Welcome to the Markets Monthly #7!

For more information on the Climate Bonds Database on Market Data email: dataenquiries@climatebonds.net

Don’t Miss! Only 4 weeks to Climate Bonds Annual Conference!

The old ‘normal’ wasn’t sustainable and is gone. Transition is upon us. Join the global conversation on what shape it should take as we explore the Transition Decade at Climate Bonds annual conference 8-10th September. Registration, Speakers & Agenda conference website.

Stay Connected with Climate Bonds Webinars

Leading Climate Ideas: Covid Aftermath: Can Sustainable Finance Help India Shape a Green and Inclusive Recovery? Speakers - Rathin Roy, Naina Lal Kidwai, Samir Saran. Wed 19th August: 2:00-3.15 pm India / 10:30-11:45am Paris / 9:30-10:45 am London. Register here!

Latest Reports

Green Bonds Global State of the Market 2019

Green Bonds Global State of the Market 2019

The Global Green Bonds State of the Market 2019 report, the first of a new annual series analysing each calendar years market developments in detail including global trends in green bond, loan and sukuk issuance and avenues for market growth.

July at a glance

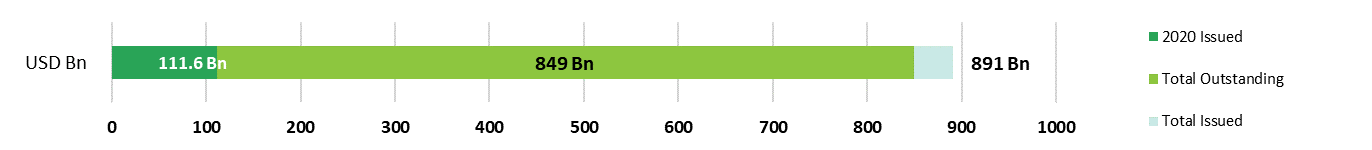

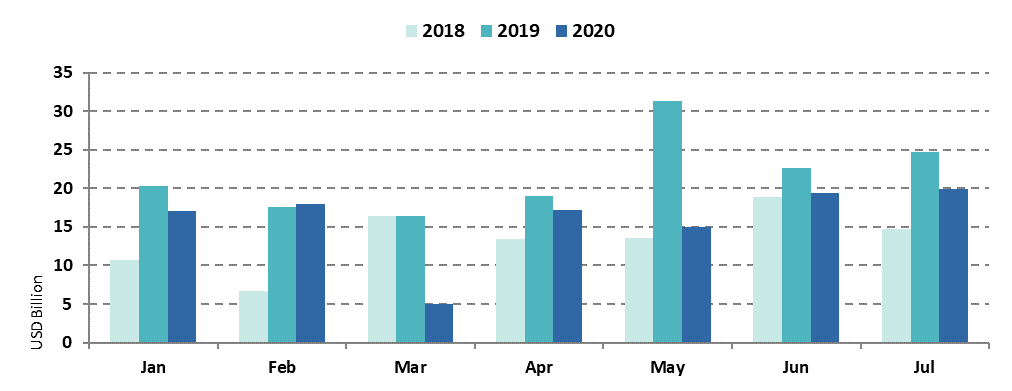

Overall, July 2020 issuance added up to USD20bn, bringing total cumulative issuance since market inception to USD891bn. This is the highest monthly figure seen so far in 2020 – indicating the market is bouncing back from the shocks earlier in the year.

Multiple green recovery plans are underway with the EU’s Technical Expert Group having published five high-level principles for Recovery and Resilience. South Korea promises carbon-neutrality facilitated by its ‘Green New Deal’ recovery programme. Similarly, UK prime minister Boris Johnson revealed plans to invest GBP350m towards a ‘green, sustainable recovery’.

Elsewhere, the green index space is evolving and expanding. Ninety One and WWF are partnering for a climate debt index and Solactive is collaborating with ISS ESG to produce the Solactive ISS SDG Leaders Index based on the 17 UN Sustainable Development Goals.

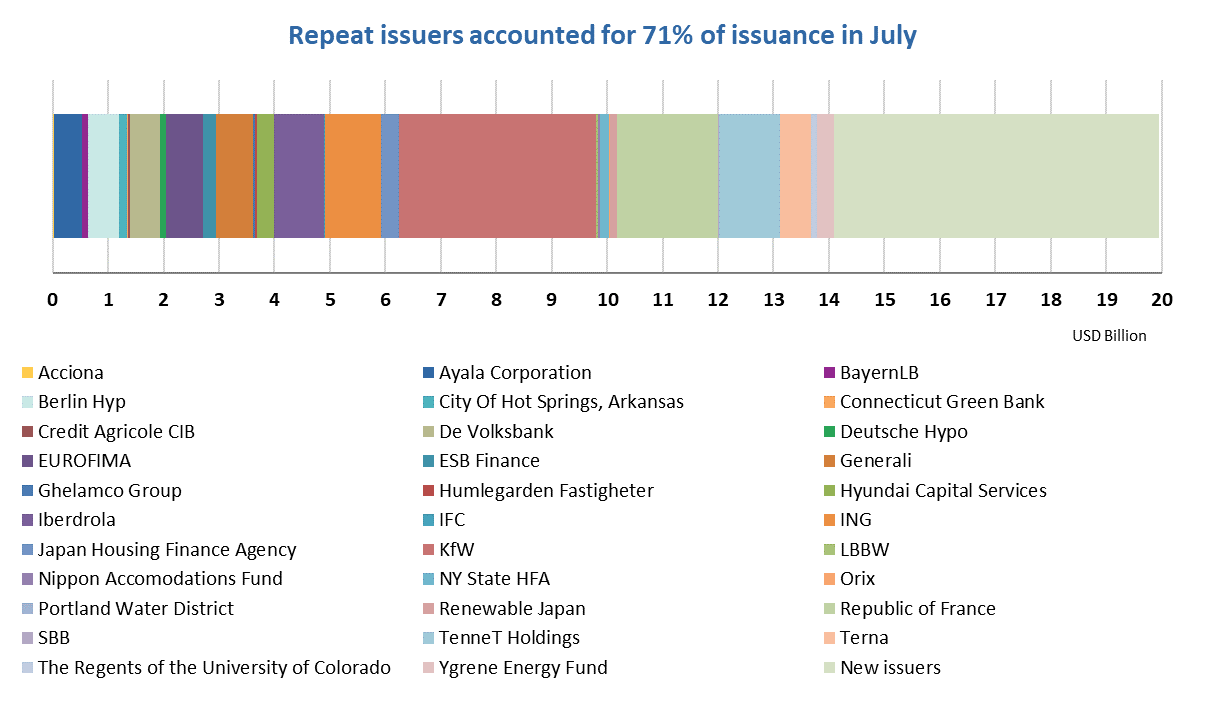

In look at the month out of a total of 71 deals, 71% came from repeat issuers. Terna (Italy) returned to the market financing grid infrastructure as well as soil remediation. The Philippines added another green issue to their list with Manila Water (Ayala Corporation) tapping the market again. After the last PACE ABS in October 2019, Ygrene Energy Fund (GoodGreen - USA) came back with a USD318m deal.

A healthy25 new issuers joined the market in July 2020. Amongst them are Argent (UK) financing a building complex at Kings Cross in London aiming to reduce carbon emissions by 28% compared to the typical UK home. Proceed allocations to Climate Change Adaption projects are also becoming more frequent: the latest example is from Quadreal Property Group (Canada), whose bond will partially fund flood defence systems and the structural resilience of buildings.

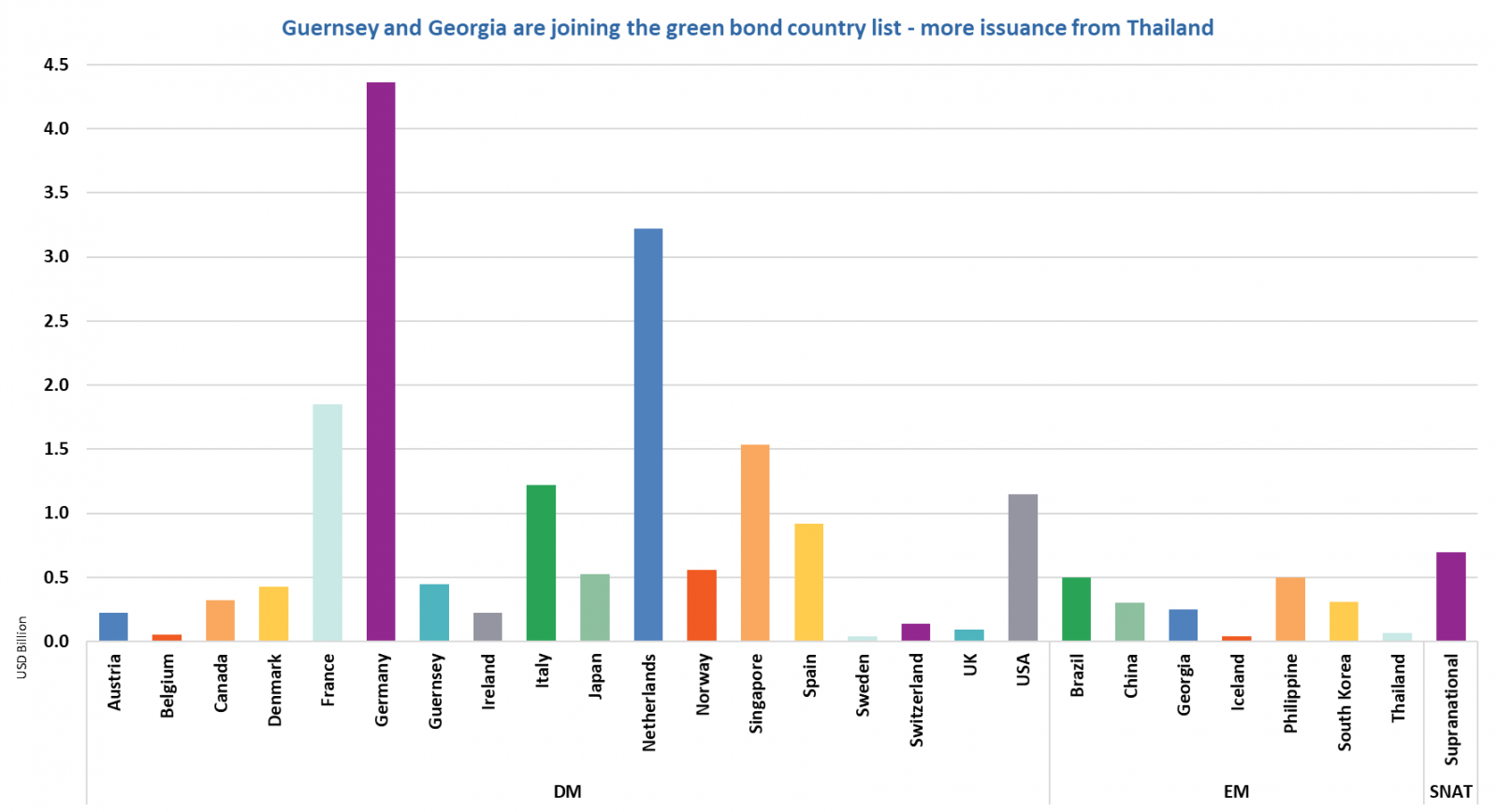

The green bond country list also keeps growing: Globalworth Real Estate Investments from Guernsey issued its maiden green bond in July 2020, as did Georgia Global Utilities (Georgia Capital PLC) form Georgia (see New issuer spotlight).

In total, 26 DM countries contributed to this month’s volume and made up 87% of all July issuance; seven countries from EM accounted for 10%.

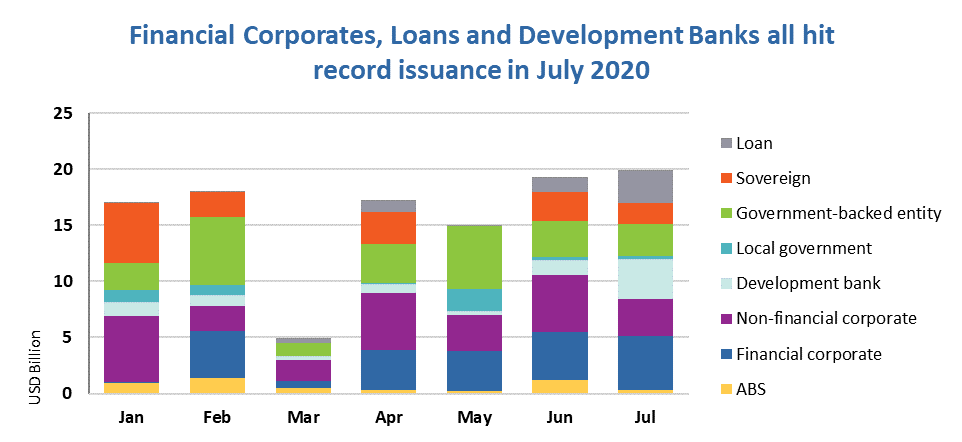

Germany led the country rankings with USD4.4bn, the bulk of which came from repeat issuer KfW. Its EUR3bn (USD3.5bn) is one of the ten largest deals ever issued and boosted Development Bank volumes to the highest monthly figure of the year with a total of USD3.6bn.

The Netherlands came in second with four deals, one of which was NE Property issuing its market debut: a senior preferred instrument financing low-carbon buildings.

The Netherlands came in second with four deals, one of which was NE Property issuing its market debut: a senior preferred instrument financing low-carbon buildings.

Financial Corporates also had their strongest month in 2020 with USD4.8bn. One of them was repeat issuer Hyundai Capital Services: making it the second entity from South Korea to raise debt through green bonds this year.

The only green Sovereign issuance of the month came from France with a tap that added once more to their initial issuance from January 2017 – this time EUR1.6bn (USD1.8bn) - leaving the market still eagerly awaiting more Sovereign issuance from Sweden and Germany this year (see Green bond outlook).

Green loans also reached a new high for 2020 with USD3bn – the second largest monthly amount ever. There were six deals in total, five of which were from new issuers. M+S (see New Issuer Spotlight) from Singapore issued the second largest loan recorded with SDG2bn (USD1.4bn) to refinance the Marina One green building projects. Low-carbon buildings made up the lion’s share of project categories financed in July with USD8.4bn, closely followed by Renewable energy with USD6.6bn. Land use projects added up to USD813m, which is also the largest volume for such projects this year.

> Check out the full list of new and repeat issuers.

> Click on the issuer name to access the new issue deal sheet in our online Bond Library.

Worth reading

‘How to Develop a National Green Taxonomy for Emerging Markets - A New World Bank Guide’ – World Bank

…and:

- ECB study shows nearly a third of European banks are not considering financial risks posed by climate change

- FSB finds poor data is hindering financial authorities’ efforts to quantify climate risks

- US investors – including CalSTRS – push the Fed to act on climate change

- IIGCC’s Net Zero Investment Framework opens for consultation

New issuer spotlight - Certified Climate Bonds

PTT Public Company Ltd (THB2bn/USD65m), Thailand, came out with a three-year instrument Certified against the Forestry Criteria of the Climate Bonds Standard 3.0. The proceeds will be used to finance and refinance investments into reforestation of various areas of land throughout Thailand. Annual reports will be made available publicly on the issuer’s website. These will have information on the allocation of the proceeds, as well as impact reporting. The impact reporting may include indicators such as amount of reforested land.

This is the first Certification using the Land Conservation and Restoration Criteria, which falls under the Forestry umbrella of the Climate Bonds Standard.

Rumo SA (USD500m), Brazil, completed its debut green issuance with an eight-year bond Certified against the Low Carbon Transport Criteria of the Climate Bonds Standard. The proceeds will be used to finance the purchase of new locomotives and rolling stock which are eligible under the relevant Criteria thresholds. Bond proceeds will also be allocated to upgrading the related infrastructure to support these trains and the associated railway lines.

Annual reports will be made available publicly on Rumo’s website. The disclosure will include information about how the bond proceeds have been allocated, along with simple quantitative metrics on the investments, such as the length of railways upgraded, and the number of trains acquired. This deal is the first Certification related to rail networks in LATAM.

Sparebanken Vest Boligkreditt AS (EUR500m/USD556m), Norway, debuted with a green bond Certified against the Low Carbon Buildings (Residential) Criteria of the Climate Bonds Standard and maturing in seven years’ time. This covered bond’s proceeds will be used to finance and refinance mortgages linked to residential buildings in Norway; meeting certain criteria such as a minimum EPC level of C or above or compliance with the Norwegian building codes of 2010 or 2017.

An annual report with details on the allocation of proceeds will be produced until the proceeds are fully allocated. An impact report with indicators such as energy use and emissions per floor area will be produced by Multiconsult, a technical environmental consultancy.

New issuer spotlight

Northern Power Grid (NorthEast - GBP300m/USD393m), UK, completed its inaugural issuance with a six-year senior unsecured bond that settled in June 2020. The instrument benefits from a SPO issued by DNV GL. The bond will finance and re-finance (completed or charged in the last three years) projects in a number of key business areas, including connecting and/or integrating renewable energy to the grid; improving grid reliability and energy efficiency; smart equipment and battery replacement; flood mitigation; and earthing system improvements, among others. Biodiversity and wildlife are also considered through potential allocations into categories such as care for environment and wildlife and the management of natural habitats.

The company will make allocation and impact reporting available on its website. This will include allocated amounts to each category, financing vs refinancing, year of investment and unallocated proceeds. The impact report will include metrics such as capacity of renewable energy production connected in the grid (MW) and estimated annual CO2 emission reduction (in tCO2eq). There may also be case studies and information on the methodologies used.

Climate Bonds view: This is the second grid operator from the UK to join the green bond market. Such organisations play a pivotal role in the fight against climate change, especially when it comes to connecting and/or integrating low-carbon electricity generation sources to the grid. This also includes the replacement and improvement of assets to reduce energy losses and improving the resilience of the grid.

An increasing number of grid providers are joining the green bond market globally. This year alone we saw maiden issuances from National Grid (UK), Red Eléctrica (Spain) and Statnett SF (Norway). This shows issuers are recognising the potential of such projects in the fight against climate change. We hope this will encourage more grid companies to issue green bonds to finance these crucial climate solutions.

West Berkshire Council (GBP1m/USD1m), UK, had its debut issue with a green instrument maturing in five years. West Berkshire Council is the local authority of West Berkshire in Berkshire, Southern England. The funds will go towards solar panel installations on five council-owned buildings such as Greenham Common and local schools. There is an environment strategy in place to make the district carbon neutral by 2030. This is the UK's first local government green bond.

Climate Bonds view: This bond was issued under a Community Municipal Investment framework with an ethical investment platform. It is likely that there will be more such deals in the future with more UK local authorities aiming to green the economy. The scheme is made for crowdfunding and is open to public: minimum investments start from GBP5. This helps to make green bond investing more accessible to individuals and significantly broadens the set of potential investors. We welcome such innovative programmes and hope to see more in the future.

Reginn HF (ISK5bn/USD41m), Iceland, issued its first green bond with a 30-year original tenor. There are five categories eligible for financing and refinancing: Green buildings, renewable energy, energy efficiency, pollution prevention and control, and clean transportation. Reginn states that it is likely that a vast majority of the funds will be used for refinancing existing buildings without a defined look-back period. The green buildings category is expected to account for 90% with less than 5% going to energy efficiency and clean transportation.

Explicitly excluded from financing are fossil-based activities, nuclear energy, weapons and defence, along with environmentally negative resource extraction, gambling, and tobacco.

There will be allocation as well as impact reporting on an annual basis on the green financing website until maturity of the bonds. The report will include the amount of financing as well as the assets in the pool including examples of assets, the share of financing vs refinancing and unallocated proceeds. It will also include amongst other impact indicators the share of renewable energy used, type and level of certification, energy performance, CO2 scope 1 and 2 emissions as well as water intensity.

Climate Bonds view: This marks the first non-financial corporate from Iceland to issue a green bond, as well as the second largest issuance from the country. None of the Icelandic green bonds issued so far have come with allocations into green buildings that match Reginn’s. It is great to see the greening of the housing market in Iceland and the encouraging signals toward more issuance from non-financial corporates.

Georgia Global Utilities (Georgia Capital PLC - USD250m), Georgia, entered the market with a five-year private placement where proceeds will be earmarked for capital expenditure in upgrading water supply and sanitation in the capital, Tbilisi, and nearby municipalities, and to refinance existing loans of renewable energy and water operations.

The issuer intends to publish an annual allocation and impact report on its website until maturity.

Climate Bonds view: Climate Bonds hails the first green bond from Georgia. This inaugural green note will contribute to a low-carbon and resilient economy in the country, which is still heavy reliant on fossil fuels in its energy supply and is sensitive to extreme climate events, as it is home to the Caucasus mountain range. Bond issuance will continue to play a key part in financing large-scale infrastructure projects by the private and public sectors towards a greener and sustainable future.

M+S (SGD2bn/USD1.4bn), Singapore, took out its inaugural green loan for the office and retail components of the Marina One complex. Marina One is LEED Platinum certified and has achieved the Building and Construction Authority Green Mark Platinum rating.

Climate Bonds view: To fund sustainable projects, borrowers can explore both syndicated loans and bonds for long-term debt financing. The former is arguably more flexible and is usually signed based on relationships between lenders and borrowers, while the latter can raise large amounts from investors also in public markets. Securing a large green loan for a certified green building by M+S is a success story for green financing. This deal marks the second largest loan ever signed, and the largest to date by an Asian real estate company.

New issuers continued...

Public Sector

- Brick Township Municipal Utilities Authority (USD13.3m), USA, 16.4Y original term, no third-party review.

- City of Lawrence (USD12m), USA, 29.5Y original term, assured by BAM GreenStar.

- Hypo Neo (EUR500m/USD564m), Austria, 4Y original term, SPO provided by ISS-oekom – issued in June 2020.

- Maryland Stadium Authority (USD34m), USA, 26.8Y original term, no third-party review.

- San Diego County Water Authority (USD283m), USA, 13.8Y original term, no third-party review.

- The County of Dupage (USD51m), USA, 26.8Y original term, no third-party review.

- Town Of Schererville, Lake County (USD3.4m), USA, 9.5Y original term, assured by BAM GreenStar.

- Triview Metropolitan District (USD14.14m), USA, 30.5Y original term, assured by BAM GreenStar – issued in May 2020.

- Washington Township Municipal Authority (USD5m), USA, 11.6Y original term, assured by BAM GreenStar.

Financial Corporates

- Comforia Residential REIT (JPY1.5bn/USD14m), Japan, 10Y original term, SPO provided by Sustainalytics.

- CIFI Holdings (USD300m), China, 5.3Y original term, SPO provided by Sustainalytics.

- Globalworth Real Estate Investments (EUR400m/USD445m), Guernsey, 6Y original term, SPO provided by Sustainalytics.

- NE Properties (USD556m), Netherlands, 7Y original term, SPO provided by Sustainalytics.

- NTT Finance Corporation (USD375m), Japan, 3Y original term, SPO provided by Sustainalytics – issued in June 2002.

- Uniqa Insurance Group (EUR200m/USD222m), Austria, 15.3Y original term, SPO provided by Sustainalytics.

Non-Financial Corporates

- Arclight Solar (USD48m), Spain, rated E1/80 by S&P Global Ratings – issued in June 2020.

- Axpo Holding (USD137m), Switzerland, 3Y original term, SPO provided by ISS-oekom.

- Enexis Holding NV (EUR500m/USD565m), Netherlands, 12Y original term, SPO provided by ISS-oekom – issued in June 2020.

- Quadreal Property Group (CAD350m/USD268m), Canada, 10Y original term, SPO provided by Sustainalytics.

- Northern Power Grid (NorthEast) (GBP300m/USD393m), UK, 6Y original term, SPO provided by DNV GL – issued in June 2020.

Loans

- Argent (GBP69m/USD90m), UK, no third-party review.

- Concert Properties (CAD71.5m/USD54.9m), Canada, no third-party review.

- Copenhagen Infrastructure Partners (EUR380m/USD429.5m), Denmark, no third-party review.

- UOB (SGD120m/USD89m), Singapore, 3Y original term, no third-party review.

Visit our Bond Library for more details on July deals and a full history of debut green issuances going back to 2017.

Green bond outlook – selected deals

|

Issuer Name |

Country |

Closing Date |

Source |

|

China Construction Bank Corp (Hong Kong Branch) |

China |

04/08/2020 |

|

|

Alphabet Inc. |

USA |

05/08/2020 |

|

|

Bayerische Landesbank |

Germany |

13/08/2020 |

|

|

Brookfield Renewable |

Canada |

13/08/2020 |

|

|

JSC Entrepreneurship Development Fund “Damu” |

Kazakhstan |

11/08/2020 |

|

|

MTR Corp, Ltd. |

Hong Kong |

18/08/2020 |

|

|

Reconcept GmbH |

Germany |

24/08/2020 |

|

|

Visa Inc. |

USA |

17/08/2020 |

Google parent Alphabet has issued a USD5.8bn sustainability bond, which is believed to be the largest corporate sustainability bond in history. This week, digital payment company Visa became the first in its industry to issue a green bond (USD500m) to finance projects across multiple categories, including initiatives to foster sustainable consumer behaviour. The company also appointed its first ever Chief Sustainability Officer.

In addition to other deals that were issued recently or will settle soon (see table above), Banco Sabadell launched a framework for the issuance of bonds linked to sustainable development goals. CPI Property Group (Czech Republic) may return to the green bond market with its plans to issue green bonds in Hungary.

Sovereign Green Bond Club

The plans of more potential members to the Sovereign Green Bond Club are beginning to materialise. Sweden is getting ready to issue sovereign bonds to a potential total of SEK20bn (USD2.2bn) with original terms between seven and 10 years to finance government expenditures towards meeting the country’s environmental and climate objectives. Longstanding member France is considering to issue another green bond in 2021 after tapping its first issuance from 2017 multiple times. Thailand is also exploring the option of offering up to THB30bn (USD966m) of green bonds, potentially as soon as this month – August 2020.

Data and references

Repeat issuers in July

Repeat issuers: January to June 2020 (not previously included)

- AC Energy: USD60m - June 2020

- Asian Development Bank: HKD115m/USD14.8m - May 2020

- City of Gothenburg: SEK1.5bn/USD158.6m - June 2020 (2 deals)

- Credit Agricole CIB: USD80.6m - issued from February to June 2020 (12 deals, 5 currencies)

- Deutsche Hypo: EUR10m/USD11.1m - June 2020

- Dutch State Treasury Agency: EUR214m/USD237.9m - June 2020

- Entra ASA: NOK450m/USD50.8m - Febuary 2020

- Fabege AB: SEK500m/USD52.9m - June 2020

- Fannie Mae: USD115.6m - June 2020 (5 deals)

- LBBW Landesbank Baden-Wuerttemberg: EUR48m/USD53.8m - June 2020 (2 deals)

- LoanPal Solar Loan 2020-2: USD492.5m - June 2020 (2 deals)

- Mill City Solar Loan 2020-1: USD161.622m - June 2020

- Mosaic Solar Loan Trust 2020-1: USD279.54m - June 2020

- Niagara Mohawk Power Corporation (National Grid): USD600m - June 2020

- NorgesGruppen: NOK650m/USD73.3m - April 2020

- Societe Generale: EUR1bn/USD1.1bn - Febuary 2020

- Sunnova Helios IV: USD158.492m - June 2020

- Sunnova Sol: USD412.5m - Febuary 2020

- Swedish Export Credit: SEK500m/USD52.9m - April 2020

- Taesa (Transmissora Alianca de Energia Eletrica): BRL300m/USD73.9m - January 2020

- Taesa (Transmissora Alianca de Energia Eletrica): BRL450m/USD110.9m - April 2020

- Telia Co: SEK750m/USD79.3m - June 2020

- Vasakronan: SEK200m/USD21.1m - June 2020

- Vattenfall: EUR500m/USD555.8m - March 2020

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Excluded |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

LBBW |

EUR1bn/USD1.1bn |

18/02/2020 |

Social/sustainability bond |

|

Shouguang Huinong New Rural Construction Investment Development Co., Ltd. |

CNY600m/USD86.4m |

08/07/2020 |

General operating expenditure |

|

Pending |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Shangrao City Construction Investment Development Co. Ltd. |

CNY1.7bn/USD244.8m |

29/07/2020 |

Insufficient information |

|

BKS Bank |

EUR3m/USD3.3m |

31/07/2020 |

Insufficient information |

|

County Of Meade, Kentucky |

USD81.3m USD81.3m |

27/07/2020 27/07/2020 |

Insufficient information Insufficient information |

|

Pattern Energy Operations |

USD700m |

28/07/2020 |

Insufficient information |

|

Maxeon Solar Technologies |

USD200m |

17/07/2020 |

Insufficient information |

|

Asian Development Bank |

USD50.4m |

22/07/2020 |

Insufficient information |

|

Vestel Elektronik Sanayi ve Ticaret AS |

TRY50.4m/USD8.5m |

09/07/2020 |

Insufficient information |

|

Modern Land China |

USD250m |

13/07/2020 |

Insufficient information |

|

Atlantica Sustainable Infrastructure |

USD100m |

17/07/2020 |

Insufficient information |

|

Komatsu Ltd |

JPY10bn/USD92m |

16/07/2020 |

Insufficient information |

|

Seiko Epson Corp |

JPY40bn/USD367.9m JPY10bn/USD92m JPY20bn/USD183.9m |

16/07/2020 16/07/2020 16/07/2020 |

Insufficient information Insufficient information Insufficient information |

|

BBVA |

EUR1bn/USD1.1bn |

15/07/2020 |

Insufficient information |

|

KIMCO Realty |

USD500m |

13/07/2020 |

Insufficient information |

|

FortisBC Energy Inc |

CAD200m/USD153.6m |

13/07/2020 |

Insufficient information |

|

Arboretum |

EUR200m/USD222.3m |

02/07/2020 |

Insufficient information |

|

Siemens Gamesa Renewable Energy |

EUR172bn/USD0m |

Tbc |

Insufficient information |

|

NMB Bank |

USD25m |

30/06/2020 |

Insufficient information |

|

Credit Agricole |

USD25m |

08/07/2020 |

Insufficient information |

|

Henkel |

USD70m |

03/07/2020 |

Insufficient information |

|

Synthesis Analytics |

GBP28.1m/USD34.5m USD14.8m

|

14/05/2020 14/05/2020 |

Insufficient information Insufficient information |

|

Metropolitan Life Global Funding 1 |

USD750m |

02/07/2020 |

Insufficient information |

As always, your feedback is welcome!

Watch this space for more market developments. Follow our Twitter or LinkedIn for updates. E-mail data requests to dataenquiries@climatebonds.net.

Registrations have just opened for Climate Bonds Conference 8-10 September 2020! All online. More information here.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.