Reach of science based Standard extended

Marine Renewable Energy joins the suite of sector Criteria already available; Wind, Solar, Geothermal, Transport, Buildings & Water

More in the pipeline

![]() Today, we’re excited to announce the release of the Marine Renewable Energy Criteria for use under the Climate Bonds Standard.

Today, we’re excited to announce the release of the Marine Renewable Energy Criteria for use under the Climate Bonds Standard.

This release means that marine renewable energy investments are now eligible for Climate Bonds Certification.

What’s in the Marine Renewable Energy Criteria?

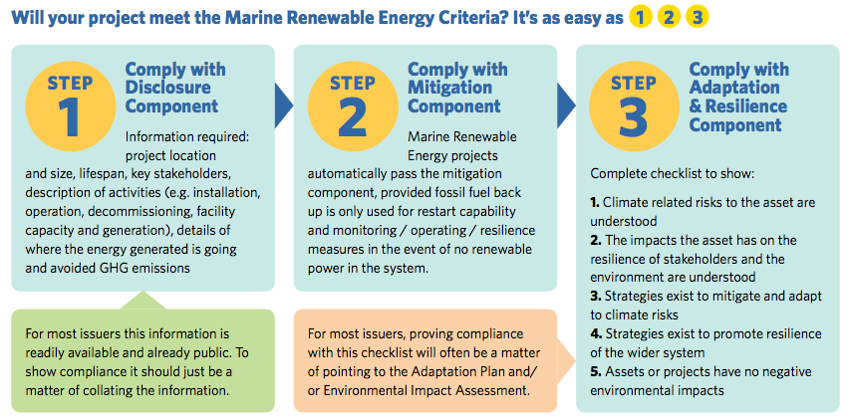

These Criteria lay out disclosure, GHG emission mitigation and climate adaptation and resilience requirements that marine renewable energy investments must meet to be eligible for Climate Bonds Certification.

Bonds seeking Certification must also meet the reporting and transparency requirements of the overarching Climate Bonds Standard.

Why a Marine Renewable Energy Criteria?

A diverse array of technologies are being developed and deployed to harness clean power from tides, waves, ocean currents, offshore wind, offshore solar and salinity and temperature gradients. Technology convergence has not yet occurred and new applications continue to emerge.

As technologies progress from research and prototyping to commercial scale, marine renewable energy offers potential to meet power needs. However, more investment in the sector is imperative to realise this potential.

The Marine Renewable Energy Criteria have been designed to encompass all marine renewable energy technologies, both the established and the emerging. The Criteria can be applied to offshore wind, offshore solar, wave power, tidal power and have been designed so that emerging marine renewable energy technologies can comply in the future. Find a brief summary here.

Where can I find more?

Further details on the Marine Renewable Energy Criteria can be found in three supporting documents:

- The Marine Renewable Energy Criteria Summary

- The Marine Renewable Energy Criteria

- The Marine Renewable Energy Background Document

Isn’t all renewable energy already climate friendly?

Put simply: yes, renewable energy generation replaces fossil fuel energy generation and accordingly is climate-friendly.

Increased renewable energy generation capacity and associated climate-resilient infrastructure is essential to move to a low carbon economy and is definitely in-line with limiting warming to 2°C – the key principle we guide all our Sector Criteria by.

However, distinct Criteria for marine investments is now necessary for the following reasons:

- To ensure sufficient transparency and disclosure

- To confirm facilities do not rely on substantial fossil fuel back-up and

- To confirm the climate resilience of the assets.

Three Steps for Marine Renewable Energy Certification

What Marine Technologies are covered?

The Criteria apply to ALL marine renewable energy technologies and related dedicated infrastructure, such as;

- Offshore wind

- Offshore solar

- Tidal

- Wave

- Ocean thermal energy conversion

- Salinity gradient electricity generation

- And, any other new marine renewables technology that may emerge as the sector expands

Why is Marine Renewable Energy so important?

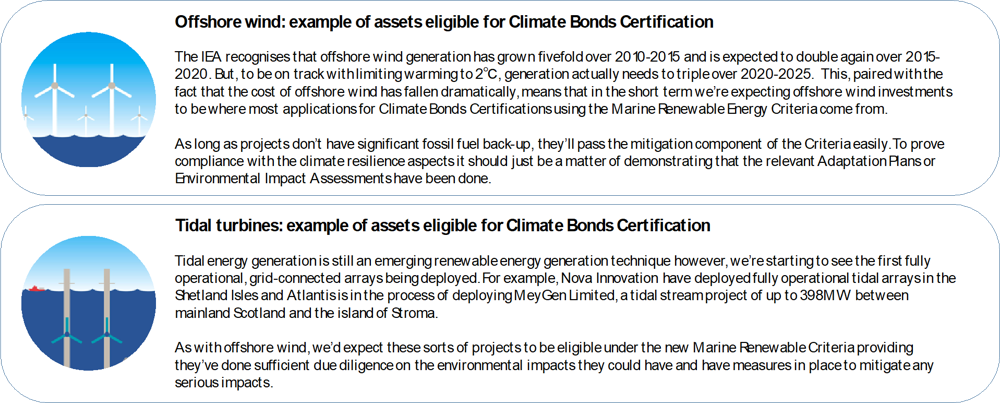

Marine renewables are a growing and essential part of the future energy mix. The IEA recognises that the energy mix is being redefined and increased renewables capacity, alongside nuclear, will supply most of the demanded growth.

They also recognise that sustainable energy systems need to feature diverse energy sources. Marine renewable energy is a crucial generation technology for helping provide this diversity.

In recent news, the cost of offshore wind has fallen dramatically since the results of competitive auctions for new contracts to provide clean electricity were announced. Both onshore and offshore wind compare well or are becoming cheaper than gas and nuclear.

As we see more offshore wind being developed, this Criteria and green bonds can play an important role in helping developers access the finance they need.

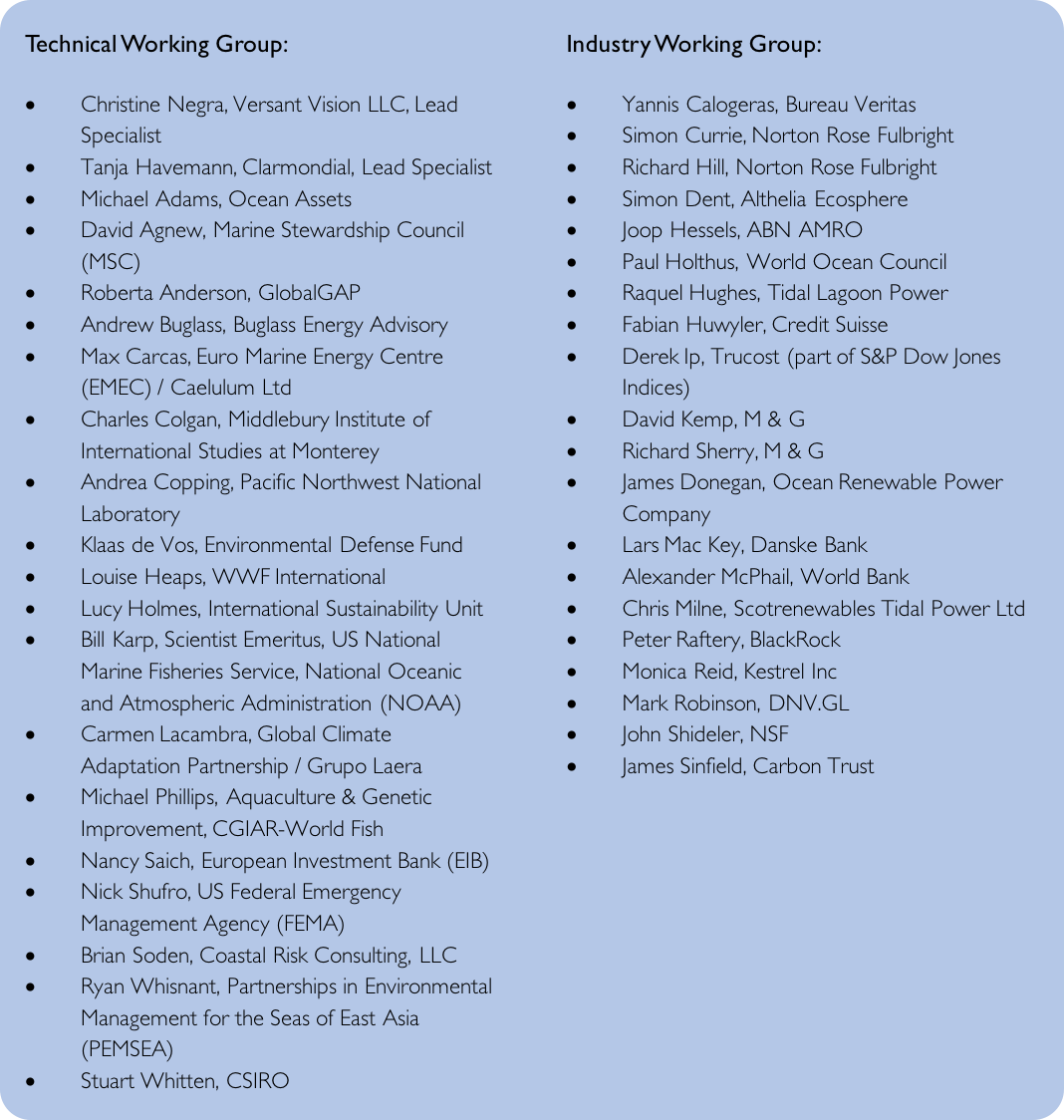

Who developed the Marine Renewable Energy Criteria?

To develop the Criteria we convened a Technical Working Group (TWG) and an Industry Working Group (IWG). The TWG was convened in April 2016 with the remit of developing Criteria for marine renewable energy, fisheries, aquaculture and coastal infrastructure. Wind & Solar projects have been available for Climate Bonds Certification for some time, from this point offshore wind and offshore solar projects will be evaluated using this Criteria which are more specific to marine based energy and ecosystem issues.

The IWG was convened specifically for marine renewable energy and provided feedback on the Criteria proposed by the TWG from an industry perspective.

Across the two groups there was representation from leaders and subject matter experts drawn from academic, NGO, issuer, investor and verifier backgrounds.

The Criteria also underwent public consultation.

A big thanks goes to our dedicated TWG & IWG for their instrumental role in developing these Criteria.

Who’s saying what?

Dr. Christine Negra, Versant Vision & Lead of TWG

“For marine renewable energy technologies to deliver on their full potential in a diversified global energy economy, we need scientifically robust Criteria that give investors the confidence to put capital towards pilot and commercial scale deployment.”

“These science-based Criteria deliver that confidence, helping investors to accelerate the global transition toward renewable energy sources, while ensuring that use of bond proceeds are aligned with the UN Sustainable Development Goal calling for sustainable use of marine resources.”

Dr. Andrea Copping, researcher at the U.S. Department of Energy’s Pacific Northwest National Laboratory & TWG member

“Offshore renewable energy has the potential to be a key provider of the energy the economy needs to transition to a lower carbon future. Siting considerations and requirements are extremely important with offshore arrays, more so than for onshore counterparts, and if not properly considered they can affect the success and power generation of the array.”

Paul Holthus, World Ocean Council (WOC) & IWG member:

“The World Ocean Council is pleased that Climate Bonds Initiative convened the development of Marine Renewable Energy Criteria for green investments. Scaling up marine renewable energy is an important part of the WOC work in support of the Sustainable Development Goals, and was a key topic at the WOC Sustainable Ocean Summit in 2016, as it will be again at this year’s SOS in Halifax in late November.”

“Over the next few years, marine renewable energy generation capacity needs to increase rapidly, and is a focus of the WOC Ocean Investment Platform. The Climate Bonds Initiative Criteria and Certification are a useful tool that developers seeking finance can use to prove the environmental credentials of their projects to investors. Using these Criteria and issuing in the green bond market will help attract new investors to the marine renewable energy sector.”

Mark Robinson, DNV.GL & IWG member:

“We are very pleased to see the Marine Renewable Energy Criteria for the Climate Bonds Standard being finalised for use after a constructive Working Group. These criteria set a benchmark for qualifying Marine Renewable Energy projects in green bonds including consideration of mitigation, climate adaptation and resilience with a focus on disclosure and quantified benefits.”

Anna Creed, Head of Standards at Climate Bonds Initiative:

“Releasing the Marine Renewable Energy Criteria is another step in the ongoing development of the Climate Bonds Standard and suite of Sector Criteria. The engagement and contributions from the TWG and IWG members ensures each new Criteria we launch is robust, comprehensive, has strong environmental credentials and takes into account climate resilience considerations.”

“This gives investors’ confidence in the benefits of Climate Bonds Certification. We expect to see initial marine renewable certifications in the next six months.”

Why seek Climate Bonds Certification?

Climate Bonds Certification allows issuers to demonstrate to the market that their bond meets industry best practice for climate change mitigation, adaptation and resilience, as well as for management of proceeds and transparency. Marine renewable energy has yet to made up a significant share of the green bond market and commonly accepted best practice or standards are still to be established in this sector.

Certification will signal investors that proper environmental due diligence has been done on the assets they are investing in. It’s a robust and credible way for this new asset type to enter the green bond market.

Other benefits of issuing a Certified Climate Bond include;

- Investor diversification: marine renewable energy issuers should find they attract new investors by certifying

- Greater investor engagement

- Investor stickiness: investors buying Certified Climate Bonds tend to buy and hold

- Strengthened reputation: certifying shows commitment to delivering low carbon infrastructure

- And a freeing up of balance sheets

The Last Word

The race is now on to become the first issuer of a Certified Climate Bond for Marine Renewable Energy.

Will it be offshore wind? Or maybe tidal?

We’re hoping to see a lot of issuance for these renewable energy facilities in the near future.

Also, keep an eye out for further announcements.

We’re expecting to release Water Criteria and Bioenergy Criteria for public consultation before the year’s out. Further developments in the marine sector are also not far off as our development of our respective Fisheries and Aquaculture Criteria continues apace.

And the new Standards 3.0 is on the way as well.

‘Till next time,

Climate Bonds

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.