Halfway through February, here's some of our favourite green bond stories so far...

MTA Latest USD 350m Certified Climate Bond

The Metropolitan Transportation Authority (MTA) looks set to offer New Yorkers access to their latest green bond offering, building on the success of the ground-breaking “Invest in the planet, Invest in the MTA” campaign of February 2016, which saw demand for the transit authority’s inaugural green bond upsized from USD 500m to USD 782m.

As part of the 2016 green bonds issuance, the MTA placed ads aimed at retail investors on the websites of media outlets that cover the New York region and over the air on New York-area radio stations.

Advertising in the Subway

This time around advertising has included their network of station displays; including on Penn Station and Grand Central Terminal and other digital displays on the subway system.

MTA are also going a step further by becoming one of the first green bond issuers to take advantage of the Climate Bonds new Programmatic Certification option, an addition on the just released Version 2.1 of the Climate Bonds Standard.

The programmatic approach allows issuers with large pools of eligible assets who aspire to be frequent issuers of Certified Climate Bonds - such as MTA - to issue multiple Certified bonds using a streamlined pre and post issuance reporting processes, while maintaining the environmental integrity that the Climate Bonds Standard ensures.

Sustainalytics has verified that from MTA’s 2010-2014 Capital Plan, a multi-billion pool exists of assets and projects that are eligible under the Low-carbon transport criteria of the Climate Bonds Standard.

We’ll have some details on this latest bond and the streamlining that Programmatic Certification offer repeat issuers in the next Market Blog due later in February.

Meantime, a big shout out to the MTA and our New York readers!

The latest China Green Bond Market Newsletter is out - 中国绿色债券市场季报

Our new Climate Bonds China Green Bond Market Newsletter is here.

Published in Both English and Chinese, issue No2 includes a summary of every Chinese green bond issued in Q4; including the Bank of Communications RMB 30bn (USD 4.3bn) issuance.

This was the biggest green bond issued anywhere in the world - until it was overtaken by the USD 7.5bn French sovereign earlier in January!

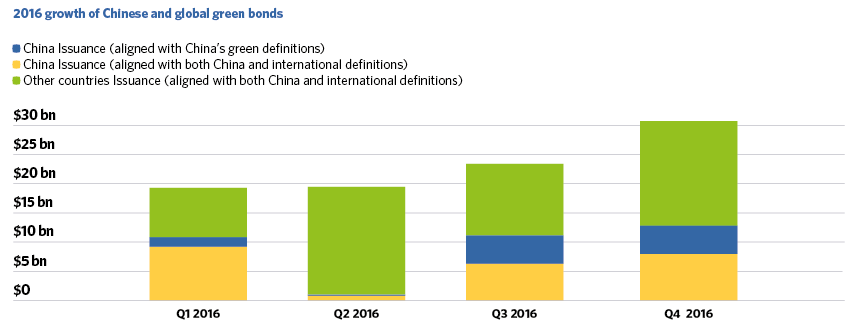

Getting bigger - China Aligned Green Bond Issuance Q1-Q4 2016

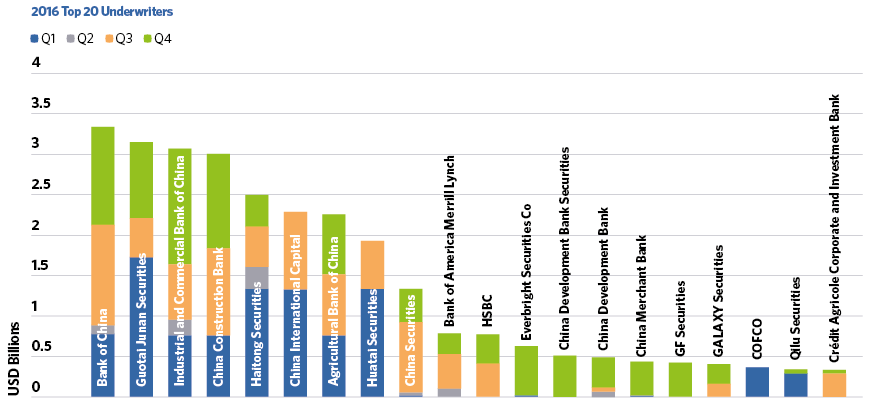

New: 2016 Top 20 Chinese Green Bonds Underwriters

From this quarter onwards, the newsletter will now include a league table of Chinese green bonds underwriters.

It’s another step to keep readers informed as the Chinese market grows.

To give some perspective the table below shows the final 2016 rankings.

Note that the Bank of China, already a prominent issuer, also tops the underwriters.

2016 Chinese Underwriters League Table

A Policy Update to watch:

A major policy update of Q4 was the 13th Five-year Plan on Energy, issued by the National Energy Administration of China in late November.

According to projections, to meet the Wind Energy component of the plan an estimated RMB 700bn (USD 102bn) of investment is needed.

Companies in the wind industry are encouraged to “utilise instruments such as green bonds and securitisation” as financing tools.

The plan is targeting many clean energy SOEs, including existing green bond issuers such as State Grid, Huaneng, Datang and CECEP.

There’s more inside: download the full PDF in both English or Chinese.

Big events in Australia and India

Indian Green Bonds Council Launches New Logo & 2017 Program

The Indian Green Bonds Council held its first meeting for the year in Mumbai.

A joint initiative between the Federation of Indian Chambers of Commerce and Industry (FICCI) and Climate Bonds, the Council has launched an ambitious agenda for 2017 including:

- Drafting policy recommendations that will integrate into a National Blueprint for the development of the Indian green bond market and guidance to Government on green finance directions.

- A schedule of green bond training programs facilitated by CBI, FICCI and supported by partnering organisations to build green finance capabilities.

- A series of major investor-focused events are also planned for later in the year including the third Green Infrastructure Investment Coalition (GIIC) India event and RE-Invest 2017, both focussed on fostering investment in sustainable infrastructure in order to meet India’s climate mitigation goals.

Who’s saying what

"The work of the Council ties in well with the Prime Minister's initiatives for building renewable energy and setting a benchmark for other countries.”

“There may be policy issues to address for investors and issuers of green bonds but it is worth pursuing as the momentum for green is now and here, and Council can bring this discourse upfront to all stakeholders.”

New Logo for 2017

The Council also has released their official logo, check it out:

Renew Power Goes to Market

Upsized from an original USD 450m target, this is Renew’s second Climate Certified issuance following a USD 73m private placement in October 2016.

You can read more details in our latest Market blog.

Live from Sydney: Low-Carbon Commercial Buildings Webinar

Last week in Sydney saw an expert panel on Low Carbon Commercial Buildings present to a live and online audience at our first webinar for the year.

Kindly hosted by NAB, speakers included Jorge Chapa, Executive Director of Market Transformation for the Green Building Council of Australia (GBCA), Ché Wall (Director of Flux Consultants and Lead Specialist) from our Low Carbon Buildings Technical Working Group, Emma Herd, CEO of the Investor Group on Climate Change (IGCC), and David Jenkins, Director of Capital Financing Solutions, GBs, DCM, Renewables & Clean Energy & Structured Finance at NAB.

We could tell you more, but why not take a shortcut?

All the expert presentations are available here. Have a look.

Australia and sustainable buildings

Australia is fast becoming a best practice example for Low Carbon Certification of buildings, with emission baselines now set for major CBD markets and Monash University the latest to issue a Certified Climate Bond, just before Christmas.

Local Climate Contacts

Further opportunities exist especially for Commercial Buildings and Significant Upgrades. Contact Rob Fowler (Melbourne) or Bridget Boulle (Sydney) for more info.

Missed the Webinar - The GBCA is holding another one

Don’t worry if you missed this one.

You can catch CEO Sean Kidney giving his global perspective on green finance, infrastructure and sustainable buildings during a special Webinar hosted by the Green Building Council of Australia on Wednesday, Feb 15, 2017 12:30 PM - 1:30 PM AEDT.

Contact the GBCA for details.

The Last Word

"I firmly believe that 2017 will be the year of green bonds for Brazil"

Our Director of Market Development, Justine Leigh-Bell, speaks to Bonds and Loans about the huge untapped potential of green bonds in LATAM and South America.

Go here for the very snazzy looking online edition of the Bonds and Loans January E-Magazine and flip straight to page 27 for the feature.

We’ve spoken often of green finance developments in Brazil, and the December 2016 Brazil's New Economy Forum in London signalled momentum for 2017.

Fibria has issued Brazil's 4th green bond and first this year, page 30 has some more in this story.

There’s more green announcements from Brazil in the pipeline, keep an eye out. Fiquem de olho!

'Till next time,

Climate Bonds

Disclaimer: The information contained in this communication does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative is not advising on the merits or otherwise of any bond or other type of investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.