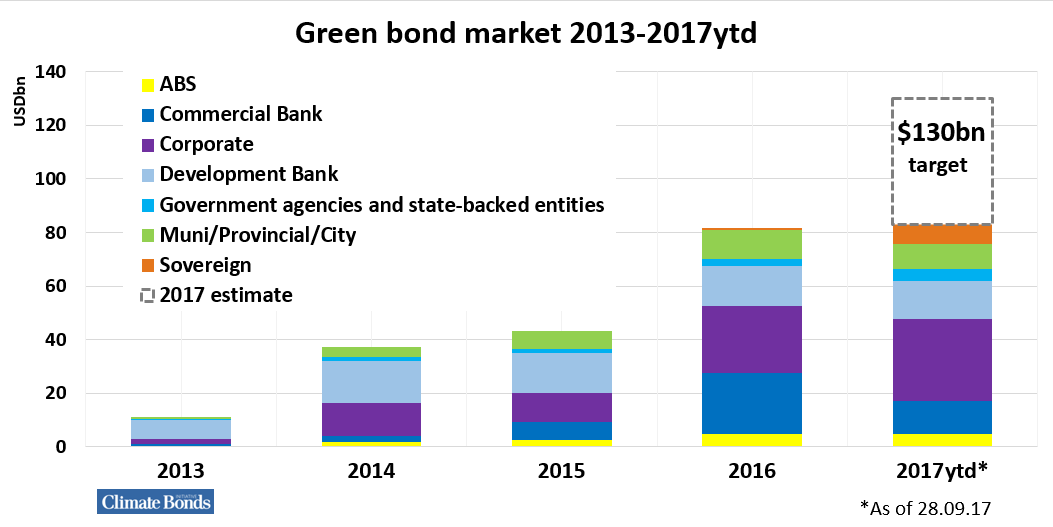

Late September news to celebrate! Green bond issuance in 2017 has just reached $83bn as of yesterday.

What’s it all about?

The record 2016 green bonds total of USD81.6bn has been surpassed. As at 28th September, USD83bn in green bonds have closed.

Ninety four (94) days left to reach our longstanding $130bn forecast for 2017.

Latest green issuance from New York MTA, New York State Housing Finance Agency, Engie and the EIB have tipped us over the 2016 line.

At a Glance - Growth since 2015

The late September movers

New York MTA have just finalised their latest USD662m Climate Bonds Certified green bond, with Sustainalytics providing verification.

MTA is one of the large issuers who have adopted our streamlined Programmatic Certification process for green issuance.

This is their 6th green bond since February 2016, for a cumulative total of USD3.4bn.

New York State Housing Finance Agency is another large issuer to use the Programmatic Certification process.

Their latest is a USD40.9m Climate Bonds Certified green bond under the Low Carbon Buildings Criteria.

This is HFA’s 5th green bond, totalling USD275m since December 2016.

On the 28th, Engie closed a EUR1.25bn (USD1.5bn) green bond. It’s their second for 2017 and third issued since 2014, for a total of USD6.6bn.

Vigeo EIRIS provided the second opinion.

The EIB re-opened their August 2017 Climate Awareness bond on the 28th adding AUD200m to the original AUD125m issuance.

Here’s a peek at all the Top 3’s for 2017 to date

Top 3 Issuers (amount issued):

- Republic of France: $7.5bn

- EIB: $4.6bn

- Mexico City Airport: $4bn

Top 4 issuers (number of deals**)

- EIB: 5

- Fabege: 5

- New York State Housing Finance Agency: 4

- New York MTA: 4

Top 3 nations:

- France: $14.7bn

- China: $12.2bn

- USA: $11.7bn

Top 3 issuer types:

- Corporates: $30.4bn

- Development banks: $14.4bn

- Commercial banks: $12.1bn

At a Glance-Growth since Jan 2013 & the $130bn 2017 target

$130bn by Dec 31st?

Our State of the Market Report 2017 – just released at Climate Week NYC – detailed global issuance up to 31st June and we reiterated our earlier $130bn forecast for 2017.

There’s still plenty of headroom for banks and corporates to increase their green issuance.

At this week’s PRIinPerson Berlin conference Christiana Figueres issued a challenge to institutional investors worth $70tn in AUM to lift green investment between now and 2020.

With USD70 trillion in their pockets, such a group should be able to generate a mere $47bn of new green issuance by Christmas.

The Last Word

You’ll hear more from us on all the highs and lows of Q3 in early October. And watch this space for the next Market Blog, coming soon.

Just to note – different organisations have different methods for calculating totals for 2016 – ranging between $80 and $90bn. Hence, the public reporting varies.

Climate Bonds Initiative regular reporting only includes green bonds (not ‘social’ or ‘sustainability’ bonds) that fit inside our rigorous definitions and Taxonomy, around what constitutes a green bond and where we’ve been able to find sufficient documentation to make a reasonable assessment.

Our figures may not be the largest, but they’re the greenest.

‘Till next time,

Climate Bonds

**not including new taps of existing bonds or multiple tranches of the same deal

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.