Green infrastructure presents a huge investment opportunity globally, with an estimated USD100tn worth of climate compatible infrastructure required between now and 2030 in order to meet Paris Agreement emissions reduction targets. However, there remains a lack of identifiable, investment-ready and bankable projects. There is also a lack of understanding of what types of assets and projects qualify for green financing.

In response to this challenge, Climate Bonds is developing a series of reports that aim to identify and demonstrate green infrastructure investment opportunities around the world. By so doing, it aims to raise awareness of what is green and where to invest, and to promote green bond issuance as a tool to finance green infrastructure.

The report series commenced with the GIIO Indonesia report, launched in May 2018. The pipeline of GIIO reports being developed includes further exploration of opportunities in Asia-Pacific as well as in Latin America.

Brown to Green transition

The reports also support the need for a brown-to-green transition. In the short- to medium-term, governments and large companies will progressively be reducing exposure to brown assets and practices as they increase capex towards, and adoption of, greener modes of operation. When such industry sectors start to align with a 2-degree emissions trajectory, new green infrastructure opportunities can be created, such as in industries like shipping and logistics.

Reports: Australia & New Zealand • Brazil • Indonesia • Philippines • Vietnam • Malaysia

Australia & New Zealand

The GIIO Australia 2019 report advocates increasing green investment in the real economy including green bonds and other green investment products and greater engagement between the financial sector, ASX listed corporates, the superannuation sector and governments around infrastructure and brown to green transition.

This report builds on the inaugural Green Infrastructure Investment Opportunities Australia and Zealand (GIIO) report released August 2018.

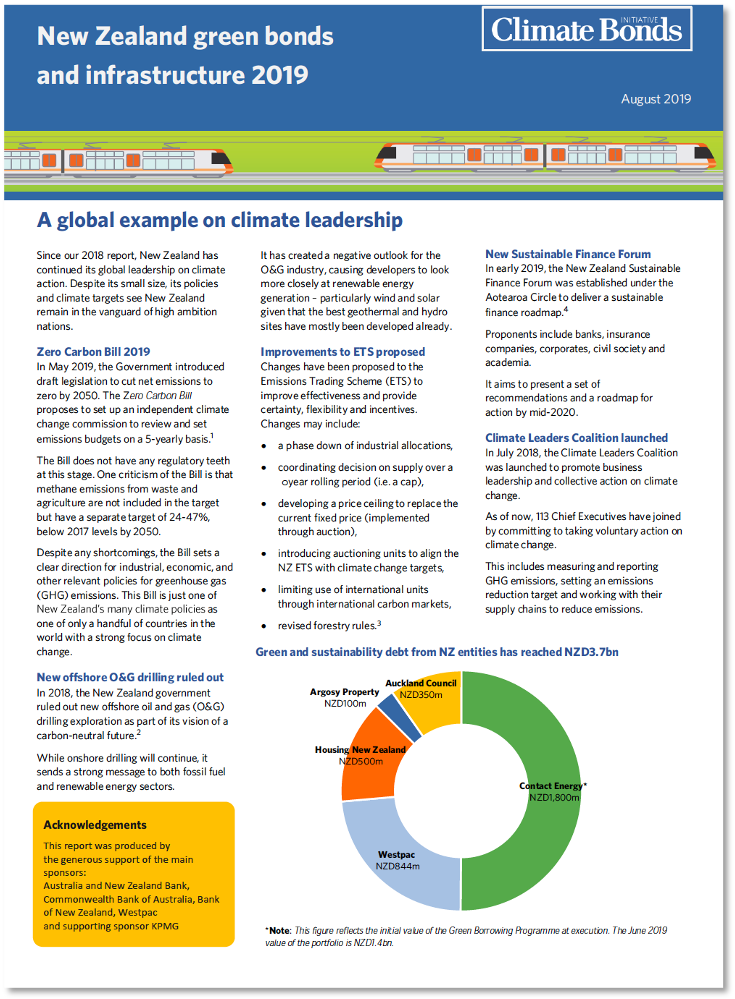

The New Zealand Green Bonds and Infrastructure 2019 report reveals that the existing green bond market in New Zealand is small but has momentum. The green loans market is also another area of promising growth in New Zealand. The report states New Zealand’s cumulative green and sustainability debt issuance is at NZD3.8bn as of 30 June 2019.

The GIIO Australia & New Zealand aims to facilitate greater engagement on these topics between project owners and developers, and institutional investors including asset managers and superannuation funds.

Green finance instruments and trends are explored in the report, with sector-by-sector green infrastructure investment opportunities presented in reference case studies.

Brazil

O relatório Oportunidades de Investimento em Infraestrutura Verde — Brasil 2019 relaciona o atual estado do mercado brasileiro de finanças sustentáveis e o progresso de projetos de infraestrutura verde no Brasil.

The Green Infrastructure Investment Opportunities - Brazil 2019 report lists the current state of the Brazilian sustainable finance market and the progress of green infrastructure projects in Brazil.

Indonesia

This report builds on the inaugural Green Infrastructure Investment Opportunities, Indonesia report released in May 2018 (see below). It provides updated content to help meet the growing demand for green investment opportunities, including green bonds, as well as to support the country’s transition to a low-carbon economy.

Green Infrastructure Investments Opportunities, Indonesia was the first GIIO report developed. Released in May 2018, the report explores a wide variety of green investment opportunities in Indonesia. It has been prepared to support Indonesia’s mission to develop low carbon and climate resilient infrastructure; and aims to facilitate engagement on this topic between project owners and developers, and investors.

Philippines

The Inaugural Green Infrastructure Investment Opportunities (GIIO) Philippines report brings the key trends and developments for green infrastructure and energy in the Philippines.

The Inaugural Green Infrastructure Investment Opportunities (GIIO) Philippines report brings the key trends and developments for green infrastructure and energy in the Philippines.

Twenty (20) green projects in renewable energy, low carbon transport, water infrastructure and waste management are showcased and a sample pipeline of over seventy (70) projects in low carbon transport, renewable energy, sustainable water and sustainable waste management are identified.

This report has been prepared to help meet the growing demand for green investment opportunities in the Philippines and to support the country’s transition to a low carbon economy. It aims to facilitate greater engagement on this topic between project owners and developers, and institutional investors. Green infrastructure and corresponding green finance instruments are explored in the report, with sector-by-sector investment options presented.

The report is intended for a wide range of stakeholders, including domestic investors, offshore pension funds and asset managers, potential issuers, infrastructure owners and developers, as well as relevant government ministries.

Webinar Launch: Philippines: Green Infrastructure Investment Opportunities (GIIO)

Vietnam

Báo cáo Cơ hội đầu tư vào Cơ sở Hạ tầng xanh Việt Nam (GIIO Vietnam) khám phá nhiều cơ hội đầu tư xanh tại Việt Nam, nêu bật mười sáu (16) dự án năng lượng tái tạo, vận chuyển carbon thấp, cơ sở hạ tầng nước và giản lý chất thải. Các công cụ và xu hướng tài chính xanh cũng được liệt kê, phân tích trong báo cáo.

The GIIO Vietnam report explores a variety of green investment opportunities in Vietnam, highlighting sixteen (16) projects in renewable energy and green infrastructure including low carbon transport, water infrastructure and waste management. Green finance instruments and trends were also explored in the report.

The GIIO Vietnam report was launched on April 30th, 2020 during a webinar hosted by Climate Bonds that explored green infrastructure investment opportunities in Vietnam and Indonesia.

Webinar Launch: Green Infrastructure Investment Opportunity Vietnam

Malaysia

This report highlights green infrastructure investment opportunities in Malaysia. It has been prepared to help meet the growing demand for green investment opportunities and to support the country’s transition to a low carbon economy.

This report highlights green infrastructure investment opportunities in Malaysia. It has been prepared to help meet the growing demand for green investment opportunities and to support the country’s transition to a low carbon economy.

It aims to facilitate greater engagement on this topic between project owners and developers, and institutional investors. Green infrastructure and corresponding green finance instruments are explored in the report, with sector-by-sector investment options presented.

The report is intended for a wide range of stakeholders, including domestic superannuation funds and asset managers and their global counterparts, potential issuers, infrastructure owners and developers, as well as relevant government ministries.

In developing this report, the Climate Bonds Initiative consulted with key Government bodies, industry, the financial sector, peak bodies, NGOs and think tanks – in partnership with Capital Markets Malaysia. We would like to thank these partners along with the other organisations that contributed to the report.