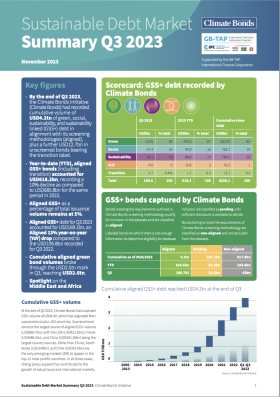

By the end of Q3 2023, the Climate Bonds Initiative (Climate Bonds) had recorded cumulative volume of USD4.2tn of green, social, sustainability, and sustainability linked (GSS+) debt in alignment with its screening methodologies (aligned), plus a further USD12.7bn in unscreened bonds bearing the transition label. Bonds meeting the requirements outlined in Climate Bonds screening methodology qualify for inclusion in the datasets and are classified as aligned.

Year-to-date(YTD), aligned GSS+ bonds (including transition) accounted for USD618.2bn, recording a 10% decline as compared to USD685.8bn for the same period in 2022. Aligned GSS+ as a percentage of total issuance volume remains at 5%.