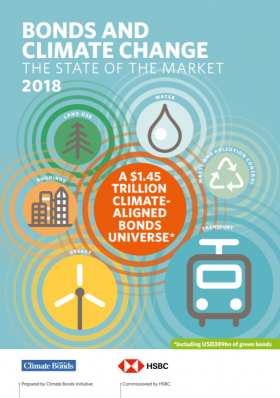

This report identifies a universe of USD1.45tn climate-aligned bonds:

• 389bn in green bonds

• 497bn in bonds from fully-aligned issuers

• 314bn in issuance from strongly-aligned issuers

• 250bn in issuance from fully-aligned US Muni issuers

What does it mean?

• Global growth of green finance is encouraging

• There is a large universe of unlabelled bonds financing green infrastructure

• There is huge potential for a larger and even more diverse green bond market

There is still a long way to go

• Global emissions remain on track to exceed 2 degrees of warming

• USD90tn of investment in climate projects is needed by 2030

• Global green finance needs to reach USD1tn by end 2020 and grow each year of the new decade

Related links:

The State of the Market Portuguese Edition: TÍTULOS DE DÍVIDA E MUDANÇAS CLIMÁTICAS ANÁLISE DO MERCADO 2018

The State of the Market Spanish Edition: BONOS Y CAMBIO CLIMÁTICO - ESTADO DEL MERCAdO 2018