Highlights:

- Issuance reaches record-breaking USD23.8bn – biggest May volume to date and second-highest month ever

- Hong Kong joins sovereign green issuers

- PKO Bank issues Certified Climate Bond for green mortgages

- Second Thai GB and big push for rail assets

- Spotlight on plastic waste and possible solutions

Don’t miss! Our Africa Program Manager Olumide Lala talking green market development from Nigeria.

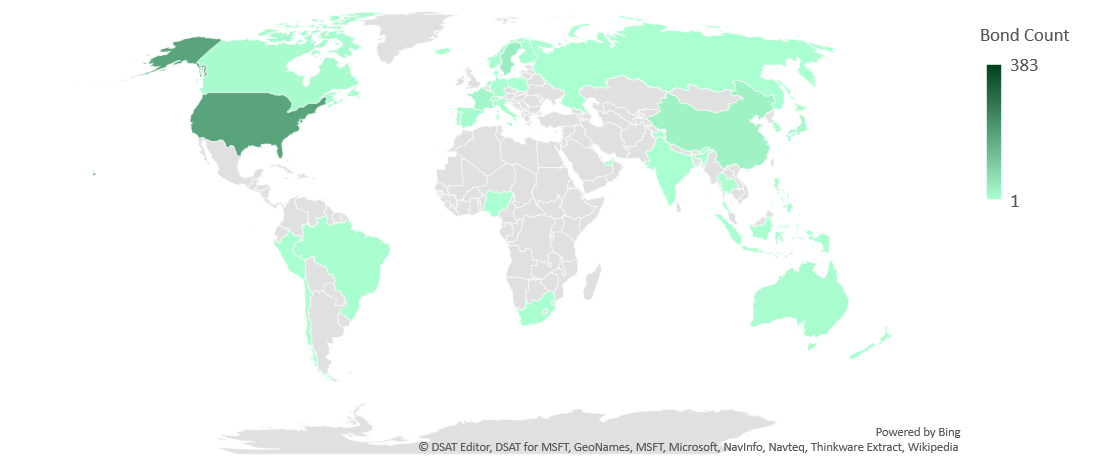

Green bond deals across the globe – 2019

Go here to see the full list of new and repeat issuers in May.

At a glance

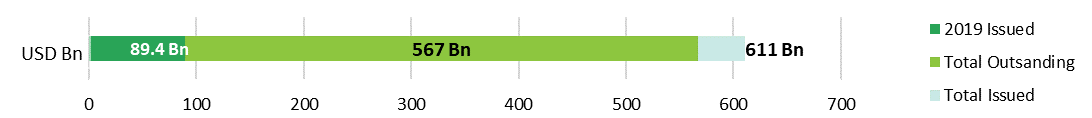

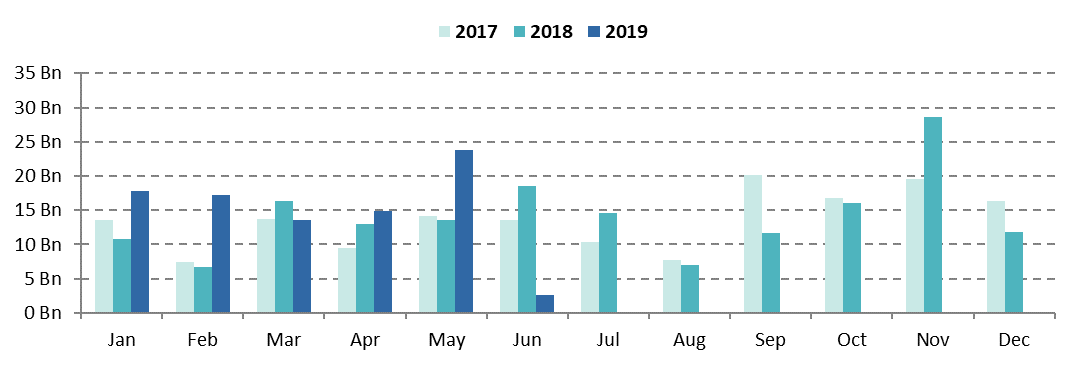

Issuance volume in May reached an impressive USD23.8bn. This equates to just over three-quarters (76%) of year-on-year growth. Overall, the USD20bn monthly volume mark has only been surpassed three times in the past 2.5 years: in September 2017, November 2018, and now in May 2019.

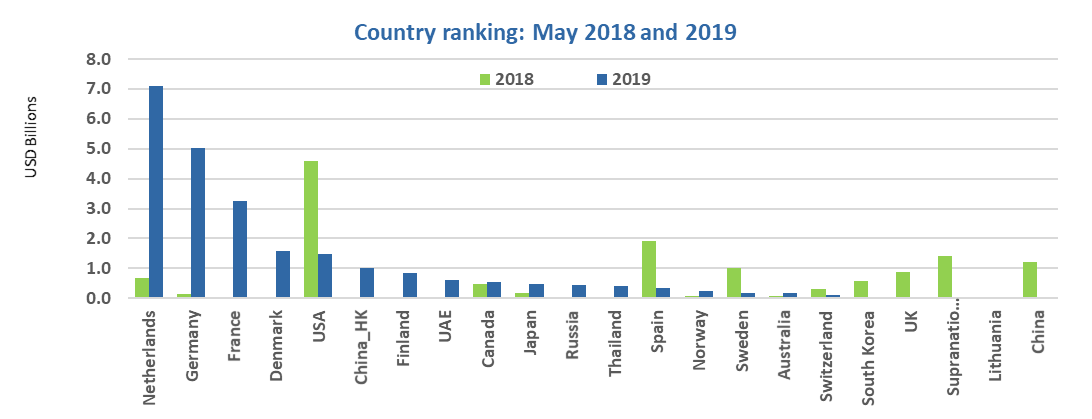

May numbers were driven by developed market issuers, which contributed 94% of total volume. At 30% of issuance Netherlands, Germany (21%), France (14%), the USA (6%) and Denmark (5%) taking the top spots. US volumes were modest compared to those of May last year when they comprised 34% of the monthly total. However, this is pending the inclusion of Fannie Mae deals. Developed markets Hong Kong, Finland, Canada and Japan also made it into the top 10, each grabbing between 1% and 4% of the market.

Of the total emerging market share of 6%, the UAE contributed 41% and Russia and Thailand shared the remainder almost equally (31% and 28%, respectively).

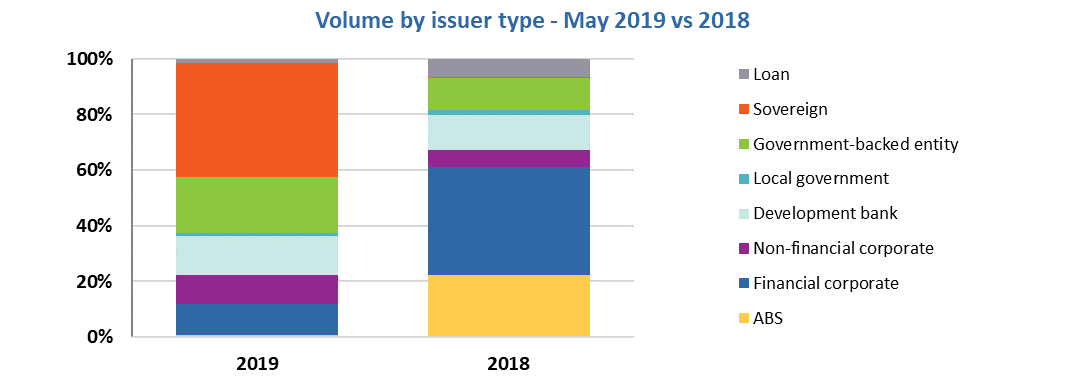

As we noted in our previous market blog, the dominance of Dutch issuance in May was mostly due to the country’s sizeable (USD6.6bn) debut sovereign green bond, which was also the largest deal of the month. Sovereign issuance continues to flourish elsewhere, too: its share of total volume grew from 0.2% in May 2018 to 41% last month. Hong Kong SAR threw its hat in the ring with a sovereign green debut, which we cover in depth below. Volumes were helped by the Republic of France’s EUR1.9bn (USD2.3bn) green tap in early May.

In addition to sovereigns, the issuer type breakdown reveals a changing composition in other respects as well. The share of financial corporates dropped from 39% to 11% compared to last year. The largest deal was Nordea’s EUR750m (USD893m) bond. It was the bank’s second green bond and the eighth from a Finnish issuer to date. The Royal Bank of Canada’s EUR500m (USD560m) debut boosted financial corporate numbers, along with several property issuers, such as the UAE’s Majid al Futtaim Properties, which we covered in Market Blog #26.

Issuance from non-financial corporates was more stable. These issuers captured 10% of the market in May 2019 compared to 6% the previous year. The largest bond was issued by grid operator Avangrid, a US-based subsidiary of Spanish energy giant Iberdrola. The company returned to the market with a USD750m bond after making its green debut back in November 2017. Nordic real estate repeat issuers further propped up non-financial corporate issuance, with Norway’s Entra ASA, Denmark’s Nykredit and Sweden’s Hemfosa Fastigheter AB all tapping into the market.

The share of government-backed entities grew from 12% in May 2018 to 20% this year. France’s state-backed railway operator Société du Grand Paris was the main driver of this. The entity, which is a Climate Bonds Certified issuer under the Programmatic Certification scheme, returned to market with EUR1bn (USD1.1bn). South Germany state bank LBBW provided a combined USD1.5bn volume boost with two Climate Bonds Certified issuances in May. Finally, Danish renewable energy provider Ørsted delighted the market with a series of rare sterling-denominated issues totalling GBP900m (USD1.2bn). The proceeds will help to finance the offshore wind farm Hornsea 2 in the UK.

Development bank issuance remained strong this year, growing from 12% last May to 14% this time around. This was solely due to Germany’s KfW, which issued its largest green bond to date (EUR3bn/USD3.4bn). Making good on its commitment to issue between USD5bn to USD6bn equivalent of green bonds this year, KfW has already returned to market in early June with the largest-ever SEK-denominated (SEK7bn/USD742m).

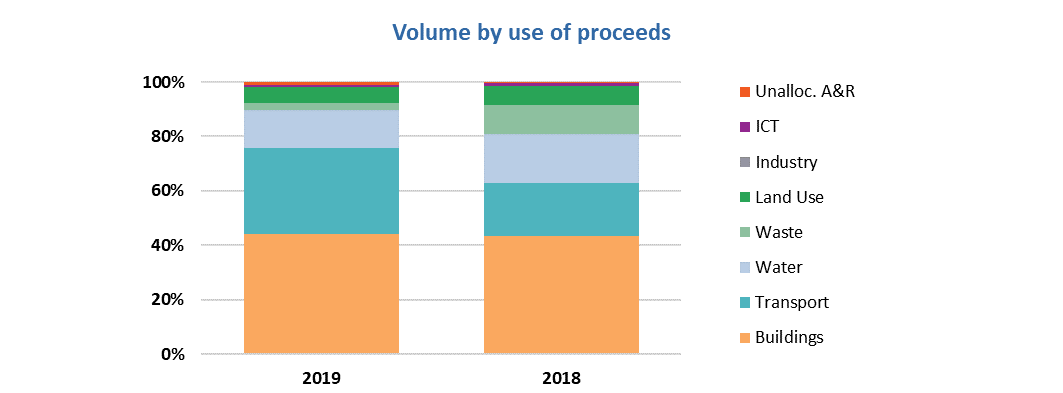

Use of proceeds was once again dominated by the low carbon buildings sector at 30%, the same share as in May 2018. However, the proportion of financing allocated to transportation projects grew from 14% to 21% year-on-year. This was helped by several green bonds financing predominantly – even exclusively – rail assets. A notable addition came from Thailand’s BTS Group, whose THB13bn (USD408m) deal was the third green bond from a Thai issuer and the first one in Southeast Asia to receive Climate Bonds Certification against the Low Carbon Transport criteria. For more on BTS and the topic of rail, see the Certified Climate Bonds section below and check out our special blog post from last week.

The shares of other sectors remained similar, with water, waste and land use taking up most of the remaining allocations.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

BTS Group (THB13bn/USD408m), Thailand, issued the second Certified Climate Bond and the third green bond from Thailand. The deal is the first in Southeast Asia to be Certified against the Low Carbon Transport criteria.

The proceeds will finance the network development of BTS Skytrain, an electric elevated metro rapid transit system in Bangkok. It currently comprises two lines with 36km of track and 43 stations and the bond will contribute to a planned tripling of the network track length. Sustainalytics provided the Pre-Issuance Verification and BTS has committed to publishing an annual report on the allocation and use of proceeds, along with performance indicators.

The financing contributes to solving congestion and air pollution problems in Bangkok. Overall, green bonds can provide a conduit for directing financing to low carbon mass transportation networks, helping large Southeast Asian cities to alleviate some of the pressures of rapid population growth and urbanisation.

PKO Bank (PLN250m/USD66m), Poland, the mortgage subsidiary of country’s largest commercial bank issued a 5-year green covered bond. The proceeds will refinance mortgages on buildings that meet the Climate Bonds Low Carbon Building Criteria. For new and recently constructed buildings, these are buildings with an Energy Performance Certificate (EPC) which includes the Technical Condition 2017 or newer. For buildings with retrofits, these buildings need to show a 30% improvement in CO2 emissions.

PKO Bank will report annually the details of the allocation of proceeds and quantitative impact indicators of the buildings financed by these mortgages. This reporting will be conducted until the bonds mature. Sustainalytics provided the SPO and Pre-Issuance Verification for the bond, which is the first ever Certified Climate Bond from Poland.

AES Tietê Energia (USD303m), Brazil, issued a 10-year green project bond in April 2019 to finance and refinance the acquisition of eight solar farms with a total capacity of 225MW. All of them will be operational by the end of 2019.

As the first Brazilian issuer to issue a Certified Climate Bond under the Solar Criteria, AES Tietê will disclose green bond information annually on its website. The verification report from Vigeo Eiris states that audited information on proceed allocation as well as the amount of electricity generated and estimated avoided emissions will be disclosed.

It is good to see more Brazilian companies entering the green bond market, especially in the energy sector given the country’s ample generation capacity for renewable energy and solar in particular.

New issuers

Hong Kong Special Administrative Region (USD1bn), Hong Kong, became the second Asian government after Indonesia to tap into the green bond market. The proceeds of the 5-year senior unsecured bond will finance across sectors. More than half of the proceeds will be allocated to new assets and projects, with refinancing projects required to be started in the previous two financial years. Examples of financing categories include:

- Renewable energy installations and energy efficiency in government buildings and facilities

- Retrofits of government buildings and construction of new ones to high energy efficiency standards

- Waste treatment and recycling facilities, energy recovery facilities (e.g. from municipal and food waste)

- Water and wastewater treatment and management systems, improved resilience of water infrastructure

- Conservation and restoration of sites with high biodiversity and environmental value

- Expansion and development of urban metro, light rail and cycling infrastructure

Vigeo Eiris provided a Second Party Opinion for the bond. HKSAR will report on the bond’s proceed allocation and environmental impact indicators for projects funded annually via a public report on its website.

Climate Bonds view: Sovereign issuance is booming in H1 2019, with Hong Kong’s green bond bringing the cumulative total to USD14.7bn. The Hong Kong government has also announced that the size of its green issuance programme may reach up to HKD100bn (USD12bn), which would make it one of the largest sovereign green issuance programmes globally.

Adani Green Energy (UP) Ltd (USD500m), India, issued a 5-year senior secured bond earmarked to re-finance part of its solar energy portfolio. The nominated assets include 25 projects (24 operational, one near completion) with a cumulative capacity of 930 MW. The projects are located in eight Indian states. According to the Assurance Report provided by KPMG, Adani will report annually on its website on the use of proceeds by project type, capacity and location. It will also disclose the estimated CO2 emissions reduced and the capacity of renewable energy plants constructed in MW.

Climate Bonds view: Adani Green Energy is a good addition to the Indian renewable energy issuer pool. The assurance report from KPMG outlines the eligible asset pool clearly. It is commendable that the issuer has also committed to providing annual post-issuance reporting publicly.

Bank of Zhengzhou (CNY2bn/USD228m), China, issued a 3-year senior unsecured bond whose proceeds will be allocated to four sectors that are eligible under the People’s Bank of China’s (PBoC) green bond catalogue. These include Pollution Prevention, Clean Transport, Energy Saving and Adaptation. Project examples include a green building that received a 2-Star Certification of China Green Building Standards, an urban metro/light rail construction project, a wastewater treatment project and a watershed management project. The issuer will disclose proceeds allocation and environmental performance quarterly and publish its annual post issuance report by 30 April every year.

Climate Bonds view: Bank of Zhengzhou issued its first green bond in 2017, but it was excluded from CBI’s database given its link to fossil fuels, such as coal. Although this deal was issued under the same green bond framework, it is included as all project examples are in line with the CBI Taxonomy. We will keep tracking post-issuance reporting from the Bank and look forward to seeing the issuer demonstrate its improved green credentials.

Fastighets AB Balder (SEK1bn/USD106m), Sweden, entered the market with a 5-year green bond to finance part of its portfolio of green and energy efficient buildings. Buildings must meet fairly typical Swedish certification requirements: Miljöbyggnad Silver, LEED Gold, BREEAM Very Good, and BREEAM In-Use Very Good, Nordic Swan Ecolabel, or Nearly Zero-Energy Building (NZEB). New, renovated and existing buildings must also have at least 25% better energy efficiency compared to the Swedish national building regulations. As per Balder’s Green Bond Framework reviewed by CICERO, the issuer is committed to annual use of proceeds and impact reporting, with detailed metrics outlined in the framework.

Climate Bonds view: Balder is a great addition to the green bond pool from the Swedish real estate sector, which includes many of the pioneers of green debt issuance in the Nordics. The cumulative green bond volume from Swedish property companies has now reached a whopping SEK50.2bn (USD5.9bn).

Mississippi Development Bank (USD13m), USA, issued its first green bond. The 20-year municipal bond will finance projects in Hancock County, Mississippi. These include establishing a countywide stormwater, drainage and erosion control programme, dredging navigational channels and creating nature and botanical areas in Buccaneer Park and McLeod Park. Mississippi Development Bank has stated in the prospectus for the bond that it is currently implementing procedures to ensure that voluntary annual updates on the use of proceeds of the bond are posted on the EMMA website.

Climate Bonds view: Whilst the US green bond market is going strong due to certain issuer types – namely municipalities and government-backed entities (Fannie Mae) – development bank issuance has been lagging. Despite the small size of this bond, it is positive to see a US-based development bank venture into the green bond space. We hope more will follow.

NSTAR Electric (USD400m), USA, a regulated electric utility, recently issued a 10-year senior secured bond to boost its renewable energy capabilities and energy efficiency initiatives. Proceeds were earmarked for new solar power generation facilities, as well as energy efficiency solutions in customers’ homes and business premises. The issuance is the first of 2019 by a Massachusetts-based non-financial corporate, and the second ever from such an issuer after MIT in 2014.

Climate Bonds view: The US corporate green bond space still has a lot of room to grow. We are happy to see another green bond from a non-financial corporate and hope more will follow in NSTAR Electric’s steps. However, it would be good for the issuer to disclose more information around the use of proceeds and reporting.

Wallenstam AB (SEK500m/USD52m), Sweden, brought to market a 2-year senior unsecured green bond. The proceeds will finance green buildings and energy efficiency in buildings, low carbon transport and renewable energy. Headline requirements include a minimum certification level of Miljöbyggnad Silver as well as 20% lower energy use than required by the national building code, and at least 20% energy savings for efficiency projects.

CICERO provided the SPO for the issuance. Wallenstam will disclose use of proceeds and impact reporting on its website annually, with the first report expected in April 2020. A full list of impact indicators is available in its Framework.

Climate Bonds view: Wallenstam has produced a robust green bond framework, for example, explicitly excluding fossil fuel and nuclear energy generation and environmentally negative resource extraction. The framework maps how the company contributes to the SDGs.

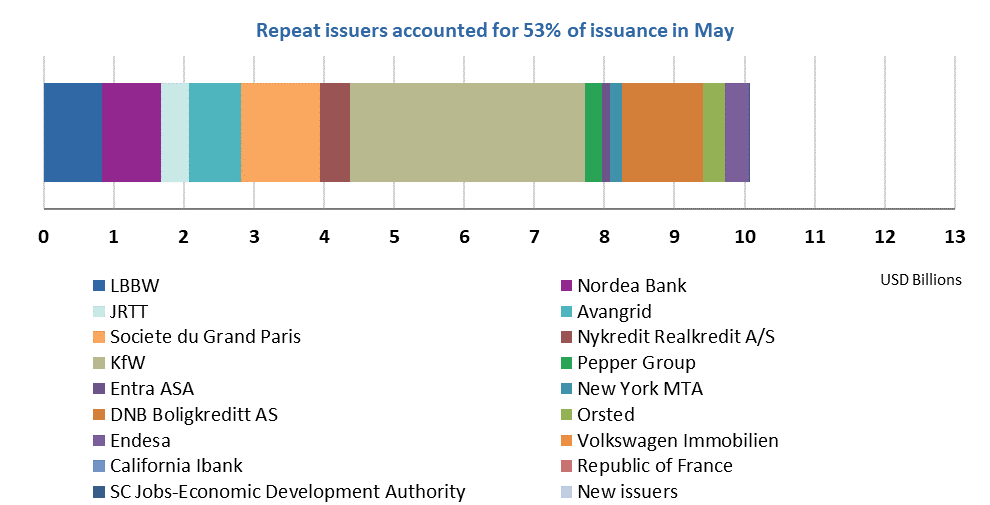

Repeat issuers – May

- Landesbank Baden-Wuerttemberg: USD750m (Certified Climate Bond)

- Landesbank Baden-Wuerttemberg: EUR750m/USD840m (Certified Climate Bond)

- Nordea Bank: EUR750m/USD839m

- Japan Railway Construction, Transport and Technology Agency: YPN43bn/USD392m (Certified Climate Bond)

- Avangrid: USD750m

- Société du Grand Paris: EUR1bn/USD1.2bn (Certified Climate Bond – Programmatic Certification)

- Nykredit Realkredit A/S: SEK4.1bn/USD429m

- KfW: EUR3bn/USD3.4bn

- Pepper Group: USD162m

- Entra ASA: NOK900m/USD103m

- New York MTA: USD177m (Certified Climate Bond – Programmatic Certification)

- DNB Boligkreditt AS: SEK500m/USD52m (Certified Climate Bond)

- Orsted: GBP350m/USD448m

- Orsted: GBP300m/USD384m

- Orsted: GBP250m/USD320m

- Endesa: EUR300m/USD336m

- Entra ASA: NOK700m/USD80m

- Volkswagen Immobilien: EUR60m/USD67m

- California Infrastructure and Economic Development Bank (Ibank): USD84m

- Republic of France: EUR1.9bn/USD2.1bn

- South Carolina Jobs-Economic Development Authority: USD14m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Deutsche KreditBank |

EUR6.8m/USD7.6m |

04/06/2019 |

Excluded (social bond) |

|

Hebei Iron & Steel Group Co., Ltd. |

CNY1bn/USD149m |

03/06/2019 |

Excluded (working capital) |

|

MLS Co., Ltd. |

CNY200m/USD29m |

03/06/2019 |

Excluded (working capital) |

|

Anji County Oasis New Rural Construction Co., Ltd |

CNY1.5bn/USD217m |

31/05/2019 |

Excluded (working capital) |

|

NWB Bank |

EUR1bn/USD1.2bn |

28/05/2019 |

Excluded (sustainability/social bond) |

|

IFC |

HKD100m/USD128m |

05/06/2019 |

Pending (waiting for prospectus) |

|

ABC Financial Leasing |

CNY3bn/USD434m |

05/06/2019 |

Pending (waiting for prospectus) |

|

City Council of Stockholm |

SEK1bn/USD106m |

04/06/2019 |

Pending (waiting for prospectus) |

|

Vacse |

SEK300m/USD32m |

04/06/2019 |

Pending (waiting for prospectus) |

|

Bayport Management |

USD260m |

29/05/2019 |

Pending (waiting for more information) |

Green bonds in the market

- City of Orebro: closing June 11

- EIB: closing June 11

- ESB Finance: closing June 11

- Hysan MTN Limited: closing June 11

- Nigerian Debt Management Office: closing June 13

Investing News

The incoming Government of Finland set a target for the country to become carbon neutral by 2035. The goal is one of the most ambitious around the globe, especially given that Finland does not intend to use carbon offset projects in other countries as part of reaching its target.

In a bid to decarbonise by 2050, Chile’s president Sebastian Piñera announced a plan to shut down eight of the total 28 coal-fired plants in the country by 2024. This would cut the proportion of coal in Chile’s grid mix to half in five years, making it one of the fastest coal phase-outs in the world.

The Costa Rica stock exchange created Green Bond Guidelines for issuers in the country. The guidelines are based on ICMA’s Green Bond Principles, and are available to read online.

HSBC Global Asset Management and IFC launched a new green bond fund: REGIO. The fund is the first of its kind in that it will look to invest in real economy, i.e. non-financial corporate, issuers in emerging markets. The vehicle will have a total life of up to 15 years, including a seven-year investment period, and is expected to catalyse USD500-700m.

Energy innovation fund Breakthrough Energy Ventures launched by Bill Gates in 2016 announced a new USD111m clean energy innovation fund. The fund, Breakthrough Energy Ventures Europe (BEV-E), was created in partnership with the European Commission. The fund will support European companies working to “bring radically new clean energy technologies to the market.”

A new, independent Impact Investing Institute was set up in the UK last week. The UK government-backed Institute’s focus is on bringing additional benefits to pension and savings products’ investors by combining financial returns with a social or environmental purpose.

Green Bond Gossip

US government-backed mortgage agency, Fannie Mae’s “little brother” Freddie Mac, issued a green bond framework. It covers the Multifamily Green Advantage® programme introduced in 2016 that offers financing incentives for e.g. energy and water efficiency retrofits. CICERO provided a SPO. Freddie Mac’s portfolio of loans totalled USD216bn as at April 2019.

The Chilean government is gearing up for its inaugural sovereign green bond. According to Finance Minister Felipe Larraín, the issuance is planned for this year and can reach up to USD1.5bn. The bond has received Climate Bonds Certification, with the pre-issuance verification conducted by Vigeo Eiris.

Renewable Japan Co., Ltd., will issue a project bond to fund the construction of a solar PV power plant in Korekawa, Hachinohe city, Aomori prefecture. The issuer’s framework received a GA1 Green Bond Assessment from R&I Japan.

Japanese construction company Obayashi Corporation is planning to return to the market with the sustainability label after its debut green bond in November 2018. The planned bond received Sustainability Bond Second Opinion from R&I Japan. It will finance smart buildings and renewable energy.

Trading company Itochu Europe issued a green bond framework for planned green bonds to finance renewable energy and pollution prevention projects. Sustainalytics provided a SPO.

Malaysian Telekosang is preparing to issue the world’s first green sukuk to finance mini-hydro projects. The project comprises two small run-of-river plants with a combined installed capacity of 40MW.

Rhode Island Infrastructure Bank plans to sell USD32m of green bonds to finance safe drinking water projects.

The Inter-American Development Bank (IDB) has asked consultancy firms for proposals by 12 June on developing a green bond issuance programme, including creating a framework and identifying suitable assets, for the Mexican state of Yucatan. The bonds would be the first of their kind. The winning consultancy will be selected by 1 July.

Readings & Reports

Lobbying efforts to block key US climate regulation cost society as much as USD60bn, a new study published in Nature Climate Change has found.

New research from CDP found that climate risks could cost the world’s largest corporates nearly USD1trn, with most losses occurring before 2025. A quarter of this is due to stranded assets. On the other hand, corporates estimated that with USD311bn of initial investment, a low carbon transition could generate USD2.1tn of revenue in the same time frame.

Moving Pictures

NY MTA issued their first green bond in way back in Feb 2016 and are now up to their 10th certified issuance. This 1:01sec clip is a reminder from those early days.

Tune in to see our Africa Program Manager Olumide Lala talking green market development from Nigeria.

Spotlight: Plastic

The issue

Plastics have got a bad rep in the past couple of years, and with good reason. As we reported in Market Blog #26, plastics have a much larger impact than previously thought. So much so that by 2050, their production and disposal could generate emissions that equate to up to 14% of the Earth’s entire remaining carbon budget.

The oceans are suffering from plastic waste, too: according to Scientific American, 8m tonnes of plastics are dumped into the ocean each year. This affects tourism, fishing, shipping, health and food chains, and causes marine ecosystems globally to suffer damages to the tune of USD13bn a year. This video from the World Economic Forum provides some more insight into the problem.

Possible solutions

Last week saw both World Environment Day (June 5) and World Oceans Day (June 8). To celebrate, we wanted to highlight the advances being made to tackle the plastics issue.

Governments

- As we previously reported, earlier in May, 186 countries came together after talks hosted by the United Nations Environment Programme (UNEP) to agree to treat plastics as hazardous waste. The agreement, which amends the Basel Convention, also envisages ways to cut down plastic production altogether.

- Asian countries are refusing to act as the plastic waste dump for other countries: China put in place a waste import ban, whereas Malaysia opted to ship waste back where it came from. Other countries hosting movements that demand similar action locally.

- Norway and Finland have both introduced schemes already in the 1990s for customers to bring used plastic and glass bottles, along with aluminium cans, back to shops and supermarkets to receive a small fee for each bottle. Today these are highly effective, with over 90% of bottles returned to stores for reuse.

Business and investors

- Canary Wharf in London set an example by becoming the world’s first plastic-free commercial centre last week.

- UK supermarket chain Waitrose is trialling a packaging-free refill concept in several locations across the country. Customers can buy daily essentials priced by weight and packed in reusable containers.

- In April, the International Bank for Reconstruction and Development (IBRD) issued a USD10m Sustainable Development Bond to highlight and combat the ocean plastic waste problem.

- CBI is developing Waste Criteria for the Climate Bond Standard – the public consultation is open now!

What you can do

- Lastly, check out this WWF video on ways you can reduce your personal plastics footprint.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.