Financing Credible Transitions

Launched in 2020, the groundbreaking white paper presented a framework for identifying credible transitions by introducing 'transition' as a concept, put forward a framework for use of the transition label in practice and propose clearly demarcated roles for both a green and a transition label.

Transition finance for transforming companies

Transition finance for transforming companies

This paper explicitly addresses the challenge of the climate mitigation transition, and specifically, assessing the credibility of a company’s decarbonisation, presenting Climate Bonds’ proposal of Five Hallmarks of a Credibly Transitioning Company.

Guidance to assess transition plans

This paper is designed to provide a complementary and introductory guide to assist stakeholders understand the basic markers of a credible transition plan, however it cannot replace independent in-depth verification and certification.

Navigating Corporate Transitions

Building on the foundational work launched last year, Climate Bonds Initiative, together with International Investor Group on Climate Change (IIGCC), Sustainable Markets Initiative (SMI), and Climate Arc, will be releasing of a significant new paper, "Navigating Corporate Transitions: a tool for financial institutions". This paper presents a methodology for a tool designed to aid financial institutions in assessing and categorising corporates by their transition credibility and maturity.

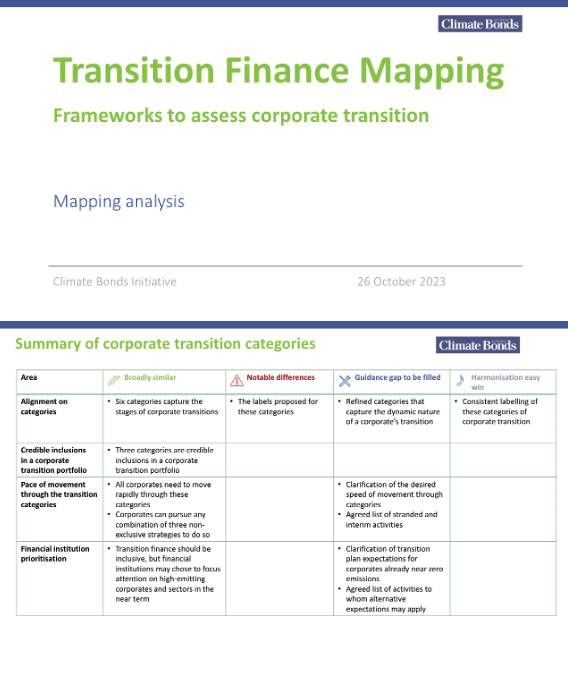

Transition Finance Consensus Mapping

Climate Bonds Initiative, in consultation with IIGCC, SMI and funded by Climate Arc, has mapped the degree of alignment of 13 corporate transition frameworks and highlighted areas where further work and alignment is needed. The initiative is part of a broader effort to assist asset managers and asset owners in analysing their investment portfolios on the path to net zero emissions.

Transition in Action Agri-Food

This report examines the current state of the AFOLU (Agriculture, Forestry, and Other Land Use) sustainable debt market and identifies key areas for further development to drive systemic change. It delves into how corporates of all sizes along the supply chain can leverage sustainable debt. The report illustrates the application of the latest international disclosure initiatives and guidance from Climate Bonds Sector Criteria, showcasing examples of metrics beyond scope 3 GHG emissions that can be used for green and sustainable debt reporting or for sustainability-linked KPIs.

The role of the Chief Financial Officer in driving low-carbon transition

The report is based on interviews with over 30 CFOs representing companies with a combined market capitalisation of USD930bn and reveals that CFOs can play a pivotal role in driving the low-carbon transition. The study is a collaborative effort between the Climate Bonds Initiative and the CFO coalition of the UN Global Compact. Interviews were conducted in the first half of 2023 to gain insights into the intersection of finance and sustainability.

Financing the Corporate Climate Transition with Bonds

The Guide helps corporate issuers to take advantage of sustainable finance markets in advancing the appropriate climate transition journey. Climate transition finance allows corporates to better manage the risks related to regulatory changes and divestments while allowing them to seize new opportunities and market trends.

Companies and Climate Change

The Climate Change Investment Framework (CCIF), designed by the Asian Infrastructure Investment Bank and Amundi, aligns investment portfolios with the Paris Agreement, focusing on climate change mitigation, adaptation, and net zero transition. This follow-up report, applying the CCIF at country, sector, and entity levels, highlights the energy transition performance of the automotive, technology-electronics, healthcare, and basic industries sectors.

Companies and Climate Change: AIIB-Amundi Climate Change Investment Framework

The Asian Infrastructure Investment Bank (AIIB) - Amundi Climate Change Investment Framework (CCIF), a tool for investors to assess investments at the issuer-level based on climate change-related financial risks and opportunities. The CCIF focuses on translating the objectives of the Paris Agreement into fundamental metrics that investors can use to evaluate progress in achieving climate change mitigation, adaptation, and low-carbon transition objectives.