Reports

-

可持续发展挂钩债券数据库 方法论

气候债券倡议组织(Climate Bonds Initiative, CBI)是一个致力于调动全球资本以应对气候变化的国际非营利性组织。

-

Agriculture Sustainable Finance State of the Market 2023 - Brazil Briefing

The report emphasizes the critical role of the agriculture sector in Brazil's transition to a net-zero emissions economy, both in terms of climate change mitigation and adaptation. It underscores the significance of sustainable finance and the commitment of Brazilian entities to invest in sustainable practices.

-

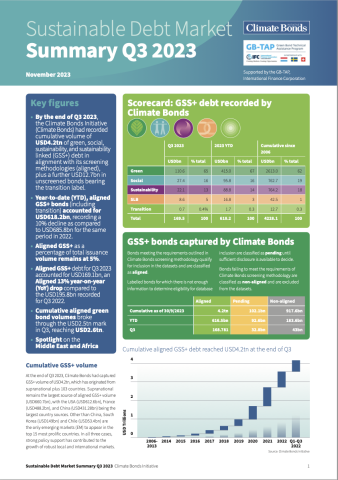

State of the Market Q3 2023

By the end of Q3 2023, the Climate Bonds Initiative (Climate Bonds) had recorded cumulative volume of USD4.2tn of green, social, sustainability, and sustainability linked (GSS+) debt in alignment with its screening methodologies (aligned), plus a further USD12.7bn in unscreened bonds bearing the transition label. Bonds meeting the requirements outlined in Climate Bonds screening methodology qualify for inclusion in the datasets and are classified as aligned.

-

Financing the Corporate Climate Transition with Bonds

The Guide helps corporate issuers to take advantage of sustainable finance markets in advancing the appropriate climate transition journey.

-

Fossil Gas in Taxonomies: What Lies Beneath

In 2023, global methane emission levels in the atmosphere reached record highs, at more than two and a half times their pre-industrial level. One of the major causes identified was the increased extraction, transportation, and utilisation of fossil gas, which cause unintended and often significant leakages of methane (fugitive emissions) across the supply chain.

-

トランジション計画の評価ガイダンス

トランジション計画の評価ガイダンスレポートの日本語版を発行しました。

排出量を削減し、科学的根拠に基づくネット・ゼロへの道筋を達成するためには、強固で追跡可能な戦略とロードマップが不可欠です。

-

European Union Chemical Sector Transition

To build a net zero economy, the world needs to build a net zero chemicals industry. Chemicals are present in over 90% of manufactured goods, and account for a large portion of global emissions.

-

Investment Opportunities: Agri-food sector in Brazil

This report demonstrates how investors can use Climate Bonds Initiative transition frameworks and guidance to scrutinise corporate strategy and identify credible investment opportunities. The focus of the paper is entities operating in the agriculture sector.

-

Cementing the Global Net Zero Transition

Cement production accounts for around 7% of global emissions and it is the second largest global industrial emitter after steel.4 Achieving the goals of the Paris Agreement will be impossible without decarbonising sectors such as cement and yet, the carbon intensity of global cement production has only slightly decreased in recent decades, and it is significantly behind a Paris-aligned pathway.

-

The role of fossil fuels in taxonomies: Canada case study

While the debate over the future content of the Canadian Taxonomy continues in the press, the main stumbling block remains the inclusion of fossil fuels, particularly fossil gas where Canada is the world’s fifth-largest producer. The controversy centers on whether fossil gas should contribute to a decarbonization pathway as an interim or a transitional fuel, or be phased out completely.

-

Japan Policies to Grow Credible Transition Finance

"Japan: Policies to Grow Credible Transition Finance" explores Japan's commitment to delivering the goals of the Paris Climate Agreement and provides policy guidance for Japan’s transition to a net zero future.

-

日本:信頼できるトランジション・ファイナンス発展のための政策

"Japan: Policies to Grow Credible Transition Finance" explores Japan's commitment to delivering the goals of the Paris Climate Agreement and provides policy guidance for Japan’s transition to a net zero future.

-

EU Regulation on Deforestation-Free Products: Guidance and recommendations for corporates and financial institutions (Paper I)

Navigating the complex terrain of deforestation and supply chains, the European Union's Deforestation Regulation (EUDR) can serve as a watershed policy directive. This regulation not only addresses deforestation associated with both legally and illegally sourced commodities but also sets a new benchmark for global sustainability practices.

-

The role of the Chief Financial Officer in driving low-carbon transition

The report is based on interviews with over 30 CFOs representing companies with a combined market capitalisation of USD930bn and reveals that CFOs can play a pivotal role in driving the low-carbon transition. The study is a collaborative effort between the Climate Bonds Initiative and the CFO coalition of the UN Global Compact. Interviews were conducted in the first half of 2023 to gain insights into the intersection of finance and sustainability.

-

Guidance to Assess Transition Plans

A transition plan is a time-bound and trackable strategy and roadmap presenting the plans and actions for reducing emissions with a science-based pathway to net zero.

This paper is designed to provide a complementary and introductory guide to assist stakeholders understand the basic markers of a credible transition plan, however it cannot replace independent in-depth verification and certification.

-

Green Bond Pricing Paper (H1 2023)

The Green Bond Pricing in the Primary Market H1 2023 report is the 16th iteration of a leading series analysing the pricing dynamics of green bonds, examining how these instruments offer pricing advantages for issuers and investors.

-

H1 Market Report 2023

A market update from the Climate Bonds Initiative (Climate Bonds) has revealed that aligned Green, Social, Sustainability, Sustainability-Linked and Transition (collectively GSS+) finance volumes passed the $4trillion mark in H1 2023, reaching a combined $4.2trillion.

-

Latin America and the Caribbean Sustainable Debt State of the Market 2022

This is the third iteration of Climate Bonds Initiative’s State of the Market series for the LAC region. The report describes the shape and size of labelled GSS+ debt issued by LAC domiciled entities to the end of December 2022. The market analysis is enhanced by an overview of key policy developments, trends, guidance, and growth opportunities for sustainable finance in LAC.

-

气候债券标准4.0中文版本

气候债券标准和认证计划已拓展到为非金融企业(在经济中提供货物和服务的企业

-

12 Policies to Unlock Deep Decarbonisation

The decarbonisation of hard-to-abate sectors requires targeted policy support to ensure rapid emissions reduction, avoid stranded asset risks, and develop transition opportunities.

Effective policy support will help to overcome market failures and problems of inertia, increase the green asset pipeline and channel funding to transition the whole economy. Transition policy development will enable countries to develop new green industries, conserve their natural resources, and ensure sustainable growth.

-

Comparison Study Between the Colombian and EU Taxonomies

The purpose of this report is to provide a comparison between the EU and Colombian Green Taxonomy to bring clarity and transparency to EU and international investors about investments that could be considered green in both the EU and Colombia. This will help reduce transaction and research costs for international and EU investors, which will facilitate cross-border financial flows between the EU and Colombia to help achieve a green and sustainable transition.

-

Resilience Taxonomy White Paper

This white paper presents a blueprint for the development of a climate resilience classification framework (hereafter referred to as the climate resilience framework or “the Framework”), with the primary objective of promoting and facilitating the much-needed investment in climate resilience through capital markets.

-

Hong Kong Green Sustainable Debt Market Briefing 2022

This is the fifth iteration of the Hong Kong Green Sustainable Debt Market Briefing, produced by the Climate Bonds Initiative (Climate Bonds) in association with the Hon

-

2022年中国可持续债券市场报告

本次报告主要盘点了截至2022年末中国绿色及可持续主题债券市场的发展状况,涵盖了绿色、社会责任和可持续发展债券(GSS)市场以及可持续发展挂钩债券(SLB)和转型债券市场(统称为GSS+ 市场)等范围。

-

China Sustainable Debt State of the Market Report 2022

This is the seventh iteration of the China Sustainable Debt State of the Market Report.

-

Property Certification Opportunities in Tokyo

One of the most pressing challenges facing Tokyo is its energy consumption. The city is heavily dependent on fossil fuels, which contribute to greenhouse gas emissions and exacerbate the impacts of climate change. To reduce its carbon footprint and minimise pollution, Tokyo needs to invest in sustainable infrastructure. This will not only reduce the city’s carbon emissions, but also create new opportunities for local businesses and job growth.

-

ガス火力発電の隠れた排出量 - True Story of Methane in Japanese

天然ガス(温室効果ガスのメタンを主成分とする化石燃料)への投資には大きなリスクがあり、パリ協定の目標達成の脅威となっている。ガス火力発電による温室効果ガス(GHG)排出量が、これまで認識されていたよりもはるかに石炭火力発電の排出量に近いことが明らかになっている。化石ガスの成分の大部分はメタンで、メタンはCO2の84倍の温室効果を有する温室効果ガスである。そのため、ガスシステム全体でのメタン漏洩が、気候目標達成の大きな脅威となっている。

-

1.5℃目標に向けた持続可能な金融政策 - Executive Summary in Japanese

このガイドは、政府、規制当局、中央銀行の政策立案者がネット・ゼロへの移行を促進するために利用できる 101 の政策手段のツールキットを提供します。

-

Q1 2023 Market Update: Sustainable debt shows recovery

Climate Bonds Initiative recorded green, social sustainability, sustainability-linked, and transition (collectively GSS+) debt of USD204.8bn for Q1 2023, a 17% increase compared to the prior quarter, but a 21% YOY drop against Q1 2022. By the end of March 2023, the Climate Bonds had recorded lifetime GSS+ of USD3.9tn since market inception in 2007, as recorded in a new report.

-

Concrete policies to underpin the cement transition

The cement industry contributes significantly to CO2 emissions. It is the second-largest industrial emitter, accounting for approximately 7% of global CO2 emissions, and demand for cement is predicted to increase over the coming decades. Cement is a critical input for many activities, including buildings and infrastructure, and is a key material in the net-zero transition.

-

Colombia Sustainable Finance State of the Market 2022

This report identifies sustainable investment opportunities in Colombia in accordance with the Colombian Green Taxonomy and the potential for green and other thematic instruments to attract investment to the country. The report describes the shape and size of the local green, social, sustainability, and sustainability-linked (GSS+) debt market. It overviews supporting policy developments and milestones over the last decade.

-

ASEAN Sustainable Finance State of the Market 2022

As the sustainable debt market has grown, the scope of this report has expanded, and now includes analysis of the green, social, and sustainability (GSS) bond and loan markets, plus sustainability-linked bonds (SLBs) and sustainability-linked loans (SLLs) and transition bonds, collectively described as thematic or GSS+ debt.

-

Global State of the Market Report 2022

Climate Bonds’ flagship global State of the Market Report details the size and substance of green and other labelled bond markets. This, the 12th iteration, has been extended and now includes analysis of the green, social and sustainability (GSS) markets, plus sustainability-linked bonds (SLBs), and transition bonds. The publication represents the most extensive analysis available in the labelled finance space with features on taxonomies and sovereign bonds.

-

Brazil Sustainable Securitisation State of the market Q3 2022

The report aims to provide an overview of the Brazilian sustainable asset-backed securities (ABS) market, its regulatory foundations and case studies, as well as highlighting opportunities to channel investment in

-

气候债券倡议组织 绿色债券数据库 方法论

Climate Bonds Initiative screens self-labelled debt instruments to identify bonds and similar debt instruments as eligible for inclusion in the Climate Bonds Initiative Green Bond Database (the Database).

The screening references the Climate Bonds Taxonomy, albeit using a modified sector list rather than the taxonomy indicators. This document provides information on the approach and the database maintenance process.

-

Companies and Climate Change

This report presents the research application of the Asian Infrastructure Investment Bank (AIIB) - Amundi Climate Change Investment Framework (CCIF). The CCIF aims to provide investors with a benchmark tool for assessing an investment, at the issuer-level, in relation to climate change-related financial risks and opportunities.

-

101 Sustainable Finance Policies for 1.5°C

This guide provides a toolkit of 101 policy levers available to government, regulator, and central bank policy makers to facilitate the transition to net zero.

The climate transition challenge is encapsulated by 1.5°C. Behind the number is a wealth of clear scientific evidence that shows it is a goal we cannot miss.

-

Green Bond Pricing in the Primary Market: H2 2022

The Green Bond Pricing in the Primary Market H2 2022 report is the 15th iteration of a leading series analysing the pricing dynamics of green bonds, examining how these instruments offer pricing advantages for issuers and investors.

-

Scaling Credible Transition Finance - ASEAN Edition

To reach net-zero greenhouse gas (GHG) emissions by 2050, entities operating in most sectors must undergo a major transformation. The key tool that will enable this transformation is the development of a transition plan that is science based, coherent, comprehensive, transparent and covers all material scopes of emissions and business activities.

-

Sustainable Agriculture Brief

Agriculture is a dynamic and complex system, composed of countless particular characteristics that defy standardization and common definitions. Hundreds of cultivated crops and a wide array of systems and practices are employed in different geographical locations with diverse social, environmental and economic landscapes.