How to ensure the transition label has impact

A joint Climate Bonds & Credit Suisse Whitepaper

Resources:

- Summary note: Financing Credible Transitions

-

Original Press Release from Sept 2020

- Transition Feature: Inclusive

- Transition Feature: Ambition

- Transition Feature: Flexible

News:

Climate Bonds Standard Version 4.0 expands to Corporate Entity and SLB Certification

Building a market for green transitions, 30th Nov 2020

本書では、パリ協定に沿った信頼できる移行を特定するためのフレームワークを提示する。

本書では、パリ協定に沿った信頼できる移行を特定するためのフレームワークを提示する。

本書には2つの目的がある。

1. 信頼できる「ブラウン」から「グリーン」への移行が、野心的で包括的、かつパリ協定に沿ったものであると市場がみなすための出発点を提示することによって、移行を概念として定義する(それによりグリーンウォッシュを回避する)。

2. グリーンラベルとトランジションラベルの役割分担を明確にし、実際にトランジションラベルを活用するための枠組みを提案する。

これらの提案の背景には、移行の性質は事業体によって異なり、経済活動の必要性や代替性、脱炭素化の短期的・長期的可能性に左右されるという認識がある。

การเงินเพื่อสนับสนุนการเปลี่ยนผ่าน

การเงินเพื่อสนับสนุนการเปลี่ยนผ่าน

1. Defining transition as a concept

Whilst the Green bond market has grown fast over recent years, there is insufficient volume and diversity of sectors and on their own, they will not deliver the goals of the Paris Agreement. To do this, all sectors of the economy will adjust to operate effectively in a low carbon economy. For many sectors - especially the high carbon emitting sectors - they may need to fundamentally reshape and transform their strategy in light of the challenges of a changing climate.

The paper presented 5 Core Principles for an ambitious transition that need to be considered for any organisation looking to transition in order to ensure that transition is done in the right way. If a bond meets these principles, it’s important to also check that:

- there is sufficient information to enable an informed decision to be made;

- that it doesn’t contribute to locking in GHG intensive infrastructure.

In addition, the paper presented 3 key features that a transition must display:

Three common features for Transition

• Ambitious – this means aiming high i.e. in line with 1.5 degrees or has a significant emissions reduction potential) and aiming well i.e ensuring that reductions are real (no offsets) and plans are real (not just a plan to have a plan).

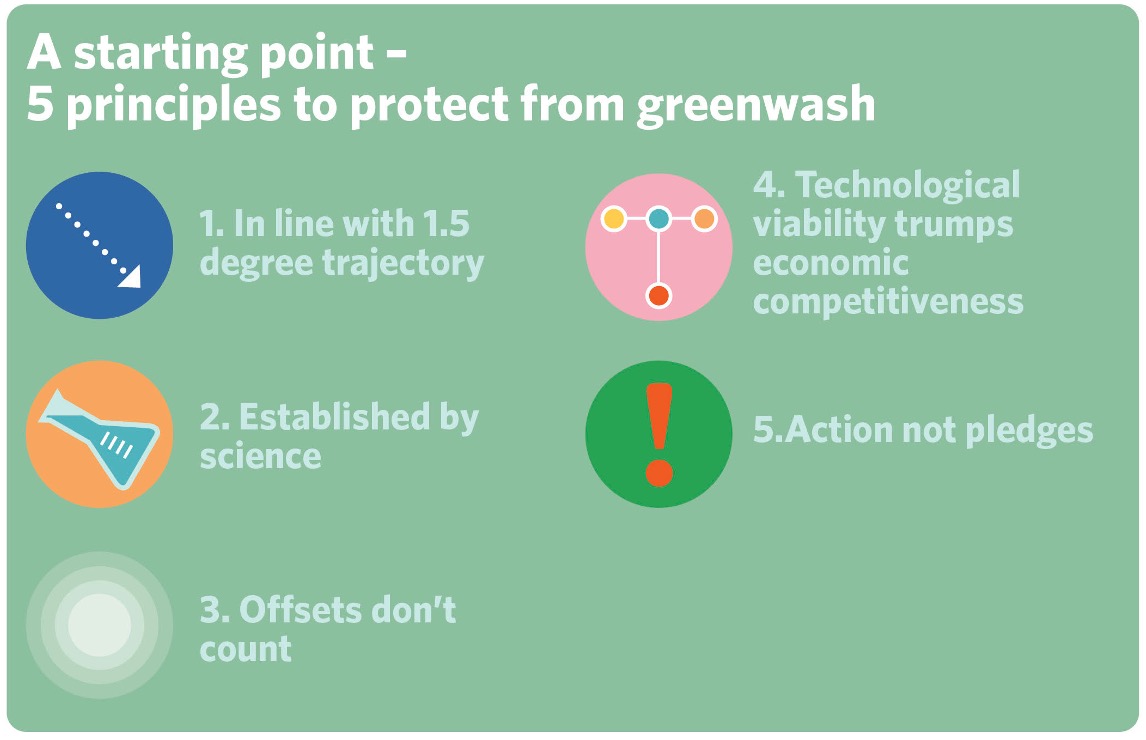

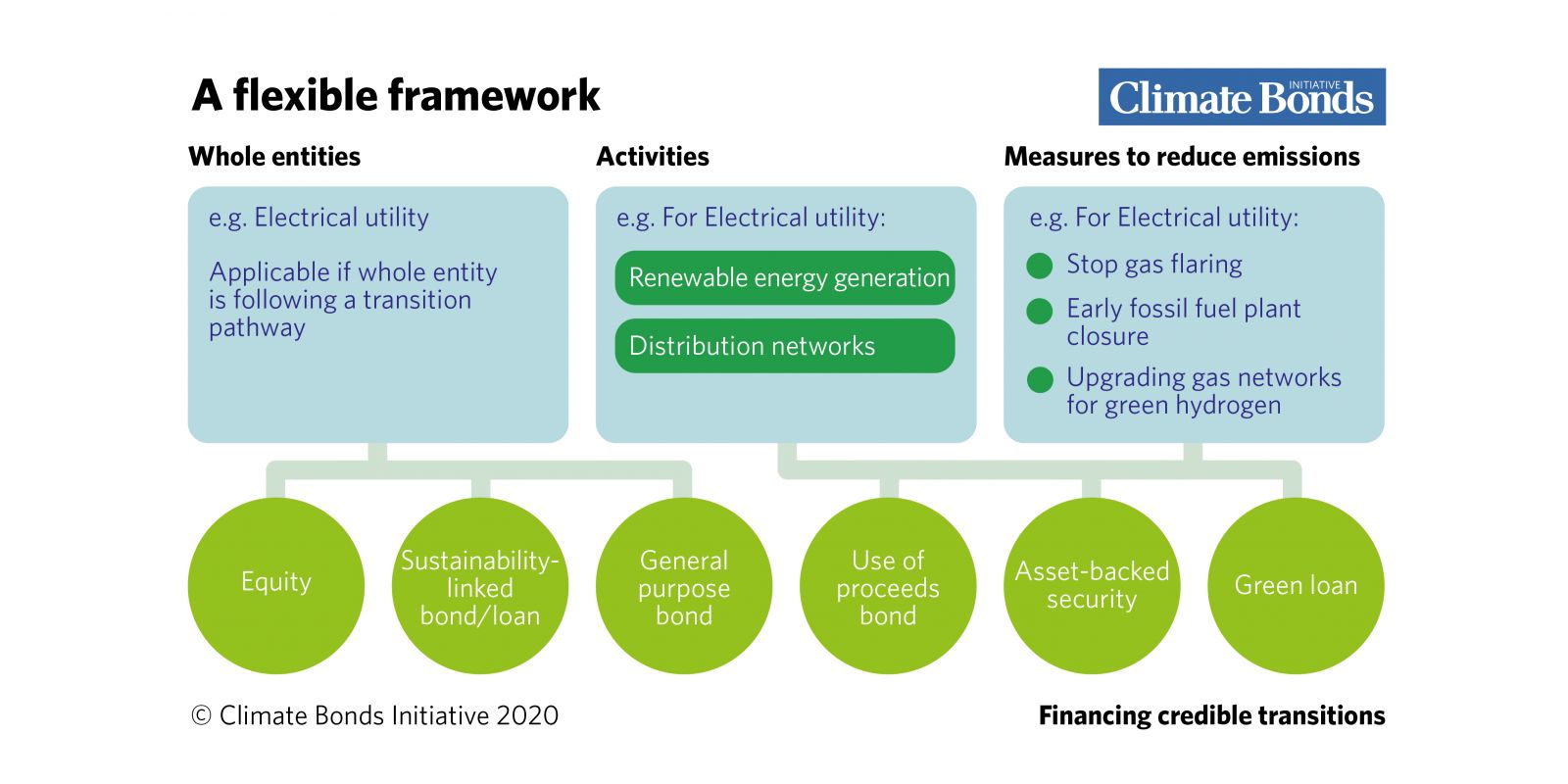

• Flexible – applicable to whole entities, everything they do, and a range of associated financial products

• Inclusive – allow all sectors and activities to participate as long as they demonstrate compliance with the principles and framework outline

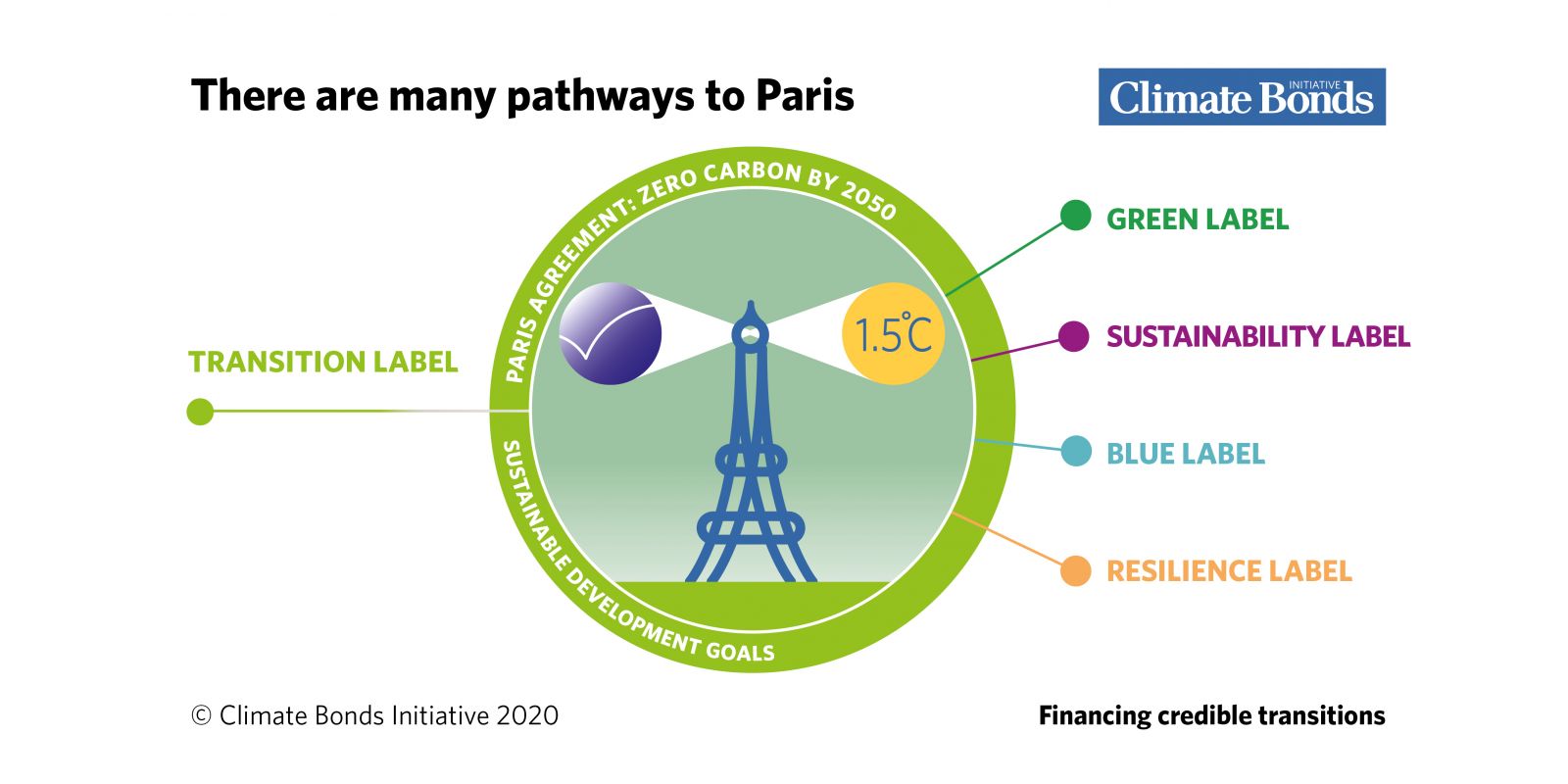

2. A framework for use of the transition label

Multiple pathways to achieve Paris goals and the SDGs

A flexible framework applicable to whole entities and everything that they do