Reports

-

金融支持农业绿色发展的共同语言 --农业绿色发展分类方案和评估方法

推進農業綠色發展,是統籌推進經濟、政治、文化、社會、生態發展的具體體現,是農業供給側結構性改革的重點。

為中國農業部門的綠色轉型融資在很多方面都很重要。它不僅鼓勵對農業產業綠色發展的投資,而且提高農業經營主體的成本、市場和風險意識,促進農業綠色發展的產業、生產和管理體系的發展。

下載我們的最新報告,了解更多關於中國在當地農業綠色轉型之路上的信息。

-

全球气候相关债券市场与发行人报告2020年

CBI《2020年全球气候相关债券市场与发行人报告》提供了全

球非贴标气候相关债券市场的最新进展和全面分析, 揭示了贴标债券市场以外的可持续投资机会。 非贴标气候相关债券市场(climate-aligned bonds universe)

是气候债券倡议组织通过特别开发的方法论长期追踪的市场, 强调了那些未被发行人明确标记为“绿色”的投资机会。 通过追踪这一部分债券市场, 可进一步引导全球资本投向与气候相关资产和活动。 目前,绿色、

社会和可持续贴标债券是气候相关债券发行人在资本市场上为其业务 运营进行再融资的主要工具。CBI的数据分析发现, 贴标债券发行人往往拥有更广泛的投资者基础, 并从绿色标签提供的额外可见度和负溢价中获益。 -

Common Language on Financially-Supported Agricultural Green Development Report

Promoting the green development of agriculture sector is a concrete manifestation of the overall plan for promoting economic, political, cultural, social, and ecological development, and the focus of supply-side structural reform in agriculture.

-

Análise do Mercado na América Latina e Caribe

O relatório "Análise do Mercado na América Latina e Caribe", publicado com o apoio do Banco Interamericano de Desenvolvimento (BID) e da Corporação Financeira Internacional (IFC), mostra que a região estabeleceu um recorde de emissão de títulos verdes em 2020 e está a caminho de atingir números semelhantes em 2021. A emissão de títulos verdes cresceu de US$ 13,6 bilhões em setembro de 2019 para US$ 30,2 bilhões no final de junho de 2021, em menos de dois anos.

-

Estado del Mercado en América Latina y El Caribe

El informe "Estado del Mercado en América Latina y El Caribe", publicado por la Climate Bonds Initiative, contó con el apoyo del Banco Interamericano de Desarrollo (BID) y la Corporación Financiera Internacional (IFC). El informe revela que la región estableció un récord de emisión de bonos verdes en 2020 y está en camino de obtener cifras similares en 2021. La emisión de bonos verdes creció de $13.6 mil millones de dólares en septiembre de 2019 a $30.2 mil millones a fines de junio de 2021, en menos de dos años. Para obtener más información, descargue el informe de forma gratuita.

-

Sustainable Debt Summary Q3 2021

Total volumes for the sustainable debt market – including labelled Green, Social and Sustainability (GSS) bonds, Sustainability-linked bonds (SLB) and Transition bonds – are well on their way to an annual trillion, reaching USD779.2bn in the first three quarters of 2021.

Key Highlights

-

Transition Finance in China’s Guangdong Hong Kong-Macau Greater Bay Area | 粤港澳大湾区转型金融展望

The Transition Finance in China’s Guangdong Hong Kong-Macau Greater Bay Area report discusses the principles that credible transition finance should adhere to and takes Guangdong-Hong Kong-Macao (GBA) Greater Bay Area – an important economic powerhouse for China – as a case for studying the application of transition finance concerning the low-carbon transition.

-

Encuesta de bonos soberanos verdes, sociales y sostenibles

Los bonos soberanos verdes, sociales y sostenibles (VSS) contribuyen a iniciativas gubernamentales estratégicas en torno al clima, catalizando los mercados financieros verdes locales y atrayendo nuevos inversores. Estos y otros hallazgos están contenidos en una primera encuesta de este tipo realizada por Climate Bonds.

-

China Green Securitization State of the Market 2020 report

The China Green Securitization State of the Market 2020 report brings an analysis of China’s green ABS market growth for both international and domestic investors. Supported by UK PACT China, the report reviews the policy initiatives that are guiding the market development in the country, while analyzing the market data and best practices.

-

Pooled Finance: Brazil’s Opportunity to finance subnational sustainable infrastructure

The Pooled Finance: Brazil’s Opportunity to finance subnational sustainable infrastructure Policy Brief identifies Brazil’s opportunity to structure Pooled Finance Mechanisms-PFMs to fund and implement subnational sustainable infrastructure projects.

-

Policy Brief: Modelagem Financeira de Gestão Consorciada: Oportunidade para o Brasil financiar infraestrutura subnacional sustentável

O Policy Brief Modelagem Financeira de Gestão Consorciada: Oportunidade para o Brasil financiar infraestrutura subnacional sustentável identifica a oportunidade que o Brasil tem para estruturar Mecanismos Finance

-

China State of the Market 2020 Report

Climate Bonds Initiative (CBI) & China Central Depository & Clearing Co. Ltd Research Centre (CCDC Research), with the support of HSBC, are pleased to present you the fith iteration of our flagship China Green Bond Market 2020 Research Report.

-

Latin America & Caribbean: Sustainable Finance State of the Market 2021

Latin America and Caribbean (LAC): State of The Market 2021

-

Green Bond Pricing in the Primary Market H1 2021

Green Bond Pricing in the Primary Market H1 2021 is the 12th iteration in the series and monitors the performance of 56 EUR and 19 USD denominated benchmark size green bonds with a total value of USD75.9bn issued between January and June 2021.

Highlights from Q1-Q2 2021

-

Sustainable Debt Highlights H1 2021

Total volumes for labelled Green, Social and Sustainability (GSS) bonds, Sustainability-linked bonds (SLB) and Transition bonds reached nearly half a trillion (USD496.1bn) in the first half of 2021.

This amount represents 59% year-on-year growth in the GSS market from the equivalent period in 2020. It also sets the labelled sustainable debt market on track to reach another record high by end December.

Cumulative labelled issuance now stands at USD2.1tn at end H1 2021.

-

Green Bonds in South Africa: How green bonds can support South Africa's energy transition

South Africa has a huge opportunity - to be the first coal-based economy in the global south to make a successful transition to a low carbon economy, particularly in the energy sector. With its aging fleet of coalfired power stations , it must build more energy generation capacity both to offset coal closures and to meet the growing demand for energy.

-

Sustainable Debt: North America State of the Market 2021

This report is Climate Bonds’ first stand-alone State of the Market report for North America, encompassing established green markets and the expanding social and sustainability labels.

-

Climate Investment Opportunities: Climate-Aligned Bonds & Issuers 2020

Climate Investment Opportunities: Climate-Aligned Bonds & Issuers 2020 report provides a comprehensive analysis of the global unlabelled climate-aligned bond market, which consists of investment opportunities that extend beyond the thematic bond market. These instruments are identified via a proprietary methodology developed by Climate Bonds.

-

Brazil Briefing: Agriculture Sustainable Finance State of The Market

The Brazil briefing on the Agriculture Sustainable Finance State of The Market provides an analysis of how labeled bonds are currently used to finance sustainable agriculture projects, assets and activities in the country. According to the study, green bonds account for 84% of the Brazilian sustainable debt market, with a cumulative total of USD 9 billion issued by February 2021. Next are sustainability bonds with USD 1.6 billion representing 15% of the total volume. And finally, social bonds with USD 111 million, equivalent to 1% of the market.

-

Análise do Mercado de Financiamento Sustentável da Agricultura no Brasil

O relatório Análise do Mercado de Financiamento Sustentável da Agricultura no Brasil traz uma análise de como títulos rotulados são atualmente utilizados para financiar projetos, ativos e atividades de agricultura sustentável no país. De acordo com o estudo, os títulos verdes respondem por 84% do mercado de dívida sustentável brasileira, com um total acumulado de USD 9 bilhões emitidos até fevereiro de 2021. Em seguida, estão os títulos sustentáveis com USD 1,6 bilhão representando 15% do volume total.

-

Greater Bay Area - Green Infrastructure Investment Opportunities (GIIO) | 粤港澳大湾区绿色基础设施投资机遇报告

This report highlights green infrastructure investment opportunities in the Guangdong-Hong Kong-Macao Greater Bay Area (the GBA) which consists of nine cities in the Guangdong Province, and two special administrative regions, i.e., Hong Kong and Macao, and is one of the economic growth engines and leading green finance regions in China.

-

Post-Issuance Reporting in the Green Bond Market 2021

This is the 3rd iteration of our Post-Issuance Reporting in the Green Bond Market Series.

Post-issuance reporting on the use of proceeds (UoP) is a core component of the Green Bond Principles (GBP), the Green Loan Principles (GLP) and the Climate Bonds Standard (CBS). Issuers that are effectively reporting on the environmental impacts of funded projects ensure the transparency and accountability underpins the credibility of the green bonds and loans.

-

Embedding Sustainability into the COVID recovery: A Primer for ASEAN Central Banks

This Policy Brief examines the possible role ASEAN central banks could play in ‘building back better’ from the COVID-19 pandemic, drawing on international examples of innovative action in both COVID-19 recovery and greening central bank activities.

This report synthesises best practice on the ‘greening’ of prudential and monetary policies and contextualises these into lessons that can be drawn on by ASEAN Central Banks as they rebuild from the economic impacts of COVID-19.

-

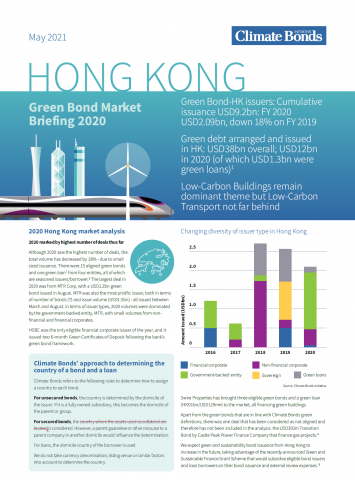

Hong Kong Green Bond Market Briefing 2020

This is the third iteration of the Hong Kong Briefing Paper, examining a range of green bond and loan deals from domestic issuers and the growing suite of sustainable finance product offerings.

-

ASEAN Sustainable Finance State of the Market 2020

The ASEAN sustainable finance market maintains rapid growth despite the negative impact of COVID-19, focusing the attention on the need for a sustainable economic recovery.

The report outlines regional and national developments covering three overarching debt themes, Green, Social, and Sustainability. Also covered are key policy developments that are anticipated to drive ASEAN’s sustainable finance market.

Regional highlights

-

Sustainable Debt: Global State of the Market 2020

Sustainable Debt-Global State of the Market report assesses the scale and depth of the green, social, and sustainability (GSS) debt markets as of the end of 2020. This report is the tenth iteration in our flagship State of the Market series, encompassing established green markets and the expanding social and sustainability labels.

-

Nordic Sustainable Debt State of the Market 2020

Nordic Sustainable Debt is the newest in our State of the Market (SotM) series providing an in-depth analysis of Green, Social and Sustainability (GSS) investment in Sweden, Norway, Finland, Denmark and Iceland.

The Nordic sustainable bond market has more than quintupled from USD16.5bn since the inaugural Climate Bonds Nordic report of 2018, and including sovereign, NIB and national issuance reached a cumulative USD 88.2bn at the end of 2020.

-

Green Finance Opportunities in Central America & the Caribbean 2021 / Oportunidades de Financiamiento Verde en Centroamérica y el Caribe 2021

Sponsored by the Central American Bank for Economic Integration (CABEI), the Green Finance Opportunities in Central America & the Caribbean 2021 report aims to support green investment in the region by facilitating greater engagement between asset owners, investors and developers, as well as to help issuers come to market.

-

Japan: Green Finance State of the Market 2020

Climate Bonds continues its collaboration with Japan’s Green Bond Issuance Promotion Platform, with the release of the third edition of the Japan Green Finance State of the Market report. The report provides an in-depth overview of the Japanese green bond market and the broader labelled universe, while highlighting opportunities to boost green finance with unlabelled climate-aligned bonds and new policy developments.

-

Green Bond Pricing in the Primary Market H2 2020

Green Bond Pricing in the Primary Market H2 2020 reveals increasing signs of greenium in both public and private sector bond issuance in the second half of the year including performance of the inaugural German sovereign green Bund of September 2020.

-

Green Infrastructure Investment Opportunities Malaysia

This report highlights green infrastructure investment opportunities in Malaysia. It has been prepared to help meet the growing demand for green investment opportunities and to support the country’s transition to a low carbon economy.

It aims to facilitate greater engagement on this topic between project owners and developers, and institutional investors. Green infrastructure and corresponding green finance instruments are explored in the report, with sector-by-sector investment options presented.

-

Financiando el transporte sustentable en México

Financiando el transporte sustentable en México

El Informe Financiando el transporte sustentable en México ofrece una visión general del mercado en crecimiento y oportunidades para canalizar inversiones hacia el transporte bajo en carbono en México y acciones de mitigación que podrían financiarse con bonos etiquetados.

-

Financing low-carbon transport in Mexico

The Financing low-carbon transport in Mexico brief provides an overview of the growing market and opportunities for channeling investments towards sustainable transport in Mexico and mitigation actions that could be financed with labelled bonds.

-

绿色、社会和可 持续主权债券: 发展贴标债券市 场的中坚力量

基于与19个主权债券发行人的对话, 气候债券倡议组织(以下简称“气候债 券”)撰写了全球首份针对绿色、社会及 可持续主权债券(Sovereign green, social, and sustainability (GSS) bond,以下简称“贴标主权债券”)的调 查报告。

-

Sovereign Green, Social, and Sustainability Bond Survey

Sovereign Green, Social & Sustainability (GSS) bonds contribute to strategic government initiatives surrounding climate, catalyzing local green finance markets and attracting new investors. These and other findings are contained in a first of its kind survey undertaken by Climate Bonds.