Resources

1. Grids and Storage Criteria Brochure (English)

2. Grids and Storage Criteria Document (English)

2.1.Climate Bonds Initiative: เกณฑ์ด้านโครงข่ายไฟฟ้าและการกักเก็บพลังงาน มาตรฐานตราสารหนี้ว่าด้วยการเปลี่ยนแปลงสภาพภูมิอากาศ (Thai)

3. Grids and Storage Background Paper (English)

4. Climate Bonds Standard V3.0

5. Criteria Frequently Asked Questions (FAQs)

Timeline of Development:

April 2018: TWG Launch

April 2018: IWG Launch

May - July 2021: Public Consultation

Certifications

To see the whole list of Electrical Grids and Storage Climate Bonds, visit our Database of Certified Bonds

Status: The Grids and Storage Criteria are now available for use for certification.

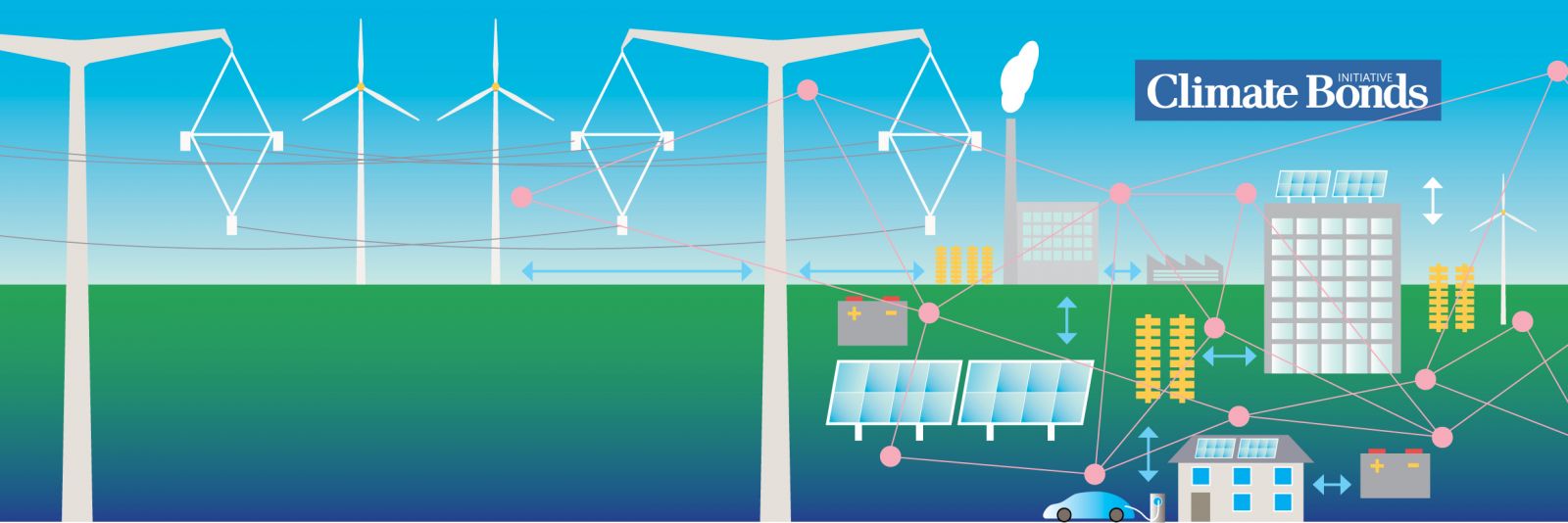

Criteria: The Grids and Storage Criteria lay out the requirements that grid and storage assets and/or projects must meet to be eligible for inclusion in a Certified Climate Bond. The Criteria apply to transmission, distribution and storage of electricity.

The Grids and Storage Criteria contain both Mitigation Requirements and Adaptation & Resilience Requirements.

Financial instruments (bonds and loans) linked to these eligible assets, activities and entities will be aligned with the Paris Agreement and the goal of keeping global temperature rises to no more than 1.5oC above pre-industrial levels.

Public consultation:

Public consultation for the Grids and Storage Criteria has now ended.

A webinar took place on Tuesday 8th June 2021 that provided an opportunity for interested parties to learn more about the Criteria and to ask our lead technical consultant Ian Walker and staff at CBI any specific questions they might have:

Why develop eligibility Criteria for grid- and storage-related low carbon investments?

Expanding and upgrading electricity grid and storage infrastructure is crucial to meeting the steep decarbonisation goals for energy systems. More flexible and distributed systems are needed to bring about clean electricity. At the same time, this infrastructure is vital for the decarbonisation of other sectors. For industrial sectors or buildings, electrification is a key means to achieving decarbonisation. This is all while ensuring this infrastructure is adapted to changes in climate. The dependence of so many sectors and societies on stable electricity provision makes grid resilience essential.

Estimates suggest investment in electricity networks needs to increase from 16% of total energy investment to 19% between the years 2025 – 2030 to meet the Paris goals. However, global investment has been falling for the past several years, down from USD 306 billion in 2016 to USD 248 billion in 2020.

Improved guidance, such as these Grids and Storage Criteria, will catalyse investment and can be utilised by governments in setting regulation or recommendations for decarbonising the sector.

The Grids and Storage Technical and Industry Working Groups (TWG and IWG)

To create the Grids and Storage Criteria, we convened a Technical Working Group (TWG) and an Industry Working Group (IWG) with representatives from investors, public entities, research institutes and international policy bodies from around the world.

Electrical Grids and Storage Criteria Technical Working Group Members

|

|

|

|

|

|

Independent |

Rochester Institute of Technology Eric Hittinger Associate Professor |

University College London Mark Barrett Professor of Energy Systems Modelling |

European Bank of Reconstruction and Development (EBRD) Oleg Bulanyi Principal |

Globalfields Andreas Biermann Director of Sustainable Finance |

|

|

|

|

|

| EBRD Carel Cronenberg Associate Director |

European Investment Bank Federico Ferrario Energy Economist |

European Commission Lorcan Lyons Project Officer |

Inter-American Development Bank Claudio Alatorre Climate Change Specialist |

EIB David Gonzalez Principal Advisor |

Electrical Grids and Storage Criteria Industry Working Group Members

| Cindy Thyfault, Global Biofuture Solutions | Steve Jackman, CTC Global |

| Enno Dykmann, Alliander | Timothy Olson, Independent |

| Richard Molke, Wells Fargo | Elvis Mendes, Electrobras |

| Eugene Montoya, Wells Fargo | Isabella Coutinho, SITAWI |

| Rajiv Srivastava, Indian Energy Exchange Ltd | Sandip Keswani, KPMG |

| Pedro Luiz de Oliveira Jatoba, IHA/Electrobras | Alex Cui, CCXI |

| Jeroen Dicker, TenneT Holdings | Kiran Kumaraswamy, Fluence Energy |

| Inese Vilcina, Latvenergo AS | Alexandre Marty, EDF |

| Juta Naglina, Latvenergo AS | Robert Weigert, Eurogrid |

Financial instruments (bonds and loans) linked to these eligible assets, activities and entities will be aligned with the Paris Agreement and the goal of keeping global temperature rises to no more than 1.5oC above pre-industrial levels.