Welcome to the Markets Monthly!

We are still fine tuning our new format and would love to hear your feedback on how we reflect the market, analysis, new deals and selected reading.

For more information on the Climate Bonds Database on Market Data mail to: dataenquiries@climatebonds.net

Don’t Miss!

Climate Bonds Connected – Online Programme

Climate Bonds Connected is our new online programme with all the latest transition, green & sustainable finance developments. Webinars, podcasts and more.

Don’t miss our popular EU Taxonomy Explored – Talk with TEG Experts series. Every Thursday at 15:00 (Paris)14:00 (London).

Up next in the EU series is Adaptation & Resilience on 14th May. The full schedule is available here.

We are also launching our new Leading Climate Ideas series of webinars next week. The first will feature international green finance authority Dr Ma Jun, interviewed by Sean Kidney.

Latest in our ASEAN webinar series is The Pricing Benefit of Green Bonds on 11th May and Green Markets: How Much do Regulators Need to Regulate on 19th May.

Finally, don’t forget our Markets Monthly ‘Coffee Break’ Webinar. 15 mins of market analysis & conversation with Lea Muething, 14th May.

Latest Reports

The Green Bond Treasurer Survey 2020 is a first of its kind, unique interrogation of market experience to identify the core benefits and challenges of issuing green bonds and provide guidance to potential newcomers into green debt markets. 86 treasurers from 34 countries were interviewed for the project.

The report is an analysis of the issuance of green bonds and green loans in Southeast Asia. Following CBI’s first 2018 publication of this report, this 2019 report reviews the progress made across the regional green finance landscape and emerging opportunities for more green bonds, loans and sukuk amongst ASEAN nations.

The inaugural Green Infrastructure Investment Opportunities Vietnam report presents the key trends and developments for green infrastructure and energy in Vietnam. It was prepared to help meet the growing demand for green investment opportunities and to support the country’s transition to a low carbon economy. Click here for the Vietnamese version.

April at a glance

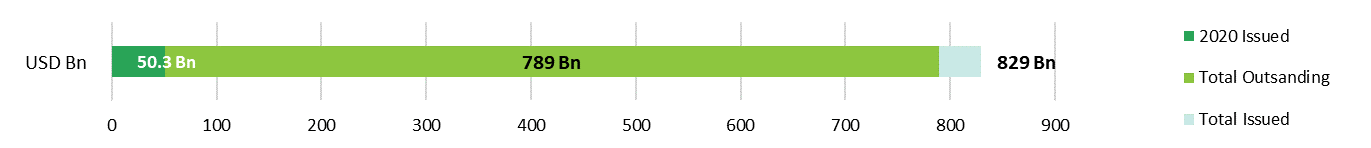

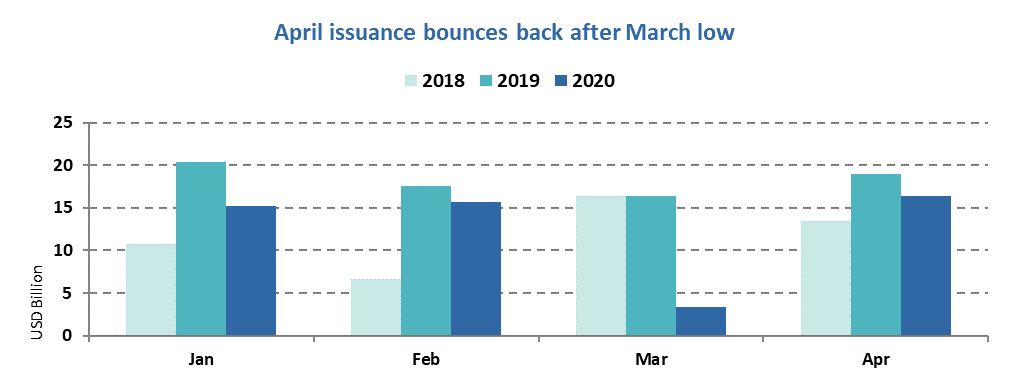

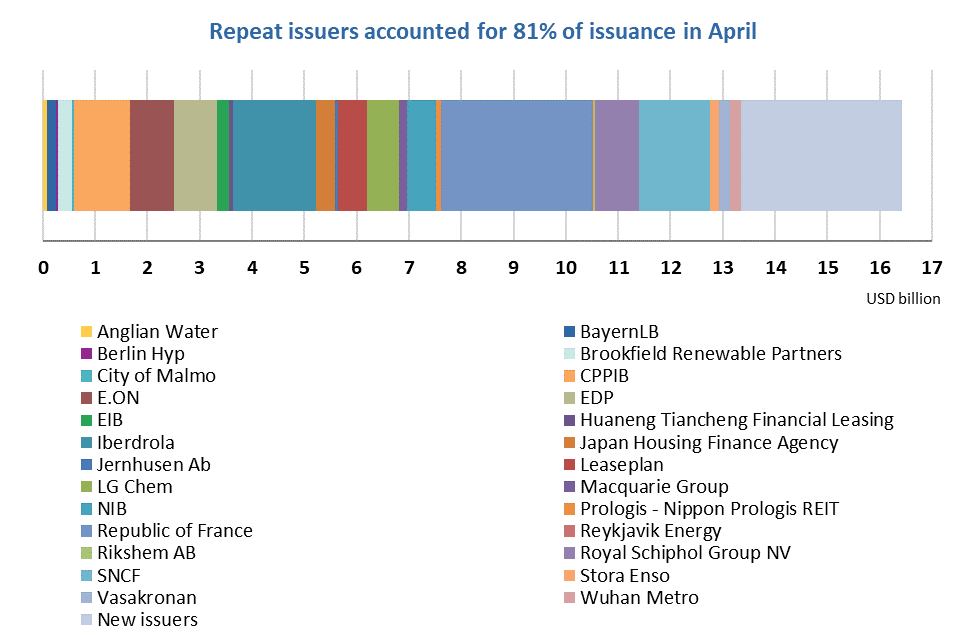

April 2020 saw green bond issuance of USD16.4bn which is the largest monthly volume this year so far. Despite this being a 14% year-on-year decrease, green issuance nearly quadrupled (+395%) compared to March 2020 (USD3.3bn). The boost takes overall cumulative global issuance on Climate Bonds figures to USD829bn.

The emerging signs of a recovery are welcome after most financial markets seeing some of their worst times in recent months due to the COVID-19 pandemic. Not only has green bond issuance bounced back to somewhat normal levels, organisations are also actively issuing social and particularly COVID-19 related instruments.

Getinge (Sweden) recently issued commercial paper that is solely dedicated to financing the expansion of production in ventilators and other life-saving equipment. Indonesia has issued a USD4.3bn bond to support the country’s battle against the pandemic, including funding for healthcare, social security and business resilience programmes. The market reaction to such bonds has been largely positive.

Many entities have offered their support: for example, Sustainalytics said it had expanded its internal taxonomy to include use of proceeds categories that relate to the current pandemic, such as healthcare and socio-economic impact mitigation. ICMA is supporting market participants with additional information through its social bond guidance including a Q&A section to address some burning questions on the topic of “COVID bonds”.

China has commenced issuing pandemic bonds at scale. Selected deals financing projects such as medical waste management for quarantine centres; rent reductions; and update and replacement of power generation equipment for epidemic prevention and control add up to USD3.1bn. China Longyuan Power Group Corporation Limited, an energy company, issued three such bonds in March and April, mainly supplementing operating expenditures and funding payment equipment leasing as well as wind farm maintenance fees for a subsidiary in Wuhan that is most affected by the pandemic.

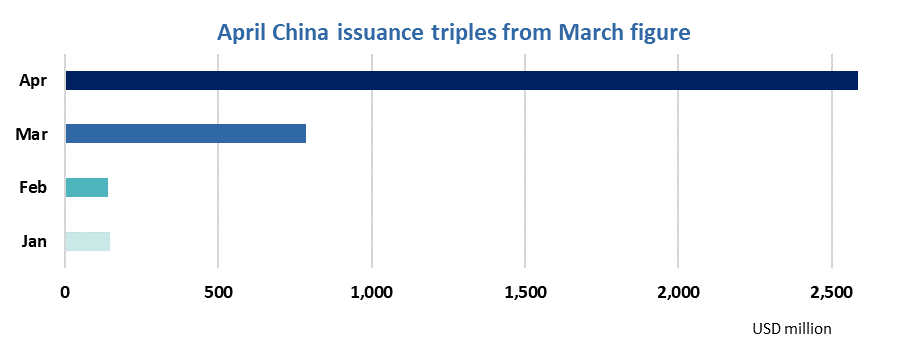

In addition to pandemic bonds, Chinese green bond markets are also recovering. After jumping from USD142m to USD786m between February and March 2020, China’s month-on-month green issuance has now more than tripled , adding up to a total of USD2.6bn. New issuers made up 89% of this with the largest deal (CNY10bn/USD1.4bn) coming from Huaxia Bank. The proceeds are mainly spent on renewable energy and water projects.

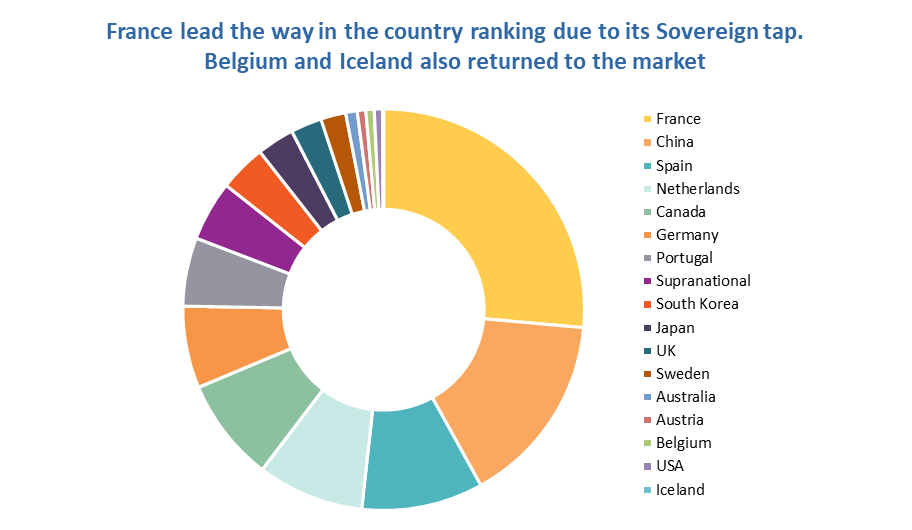

Another five countries joined China in logging issuance volumes above USD1bn in April 2020: France (USD4.2), Spain (USD1.6bn), Netherlands (USD1.4bn), Canada (USD1.3bn) and Germany (USD1.1bn). Canada last issued over USD1bn in a single month in July 2019.

France leads the country ranking mainly due to the Green Sovereign tap of USD2.9bn. There is more sovereign issuance to come.

Issuers from countries that appear on the rankings less frequently have also re-entered the market: Austria (EVN Group – EUR100m/USD111.2m), Belgium (Xior Student Housing – EUR100m/USD109m) and Iceland (Reykjavik Energy – ISK2bn/USD14m).

Overall, the above highlights some good signs that green bond markets in many nations affected by COVID-19 are showing early signs of recovery and the potential to replicate the month to month growth seen in China.

The road to green recovery

Greening of recovery and future growth remains high on the global agenda. At an international level calls from the IMF, the NGFS, ADB, major investor groups, business groups, including banking & insurance all share a constant theme around climate and sustainability being at the core of economic planning and policy by governments.

In the UK, there are calls for airline bailout packages to be tied to significant CO2 emission reductions, and the EU is in parallel eyeing ways to attach green strings to emergency funds for airlines. After the US crude oil benchmark West Texas Intermediate (WTI) monthly future contract prices settling in May crashed to below zero, France brought up the idea of implementing a carbon price floor.

In spite of the crisis and after Barclays’ commitment to net zero by 2050 last month, Shell has now announced the same ambition to be reached by 2050 and so did French oil major Total. In addition to the plan of issuing a green bond this year, Deutsche Bank has set up a sustainable finance team demonstrating its commitment to a greener agenda.

In the meantime, Robeco has revealed its first green bond fund and, following Larry Fink’s further commitment to sustainability, BlackRock has now launched its first global unconstrained ESG total return bond fund.

Worth reading

Japan's Ministry of the Environment has published updated green bond guidelines. The scope has been expanded to cover green loans and sustainability linked loans – Ministry of Environment (Japan)

Climate Bonds is continuing its collaboration with Japan’s Green Bond Issuance Promotion Platform, with the public release of two more reports. Japan Green Finance State of the Market 2019 and Financing Waste Management and Resource Efficiency both originally developed for the Platform.

…and:

- New guidance published for green and sustainable loans - LSTA

- Russia's bond market is going green - Environmental Finance

- Building Back Better. Major Oxford University and Smith School study on green recovery packages stretch back to the 2008 financial crisis – Smith School of Enterprise and the Environment

> Check out the full list of new and repeat issuers.

> Click on the issuer name to access the new issue deal sheet in our online Bond Library.

New issuer spotlight - Certified Climate Bonds

Milwaukee Metropolitan Sewerage District (USD80m), USA, had its inaugural green bond issuance with a 10-year instrument. The deal finances projects Certified against the Water Infrastructure Criteria of the Climate Bonds Standard. This is the first Certification in the US Midwest and the first Certification for a combined wastewater and stormwater program in the US.

The issuer will submit annual reports to the Municipal Securities Rulemaking Board (MSRB), as per the regulatory requirement. In addition, Milwaukee will produce reports with information on the allocation of proceeds and the projects financed.

Nanjing Jiangbei New Area Public Assets Investment & Development (RMB490m/USD72.8m), China, debuted with a green bond Certified against the Water Infrastructure Criteria of the Climate Bonds Standard, maturing in three years’ time. The proceeds will be used to refinance the construction of three new sewage treatment plants in Jiangbei New Area, which is part of the Yangtze River delta area.

Annual reports will have information on the allocation of the proceeds, as well as indicators of the sewage treatment plants, including the amount of water treated. The deal marks Approved Verifier iGreenBank’s first verification. It is also the first time the Climate Bonds Standard Version 3 has been used for a Certification in China.

New issuer spotlight

BayernLB (EUR50m/USD56m), Germany, completed its inaugural issuance with a 10.5-year instrument benefiting from an SPO from ISS-oekom. Eligible green loans in the loan portfolio include renewable energy (photovoltaic and solar thermal plants as well as wind farms), along with low-carbon real estate and mobility.

There will be allocation and impact reporting for as long as the bonds are outstanding. The reports will be published on BayernLB’s Investor Relations homepage, and will include the notional amount and maturities of outstanding green bonds; the total amount of proceeds allocated and the number of eligible green loans; the balance of unallocated proceeds; the amount or the percentage of new financing and refinancing, and the technology and geographic distribution of the projects funded.

Impact reporting, where feasible, may provide information about the added renewable energy capacity (MW) and estimated avoidance/reduction of CO2 emissions in kilotons.

Climate Bonds view: After BayernLabo issuing a social bond in November 2017, BayernLB has come out with a green bond. It joins a substantial and growing number of large German banks, including Deutsche Bank with its announcement of a potential deal for this year as well.

Similar to its peers, BayernLB’s focus is on renewable energy projects at the moment, but positively the framework also defines additional eligible categories for financing.

Sonae SGPS (EUR55m/USD60m), Portugal, took out a green loan financing various types of projects aimed at making its subsidiary, Sonae MC’s, food retailing business more environmentally friendly. This primarily includes improving energy and water management in stores (e.g. via enhanced management systems), some local renewable energy generation, improving waste management processes, and adding EV charging stations in store parking lots.

This marks the first green loan in Portugal, and the first green finance deal for a Portuguese food retailer.

Climate Bonds view: This is a milestone for green finance in Portugal in a very important sector. Even globally, there is still a lack of investment in greening food services. The deal also complements a loan to Sonae MC from the EIB earlier this year, which was aimed at achieving similar improvements in its operations.

However, the green loan could be given higher visibility in Portugal, both among the general public as well as other potential issuers, especially given Sonae MC’s ownership of influential and well-known brands and that due to the current pandemic food retail has been in the spotlight even more.

We also note that the deal does not carry an external review, and that, as a loan, reporting is often more nebulous. We encourage Sonae MC to report adequately on the use of proceeds and impacts achieved, for example in line with the recently published LMA/LSTA guidance on applying the Green Loan Principles (GLP).

SYCTOM (Agence Métropolitaine des Dechets Menagers) (EUR15m/USD17m), France, joined the green bond market with a 10-year senior unsecured instrument benefiting from an SPO by Vigeo Eiris. The net proceeds of the bond will exclusively finance or refinance, in part or in full, projects falling under two green project categories: waste collection, management and treatment, and waste-to-energy.

The issuer has committed to reporting annually on financial indicators and on performance and environmental impact indicators at project level - starting one year after the issuance and until full allocation of the funds. The annual report will be made publicly available on its website.

Climate Bonds view: This project is a welcome development as it will help to reduce GHG emissions by reducing the amount of waste going to landfill and recover energy from waste which would otherwise go to landfill. It helps to fill the financing gap and investor appetite for such projects as highlighted both in our European Green Bond Investor Survey as well as the new Waste Management and Circular Economy Sector Briefing.

Xior Student Housing (EUR100m/USD109m), Belgium, came to market with an inaugural 12-year green private placement. Sustainalytics provided an SPO for the company’s framework. Eligible categories include green buildings in Belgium, the Netherlands, Spain, and Portugal; renewable energy generation and transmission; a variety of energy efficiency projects; pollution prevention and waste management; clean transport; and water management.

There will be allocation reporting to lenders and investors until proceeds have been fully allocated. The report will contain the total amount outstanding, the amount of unallocated proceeds, and allocation of the net proceeds to the portfolio. It will also include information on the composition of the portfolio, including its geographic split, the share of financing and refinancing, and an overview of eligible projects. Impact measures will be disclosed annually as well through ESG reporting included in the annual report.

Climate Bonds view: With overall issuance of USD9.1bn from Belgium (90% of which are Sovereign green bonds), the country has potential to ramp up its green financing. Xior Student Housing is the second Belgian financial corporate to issue a green bond and the third to finance waste projects.

Their framework covers a broad spectrum of eligible projects in five different categories. It also promises good post-issuance reporting (allocation and impact) which provides transparency to the market and investors. Since the company operates in the Netherlands, Spain and Portugal, the deal is poised to create positive climate impact beyond Belgian borders.

New issuers continued...

Public Sector

- City of Berkeley (USD8m), USA, 19.4Y original term, SPO provided by Kestrel Verifiers.

- Lynwood Utility Authority Enterprise (USD20m), USA, 30.2Y original term, no third-party review.

- Guangdong Power Development (CNY300m/USD42m), China, 3Y original term, no third-party review.

- Nanjing City Construction Development Co., Ltd. (CNY1.2bn/USD169.7m), China, 2Y original term, SPO provided by Shanghai Brilliance Credit Rating.

- Shenyang Metro Co. Ltd (CNY5bn/USD707.2m), China, 10Y original term, SPO provided by Lianhe Equator.

Financial Corporates

- Bank of Ganzhou Co.,Ltd. (CNY1.5bn/USD212.2m), China, 3Y original term, assured by EY.

- Hua Xia Bank Co., Ltd. (CNY10bn/USD1.4bn), China, 3Y original term, assured by EY.

Non-financial Corporates

- Atlantica Yield (EUR290m/USD320m), UK, 6Y original term, SPO provided by Sustainaytics.

- Bothwell Spain (EUR234m/USD260m), Spain, 18.Y original term, rated (E1/80) by S&P Global Ratings – issued in December 2019.

- Daiki Axis Co, Ltd (JPY3bn/USD27.6m), Japan, 9.9Y original term, SPO provided by DNV GL – issued in February 2020.

- Looop Inc (JPY3bn/USD27.6m), Japan, 15Y original term, SPO and rating (GA1) provided by R&I (Japan).

- Nanjing Financial City Construction (CNY1.2bn/USD169m), China, 3Y original term, SPO provided by Shanghai Brilliance.

- Yalong River Hydropower Development Company (CNY1bn/USD142m), China, 3Y original term, SPO provided by Lianhe Equator.

Loans

- EVN Group (EUR100m/USD111.2m), Austria, 10Y original term, no third-party review.

- Oxley Holdings PLC (EUR77.25m/USD86.7m), Singapore, SPO provided by Sustainalytics. – issued in May 2019.

Visit our Bond Library for more details on April deals and a full history of debut green issuances going back to 2017.

Green bond outlook – selected deals

|

Issuer Name |

Country |

Closing Date |

Source |

|

NXP Semiconductors |

The Netherlands |

01/05/2020 |

|

|

Societe du Grand Paris EPIC |

France |

07/05/2020 |

|

|

Sacramento Municipal Utility District |

USA |

07/05/2020 |

|

|

Autonomous Community of Madrid |

Spain |

08/05/2020 |

|

|

Schaeffler AG |

Germany |

11/05/2020 |

|

|

Power Authority of the State of New York |

USA |

12/05/2020 |

|

|

Southern California Public Power Authority |

USA |

12/05/2020 |

|

|

New Jersey Infrastructure Bank (29 tranches) |

USA |

13/05/2020 |

For May, multiple deals have been issued and announced already. This includes three US Munis: two new issuers (Sacramento Municipal Utility District and Power Authority of the State of New York) and a repeat issuer (New Jersey Infrastructure Bank).

The Autonomous Community of Madrid (Spain) is scheduled to issue its first green bond, which will be the first green bond issued by a public administration in Spain.

The chatter on a potential UK green gilt continues – this time tied to a green recovery from the ongoing coronavirus pandemic. On the corporate side, automaker Daimler wants to venture into green bonds to stay on track with its CO2 reduction targets following the COVID-19 pandemic, according to Chairman Ola Källenius. In the meantime, Unión de Créditos Inmobiliarios (Spain) is getting ready to issue green bonds as they have established a framework reviewed by Sustainalytics.

Data and references

Repeat issuers in April

Repeat issuers: January and February 2020 (not previously included)

- EBRD (European Bank for Reconstruction and Development): SEK1bn/USD105.1m - January 2020

- Fannie Mae: USD404.5m - March 2020 (13 deals)

- SNCF: EUR50m/USD54.8m - March 2020

- Vasakronan: SEK700m/USD71.4m – January and March 2020 (3 deals)

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Excluded |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Changzhou Binjiang Economic Development Zone Investment Development Group |

CNY500m/USD70.6m |

27/04/2020 |

Working capital |

|

Inter-American Development Bank |

USD4.3bn |

24/04/2020 |

Sustainability/Social bond |

|

Caisse Francaise de Financement Local |

EUR1bn/USD1.1bn |

07/05/2020 |

Sustainability/Social bond |

|

Kookim Bank |

USD500m USD500m |

04/05/2020 04/05/2020 |

Sustainability/Social bond Sustainability/Social bond |

|

Fenghua of Ningbo City Zone Investment Co.,Ltd. |

CNY1bn/USD144m |

24/04/2020 |

Working capital |

|

Huainan City Construction and Investment Co.,Ltd. |

CNY1.5bn/USD216m |

23/04/2020 |

Working capital |

|

Rongsheng Petrochemical Co., Ltd. |

CNY1bn/USD144m |

22/04/2020 |

Working capital |

|

Nanjing Metro Group Co.,Ltd |

CNY3bn/USD432m |

20/04/2020 |

Working capital |

|

CGN International Finance Leasing Co., Ltd. |

CNY900m/USD129.6m |

16/04/2020 |

Working capital |

|

Guatemala |

USD700m USD500m |

24/04/2020 24/04/2020 |

Sustainability/Social bond Sustainability/Social bond |

|

IFC |

AUD200m/USD137.3m |

15/04/2020 |

Sustainability/Social bond |

|

Getinge |

SEK1bn/USD105.7m |

17/04/2020 |

Sustainability/Social bond |

|

Cassa Depositi e Prestiti |

EUR500m/USD555.8m EUR500m/USD555.8m |

20/04/2020 20/04/2020 |

Sustainability/Social bond Sustainability/Social bond |

|

NWB Bank |

EUR2bn/USD2.2bn |

14/04/2020 |

Sustainability/Social bond |

|

IBRD |

SEK11.5bn/USD1.2bn USD8bn |

23/04/2020 22/04/2020 |

Sustainability/Social bond Sustainability/Social bond |

|

Bayport Management |

USD260m USD80m |

14/06/2019 19/12/2020 |

Sustainability/Social bond Sustainability/Social bond |

|

Fastighets Ab Trianon |

SEK400m/USD43.3m |

17/04/2019 |

Sustainability/Social bond |

|

City of Berkeley |

USD0.8m USD0.7m USD0.7m USD0.8m USD0.8m USD0.8m USD0.9m USD0.9m USD0.9m USD1m USD1m USD5.4m USD10.9m USD12.4m |

16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 16/04/2020 |

Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond |

|

Flemish Community |

EUR1.3bn/USD1.4bn |

15/04/2020 |

Sustainability/Social bond |

|

Hongkong and Shanghai Bank |

HKD189.2m/USD24.3m |

03/04/2020 |

Maturity |

|

NIB |

SEK4bn/USD423m |

09/04/2020 |

Sustainability/Social bond |

|

Council of Europe Development Bank (CEB) |

EUR1bn/USD1.1bn |

09/04/2020 |

Sustainability/Social bond |

|

EIB |

EUR1bn/USD1.1bn |

15/04/2020 |

Sustainability/Social bond |

|

Pending |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Beijing Enterprises Clean Energy Group Ltd |

CNY900m/USD127.1m |

29/04/2020 |

Insufficient information |

|

MPT Finco |

CAD303.3m/USD228.1m |

02/12/2019 |

Insufficient information |

|

Export-Import Bank of Korea |

EUR700m/USD778.1m |

27/04/2020 |

Insufficient information |

|

Nordea Bank |

SEK64.3m/USD6.8m |

24/01/2020 |

Insufficient information |

|

Natixis |

EUR10m/USD11.1m |

22/04/2020 |

Insufficient information |

|

Hannon Armstrong |

USD400m |

21/04/2020 |

Insufficient information |

|

Hemso Fastighets AB |

SEK500m/USD51.8m |

11/02/2020 |

Insufficient information |

|

Capitaland |

SGD400m/USD296.1m |

14/04/2020 |

Insufficient information |

|

Swedish Export Credit |

SEK500m/USD52.9m |

14/04/2020 |

Insufficient information |

|

HLP Finance |

HKD500m/USD64.5m |

07/04/2020 |

Insufficient information |

|

Ontario Power Generation Inc |

CAD400m/USD307.3m CAD800m/USD614.5m |

08/04/2020 08/04/2020 |

Insufficient information Insufficient information |

|

Analog Devices |

USD400m |

08/04/2020 |

Insufficient information |

As always, your feedback is welcome!

Watch this space for more market developments. Follow our Twitter or LinkedIn for updates. E-mail data requests to dataenquiries@climatebonds.net.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.