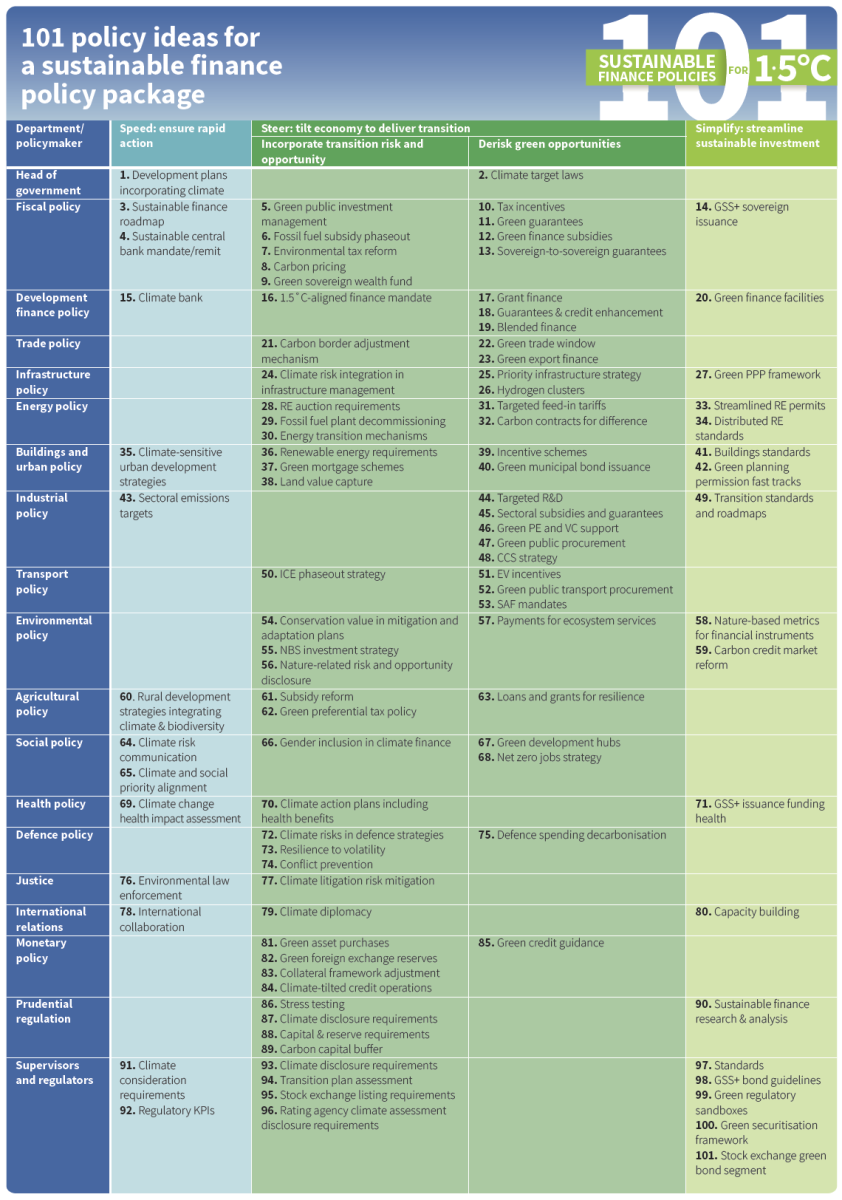

A toolkit of 101 policy levers available to government, regulator, and central bank policy makers to facilitate the transition to net zero

Policymakers must grasp the opportunities inherent in the transition to net zero

The climate transition challenge is encapsulated by 1.5°C. Behind the number is a wealth of clear scientific evidence that shows it is a goal we cannot miss.

To reach 1.5°C society must undergo a transition. The transition will offer technological, industrial, and economic opportunities, but the most important opportunity will be political. The climate challenge offers a political opportunity to steer the real and financial economy towards a green future.

The green transition will bring economic development, energy sovereignty, and job creation.

Investors have been supporting the transition since 2007, and appetite is growing as illustrated by the rapid expansion of the green bond market. By greening development plans and investments, global policymakers can harness this momentum and leverage private capital flows to fund infrastructure and development.

Download the report in full here.

Without rapid climate action, countries will experience a rising cost of capital and stunted growth.

A slow transition will be more expensive than a rapid one. According to the latest research, rapid transition will be economically beneficial due to lower costs of renewable energy technologies compared to fossil fuels without even accounting for avoided costs of climate damages or other climate policy co-benefits.

Physical climate risk exposure has increased the cost of capital in vulnerable countries, costing the Vulnerable 20 (V20) nations USD62bn in higher external interest payments over 10 years. Transition risks are materialising for the 20 sovereigns with the highest ratio of net fossil fuel exports to GDP. These suffered a median net credit rating downgrade of 1.6 notches 2015-2020 and two defaulted.

Policymakers can ensure a smooth, rapid transition and safeguard development priorities

Despite the narrowing window to meet 1.5°C, maintaining ambition is crucial to limiting climate change as much as possible. Investment can be channelled to transition with many different instruments in all areas of decision making. Awareness of this variety can increase policy ambition.

There is a wealth of policies that can be implemented to direct capital to meet sustainable development needs and deliver climate mitigation and resilience, represented by three pillars:

Contact the team at policy@climatebonds.net to find out more.