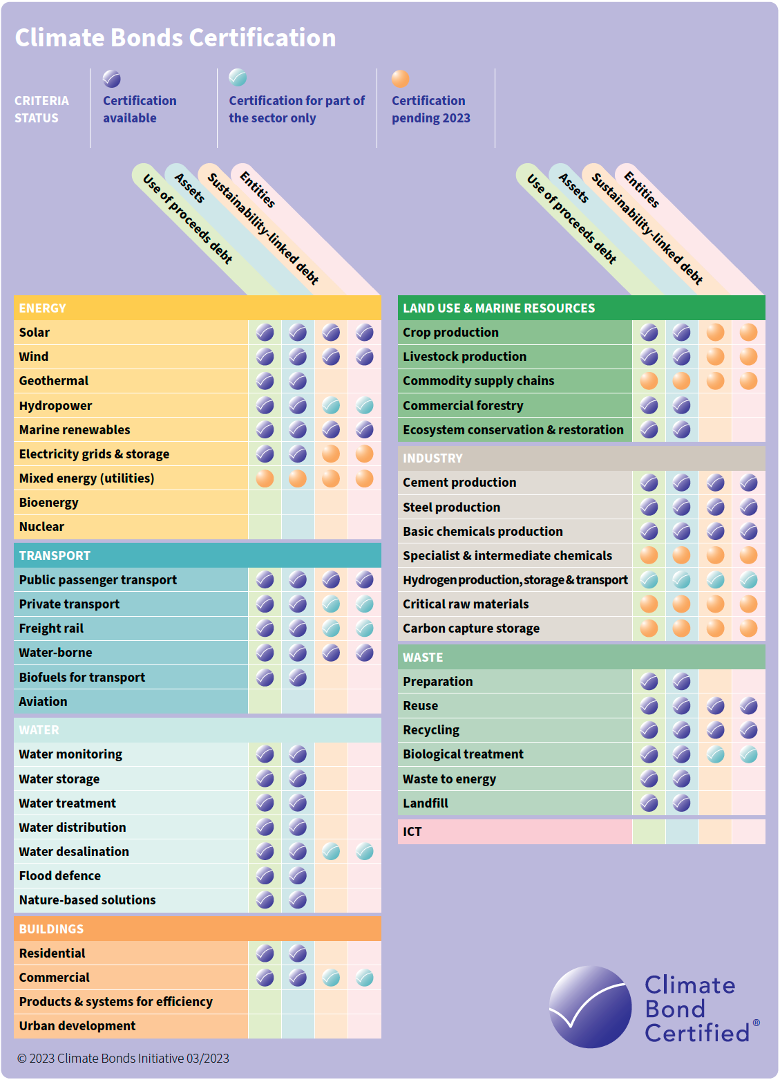

The Climate Bonds Sector Criteria are requirements that specify what assets and infrastructure can be financed with bonds / loans which have received Climate Bonds Certification. The Criteria are a subset of the Climate Bonds Taxonomy.

The requirements in the Criteria have been developed through rigorous processes with external experts, to align with the Paris Agreement and are outlined in the page on sector criteria.

Financial instruments (bonds and loans) linked to these eligible assets, activities and entities will be aligned with the Paris Agreement and the goal of keeping global temperature rises to no more than 1.5oC above pre-industrial levels.

Criteria currently under development (click here)

Currently available for certification are:

ENERGY

TRANSPORT

NATURAL CAPITAL

BUILDINGS

INDUSTRY

WASTE

Please contact certification@climatebonds.net to find out more about the different Criteria.