- 85% of issuance has at least one type of external review

- 81% of HK green bonds carry post-issuance disclosure

- Green bonds arranged and issued in HK as a financial centre comprised USD 10bn in 2019 (according to HKMA methodology)