Issuance continues to diversify, momentum grows in Mexico and Brazil, more big players from China all mark this month's Market Blog.

We’re also working on another tweak to formatting to help loyal readers keep up with the volume of issuance. It's all below.

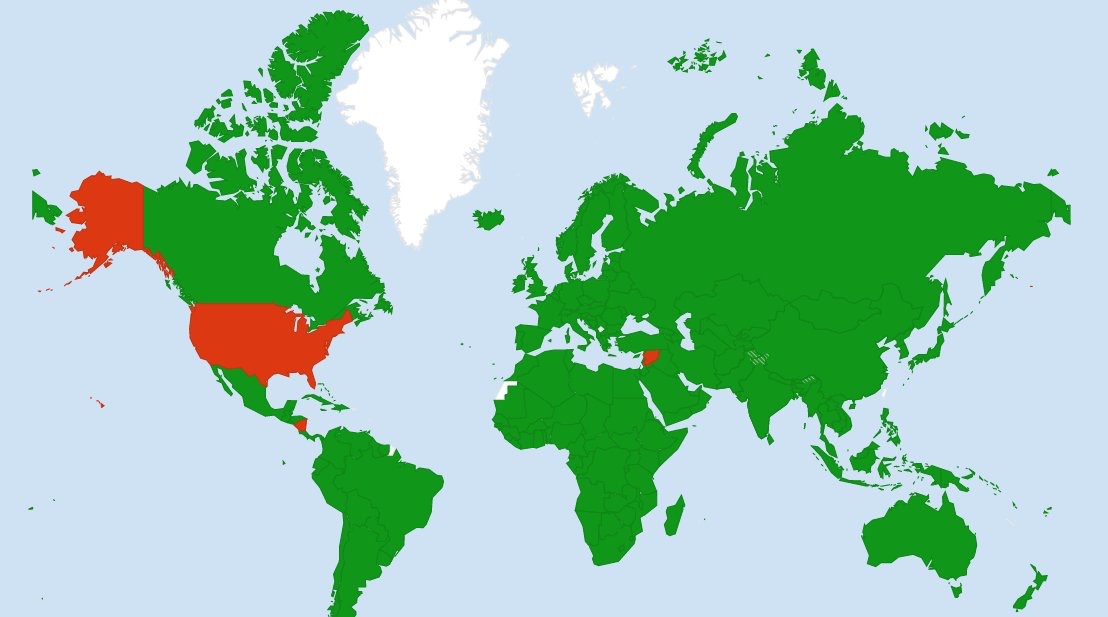

Map Reading 101: Three of these countries are not like the other ones…

Certified Bonds

San Francisco’s Bay Area Rapid Transport (BART) USD 384.7m

San Francisco’s transport authority ‘BART’ issued its first Certified Climate Bond this week after a roadshow earlier in May. The proceeds will finance or refinance projects that provide mass transit services through electric rail.

All projects must meet the Low Carbon Transport criteria under the Climate Bond Standard. The exciting news is that there will probably be lots more in the pipeline - last year, locals voted to pass a measure to issue USD 3.5bn in bonds to improve BART infrastructure. This is just the start of that issuance programme!

“Be Climate Smart Invest in BART” Retail Campaign

In another innovation BART opened an offer to direct to retail investors, with social media promotions across the network using the tag of ‘Be Climate Smart-Invest in Bart,’ which certainly has a nice ring to it.

The BART retail campaign follows the ground-breaking New York MTA “Invest in the planet-Invest in the MTA” of February 2016.

Well done to BART on taking this step!

The verifier's report is available here.

Underwriter: Barclays.

Yes, New York MTA is at it again as part of their ambitious green bond programme. This latest bond is for USD 680.2m.

Verification from Sustainalytics will be shortly uploaded here. See link to previous analysis here.

Underwriters: Samuel A Ramirez & Co. INC.

Quadran Energies Libres, EUR 46m Green loan private placement

Another French clean energy company Quadran Energies Libres (itself the result of a 2013 merger between JMB Energie and long term wind operator Aerowatt) has just issued a EUR 46m green loan to finance approximately 134MW of new wind energy and solar energy projects.

The issuer has committed to regular reporting in line with the Green Bond Principles.

The announcement (in French) is here.

Félicitations!

The verifier’s report will be shortly available here.

Some Format Changes:

We’ve more and more green bonds to cover, that’s why recent issues of the Market Blog have grown so large, so we are now separating the new issuers and re-issuance into separate tables.

We have decided to write detailed analysis for new issuers only. For your ease of reference, we’ll list them in a table and report individual stories in the body of the Blog as before.

For repeat issuers who are issuing against their original green bond framework we will continue to note the new issuance in the Repeat Issuers Table and refer you back to our original analysis or other source material.

New issuers

|

Issuer |

Size |

CBI Certified |

Verifier/Reviewer |

Issuer type |

CBI Analysis |

|---|---|---|---|---|---|

|

California Health (Kaiser Foundation Hospitals) |

USD 408.4m |

No |

Sustainalytics |

US Muni |

|

|

City of Lawrence, Kansas |

USD 11.4m |

No |

None |

US Muni |

|

|

Repsol |

EUR 500m |

No |

Vigeo Eiris |

Corp |

|

|

City of Norrköping |

SEK 600m |

No |

CICERO |

City/Muni |

|

|

City of Lunds |

SEK 750m |

No |

CICERO |

City/Muni |

|

|

China Development Bank |

CNY 5bn |

No |

PwC |

State-owned Institution |

|

|

Aquafin |

EUR 45m |

No |

CICERO |

Corp |

|

|

E.Sun Commercial Bank |

USD 60m |

No |

Deloitte |

Commercial Bank |

|

|

Bank SinoPac |

USD 45m |

No |

Deloitte |

Commercial Bank |

|

|

KGI BANK |

TWD 1bn |

No |

Deloitte |

Commercial Bank |

|

|

Davivienda |

COP 433bn |

No |

None |

Commercial Bank |

|

|

Denver City Water |

USD 142m |

No |

None |

US Muni |

|

|

Fort Bend ISD |

USD 47.5m |

No |

None |

US Muni |

|

|

Quadran Energies Libres |

EUR 46m |

Yes |

EY |

Corp |

|

|

Volvofinans |

SEK 700m |

No |

CICERO |

Corp |

|

|

Bank of Luoyang |

CNY 5bn |

No |

KPMG |

Commercial Bank |

|

|

State Grid Energy Conservation Service |

CNY 1bn |

No |

CCXI |

Corp |

|

|

Bank of Nanjing |

CNY 5bn |

No |

EY |

Commercial Bank |

|

|

CTBC Commercial Bank |

TWD 1bn |

No |

Deloitte |

Commercial Bank |

|

|

BART |

USD 384.7m |

Yes |

First Environment |

US Muni |

|

|

Bank Zachodni |

EUR 137m |

No |

None |

Commercial |

|

|

KommuneKredit |

USD 500m |

No |

CICERO |

City/Muni |

|

|

Celeo Redes Operación |

USD 379m |

No |

None |

Corp |

|

|

Longyuan Power |

CNY 2bn |

No |

PwC |

Corp |

Repeat Issuers:

For repeat issuers, we have listed the table below as well as links to information and past blogs.

|

Issuer |

Size |

CBI certified |

Verifier/Reviewer |

Link to our previous blog |

|

USD 680.2m |

Yes |

Sustainalytics |

||

|

Rhode Island Infrastructure Bank |

USD 11.35m |

No |

None |

|

|

NJ Environmental Infrastructure Trust |

USD 31.61m |

No |

None |

|

|

Massachusetts Water Resources Authority |

USD 254.7m |

No |

None |

|

|

City of Los Angeles |

USD 450m |

No |

None |

|

|

China Development Bank |

CNY 5bn |

No |

PwC |

|

|

Ygrene Energy Fund (GoodGreen) |

USD 176m |

No |

None |

|

|

Renovate America |

USD 232m |

No |

Sustainalytics |

|

|

Renew Financial |

USD 34.1m |

No |

None |

|

|

Senvion |

EUR 400m |

No |

DNV GL |

|

|

KfW |

EUR 2bn |

No |

Cicero |

|

|

Vasakronan |

SEK 115m |

No |

Cicero |

|

|

BNDES |

USD 1bn |

No |

Sustainalytics |

|

|

NIB |

EUR 500m(re-open) |

No |

Cicero |

|

|

EIB |

USD 1.5bn |

No |

None |

|

|

Asian Development Bank |

INR 3bn |

No |

Cicero |

|

|

Harbin Bank |

CNY 3bn |

No |

EY |

|

|

IREDA |

INR 7bn |

Yes |

Emergent Ventures |

|

|

Kommuninvest |

USD 500m |

No |

Cicero |

|

|

Entra ASA |

NOK 250m |

No |

Cicero |

|

|

Export Dev’t Canada |

USD 500m |

No |

Cicero |

|

|

Obvion |

EUR 594.2m |

Yes |

Oekom |

|

|

Alperia |

EUR 150m |

No |

DNV GL |

|

|

FMO |

EUR 500m |

No |

Sustainalytics |

|

|

Hero Future Energies |

INR 3bn |

Yes |

KPMG |

Corporate

Volvofinans, SEK 700m (USD 79.6m)

The bond from the finance arm of the famous car maker will back a pool of vehicle loans and leases that meet the following criteria:

- Meet the definition of ‘environmentally friendly cars’ in the Swedish Road Traffic Tax Act, and:

- Can be powered entirely or partially by non-fossil fuels, i.e.: electric cars, fuel cell cars, hybrid cars, natural gas.

Green bonds relating to cars have their own complexities – electric cars are in, yes, but hybrids are more difficult to measure.

This is what CICERO had to say in its opinion:

“Volvofinans Bank AB’s Green Bond Framework gets a Light Green shading. A darker shading would have required clearer guarantees that only best available technologies will be selected under the Green Bond Framework. Hybrid solutions qualify as bridging technologies and hence a medium green shading is within reach.”

“However, since battery capacity of most of these hybrids is still limited, and because hybrids (ethanol and biogas hybrids as well) also could run on petrol alone, and because there will be no tracking of real emissions these types of cars are graded light/medium green projects.”

"According to the issuer the majority of the existing car fleet is ethanol/petrol hybrids and biogas/natural gas/petrol vehicles.”

We couldn’t have said it better. This is light green not dark green.

Passenger Vehicles & the Climate Bonds Criteria

We also note that for cars to be considered green under the Low Carbon Transport Criteria of the Climate Bonds Standard, they must meet, or be below, a maximum emissions level of 85-90 grams of CO2 per passenger kilometre travelled (g CO2 p/km).

We also note that under the Low Carbon Transport Criteria of the Climate Bonds Standard, cars can be considered green only when their emissions per passenger kilometre travelled (g CO2 p/km) are equal or below a maximum level of 85-90 grams of CO2.

Using this data for fleet Volvo emissions, and, assuming that the car is used the majority of the time by one person, there are only a few cars that qualify, all of which are plug-in hybrids and have an estimated p/km emissions of 49g/km.

Now, we’re not sure which vehicle loans will be approved for this bond but, let’s hope it’s primarily Volvo’s most fuel-efficient hybrids.

The Volvo Green Bond framework is here.

Underwriter: SEB

Aquafin – EUR 45m private placement in 2015

This one was actually issued some time ago by the Flemish based wastewater company, Aquafin. Somehow we missed it and we’re sad we did, as it was a country first from Belgium.

The proceeds from the private placement will finance wastewater treatment infrastructure in the Flanders region of Belgium.

Eligible projects include:

- Mitigation: wastewater sludge to pellets; pellet ash to cement

- Adaptation: water purification, storm water management, pumping stations, wastewater transport infrastructure

- Water treatment: wastewater collection and treatment facilities

- Biodiversity projects: sanitation of water beds, disposal of sewage sludge.

The Green Bond Framework is here. Opinion from CICERO here.

State Grid Energy Conservation Service, CNY 1bn (USD 145m)

The State owned enterprise (SOE) State Grid Corporation of China is the world’s largest utility and sits comfortably at No2 on the Fortune Global 500 list.

State Grid Energy Conservation Company the bond issuer in this circumstance, is a directly managed subsidiary of State Grid.

All of the proceeds will refinance for its wholly owned subsidiary, the National Bio Energy Company (NBE).

NBE engages in the development and utilization of biomass energy. It constructs biomass power generation projects and extends the biomass industry chain by manufacturing and processing biomass fuels and recycling the biomass ashes. 16 biomass power plants are involved in the refinancing programme.

The bond has been reviewed by CCXI, who report the expected climate impacts of these projects include a decrease of nearly 1m tons coal equivalent (TCE) and a reduction of 2.4m tons of CO2 emission.

We’ll keep an eye out for more post issuance information.

Underwriters: Industrial Bank, Industrial and Commercial Bank of China.

Longyuan Power CNY 2bn (USD 291m)

China Longyuan Power Group Limited is the largest wind power producer in China and Asia. It is mainly engaged in designing, developing, managing and operating wind power plants, and selling the energy generated by its plants to its individual customers.

Proceeds will be used to finance 14 wind farms (1 offshore and 13 onshore) and refinance 3 onshore wind farms.

Second opinion was provided by PwC.

Underwriter: Huatai Lianhe Securities.

Commercial Banks

Latin America

Colombia's Davivienda, COP 433bn (USD 149m)

Colombia’s Davivienda issued a green bond in late April. The notes maturing in 2027 were sold exclusively to the International Finance Corporation (IFC).

The IFC is the sole investor in the bond offering. The issue has a tenor of 10 years and is priced at IBR +213bp.

The funds will be used by the bank in part to offer project financing to renewable energy, sustainable construction, cleaner production, and energy efficiency, with a focus on water, biomass, wind and photovoltaic solar energy.

This is the largest green bond issue by a private financial institution in Latin America and aligns to Colombia’s Paris COP 21 NDC commitment to reduce emissions by 20% by 2030.

Celeo Redes Operación, USD 379m

The Irish Stock Exchange (ISE) recently announced that Chilean energy services company Celeo Redes Operación which is 49% owned by giant Dutch pension fund APG, has just listed a green bond on the ISE.

Details have been hard to come by, but from the information we could find, it looks like it may be refinancing transmission infrastructure – this would be fine if it was connecting renewables to the grid, but there is no indication that this is the case so we will not include it in our numbers just yet.

China

Bank of Luoyang, CNY 1bn (USD 145m)

Bank of Luoyang is a Chinese commercial bank that focuses on serving small and medium sized enterprises. This is its first green bond (CNY 1bn, 4.7%) and was issued in May.

The proceeds of this bond will finance and refinance projects under the PBoC’s Catalogue.

Project categories and expected climate impacts of the projects to be financed are disclosed as follows:

- Energy Saving - reduction of 12k tons of coal equivalent (TCE), and 5k tons of CO2 emission;

- Clean Transportation - reduction of 159k tons of CO and 257k tons of CO2 emission;

- Pollution Prevention - reduction of 112k TCE, 133K tons of CO2 emission, and 5.2 tons of SO2 discharge;

- Ecological Protection and Adaptation - river dredging projects with a total length of 5.3km, and disposal of 54km3 sediments;

- Resources Conservation and Recycling - reduction of 11k tons of chemical oxygen demand (COD) and recycling of 23 tons of waste electrical and electronic equipment (WEEE).

A second opinion was provided by KPMG.

We’ll follow up as more information becomes available.

Underwriter: Zhongtai Securities.

Bank of Nanjing, CNY 5bn (USD 725m)

Issued on China's interbank market, this bond will finance or refinance projects under the PBoC’s Catalogue including: Energy Saving, Clean Transportation, Pollution Prevention, Ecological Protection and Adaptation, and Resources Conservation and Recycling.

The bank provides examples of eligible projects, including:

- Reconstruction of 5 sewage plants, which aim at reducing biochemical oxygen demand (BOD) and chemical oxygen demand (COD) discharges;

- Building ecological irrigation systems;

- Construction of underground lines;

- Projects that can increase the flow of a river by dredging;

- Green buildings that receive at least a 2-Star Certificate from the Evaluation Standard for Green Buildings, which is equivalent to LEED Silver.

As we blog, this is a widely-used Chinese domestic green building standard and was developed by the Ministry of Housing and Urban-Rural Development.

A second opinion was provided by EY.

Underwriters: Industrial Bank of China, Agricultural Bank of China, Galaxy Securities, BNP (China)

Taiwan

According to the official announcement: To assist green industry obtain capital, and promote environmental sustainability and a diversified domestic bond market, the Financial Supervisory Commission of Taiwan has overseen the formulation of a green bond promotion plan by Taipei Exchange (TPEx) and also approved its General Introduction to the Taipei Exchange Operational Directions for Green Bonds on April 18, 2017.

TPEx promulgated the Directions on April 21, 2017.

Upon coming into effect, four Taiwanese banks promptly issued green bonds, totalling USD 171m.

CTBC Commercial Bank, TWD 1bn (USD 33m)

CTBC commercial bank issued their first green bond in TWD to extend its loans to projects in four major categories outlined by the Taipei Exchange.

Board categories and eligible projects include:

- Development of Renewable Energy and Energy Technology: solar, wind and bio energy;

- Energy Efficiency and Energy Saving: industrial efficiency, green buildings and smart grid;

- Carbon Emission Reduction;

- Waste Control and Recycling.

Deloitte provided a second opinion for this bond.

E.Sun Commercial Bank, USD 60m

E.Sun Commercial Bank issued its inaugural green bond in USD, financing for the following eligible projects:

- Development of Renewable Energy and Energy Technology: solar and wind energy;

- Carbon Emission Reduction: mass rapid transit such as high speed train and metro;

- Water Resource Conservation and Recycling: sewage plants and other pollution treatments.

Deloitte provided a second opinion for this bond.

Bank SonoPac is another in this quartet of inital green issuers. All proceeds will be used to finance and refinance for a solar farm with designed capacity of 40MW. Pretty easy one - it's green! The project is expected to reduce 20k tons of CO2 emission every year.

A second opinion is provided by Deloitte.

KGI Bank’s first green bond, was issued under the Taipei Exchange’s Green Bond listing rules as well. Eligible projects include:

- Development of Renewable Energy and Energy Technology: solar and wind farms;

- Waste Control and Recycling: disposal of hazardous waste and recycling;

- Energy Efficiency and Energy Saving: industrial efficiency improvement;

- Carbon Emission Reduction: reduction of chemical emission.

A second opinion is provided by Deloitte.

Poland

Bank Zachodni WBK, EUR 137m private placement with IFC

We don’t know much about this one as it’s a private placement but the whole bond was placed with IFC – one of our hero development banks.

It’s the first green bond from a Polish commercial bank and the proceeds will be used to expand the bank’s climate portfolio including renewable energy, energy efficient buildings and ‘climate-smart’ equipment.

State-owned Institutions

China Development Bank’s CNY 5bn (USD 728m)

This is China Development Bank’s second issuance, however, its first issuance was excluded from our database for projects linking to coal, as we outlined in the March market blog.

Although the framework is the same as the first issuance, proceeds will be used for projects such as Energy Saving, Clean Transport and Clean Energy categories, etc. The examples of projects disclosed look very green, including:

- 2 intercity railway projects

- 1 onshore and 1 offshore wind farms

- 2 reforestation projects.

The expected environmental impact will be the reduction of 951k TCE, 2.2m tons of CO2, 591 tons of PM, 25.7k tons of SO2, etc.

External review was provided by PwC.

Underwriter: Bank of Ningbo, Agricultural Bank of China, China Construction Bank, Bank of China, Bank of Hangzhou.

Municipalities/Cities

Kaiser Foundation Hospitals – USD 409m and USD 575m

In May, Kaiser Foundation Hospitals issued their first green bond. The proceeds are intended for environmentally sustainable construction.

The Kaiser Foundation intend to select facilities based on their ability to achieve Gold or Platinum LEED (Leadership in Energy and Environmental Design) certification.

This certification process looks at design aspects such as:

- sustainable sites

- water efficiency

- energy and atmosphere

- material resources

- indoor environmental quality

- innovation in design

- regional priority

Sustainalytics have provided both a framework overview and a second opinion for the Kaiser Foundation.

Underwriters: Barclays, Citigroup, Goldman Sachs, JP Morgan, Morgan Stanley, Wells Fargo Securities.

This is a first for the Lone Star State and attracted widespread local media comment. Fort Bend is a fast growing school district south west of Houston and this green bond is a first from the education sector in the Lone Star State.

Proceeds are being used to finance construction costs relating to three new schools scheduled to open in August 2017 and the intention is for each school to receive LEED certification.

The prospectus states that while it is the Board’s intention for the buildings to achieve LEED status, ‘there can be no assurance that such certification or any particular minimum LEED certification level will be achieved for the Green Projects and failure to achieve any particular LEED certification level will not constitute a default under the Order.’

OK, yes, we do get that the prospectus is a very legal document and the US is a very litigious jurisdiction, so they are covering themselves. However, the aspiration to achieve any LEED certification does not, according to buildings experts, guarantee low energy consumption.

For this reason, experts working on the Climate Bonds Low Carbon Buildings criteria have put the minimum hurdle for inclusion at LEED Gold or Platinum.

The prospectus specifically states that the Board intends to provide notice of the schools opening on the website but, other than this, it does not intend to make any additional disclosures regarding the green projects. So, this bond is light green and it’s not fully in line with Principal 4 of the Green Bond Principles.

But it’s also a positive sign of green finance growing deep in the heart of Texas.

Well done to Fort Bend for taking this step.

Prospectus is here.

Underwriter: Siebert Cisneros Shank.

KommuneKredit, EUR 500m (USD 559.1m)

Denmark’s KommuneKredit has just issued its first green bond – becoming the latest of the Nordic municipality debt aggregators to tap into the green bond market.

KommuneKredit is a non-profit organisation with the objective to secure low cost funding for its members (Danish municipalities and regions).

The green bond framework has listed the following project categories as eligible:

- Water management: new investment in collection, treatment, recycling, reuse and related infrastructure

- District heating: new investment and ongoing maintenance in distribution infrastructure and maintenance and new investment of non-fossil energy generation and associated technical solutions

- Energy efficiency: energy efficient buildings and public street lighting

- Public transport: new investment and ongoing maintenance of non-fossil fuel transportation assets systems and infrastructure.

CICERO notes in its review of the bond that a weakness of the framework is that the categories are quite general which makes it difficult to ascertain best available technologies and solutions.

It also notes that because of the broad nature of the categories, it is possible that some may include fossil fuels – for example while new district heating project explicitly exclude fossil fuel projects, the maintenance of existing projects may depend on fossil fuels.

Further, for buildings, no certification schemes or minimum hurdle performance are stated in order for the buildings to be included. Similarly, investment in street lighting is very vague particularly when LED is well known to be the best technology street lighting that is currently available and very green.

Overall, we realise that the categories are broad due to the wide-ranging nature of KommuneKredit’s members but we also agree with CICERO’s judgement that the framework is medium green. We look forward to seeing more information soon.

A green bond committee approves applications for eligibility within this scheme.

Second review from CICERO is here.

Underwriters: CACIB, HSBC, SEB.

City of Lunds, SEK 750m (USD 85.1m)

Eligible projects under the green bond framework include:

- Renewable energy: wind, solar and bio-energy from agricultural residues

- Energy efficiency: district heating/cooling, energy recovery, energy storage and smart grids

- Transport: public transport, pedestrian/cycle ways, alternative fuel vehicles

- Replacement of fossil fuel raw materials – e.g. plastics to bioplastic

- Energy efficiency buildings: Miljöbyggnad Silver or reduction of 35% in energy use per m2.

- Waste management

- Water and wastewater management

- Adaptation of buildings, infrastructure and sensitive habitats

- Environmental measures: nature conservation, biodiversity etc.

Projects identified to date include: the extension of a tramway line, energy efficient housing at passive house standard (45kWh/sqm), and a rooftop solar project at the municipal court.

The framework gives the city a very wide brief and while there are no red flags, there could be further clarification around waste and wastewater management.

That said, the energy efficiency criteria are excellent and the projects outlined to date are, as CICERO’s rating suggests, dark green.

We also note that the ambition is to use the majority of proceeds for new projects.

Second review from CICERO.

Underwriter: SEB.

City of Norrköping – SEK 600m (USD 68.2m)

The city of Norrköping issued its inaugural green bond back in October 2016; we report it now as it has just recently come on our radar.

The city’s robust green bond framework was referenced in a second opinion from CICERO, available here.

Eligible projects fall under the following categories:

- Renewable energy (wind, solar, geothermal and biogas from waste);

- Energy efficiency:

- major buildings renovations leading to at least a 35% reduction in energy use per m2 and year;

- new constructions with at least 25% less energy use per m2 and year than required by applicable Swedish buildings regulations such as BBR and preferably a minimum certification of either LEED gold, BREEAM very good, or Miljöbyggnad Silver;

- Low carbon transport;

- Waste management (recycling and re-use; rehabilitation of contaminated areas);

- Water management;

- Adaptation and other sustainable initiatives (including nature and biodiversity conservation, and sustainable agriculture).

The municipality made it also clear that the proceeds will not finance any nuclear or fossil fuel activities.

It has already published its first green bond impact report in English.

The green bond portfolio is reported to exclusively finance projects:

- A sustainable housing project, “Kopparhammaren 2”

- A LED street lightning project: the SEK 60m investment resulted in an energy efficiency of about 46%

- Increased recycling by the introduction of multi-compartment containers for households: the estimated investment of SEK 70m aims to reduce CO2 emissions by about 2,500 tons equivalent/year

- Project Röjningen 3:1: An estimated SEK 150m will finance a new construction for the elderly, with a target of 33% less energy use compared to Swedish regulation BBR 21. The building is reported to be ready in springtime this year.

We applaud the municipality’s diligent reporting.

Nine Swedish municipalities have issued green bonds so far, Norrköping's October 2016 issuance was the seventh.

Sweden Green Munis are Growing

On a more general note, the Swedish green bond market displays an interesting characteristic: the number of green bonds raised by municipalities comes very close after corporates.

Swedish green muni issuance is also the second largest at the global level - the USA being the first (although a much larger overall market) - in terms of total municipal green bond issuance.

This is an excellent example of European green municipal leadership, financing key environmentally-friendly solutions at the local level.

Underwriter: SEB.

Denver City & County Board of Water Commissioners, USD 142m

Proceeds will be used to finance Denver Water’s main operating and administrative complex which was registered in October 2015 with the U.S. Green Buildings Council – it will be submitted for certification upon completion of construction.

The issuer outlines a number of environmental benefits including:

- Possible LEED certification;

- Significant energy efficiency through appropriate envelope design;

- The use of an existent water pipeline on site for radiant heating and cooling;

- A water reduction strategy that maximises use of non-potable water from an on-site ecological wastewater treatment system, rainwater capture;

- Recycling of construction waste.

For reasons stated above, our expert committee believes that buildings should aspire to the highest levels of LEED certification to ensure that they are in line with a low carbon economy or 2-degree trajectory which requires deep cuts to emissions.

That said, the issuer has outlined a range of innovative environmental benefits to the buildings and we are interested to read from later reporting (which has been promised) which level of certification the building achieves.

Prospectus is here.

Underwriter: BAML.

City of Lawrence, Kansas, USD 11.3m

The City of Lawrence issued its first green bond in May. Proceeds from this bond have been designated to projects primarily relating to energy efficiency. This includes upgrading existing heating systems, energy & indoor air quality improvements, new HVAC systems, LED retrofits, and many other projects.

The Prospectus lists over 20 separate projects that the bond will finance, including various buildings, parks area lighting and HVAC replacements.

While there is good disclosure of each project and the funds attributed to each, there is no information stating how these projects were selected.

Underwriter: Robert W. Baird & Co.

Excluded bonds

Repsol, EUR 500m

The Repsol Green Bond rightly attracted widespread attention.

The Climate Bonds view is here in our Repsol Blog from May 27th.

Environmental Finance have also covered the wider issues in detail including editorial comment by Peter Cripps and this challenging piece by financial commentator Keith Mullin discussing the bigger picture.

We welcome debate as part of the wider scrutiny of capex by highly exposed industries and companies.

The global carbon budget can’t be ignored. Brown to green financing needs to accelerate, companies need to develop and implement 2 degree compliant business plans.

No, this bond is not greenwashing, Repsol have good reporting and transparency, and yes its ‘incremental’ and yes we’ve excluded it.

You can read our full analysis here.

Liuyang Modern Manufacturing, RMB 900m (USD 130.5m)

50% of proceeds will finance and refinance the eligible industrial waste management and recycling projects. However, the other half will be used as the company’s working capital.

Although the NDRC allows issuers to use up to 50% of bond proceeds to repay bank loans and invest in general working capital, internationally, at least 95% of proceeds must be linked to green assets or projects.

Accordingly, this bond was excluded from our database.

Underwriter: Zhongtai Changcai Securities.

Bank of Gansu, CNY 1bn (USD 145m)

Included in the examples of eligible projects, coal gasification projects will be financed by this bond. While we recognise the positive environmental attributes of coal efficiency in the Chinese context, clean coal is not included in the Climate Bonds Taxonomy of eligible green assets.

Underwriter: Huatai Securities.

Bank of Changsha, CNY 2bn (USD 291m)

Proceeds of this bond will be used to refinance three hydro stations, with 12 MW capacity respectively.

Although small hydro is generally thought to have less emission impacts, underlying assets that have a large combined capacity, which is 36MW in this case, has made the assessment of this bond a complex question.

For this reason, we have been excluding them from our database pending completion of our Hydro Power Technical Working Group (TWG) process.

Underwriter: Zhongtai Securities.

Gossip and News Bites

On the green horizon

Berlin Hyp - new green pfandbrief from Berlin Hyp out.

City of Cape Town is also looking to issue a green bond in the coming months, following in the footsteps of Johannesburg who have done so previously.

Mexico City is planning water-related green bonds of MXN 1bn.

Russian Minister of natural resources and ecology Sergey Donskoy has piqued our interest with his proposal to introduce the "green bond" in Russia.

Sovereign and Policy News

India’s SEBI releases guidelines for listing.

Reading and Reports

European Policy Strategy Centre

Financing Sustainability-Triggering Investments for the Clean Economy

18 pages. So new we haven’t had time to look through it yet.

UN ESCAP (Asia and Pacific)

Tapping Capital Markets & Institutional Investors for Infrastructure Development

At twenty four pages it’s a succinct read. We particularly like Section 3 on Investment Modalities.

UNEP:

UN publishes second briefing of its green finance series "Greening the Financial System: Enhancing Competitiveness through Economic Development” after the first one in May 2016.

4 pages, a quick read.

American Bar Association Enviro, Energy and Resources July 2016 Newsletter:

We missed this originally, but we’re happy to see more lawyers reading four pages devoted to Green Bonds: Managing Risks & Rewards to Achieve Climate Mitigation Goals.

Green Bond Funds and Investors

Largest emerging market GB fund ready to launch.

NRW Bank launches Green Bond portfolio.

Union Investment has launched a green bond fund.

Dutch pension fund PFZW starts investing in green bonds.

Knight & Mackenzie Partners to invest into emerging Green Bonds.

Afore XXI Banorte wants to invest up to MXN 50bn in green bonds.

IFC Invests in Turkey’s First Mortgage Covered Bond in Local Currency to Boost Green Mortgages.

Other market news

Innovative financing and marketing of green bonds from BofAML.

New S&P Global Green Evaluation Service announcement.

French RATP Group launches a Green Bond issue.

World Bank planning $2bn green bonds for Peru.

Australia gets first P2P green loan marketplace.

Italian Group CAP planning a EUR 40m green bond for September.

Luxembourg Stock Exchange extends green universe to SRI.

Moving Pictures

Brazil: Climate Bonds Executive Dialogue: Investment potential for Brazil's Low Carbon Economy held in São Paulo. Narrated by Justine Leigh-Bell: 1.51 secs.

USA: 'Green Bonds in Focus:' William Sokol, from Van Eck and Justine Leigh-Bell, discuss green bonds, retail investment trends and global directions: 12:43secs.

Massachusetts: State Treasurer Steven Grossman discusses the Massachusetts experience, investor responses and use of green bond proceeds to help the environment. Via Bloomberg: 5:19secs.

Kenya: Extended interview with Central Bank Governor Patrick Njoroge on boosting Africa’s capital markets and green bonds: 28:13sec

Mexico: Green Bond Statement: Inversionistas firman declaración de Bonos Verdes. Via NuestraVisión (Spanish): 30secs.

France: President Macron 'Make Our Planet Great Again' (English): 3:06secs.

California and China sign new Climate Deal: 52secs.

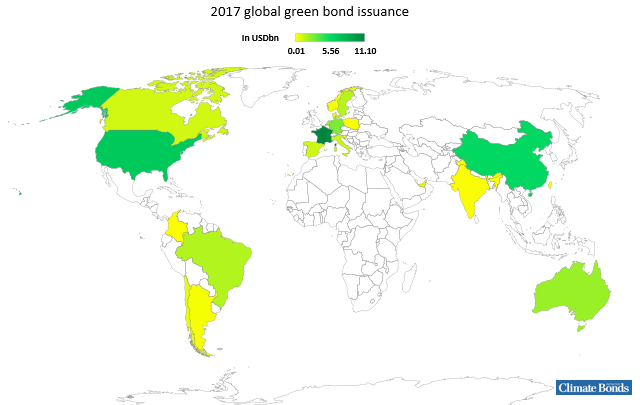

Chart of the Month: Global Green Bond Issuance as of 1st June 2017

‘Till next time,

Climate Bonds Markets Team

Disclosure: Several organisations named in this communication are Climate Bond Partners. A full list of Partners can be found here.

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the merits or otherwise of any investment or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.