A key part of the Standard is a suite of sector-specific eligibility Criteria. Each Sector Criteria sets climate change benchmarks for that sector that are used to screen assets and capital projects so that only those that have climate integrity, either through their contribution to climate mitigation, and/or to adaptation and resilience to climate change, will be certified. Where a bond encompasses a mixed portfolio of assets across several sectors, each sub-category of assets will be subject to the relevant Sector Criteria for those assets.

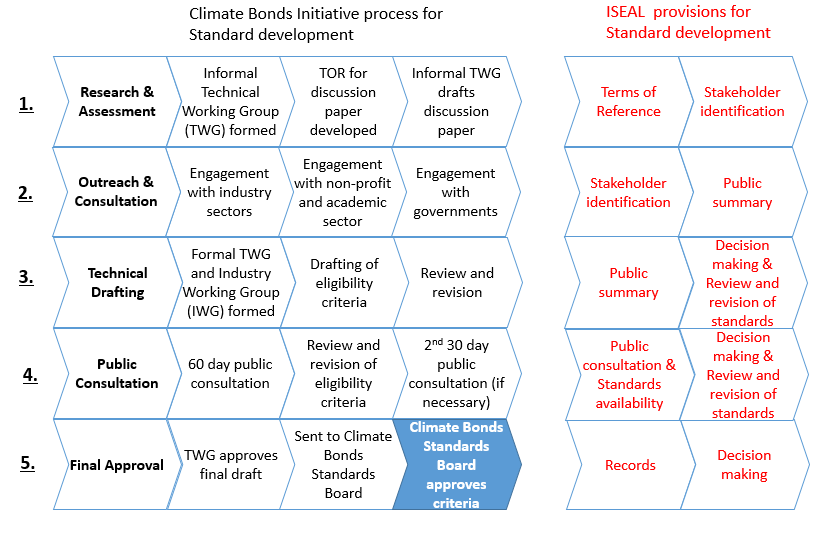

The Sector Criteria are determined through a multi-stakeholder engagement process, including Technical and Industry Working Groups, convened and managed by the Climate Bonds Initiative, and are subject to public consultation and revised as needed as a result of that feedback. Finally, they are reviewed and approved by the Climate Bonds Standard Board.

The Criteria are a subset of the Climate Bonds Taxonomy.

Criteria Development Process

Criteria are developed in accordance with guidance for standard setting organistions published by ISEAL. Detailed explanations are found here. The schematic below shows the process Climate Bonds goes through to develop criteria (against the ISEAL provisions shown on the right)

Developing the Sector Criteria

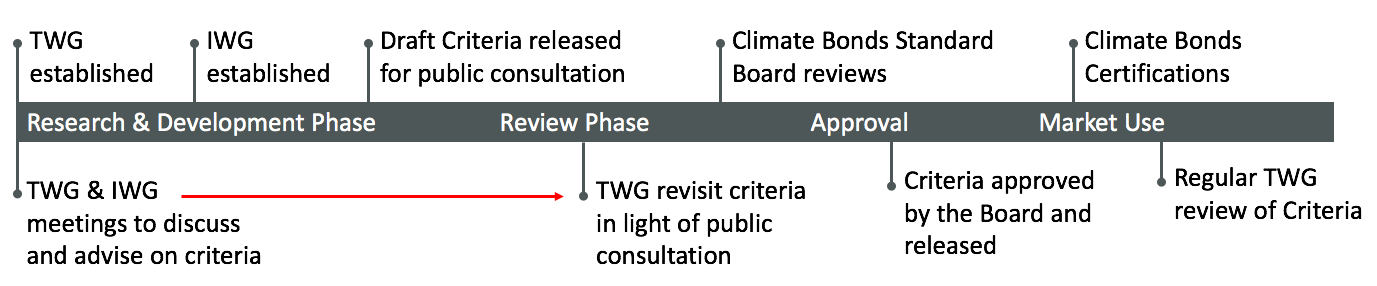

The criteria are developed by Technical Working Groups (TWG) and commented on by Industry Working Groups (IWG):

Disclaimer: The Climate Bonds Standard Board operates legally as an advisory committee of the Climate Bonds Initiative Board and oversees the development of the Climate Bonds Standard. Neither the Climate Bonds Standard Board nor any organisation, individual or other person forming part of, or representing, the Climate Bonds Standard Board (together, "CBSB") accepts or owes any duty, liability or responsibility of any kind whatsoever to any issuer which wishes to apply for any of its bonds to be certified under the Climate Bonds Certification Scheme ("Scheme"), or to any issuer whose bonds may at any time be certified under the Scheme or to any other person or body whatsoever, whether with respect to the award or withdrawal of any certification under the Scheme or otherwise. All advice or recommendations with respect to any certification under the Scheme or otherwise that CBSB provides to the Climate Bonds Initiative Board is provided to it in an advisory capacity only and is not to be treated as provided or offered to any other person.