ICBC is the world’s biggest bank and it’s also the world’s biggest listed company. When they issue their inaugural green bond and it's Climate Bonds Certified, we think it's news worth repeating.

And when India’s state-owned energy agency IREDA does the same, we think that’s good news as well.

Also in the news; New York State HFA & MTA taking the streamlined Programmatic Certification path again as they forge ahead on issuing green.

Plenty more in this month’s Market Blog, so let’s jump straight in...

New Issuers

A reminder of our new format to help readers keep up with the volume of green bonds emerging.

New issuers in Table 1, repeat issuers in Table 2, with a link back to our original blog posts.

|

Issuer |

Size |

CBI Certified |

Verifier/Reviewer |

Issuer Type |

CBI Analysis |

|

SSE |

EUR600m |

No |

DNV GL |

Corporate |

|

|

Santa Monica Public Financing Authority |

USD68.6m |

No |

None |

US Muni |

|

|

Hypo Vorarlberg |

EUR300m |

No |

Oekom |

Commercial Bank |

|

|

Region Skåne |

SEK1.2bn |

No |

CICERO |

Muni/Provincial/City |

|

|

Klabin |

USD500m |

No |

Sustainalytics |

Corporate |

|

|

Icade |

EUR600m |

No |

Sustainalytics |

Corporate |

|

|

Tenaska |

USD400m |

No |

Sustainalytics |

Corporate |

|

|

Province of Jujuy |

USD210m |

No |

Sustainalytics |

Muni/Provincial/City |

|

|

CECEP Wind-Power Corp |

RMB300m |

No |

CECEP |

Corporate |

|

|

Tus-Holdings |

RMB350m |

No |

CCXI |

Corporate |

|

|

Huishang Bank |

RMB1bn |

No |

EY |

Commercial Bank |

|

|

Bank of Dongguan |

RMB2bn |

No |

EY |

Commercial Bank |

|

|

Nanhai Rural Bank |

RMB300m |

No |

CECEP |

Commercial Bank |

|

|

Hanjin International |

USD300m |

No |

Sustainalytics |

Corporate |

Repeat issuers

|

Issuer |

Size |

CBI Certified |

Verifier/Reviewer |

Issuer Type |

CBI Analysis |

|

Nordic Investment Bank |

SEK2bn |

No |

CICERO |

Development Bank |

|

|

KfW |

USD1bn |

No |

CICERO |

Development Bank |

|

|

EBRD |

USD500m |

No |

CICERO |

Development Bank |

|

|

Municipality Finance |

EUR500 |

No |

CICERO |

Muni/Provincial/City |

|

|

Export Development Canada |

CAD500m |

No |

CICERO |

Development Bank |

|

|

New York State Housing Finance Agency |

USD40.9m |

Yes |

Sustainalytics |

US Muni |

|

|

New York MTA |

USD662m |

Yes |

Sustainalytics |

US Muni |

|

|

City and County of Honolulu |

USD20m |

No |

None |

US Muni |

|

|

Guangdong Huaxing Bank |

RMB2bn |

No |

CECEP |

Commercial Bank |

|

|

Hebei Financial Leasing |

RMB500m |

No |

EY |

Corporate |

|

|

NRW.BANK |

EUR500m |

No |

Oekom |

Government agencies and state-backed entities |

|

|

Iberdrola |

EUR750m |

No |

Vigeo EIRIS |

Corporate |

|

|

Vasakronan |

SEK200m |

No |

CICERO |

Corporate |

|

|

Fabege |

SEK300m and SEK600m |

No |

Sustainalytics |

Corporate |

|

|

Engie |

EUR1.25bn |

No |

Vigeo EIRIS |

Corporate |

|

|

Deutsche KreditBank |

EUR500m |

No |

Oekom |

Commercial Bank |

|

|

EIB |

AUD125m & AUD200m (tap) |

No |

None |

Development Bank |

|

|

GCL New Energy |

RMB375m |

No |

None |

Corporate |

|

|

China Development Bank |

RMB5bn |

No |

PwC |

Government agencies and state-backed entities |

|

|

Suzano Papel e Celulose |

USD200m (tap) |

No |

Sustainalytics |

Corporate |

|

|

Mexico City Airport |

USD4bn |

No |

Sustainalytics |

Corporate |

|

|

Guangdong Huaxing Bank |

RMB2bn |

No |

CECEP |

Commercial Bank |

|

|

TD Bank |

USD1bn |

No |

DNV GL |

Commercial Bank |

|

|

Qingdao Rural Bank |

RMB1bn |

No |

KPMG |

Commercial Bank |

Certified Climate Bonds

Industrial & Commercial Bank of China (ICBC) – USD2.1bn

The world’s largest bank, ICBC issued its first green – a One Belt One Road Green Climate Bond.

If that formal name for the bond doesn’t send you a message you’re not paying attention.

We covered the story as it broke, and the ramifications of this bond are worth a quick look.

It’s worth noting a few extra points – Global Capital reports the bond was issued in three tranches: a EUR1.1bn 3-year floating rate note, a USD450m 3-year floating-rate note and a USD400m fixed rate note. All tranches were oversubscribed - with the EUR1.1bn tranche receiving EUR1.8bn in orders! Pricing was tighter than expectations.

In another coup for the Luxembourg Green Exchange (LGX) they’ve snared this plum listing.

See the Green bond framework, verifier’s report and CICERO second opinion here.

IREDA – INR19.5bn (USD300m)

IREDA, India’s state owned energy development agency just issued their inaugural Climate Bonds Certified green Masala bond, after their green bond debut in March 2017.

It is the first green Masala bond to be listed on the London Stock Exchange. The bond was certified against the Solar and Wind Criteria of the Climate Bonds Standard.

EVI provided the verification document.

More information is available in our recent Blog Post.

This may be a good time to note the recent comments from Secretary of the Ministry for New and Renewable Energy Anand Kumar that India will meet its ambitious 175GW of renewable energy by 2022 target.

This will require significant domestic and offshore investment.

Corporate

Mexico City Airport Trust

Grupo Aeroportuario de la Ciudad de México issued their second green bond, raising a whopping USD4bn in two tranches. The deal achieved the highest grade of GB1 in Moody’s Green Bond Assessment rating. Sustainalytics provided the second party opinion.

Eligible projects to be financed include: LEED-certified low carbon buildings, renewable energy as well as waste and water management.

The first bond was issued in late 2016 at the time a record USD2bn. You can read more on our positioning on our "Big End to September" 2016 Blog Post here.

This is the largest UK green bond issue to date, topping the recent Anglian Water £250 million Green Bond and is a first for British energy company SSE.

According to the green bond framework, eligible projects fall under renewable energy:

- Production: onshore wind farms; offshore equity investments where equity investments are joint ventures agreements with other parties – e.g. Beatrice Windfarm

- Transmission: onshore transmission network infrastructure.

This debut bond will refinance part of the issuer’s GBP1.1bn onshore wind portfolio in the UK and Ireland, including:

- Completed projects in the last 2 years: Slieve Divena 2 (19MW), Strathy North (67MW), Galway (64MW), Tievenameenta (35MW), Dunmaglass (94MW) and

- Projects under construction to be finalised in next 2 years: Bhlaraidh (108MW), Leanamore (18MW), Clyde Extension (173MW), and Stronelairg (225MW).

DNV GL provided the second opinion.

Proceeds going to offshore renewable energy are quite easily included as green. The inclusion of equity investments is something we don’t see a great deal of – it does raise the potential for double counting if more than one owner refinances the same project. However, SSE have stated that only the equity share will be reported on.

Energy transmission infrastructure is straightforward in this case. As its offshore generation the transmission lines are fully dedicated to renewable energy.

In other cases, it can be more difficult – particularly if new transmission lines will enable new renewable energy to be built but are not necessarily fully-dedicated – not the case here, but a difficult area to quantify and something that our academic network is contemplating.

Reporting on allocation will be provided once, one year after issuance. All proceeds will refinance projects and therefore the full amount raised will be allocated immediately which is why they have committed to reporting just once.

Underwriters: BBVA, Santander, Barclays, NatWest.

Where are the UK Corporates?

The UK has not been a large source of green bond issuance to date. While the City of London GFI and LSE are working hard to establish London as a green finance hub, banks and corporates have largely been MIA on domestic green issuance. Unilever and EIB in 2014, TfL and KFW, in 2015, the same names re-appear, then Belectric and the list starts to flag after that.

The UK doesn’t even rate in Climate Bonds list of Top 15 green issuing nations (counting supranationals as one group) from 2005 to 2017.

Could the Anglian Water and now this SSE issuance be the new green shoots we’ve been looking for?

Brazilian paper and pulp producer, Klabin just issued their inaugural green bond. This is the 9th Brazilian green bond to be issued.

Eligible projects fall under:

- Sustainable Forest Management:

- FSC-certified new planting and replanting activities

- restoration of native forests in degraded land and biodiversity conservation

- Renewable Energy, such as biomass recovery boilers

- Clean Transportation: acquisition of locomotives and train wagons to replace trucks transporting pulp; extension of existing railway lines

- Energy Efficiency: facilities upgrade and equipment optimizing energy consumption such as efficient electric engines, valves and pumps

- Waste Management: wastewater treatment, reusing and decreasing waste

- Water Management to reduce water consumption and increase reuse

- Eco-Efficient and Circular Economy Adapted Products, Production Technologies and Processes such as eco-responsible packaging

- Adaptation: biological control such as a pesticide substitute, fire risk prevention activities.

Wow, there is a lot to take into account! It’s difficult to unpack the greenness of each area until reporting on selected projects is published. However, there are no red flags and the framework appears robust, including the sustainable forest management category comprising only FSC-certified activities.

Second opinion provided by Sustainalytics.

Klabin reinforces the trend of Brazilian green bonds having a more prevalent agriculture or forestry component than their peers.

There’s a bigger sustainability story to watch here considering Brazil's pivotal role as a global supplier of agricultural and forest products.

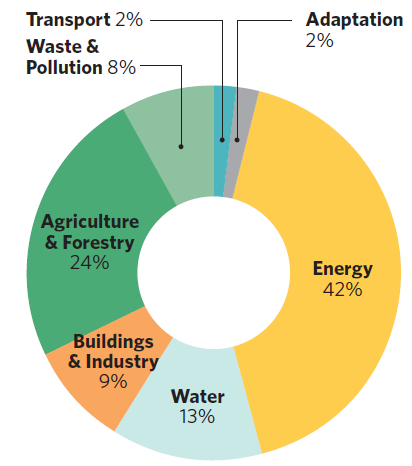

Brazilian’s green bonds use of proceeds

Source: Climate Bonds Initiative, Bonds and Climate Change: The State of the Market 2017 – Brazil Edition.

We’ve just launched our 2017 Brazil Edition State of the Market Report in both English & Portuguese. There’s a lot more inside.

Underwriter: BAML, Citi, Itau, Morgan Stanley, Santander.

Tenaska, Private placement – USD400m

Unlisted Californian independent power producer, Tenaska just issued their first green bond to refinance their 150MW Imperial Solar Energy Center West project.

Proceeds of the $400m private placement will be used to refinance capital and operational expenditures related to the acquisition, development, operation and maintenance of a PV solar power plant including engineering, legal, and project management costs.

Sustainalytics provided the second opinion which is good practice as private placements rarely have an external review.

Co-placement agents: Morgan Stanley, MUFG Securities and BNP Paribas.

French real estate company Icade successfully issued their inaugural green bond, almost 3x oversubscribed.

According to the green bond framework, proceeds will be used to finance or refinance:

- Investments in construction and/or renovation of Green Buildings meeting all three eligibility criteria:

- A minimum level of HQE ‘Very Good’ and/or BREEAM ‘Very Good’ certification

- Distance to public transport under 400m (defined as either bus, train, tram, metro, river shuttle, or private bus shuttle)

- Existing or planned set up of a Green Lease Committee “Comité Bail Vert” with its tenants, with a specific action plan regarding energy, carbon, waste and water*

- Energy efficiency and energy transition projects, according to the following criteria:

- Equipment achieving a minimum improvement of 20% in energy savings and/or 20% CO2 emissions reduction

- Renewable energy production projects such as solar, wind or geothermal

- Eco-mobility projects including electric vehicle charging stations and any infrastructure promoting the use of low-carbon transport solutions in urban areas, such as electric vehicles and bicycles.

Icade have placed strong minimum certification hurdles for buildings to be eligible, a very positive marker that puts them in line with best practice to date for green bonds for buildings.

For energy efficiency projects, a specific threshold relating to energy or carbon is a good step towards ensuring projects make deep cuts rather than marginal improvements.

We note, however, that 20% is not enough to meet the Climate Bonds Standard, which requires improvements of 30-50% depending on the life of the bond.

The allocation of the bond’s proceeds will be audited by PwC on an annual basis.

Sustainalytics provided a second-party opinion.

Underwriters: BNP Paribas, Credit Agricole CIB, HSBC, Natixis, Société Générale.

Well done Icade!

A general note about differing green building certification schemes

For green buildings, certification scheme varies widely in intent and strategy. This means that schemes such as HQE, BREEAM, and LEED (focused on energy) and the Climate Bond’s Building Criteria (focused on emissions) are not directly comparable.

Many schemes cover a range of broad “green” categories, including water use efficiency, healthy building materials, ease of access to public transport, that are weighted differently.

The Climate Bonds Low Carbon Buildings Criteria relies on tracking the emission performance of an asset against a local (city/regional) baseline to determine the ‘greenness’. As city and regional data is not always available, some existing schemes can be used as temporary performance proxies. Initial analysis has determined that assets achieving LEED Gold and Platinum are Climate Bonds Certifiable.

Other schemes, such as HQE and BREEAM will require additional analysis to determine whether their requirements meet the standards of the Buildings Criteria.

*"Green lease" is the name given to an environmental annex imposed by the Grenelle II.

According to this annex, the tenant and the owner will have to communicate to each other all useful information relating to the energy consumption of the rented premises. The tenant will allow the owner to access the rented premises to conduct works to improve energy performance.

The "green lease" is part of the range of actions aimed at increasing the energy efficiency of buildings by 20% by 2020 compared to the end of 2006.

Hanjin International – USD300m

South Korean-based Hanjin International issued their first 3-year green note at the end of September, backed by policy bank Export-Import Bank of Korea. Proceeds will exclusively refinance the debt associated to the deconstruction and the construction of the Wilshire Grand Center building in Los Angeles, which opened to the public in June 2017. It is expected to be awarded a LEED Gold level.

Sustainalytics provided the second party opinion.

Underwriters: BNP Paribas, Daiwa, Goldman Sachs.

Tus-Holdings Co., Ltd., Private placement – RMB350m (USD52.5m)

China based Tus-Holdings Co, is the former Tsinghua University Science Park Centre (TusPark Centre), responsible for developing, constructing, operating and managing TusPark.

TusPark is the largest university-initiated science park in the world, home to 1500 multinational R&D headquarters and domestic innovation enterprises.

All bond proceeds will be used to finance a solar farm developed by a Tus-Holdings’ subsidiary.

It’s a private placement and, while it is best practice for all bonds to disclose information publicly, it is quite common to have limited availability of information for private placements. As the proceeds will go to solar projects, this is fairly easy defined as green so we’ll include it, but will continue to track further disclosure.

Underwriter: Great Wall Securities.

Second opinion provided by CCXI (not publicly available).

CECEP Wind-Power Corp – RMB500m (USD75m)

CECEP Wind Energy is a subsidiary of China Energy Conservation and Environmental Protection (CECEP) - a key partner that Climate Bonds has been working closely with. This RMB500m (USD75m) inaugural issuance will be exclusively used to refinance 17 wind farms, which are expected to deliver the following environmental impacts:

- Energy generation 1m TCE/a

- CO2 reduction 2.8m t/a

- SO2 reduction 22k t/a

- NOx reduction 343 t/a

Underwriter: Zhongtai Securities.

Second opinion provider: CECEP Consulting (the document is not publicly available).

Municipalities/Cities

Santa Monica Public Financing Authority – USD68.5m

Santa Monica has issued its first green bond to finance the construction of a city services building and its related improvements. The project is expected to be completed by April 2020.

The building’s design is intended to meet the Living Building Challenge certification (LBC). According to the prospectus, LBC certification exceeds LEED platinum standards. It requires actual, rather than anticipated, performance demonstrated over twelve consecutive months. Components include ‘Net Zero Energy’ and ‘Net Zero Water’.

We haven’t come across this certification scheme previously but from initial research it seems to have high performance criteria.

In particular, the fact that certification is based on actual building performance similar to the Climate Bonds Low Carbon Buildings Criteria makes it a strong positive. Further, if it does indeed exceed LEED Platinum certification standard, this would certainly meet the requirements for the standard.

Underwriter: Morgan Stanley.

Region Skåne – SEK1.2bn (USD136m)

While this green bond was issued in October 2016, we have just recently come across it.

Region Skåne is the southernmost county of Sweden. Its green bond framework includes the following eligible categories:

- Low carbon buildings

- New constructions with at least 25% less energy use per m2 than required by applicable regulations and preferably a minimum silver Miljöbyggnad certification

- Major building renovations leading to a reduced energy use per m2 of at least 25%

- Energy efficiency: measures leading to improvements of at least 20%

- Clean transportation: non-fossil public and cargo transportation

- Adaptation: adaptation measures in buildings and infrastructure

- Renewable energy: wind, solar, geothermal, bioenergy and biogas from waste

As noted earlier, building certification schemes are not easily comparable. The Swedish Miljöbyggnad scheme is commonly used by Swedish issuers and covers a broad range of climate and other metrics.

In its external review, CICERO notes the following with regard to the Silver certification:

"It is a strength that Region Skåne requires additional energy requirements to the regulations. However, in a low carbon 2050 perspective the energy performance of buildings, is expected to be improved".

This is aligned with Climate Bonds’ view.

We note that there are potential pitfalls in using biogas and bioenergy. However, the majority of the energy sourced is locally produced, primarily from food waste. The second opinion notes that peat is not eligible.

As nearly a year has elapsed since the issuance, we are looking forward to seeing the green bond reporting.

CICERO’s second opinion on the issuer’s green bond framework is available here.

Underwriter: SEB.

Jujuy has just become the second Argentinian region to issue a green bond.

Jujuy will use its debut green bond proceeds for the development of its 300MW Cauchari solar park project, expected to be completed in May 2018. Proceeds may be used towards capital and operational expenditures allocated to the acquisition, development, operation and maintenance of the park. The full list of eligible expenditures is available here.

The province was awarded the project during the first national renewable energy tender offer of the RenovAr program in 2016.

The plants will be built on 600 hectares in the Cauchari Salt Flat at 4,000 meters above sea level. The panels will be supplied by Shanghai Electric.

The issuer will provide annual disclosure on its website until proceeds are fully allocated. Jujuy has committed to measure the net annual installed capacity in MW and the estimated CO2 annual emissions avoided.

Sustainalytics’ second opinion can be found here.

Underwriter: BCP.

Commercial Banks

Hypo Vorarlberg – EUR300m (USD360m)

Austrian commercial bank Hypo Vorarlberg issued its first green bond, becoming the second Austrian issuer to date.

Proceeds will finance mortgage loans or investment in residential (98% allocation) and commercial (2%) buildings. The green bond framework states that buildings are eligible if:

- They meet the State of Vorarlberg energy efficient building criteria and therefore have received residential building subsidies or

- Have not yet received but fulfil criteria (below).

This is based on the State of Vorarlberg’s residential building subsidies which are provided for the construction of residential housing (new, conversions or additions). To obtain a subsidy, stricter energy consumption than the minimum standards of the Austrian federal standard have to be achieved (more detailed in the green bond framework).

In effect, this means that eligible buildings must achieve the following performance:

- Residential buildings with subsidies: 45kWh/m2 maximum energy consumption - equivalent to class B

- Residential buildings without subsidies: 50kW h/m2 maximum energy consumption

- Commercial green buildings with a maximum energy consumption of 20kWh/m2: class B, for buildings constructed up to 2012 and LEK-Wert of 25 for buildings after 2013 (LEK-Wert is a measure of the thermal quality of the building envelope).

Great that there are maximum energy consumption thresholds in place!

How stringent are they? This is hard to assess without having background knowledge on energy consumption norms within the residential and commercial buildings sector.

It would be useful to have something to compare these metrics against like average energy consumption in buildings across Europe or Austria. In the absence of this, they have provided an equivalent certification level (Class B) of the Austrian Institute for Structural Engineering.

Again, to assess the stringency, a bit more information is needed about how this compares to other standards. We note that the proposed go from Class A++ to Class G, meaning Class B is the 4th most stringent of the nine classes.

Reporting will be made available on the bank’s investor relations page. It will include a description of the energy features of the buildings financed (for example C02 emissions, heat demand) as well as the amount of C02 avoided (compared to similar buildings in Austria).

Well done Hypo Vorarlberg!

Oekom’s second opinion in German on the issuer’s green bond framework (English).

Underwriter: ABN Amro, DZBK, Erste, HSBC.

Huishang Bank – RMB1bn (USD154m)

Headquartered Hefei City, Anhui Province of China, the bank serves local economy and SMEs in that region. The RMB1bn (USD154m) issue will support the province to green its resource intensive industrial structure. All proceeds will be used for “Environmental Restoration” projects, including land restoration and water quality recovery through drainage works and silt removal in completed mining sites.

Projects financed by this bond aim to reclaim an ex-mining land area of more than 2,500ha by methods such as hydraulic filling in granular soils caused by mining, and recover a water area of more than 2,000ha by replenishing and cleaning surface water and ground water.

These projects will focus on completed or abandoned mining sites which is generally a good thing although the techniques being employed are technical and not easily assessed. Land Use Criteria are still being developed by Climate Bonds’ Standards Team and mine reclamation in general still needs to be examined.

Underwriter: GuotaiJunan Securities, China Construction Bank, China Merchandise Bank, GF Securities.

Second opinion provider: EY.

Bank of Dongguan – RMB2bn (USD306m)

Bank of Dongguan operates as a regional bank in Guangdong Province of China.

The proceeds of its very first green bond will go to:

- Clean Energy: Wind farm in Qingyuan City, Guangdong Province

- Pollution Prevention and Control: include construction and improvement of sewage plants and drainage pipelines, 15 projects to be financed

- Clean Transport: purchase of LNG buses

- Adaptation: include waterway dredging, four projects to be financed.

There is an ongoing discussion about the role of public transport powered by fossil fuels in a transition to a low carbon economy. This was included in deliberations by the low carbon transport working group. In the end, most bus transportation is included, even that powered by fossil fuels. This is because although fossil fuels like liquefied natural gas (LNG) do not guarantee low emissions of all pollutants, emissions are measured on a per passenger basis making them much lower emissions than many other forms of transportation. In the future, these criteria will likely become more stringent as efficiency improves and as electric and alternative fuel buses diffuse.

Dredging is a difficult area, as we have noted before, because this activity can lead to both positive and negative environmental outcomes depending on the specific projects. We will look into this in more detail as reporting becomes available.

Underwriter: China Securities, China CITIC Bank.

Second opinion provided by EY.

Nanhai Rural Bank (NRC Bank) – RMB300m (USD45m)

NRC bank is based in Foshan City, Guangdong Province of China. Guangdong is one of the five pilot zones to promote green finance launched by the State Council earlier this year.

The proceeds will be used to finance 41 projects divided in 4 categories under PBoC’s Green Bonds Endorsed Project Catalogue:

- Pollution prevention and control: include urban sewage and drainage construction and improvement (10 projects)

- Resources conservation and recycling (19 projects)

- Energy saving: include investment in industrial efficiency equipment, efficiency improvement of industrial process and green buildings (8 projects)

- Ecological protection and adaptation (4 projects).

Although specific numbers of projects have been disclosed under each broad category, there is no detailed information on types of those projects. We include this bond for now, but more careful research will be carried out when further disclosure is available in the future.

In the Ecological Protection and Adaptation category, PBoC’s green bond catalogue includes mostly projects in soil and water loss control, ecological protection of forests and prairies, and also allows national park and national geological park to be financed.

Underwriter: CMS.

Second opinion provided by CECEP Consulting.

China Development Bank– RMB5bn (USD751.5m)

Although it’s the 3rd green bond issued by the China Development Bank this year, it’s the country’s first retail green bond! RMB600m (USD90.2m) out of the total RMB5bn (USD751.5m) bond will be available to individual investors on the OTC market. Proceeds are going to:

- A sewage processing improvement project in Xiangyang City

- Aquatic ecological restoration projects for 2 rivers in Xiangan City and Jingmen City.

The projects aim to remove contaminants from the water and improve the ecological resilience in the drainage area. Expected environmental impact:

- Biochemical Oxygen Demand (BOD) reduction: 365 t/a

- Chemical Oxygen Demand (COD) reduction: 6,091 t/a

- Suspended solids reduction: 5,785 t/a, etc.

River restoration is broadly positive so it’s great that this is happening. However, while the figures provided are useful, they would be far more useful with some additional context.

This could include as what the natural or safe level of BOD for a river is and whether these projects will bring the rivers to such levels. This is the direction the green bond market should be going in.

Underwriter: Bank of Hangzhou, Jiangnan Rural Commercial Bank, Hengfeng Bank, Bank of Nanjing, Zhongyuan Bank.

PwC provided the second opinion.

Sveaskog – SEK1bn (USD126m)

This is the second green bond issued by Sweden’s largest forest owner. The green bond framework states that the net proceeds will wholly or partly finance a selected pool of FSC certified forest and forestry related investments, projects and assets to promote a low carbon and climate resilient growth through sustainable forestry and its related operations.

Sveaskog will provide annual reporting until the bond matures, including a description of FSC projects/assets financed as well as disclosure on R&D investments.

DNV GL provided the second opinion.

Underwriter: Danske Bank.

Pending inclusion

Meggle’s Green Schuldschein – EUR50m (USD58.7m)

German dairy producer Meggle issued a green Schuldschein in September. The EUR50m (USD58.7m) will be used for already-implemented investments in the production.

Due to the lack of available information on the nature of the projects refinanced and their climate benefits, it is currently not possible to include this as a green bond.

We therefore hope to see more transparency in the annual green reporting published by the issuer at which point it may be considered for inclusion. To be continued…

Vigeo EIRIS provided the second opinion (not publicly available).

State of Lagos – NGN27bn (USD75m)

The State of Lagos issued their inaugural green note in August. News articles report that the NGN27bn issuance is the first tranche of a wider NGN50bn environmental and social impact investments plan. The State will use the capital raised to support solid waste management projects falling under the “Cleaner Lagos Initiative”, including increasing citizens’ awareness and training on waste disposal practices.

There is currently no green bond framework in place or external review making it difficult to assess the project’s environmental or climate impact. In particular, we are not able to ascertain whether or not the eligible projects will include landfill projects (which are not eligible under the Climate Bonds Taxonomy).

We look forward to reading the annual green bond reporting as well as any quantitative indicators of the waste reduction impact achieved.

Eidsiva Energi – NOK750m (USD93.7m)

Norwegian energy company Eidsiva Energi issued their debut green bond. According to the press release, proceeds will be used to finance any of the eligible categories included under the issuer’s green bond framework. However, this is not publicly available.

This bond is currently pending approval until more detailed information is available to confirm the green alignment of the eligible categories.

Should the annual green bond reporting disclose the specific technology and energy project(s) financed by the bond, we would have sufficient information to include the bond.

Underwriter: SEB.

Green Bonds Gossip and News Bites

The Astana International Financial Centre (Kazakhstan) is planning to issue a green bond within a year.

Berlin Hyp is planning its 4th green bond.

Quantum Solar Park has issued its inaugural Green SRI Sukuk of MYR1bn. More in our next market blog!

Massachusetts Bay Transportation Authority issued its inaugural Sustainability Bond. It look like a green transport bond from here.

We are seeing more stories mentioning green bonds coming out of Italy. Stay tuned.

Latvian development finance institution Altum plans to issue a E20m green bond.

Reading & Reports

Towards A Green Finance Network by the European Banking Federation outlining recommendations to facilitate growth of green finance, including the development of a common European taxonomy. 40+ pages must read.

UNEP Finance Initiative launched their Guide to Banking and Sustainability, providing a clear definition of what a sustainable bank looks like and laying out practical steps for bank practitioners to follow to be successfully recognised as sustainable.

This one of three Green Progress Reports from the G20 Green Finance Study Group (GFSG) underlines that green finance is gaining momentum and consolidating its presence within financial and capital markets.

Bonds & Loans have just released their “Sustainable Finance Emerging Markets Special Report 2017” with a Foreword by our CEO Sean Kidney.

In Brasil, lançamento em São Paulo: Edição Brasil - Títulos de Dívida & Mudanças Climáticas: Análise do Mercado 2017.

The IEA have just released its Energy Efficiency 2017 Report. A thorough 140+ pages analysis. Or skip to Chapter 4 (p90) to see the role green bonds can play around investment and securitization initiatives.

Offshore wind, Offshore solar, Tidal, Wave, Ocean thermal energy conversion and Salinity gradient electricity generation systems are all covered under our newly launched Marine Renewables Criteria for Climate Bonds Certification. More here.

ICYMI, green bonds issuance this year has surpassed last year's. Read more on our “Global green bonds overtake 2016 total” blog.

Moving Pictures

Take 4:25 secs to watch the UN Sec Gen Antonio Guterres call for action on the Sustainable Development Goals and the 2030 Agenda. He wants to end “unproductive and unrewarding” finance and redirect investment to creating a better world for all, which he noted, includes climate finance.

Don’t miss our short video clips (1:30secs) introducing our latest report 'The State of the Market 2017' in English, francais, Deutsch, italiano & español from our next generation of green finance advocates. Watch them on our YouTube channel here.

That's all for now.

'Till next time,

Climate Bonds

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.