Reports

-

Green Bond Pricing Paper (H1 2023)

The Green Bond Pricing in the Primary Market H1 2023 report is the 16th iteration of a leading series analysing the pricing dynamics of green bonds, examining how these instruments offer pricing advantages for issuers and investors.

-

Green Bond Pricing in the Primary Market: H2 2022

The Green Bond Pricing in the Primary Market H2 2022 report is the 15th iteration of a leading series analysing the pricing dynamics of green bonds, examining how these instruments offer pricing advantages for issuers and investors.

-

Green Bond Pricing in the Primary Market H1 2022

The Green Bond Pricing in the Primary Market H1 2022 Report, this is the 14th report in our pricing series, in which we observe how green bonds perform in the primary markets. This report includes green bonds issued in the first six months of 2022 (H1 2022) and in a first time analysis we saw greenium emerge for Sustainability-Linked Bonds (SLBs), covered in the spotlight section of this report.

Webinar:

-

Green Bond Pricing in the Primary Market H2 2021

The Report is the 13th iteration of a leading series analysing pricing dynamics of green bonds, examining how these instruments offer pricing advantages for investors and issuers alike.

-

Green Bond Pricing in the Primary Market H1 2021

Green Bond Pricing in the Primary Market H1 2021 is the 12th iteration in the series and monitors the performance of 56 EUR and 19 USD denominated benchmark size green bonds with a total value of USD75.9bn issued between January and June 2021.

Highlights from Q1-Q2 2021

-

Green Bond Pricing in the Primary Market H2 2020

Green Bond Pricing in the Primary Market H2 2020 reveals increasing signs of greenium in both public and private sector bond issuance in the second half of the year including performance of the inaugural German sovereign green Bund of September 2020.

-

Green Bond Pricing in Primary Market : H1 (Q1-Q2) 2020

This is the 10th iteration of "Green Bond Pricing in the Primary Market” covering January to June 2020.

The report monitors the performance of 38 EUR and eight USD denominated benchmark size green bonds with a total value of USD37bn issued during H1 2020.

The full series of Pricing reports is available here.

-

Green Bond Pricing in the Primary Market: H2 (Q3-Q4) 2019

The report monitors the performance of 36 EUR and 13 USD denominated benchmark size green bonds with a total value of USD36bn issued during H2 2019.

This is the 9th report, and the fourth semi-annual report, marking the period July-December 2019. Prior to 2018, reports were released every quarter, the first one being the Q4 2016 Snapshot.

-

Green Bond Pricing in the Primary Market: H1 2019

Green bond pricing in the primary market: January - June 2019 monitors the performance of 46 EUR and 15 USD denominated benchmark-sized green bonds with a total value of USD56.6

-

Green bond pricing in the primary market: July - December 2018

This is the 7th iteration in a long-term analytical series by Climate Bonds. It features a special EM section looking at China and guest commentary by Jason Mortimer of Nomura Investment Management in Tokyo, discussing the concepts around ‘greenium.’

For this report 24 EUR and 10 USD labelled green bonds issued in H2 2018 and totalling USD29bn were analysed. Eighteen out of 34 bonds are from repeat issuers.

-

Green Bond Pricing in the Primary Market: H1 (Q1-Q2) 2018

A semi-annual report assessing green bond pricing that commenced in January 2016 and is prepared on a joint basis with the International Finance Corporation (IFC).

-

Green Bond Pricing in the Primary Market: October - December 2017

Climate Bonds Initiative has released the fourth “Green Bond Pricing in the Primary Market” report analysing the performance of green bonds issued in the period October-December 2017. This is the last quarterly report; future publications will be produced semi-annually.

-

Green Bond Pricing in the Primary Market: July - September 2017

Green Bond Pricing in the Primary Market: Climate Bonds Releases Third Report in Series

Climate Bonds Initiative has released “Green Bond Pricing in the Primary Market” report analysing the performance of green bonds at issue July - September 2017. The report covers USD15.4bn, slightly over half of the combined face value of labelled green bonds issued in the third quarter of 2017.

-

Green Bond Pricing in the Primary Market: April - June 2017

Our Quarterly comparison between the behaviour of selected green and vanilla bonds in the primary market continues. The data sample expands further with the second report of the Green Bond Pricing in the Primary Market series.

-

Green Bond Pricing in the Primary Market: Jan/2016 - March/2017

Anecdotal evidence has suggested that green bonds are heavily oversubscribed and may price tighter than expected. This report explores the data to discover whether or not this is happening.

-

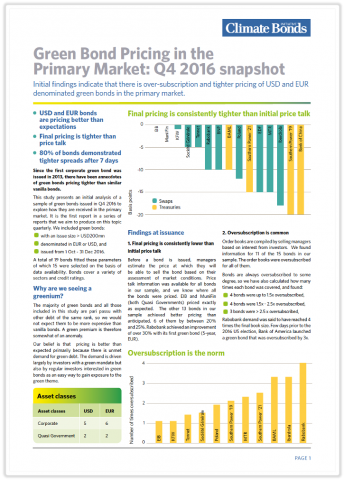

Green Bond Pricing in the Primary Market: Q4 2016

Initial findings indicate that there is over-subscription and tighter pricing of USD and EUR denominated green bonds in the primary market.