Resources:

1. Marine Renewable Energy Brochure

2. Marine Renewable Energy Criteria

3. Marine Renewable Energy - background document

4. Checklist Template for Disclosure and Adaptation / Resilience

Certifications

To see the whole list of Marine Renewable Energy Climate Bonds, visit our Database of Certified Bonds

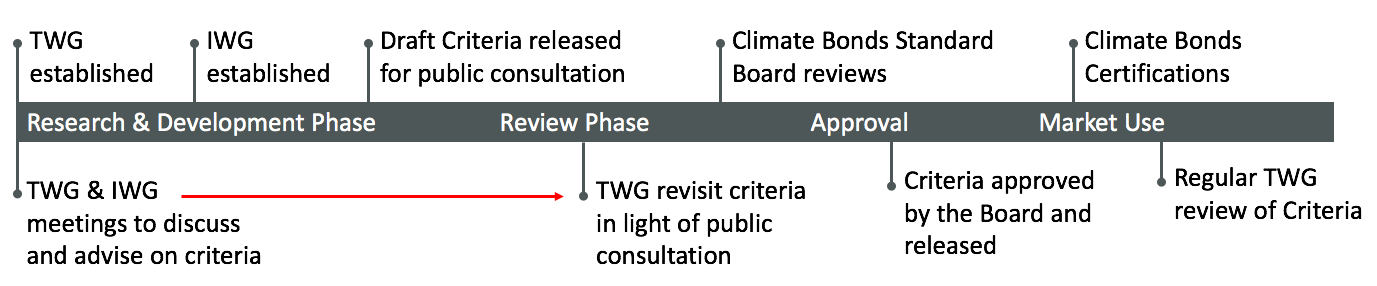

Timeline of development:

July 2020: Criteria updated to include eligible dedicated installation vessels for offshore wind

Oct 2017: Marine Renewable Energy Criteria released for Certification

June 2017: Marine Renewable Energy Criteria launched for public consultation

May 2017: Industry Working Group launched

April 2016: Technical Working Group established

Status: The Marine Renewable Energy Criteria is available for use in certifications. Get in contact with certification@climatebonds.net to start the certification process of your Marine Renewable Energy Criteria green bond.

Financial instruments (bonds and loans) linked to these eligible assets, activities and entities will be aligned with the Paris Agreement and the goal of keeping global temperature rises to no more than 1.5oC above pre-industrial levels.

Update July 2020: The Marine Renewable Energy Criteria have been updated to include eligible dedicated installation vessels for offshore wind for Climate Bonds Certification.

THE CRITERIA

The Marine Renewable Energy Criteria have been designed to encompass all marine renewable energy technologies, both the established and the emerging. The Criteria can be applied to offshore wind, offshore solar, wave power, tidal power and have been designed so that emerging marine renewable energy technologies can also comply in the future.

Increased renewable energy generation capacity and associated climate resilient infrastructure are essential to move to a low carbon economy and is definitely in-line with limiting warming to 2°C – the key principle by which we guide all our Sector Criteria.

1. Read more about the Climate Bonds Standard

2. Email certification@climatebonds.net for more information

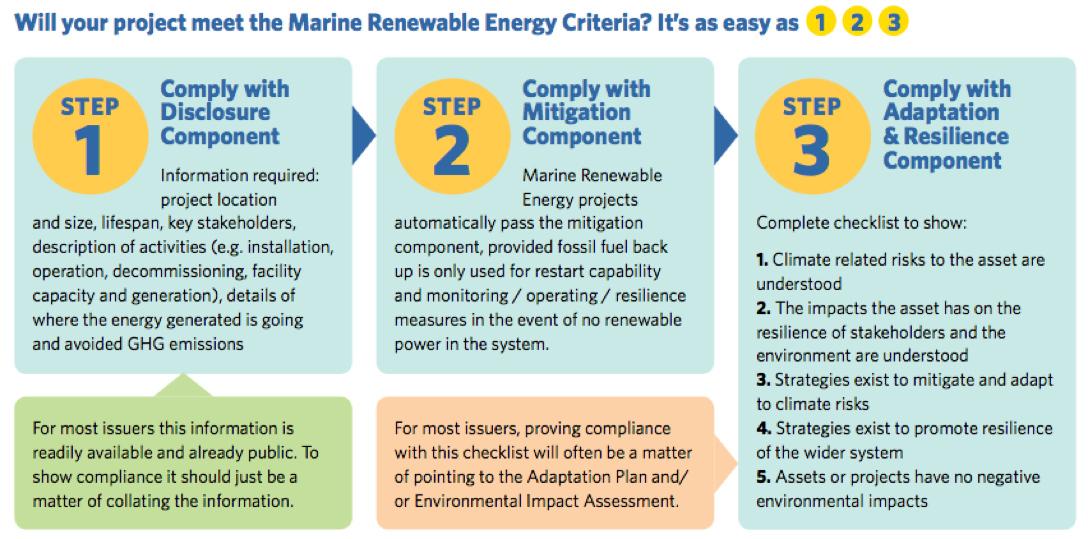

However, distinct Criteria for marine renewable energy investments is necessary for the following reasons:

- To ensure sufficient transparency and disclosure

- To confirm facilities do not rely on substantial fossil fuel back-up

- And, to confirm the climate resilience of the assets

To better understand the Criteria in detail, watch this recorded webinar.

SPONSORS

These Criteria were developed by a Technical Working Group (TWG) and Industry Working Group (IWG). They recognise the diversity of countries, issuers and verifiers as well as the potential for secondary use of the Climate Bonds Standard by other entities such as Green Climate Fund, Corporate Social Responsibility (CSR) programs and impact investors.

MARINE TECHNICAL WORKING GROUP

Lead Specialists

|

|

|

Versant Vision |

Clarmondial |

Technical Working Group Members

|

|

|

|

|

Marine Stewardship Council (MSC) |

National Oceanic & Atmospheric Administration (NOAA) |

European Investment Bank (EIB) |

Partnerships in Environmental Management for the Seas of East Asia (PEMSEA) |

|

|

|

|

|

World Fish / CGIAR |

Environmental Defense Fund |

GlobalGAP |

CSIRO |

|

|

|

|

|

WWF |

Middlebury Institute of International Studies at Monterey |

Global Climate Adaptation |

Independent Consultant

|

|

|

|

|

|

International Sustainability Unit |

Buglass Energy Advisory |

Caelulum Ltd / Euro Marine Energy Centre |

Pacific Northwest National Laboratory |

|

|

||

|

Coastal Risk Consulting, LLC |

Ocean Assets |

|

|

|

|

Eligibility criteria are currently available for Solar, Wind, Geothermal, Low Carbon Buildings, Water, Low Carbon Transport, Forestry and Waste Management. Soon to be available are criteria for Bioenergy, Agriculture and Shipping. Work is ongoing on Hydropower..

Disclaimer: The Climate Bonds Standard Board operates legally as an advisory committee of the Climate Bonds Initiative Board and oversees the development of the Climate Bonds Standard. Neither the Climate Bonds Standard Board nor any organisation, individual or other person forming part of, or representing, the Climate Bonds Standard Board (together, "CBSB") accepts or owes any duty, liability or responsibility of any kind whatsoever to any issuer which wishes to apply for any of its bonds to be certified under the Climate Bonds Certification Scheme ("Scheme"), or to any issuer whose bonds may at any time be certified under the Scheme or to any other person or body whatsoever, whether with respect to the award or withdrawal of any certification under the Scheme or otherwise. All advice or recommendations with respect to any certification under the Scheme or otherwise that CBSB provides to the Climate Bonds Initiative Board is provided to it in an advisory capacity only and is not to be treated as provided or offered to any other person.

Financial instruments (bonds and loans) linked to these eligible assets, activities and entities will be aligned with the Paris Agreement and the goal of keeping global temperature rises to no more than 1.5oC above pre-industrial levels.