Highlights:

- Issuance reaches USD17.8bn as of 23 May - already a 31% increase year-on-year with another week to go

- Netherlands: Dutch green bond becomes the largest Sovereign Certified under the Climate Bonds Standard

- Russia: Russian Railways debuts with a Certified Climate Bond, opening up a green bond market in Russia

- Switzerland: Raiffeisen Schweiz completes debut issuance in a first for Swiss financial corporates

- UAE: Majid al Futtaim Properties enters the market with second green bond from an UAE issuer

Don’t miss it! Limited spaces.

Register now for our Green Bond Boot Camp in London on 7 June by email to training@climatebonds.net

More details here.

New releases

Protected Agriculture Criteria for Mexico

Climate Bonds Initiative has published Protected Agriculture Criteria under the Climate Bonds Standard. Under

development throughout 2018, the new Criteria have been developed by Climate Bonds in partnership with

the Inter-American Development Bank (IDB).

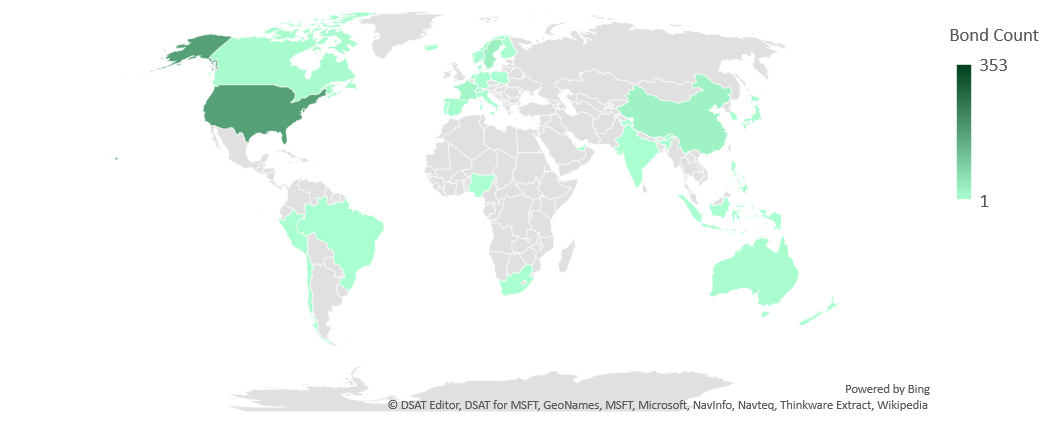

Green bond deals across the globe – 2019

Go here to see the full list of new and repeat issuers in May.

At a glance

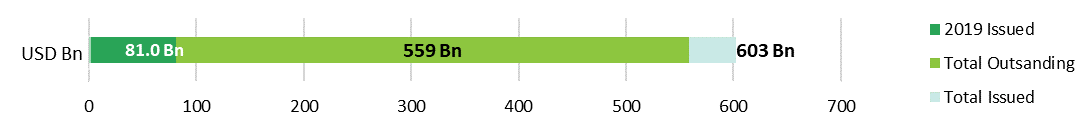

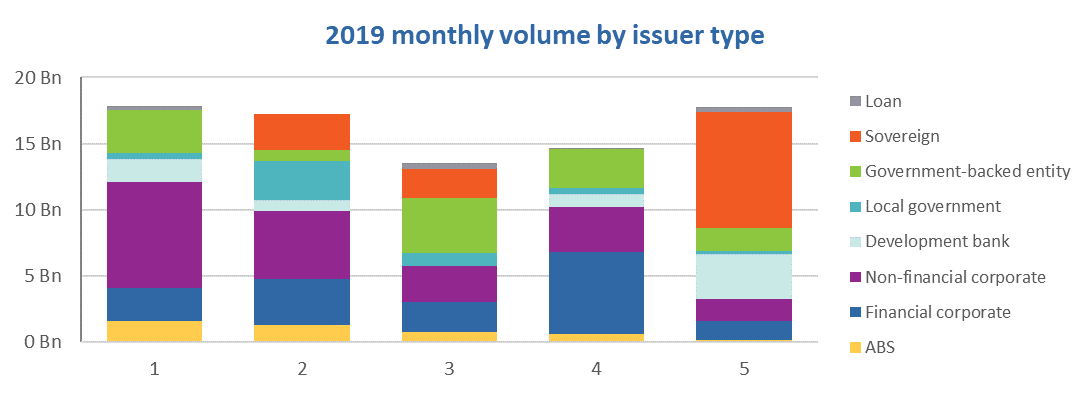

May issuance to date has reached USD17.8bn. This represents a 31% increase over May 2018 (USD13.5bn).

Sovereign issuance represents nearly half (48%) of issued volume so far. This is mostly due to the Dutch sovereign Certified Climate bond, which on its own makes up 40% and is the single largest deal of 2019 so far. France tapped its Green OAT for a further EUR1.9bn (USD2.1bn). The Hong Kong green sovereign debut, which we’ll report on in more detail in the next blog, will provide a further boost to May figures.

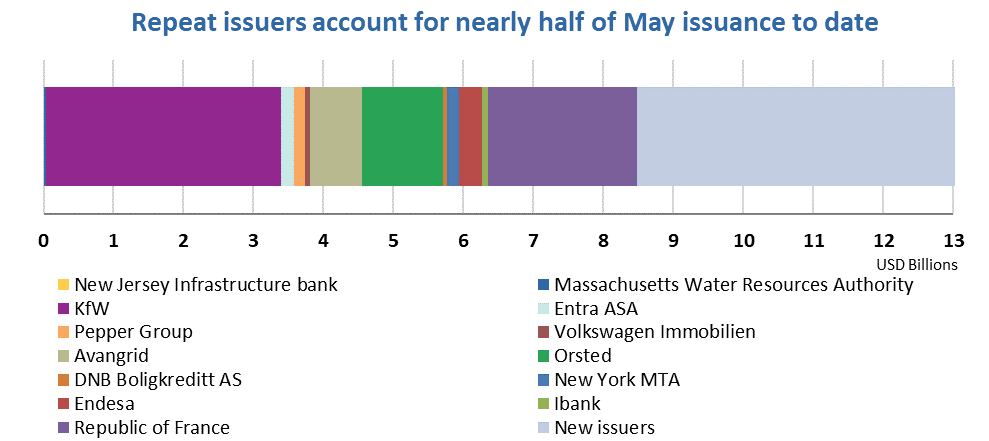

We’ve also seen an uptick in issuance in the development bank space this month. They have contributed 19% of May issuance so far, compared to 7% in April. The bulk of this is from German KfW, which successfully closed its largest green bond to date this week. The EUR3bn (USD3.4bn) deal brings the total outstanding volume from KfW to USD19.7bn.

The rest of May volumes are distributed fairly evenly across government-backed entities (10%), financial (8%) and non-financial corporates (10%). New non-financial corporate issuers include Dubai-based Majid Al Futtaim Properties, which issued the second ever bond from the UAE to finance low carbon buildings, bringing the country’s issuance to USD1.2bn and boosting the UAE to 6th place in monthly country rankings so far.

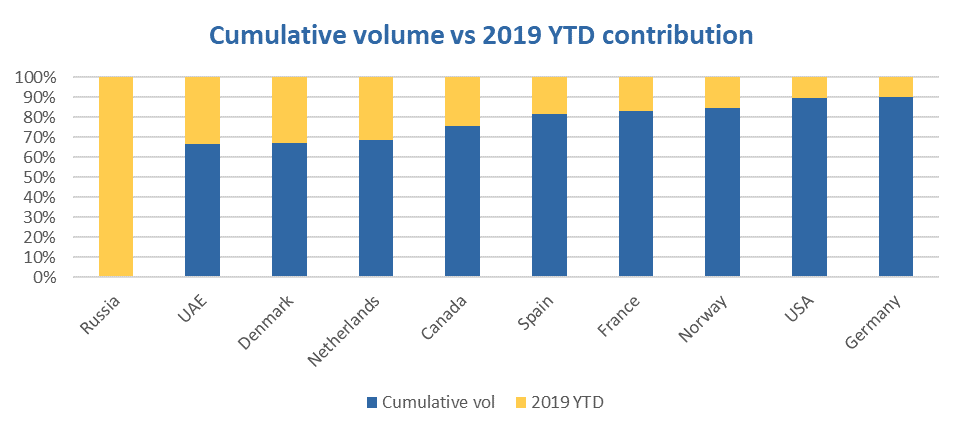

The Dutch sovereign green bond places the Netherlands at the top of the country leader board for May so far, followed by Germany, France, Denmark and the USA. We will cover May country ranking in the next blog. In the meantime, we looked at the contribution 2019 has made to cumulative country issuance for the top 10 issuers in May so far.

The trend of increasingly diversified issuance continues. So far in May, some notable examples of sustainability bonds from coffee giant Starbucks (USD1bn) and two Korean issuers: USD300m from Mirae Asset Daewoo, and USD450m from Woori Bank. More details can be found in the Pending and Excluded section below.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Connecticut Green Bank (USD38m), USA, completed a 25-year securitized deal that monetizes solar home renewable energy credits (SHRECs) generated through the Residential Solar Investment Program (RSIP) in Connecticut State.

Eligible systems will be granted the incentives, and the Bank will in turn receive title to the environmental attributes of the solar project. This will allow it to meet its goal of 300MW of residential solar deployment by 2022. Only systems whose incentives have been approved after January 1st 2015 are eligible. The deal is the first solar transaction by a US green bank.

Although the issuer has not made a commitment towards post-issuance reporting, it has commissioned ex-ante impact reporting (a “Climate Impact Assessment”) from the Climate Action Reserve. The assessment concluded that the SHREC systems will produce 238,000 MWh of electricity annually, thereby reducing approximately 749,494 tonnes of carbon dioxide equivalent (tCO2e) per year.

Fideicomisos Instituidos en Relación con la Agricultura (FIRA) (MXN2.5bn/USD130m), Mexico, issued a 3-year senior unsecured green bond in October 2018 (check out our market blog for details). The issuance recently became the first green bond to be certified against the new Climate Bonds Standard Protected Agriculture in Mexico Criteria.

RZD Capital PLC (EUR500m/USD558m), Russia, is the first green bond from Russia to be included in the CBI green bond database. The issuer is an Irish subsidiary of Russian Railways. The Certified Climate Bond was verified by Sustainalytics. Annual reports on the allocation of proceeds will be made publicly available on the issuer’s website. The reports will also include estimates of the number of passengers transported and the avoided CO2 emissions resulting from displacing fossil fuel private vehicle use.

The proceeds will be used to refinance the procurement of wholly electrified passenger rolling stock, built by a joint venture between Siemens and Ural Locomotives. First introduced in 2013, the Lastochka (“Swallow”) trains operate on many commuter and intercity routes, and are the most common high-speed train model operating in Russia. The trains have seating for 400 or 800 passengers and can run at maximum speeds of 160km/h.

It is excellent to see a Russian company entering the market, and we hope to see its peers follow suit. The environment is becoming more and more favourable towards green issuance: the government announced earlier this month that it will subsidise up to 70% of interest incurred by issuers on new qualifying green bonds issued after January 2019.

State of the Netherlands (EUR5.99bn/USD6.66bn), Netherlands, issued its long-awaited debut green bond: a 21-year senior unsecured sovereign Certified Climate Bond, verified by Sustainalytics. Publicly available reports will be produced annually until the proceeds are fully allocated. These reports will be verified by an independent auditor of the Dutch State.

A large portion of the proceeds will fund the government’s Delta Plan, which is the world’s most advanced and sophisticated floodplain management system. Most of the Netherlands lies in the Rhine’s floodplain and is vulnerable to flooding and sea level rise. The new management system will enhance the country’s resilience towards increasing sea levels, as well as making freshwater distribution more secure and efficient.

The proceeds will also finance and refinance the government’s subsidies for solar and offshore wind energy, its Incentive Scheme for Energy Performance in the Rental Sector (“STEP”) and investments in its passenger railway network.

Netherlands has become the sixth European country to issue a sovereign green bond. When the bond programme was announced, the Dutch Minister of Finance said, “Our ambition is to issue a dark green bond”, and the government has stated that it intends the issuance programme to ultimately be EUR10bn. We applaud the Netherlands for their ambition towards realising the low carbon transition and welcome the positive signal to other market stakeholders from sovereign green bond issuance. For more CBI commentary, check out our special blog post on this deal.

Vesteda (EUR500m/USD558m), Netherlands, is the first residential property fund globally to receive Certification under the Low Carbon Buildings (Residential) criteria of the Climate Bonds Standard, and the first property fund in Europe to receive Certification. Previously, CDL Properties (Singapore), Investa (Australia) and Brookfield Properties (Australia) have received Certification, but for commercial property.

Vesteda’s 8-year, benchmark-sized Euro-denominated bond is verified by Sustainalytics. According to Vesteda’s Framework, the bond will finance and refinance Dutch residential properties with an Energy Performance Certificate (EPC) of A or refurbishments, which result in two levels of improvement in the EPC label and reach at least a ‘C’ EPC label.

Annual reports will be made publicly available on the issuer’s website at least until full allocation. These will detail allocated and unallocated proceeds and the proportion of financing vs refinancing. Annual impact reports will also be made available and will disclose information about the EPC labels of the portfolio and its estimated energy savings, along with avoided CO2 emissions compared to a representative residential portfolio.

New issuers

Hemfosa Fastigheter AB (SEK1.3bn/USD135m), Sweden, came to market with a 3-year green bond, which will exclusively finance new and existing green buildings and energy efficiency in buildings. The energy efficiency sub-category includes replacing heat pumps, upgrading to LED lighting, improving ventilation systems and extending district heating/cooling systems. All buildings are required to meet pre-defined certification standards, as outlined in the Green Bond Framework.

Hemfosa has committed to post-issuance reporting at least annually while the bond is outstanding. The reports will be made public on Hemfosa’s website and will include use of proceeds and impact reporting. CICERO’s Second Party Opinion clarifies that Hemfosa will use country-specific emission factors when calculating emissions from electricity use.

Climate Bonds view: Swedish property sector green issuance continues to boom. Hemfosa’s bond brings the cumulative volume to a whopping SEK54bn (USD6.4bn). We are pleased to see that Hemfosa has opted to follow market best practice and committed to comprehensive post-issuance reporting, following in the footsteps of many other Swedish issuers.

Majid Al Futtaim Properties (USD600m), United Arab Emirates, issued an inaugural 10-year green sukuk, the first green sukuk out of the Middle East and the first outside Asia. The deal will finance and refinance green buildings certified LEED Gold / BREEAM Very Good or above and building upgrades to achieve energy efficiency improvements of at least 20%, as well as solar and wind projects and sustainable water management, as set out in the issuer’s Green Finance Framework.

Majid al Futtaim will provide public annual reporting, which will be reviewed by a third party. The issuer will disclose a list of eligible projects and amounts allocated to each of these (as well as to each category), and any unallocated proceeds. The report will include impact metrics, a list of which has been provided in the Framework.

Climate Bonds view: We are pleased to see activity from a country whose economy has traditionally relied heavily on fossil fuels. We hope the success of this issuer will spur others to join the momentum. Majid Al Futtaim’s Framework is robust with clear targets for each eligible project category. The issuer has also committed to obtaining an external review of its post-issuance reporting from a third party, which demonstrates an understanding of the very best market practice.

Raiffeisen Schweiz Genossenschaft (CHF100m/USD98.3m), Switzerland’s largest retail bank, made its market debut by issuing a 5-year senior domestic public sustainability bond. In its Framework (reviewed by ISS Oekom), the issuer outlines that proceeds will be allocated towards loans to social housing developers that hold charitable status. The issuer also strives for the assets to be within the top 15% of final energy consumption and CO2 emissions compared to the Swiss building stock.

The properties, mainly apartment buildings, must be energy efficient, generate low CO2 emissions and permitted energy sources will be limited to heat pumps, wood, pellets or district heating (if the energy mix for district heating is better than average CO2 emissions). The assets must also meet recognized certification and energy standards, as well as be located within a 1km from public transport links.

Climate Bonds view: Additional issuance from the Swiss banking sector, which continues to be a prominent pillar of the country’s economy, is an encouraging sign. We especially like seeing the diversification of issuance labels manifested in this bond with the dual benefits of social sustainability (in this case through social housing) and green (low carbon buildings in the top 15% of the Swiss market, in accordance with the CBI Taxonomy).

United Urban Investment (JPY10bn/USD90.5m), Japan, entered the market with a 7-year green bond, which received a Green 1 rating from Japan Credit Rating Agency. The proceeds are earmarked for financing and re-financing a pre-determined pool of low carbon properties located across Japan. These include five office buildings, two hotels, a retail unit and a shopping centre. The assets must have acquired or be expected to obtain a specific level of green building certification (as more fully listed in the rating report) to qualify for investment.

United Urban Investment will report annually on its website on any unallocated proceeds. By way of impact reporting, the number of properties that obtained external certification, their electric power consumption, gas consumption, CO2 emissions, and water usage will also be disclosed annually. The issuer is considering obtaining a third-party review of the reporting until the bond matures.

Climate Bonds view: Japanese REIT issuance continues growing: United Urban Investment’s green bond is the seventh, bringing total volume from this issuer segment in the country to JPY40.6bn (USD367m). The issuer has followed market best practice by obtaining a Green Bond Rating and committing to reporting on the environmental impacts of its portfolio (and any changes to its post-issuance). We encourage the issuer to follow through on its intention to obtain third-party verification for reporting to further enhance its credibility and transparency.

New issuers issued prior to May 2019

Guangzhou Metro Group Co., Ltd. (CNY3bn/USD441.6m), China, issued a 5-year ABS, comprised of 6 tranches, in January 2019. The deal is secured on subway ticket revenue receivables and will finance 6 rail transit projects (subway construction work). The green bond framework indicates that green buildings that received China’s local 2-Star Green Building Certification are also eligible for use of proceeds. The issuer has appointed the iGreenBank to provide a Second Party Opinion. The use of proceeds and associated environmental benefits will be disclosed before 30th April annually.

Climate Bonds view: Although half of the proceeds will be used for working capital and to repay bank loans, the deal is included in our database as an ABS deal which can be defined as “green” when it is secured on low carbon assets (here it is subway revenue receivables) and/or where the proceeds from the deal are earmarked for low carbon assets.

Shenzhen Energy Nanjing Holding Co., Ltd (CNY1bn/USD148.6m), China, issued a 5-year ABS, comprised of 6 tranches, in April 2019. The deal is backed by cash flows generated from 13 solar photovoltaic projects with a total installed capacity of 228.43MW. Expected environmental benefits include avoiding 97,746.2 tons of coal equivalent, 165,135 tons of carbon dioxide, 149.55 tons of sulphur dioxide and 830.63 tons of nitrogen oxides. CCX prepared a Second Party Opinion, which provides a detailed breakdown.

Climate Bonds view: This green ABS from pure-play solar generation company is one of just a few Chinese solar ABS.

Repeat issuers – May

- Avangrid: USD750m

- California Infrastructure and Economic Development Bank (Ibank): USD84m

- DNB Boligkreditt AS: SEK500m/USD52m – Certified Climate Bond (Programmatic Certification)

- Endesa: EUR300m/USD336m

- Entra ASA: NOK900m/USD103m

- Entra ASA: NOK700m/USD80m

- KfW: EUR3bn/USD3.4bn

- Massachusetts Water Resources Authority: USD19m

- New Jersey Infrastructure Bank: USD13m

- New York MTA: USD177m – Certified Climate Bond (Programmatic Certification)

- Orsted: GBP350m/USD448m

- Orsted: GBP300m/USD384m

- Orsted: GBP250m/USD320m

- Pepper Group: USD162m

- Republic of France: EUR1.9bn/USD2.1bn

- Volkswagen Immobilien: EUR60m/USD67m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Philips |

EUR750m/USD835m |

22/05/2019 |

Excluded (sustainability bond) |

|

Co-Operative Group |

GBP250m/USD316m |

17/05/2019 |

Excluded (sustainability bond) |

|

Starbucks |

USD1bn |

13/05/2019 |

Excluded (sustainability bond) |

|

Woori Bank |

USD450m |

08/05/2019 |

Excluded (sustainability bond) |

|

Mirae Asset Daewoo |

USD300m |

08/05/2019 |

Excluded (sustainability bond) |

|

Wallonia |

EUR500m/USD557m & EUR500m/USD557m |

03/05/2019 |

Excluded (sustainability bond) |

|

Indorama Ventures Group |

EUR100m/USD112m; USD100m |

29/04/2019 |

Excluded (Impact loan/ESG linked credit facility) |

|

East Renewable Company |

EUR75m/USD83.5m |

21/05/2019 |

Pending (waiting for prospectus) |

|

Millicom |

SEK2bn/USD210m |

16/05/2019 |

Pending (waiting for more information) |

|

Fujian Zhangzhou Long-distance Transportation Group |

CNY480m/USD69m |

07/05/2019 |

Pending (waiting for more information) |

Green bonds in the market

- Atrium Ljungberg – closed May 21st

- NSTAR Electric – closed May 22nd

- Mississippi Development Bank – closed May 22nd

- BTS Group – closed May 23rd

- Wallenstam – closing May 24th

- LBBW – closing May 24th

- Nordea Bank – closing May 28th

- Hong Kong Monetary Authority – closing May 28th

- Sumitomo Mitsui – closing May 29th

- TenneT – closing June 3rd

- Zürcher Kantonalbank – closing June 6th

- Cofide – closing June 24th

- BNP Paribas SA – closing June 28th

Investing News

In conclusion to 12 days of talks at a United Nations Environment Programme (UNEP) meeting in Geneva, 180 countries have reached an agreement to treat plastic as a hazardous waste. The USA is the only developed country notably absent from the agreement. For more on the impact of plastic, see the Readings & Reports section below.

Russia is advancing its green and sustainable finance agenda. The Russian government announced earlier this month that it will subsidise up to 70% of interest incurred by issuers on new green bonds after January 2019. The subsidy will extend to bonds up to RUB30bn (ca. USD466m) that finance qualifying projects under the government ecology programme. Elsewhere, the Moscow Stock Exchange joined the UN’s Sustainable Stock Exchanges initiative.

Several US Democrat senators are urging the US Treasury to issue USD10bn of green bonds to set up a federal green bank, with the possibility of ultimately taking the total outstanding up to USD50bn. The Senators’ United States Green Bank Act of 2019 aims "to significantly increase the pace and amount of investment in clean energy, energy efficiency, and other climate change mitigation and adaptation projects at the state and local level", Environmental Finance reports.

S&P Dow Jones Indices has launched the S&P 500 ESG Index. S&P DJI states that given its diversification and broad market exposure, the S&P500 ESG will be able to provide similar returns to the traditional benchmark index S&P500, which has been around for more than 60 years. It also launched the Dow Jones Green Real Estate Indices in collaboration with GRESB.

An annual survey by the Canadian Institute of Actuaries, the Casualty Actuarial Society, and the Society of Actuaries found that insurers particularly in North America view climate change as their most important current and emerging risk.

Oil giant BP’s Annual General Meeting (AGM) passed a shareholder resolution calling for the firm to prepare a business strategy consistent with the 2015 Paris Agreement. The resolution, which was backed by BP's board, the investor initiative group Climate Action 100+ and the Institutional Investors Group on Climate Change (IIGCC), secured 99.14% of votes. An opinion piece by BP’s Chairman echoing the sentiment was published in the Financial Times the day before.

Former US Vice President Al Gore’s Generation Investment Management closed a USD1bn impact investing fund. The Sustainable Solutions Fund is Generation’s third growth fund and the largest raised by the firm to date. It will support later-stage start-ups working in environmental and social innovation, enabling them to scale up rapidly.

The Loan Market Association (LMA), the Asia Pacific Loan Market Association (APLMA) and the Loan Syndicated and Trading Association (LSTA) recently published the Sustainability Linked Loan Principles, extending the work done previously on the Green Loan Principles. The Principles will allow lenders to incentivise borrowers to improve their sustainability performance and facilitate sustainable business models and operations.

Green Bond Gossip

The Philippines’ Rizal Commercial Banking Corporation (RCBC) is set to issue at least PHP5bn (USD95m) of sustainability bonds with proceeds earmarked for environmental and social projects. The deal will be the first of its kind in the country.

The German State Finance Agency has announced it is examining the possibility of issuing green Bunds from 2020.

Irish utility company ESB is gearing up for a green debut. ESB’s Green Bond Framework states that proceeds will be allocated to renewable energy, clean transportation and green building projects.

Polish bank PKO Bank has released a framework for its planned green covered bond. Sustainalytics provided a Second Party Opinion for the deal, which will finance energy efficient residential buildings in Poland.

US-based Greenworks Lending is preparing to issue a USD75m private placement, which will rely on the securitisation of a portfolio of commercial property-assessed clean energy (C-Pace) assets across 10 US states and the capital, Washington D.C. The issue received a E1/78 score from S&P Global Ratings.

Readings & Reports

The public policy and research organisation Our Hong Kong Foundation (OHKF) completed a policy review of global ESG frameworks and policies and the ESG investment and reporting landscape for corporates and investors in Hong Kong. The review finds that although interest in the space is rising, a lack of understanding is hindering growth. 13 recommendations are presented to help overcome the current barriers and unlock further investment.

The Environmental Paper Network (EPN) published a briefing detailing the use of green bonds to finance business-as-usual tree plantations and operations of the pulp and paper industry, claiming exaggerated CO2 savings.

The total environmental cost of plastics is much higher than previously thought, claims a new report from the Center for International Environmental Law (CIEL). “Plastic & Climate: The Hidden Costs of a Plastic Planet” finds that by 2050, the production and disposal of plastic could generate emissions that equate to up to 14% of the Earth’s entire remaining carbon budget.

A new guide for financial institutions to assess natural capital credit risk in the agricultural sector across sub-sectors and geographies was launched by the Natural Capital Finance Alliance (NCFA) in Oxford, UK.

The UN Principles for Responsible Investment (PRI) has launched the first ever global guidance for the non-life insurance industry on ESG integration. The guide is currently undergoing public consultation.

Microsoft founder, investor and philanthropist Bill Gates has argued that investing in energy innovations, particularly around wind and solar power, is the key to unlocking rapid deployment of renewables and providing the necessary speed for the transition from fossil fuels to a future of “reliable and affordable carbon-free electricity”.

Upcoming events

Don’t miss out on CBI’s Green Bond Bootcamp in London! To book your place in the one-day intensive workshop on 7 June, follow this link.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.