Welcome to the Markets Monthly!

We’re testing our new format and would love to hear your feedback…

We are looking to provide a more holistic view of the green bond market, integrating analysis and reading lists, with a focus on selected deals by new issuers.

If you’re interested in offering feedback or would like to know more about our Market Data please reach out at: dataenquiries@climatebonds.net

Don’t Miss! Livestream Event.

EU Finance Stakeholders Dialogue on EU Taxonomy final reports released on Monday. Our CEO (and TEG representative) Sean Kidney is amongst the speakers.

Thursday 12th March 10:00-15:00 CET. Two sessions.

Agenda here: Live Stream page here. Climate Bonds' latest TEG post here. Flashback! "Europe is on a march to change" Our Sept 2017 1m:26 secs video explainer on the EU process.

February at a glance

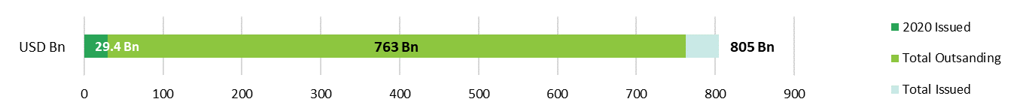

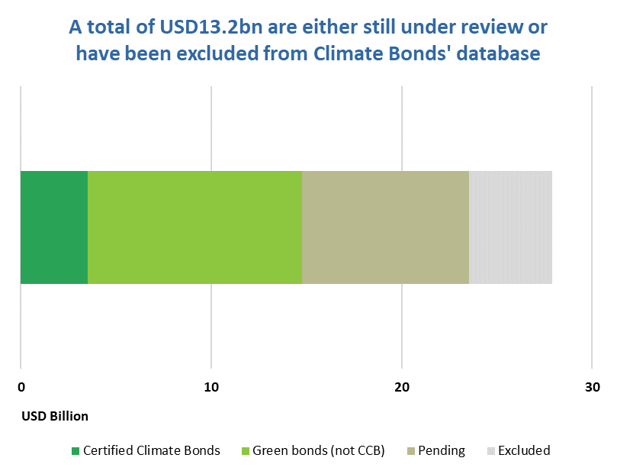

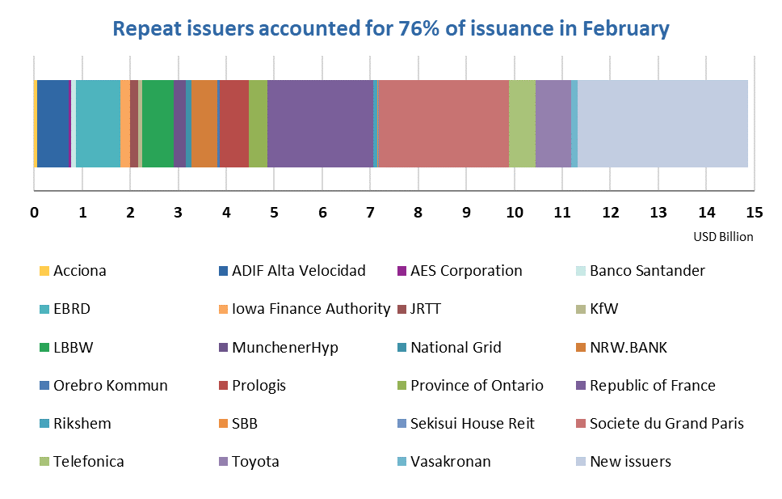

In February 2020, overall issuance added up to USD14.9bn, representing a 1% increase from January and a year-on-year decrease of 15%. This takes cumulative issuance to USD805bn. Of the total February volume, USD3.5bn (23%) were Certified Climate Bonds, including Goldman Sachs Renewable Power LLC (USA) which is new to the market for financing renewable energy assets and from Japan, Tohoku Electric Power and rail operator JRRT. A total of USD8.8bn of green bonds issued in February are still under review on whether they meet Climate Bonds’ criteria. This may provide an additional boost to February figures.

A total of USD4.4bn have been excluded from the Climate Bonds Green Bond Database for reasons including funding working capital or allocating more than 5% of proceeds to social projects. One of these excluded instruments comes from JetBlue; a sustainability-linked loan in which the interest rate varies with ESG score performance of the company. This makes JetBlue the first airline to borrow against such conditions.

Adding to the strong start of Sovereign issuance in 2020, France is the second country to come back to the market this year. With a tap it added another EUR1.9bn (USD2.2bn) to its initial green sovereign bond from January 2017, which had been tapped multiple times after. It is likely that there is more to come from the Sovereign side in 2020: Egypt and Hungary may join the Sovereign Green Bonds Club in the upcoming months (see Green bond outlook).

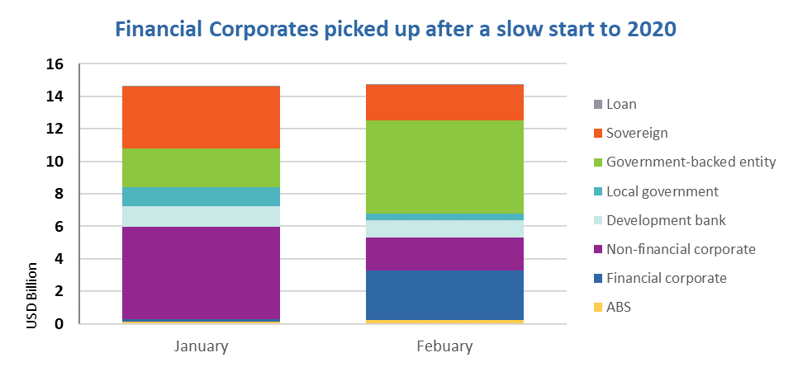

Financial Corporates had a slow start to the year in January but picked up this month with a total of USD3.1bn comprising 21% of the overall volume in February. Government-Backed Entities made up the largest share (38%), mainly due to Société du Grand Paris’ (France) EUR2.5bn/USD2.7bn deal, another Programmatic Certification from the giant transport operator undertaking a decade long infrastructure program to upgrade the Paris rail network. It is Certified against the Low Carbon Transport Criteria of the Climate Bonds Standard.

Issuance from Non-Financial Corporates only added up to USD2.2bn, compared to USD5.7bn in January and USD5.4bn in February 2019. Although there were deals from 13 different issuers, the sizes were rather small. The largest issuance in this category came from Telia Company (EUR500m/USD556m), a new issuer from Sweden financing Renewable Energy, Low Carbon Buildings as well as ICT projects. This makes it the fifth issuer from the telecommunications sector to join the green bond market and the second one to raise green financing this month together with Telefónica Europe (Netherlands, EUR500m/USD556m). Telefónica’s deal, issued through its Dutch subsidiary, was the first green perpetual hybrid bond from the sector.

In addition to ‘traditional’ green bonds, market participants are creating new green structures. After the sustainability-linked credit risk transfer by Société Générale last year, Italy’s leading insurer Generali has now created a green insurance-linked securities framework. It will allow the transfer of insurance risk to institutional investors, while the ‘greenness’ of the security will be characterised by the investment of the collateral in green assets.

The labels and use of proceeds in the green finance universe also continue to diversify: Cadent, the largest natural gas distribution network operator in the UK, has created a transition bond framework. It aims to contribute to a low carbon economy with projects that will be financed with the proceeds of bonds issued under this framework – even though such instruments are viewed as controversial in the market, as previous deals have shown some of these instruments can potentially contribute positively to the transition to a low carbon economy.

In addition to that, public transport operator TfL (UK) has revised its green bond framework from 2015 and recently published its 2020 version.

In February, the main share of funds went towards Low Carbon Transport projects with USD5.5bn equating to 37% of the overall issuance. Just under a quarter (24%) of the proceeds went towards Renewable Energy, followed by Low Carbon Buildings with 21%. One of the issuers financing building projects was Örebro Kommun (Sweden), which specifically earmarked a share of the proceeds towards climate change adaptation and resilience projects such as buildings and infrastructure. The Province of Ontario (Canada), too, financed adaptation and resilience through flood protection and storm water management.

Worth reading

Climate Bonds’ Sandeep Bhattacharya, India Projects Manager, answers questions around green bonds, adaptation finance, climate public-private partnerships, sectors of focus & South Asian markets. - South Asia fast track

…and:

- ASIFMA, the Asian arm of the industry trade group SIFMA, released its report ‘Sustainable Finance in Asia Pacific - Regulatory State of Play’, which provides an overview of sustainable finance developments and the policy environment in major jurisdictions in the region. - Asifma

- Dutch asset manager NN Investment Partners launched a green bond fund that will focus exclusively on corporate issuers. This follows high demand for the green fund that was created in 2016. - Investment Europe

- How the Riksbank can contribute to climate policy – Address by Deputy Governor Anna Breman to Royal Swedish Academy of Engineering Sciences, Stockholm

> Check out the full list of new and repeat issuers.

> Click on the issuer name to access the new issue deal sheet in our online Bond Library.

New issuer spotlight - Certified Climate Bonds

Goldman Sachs Renewable Power (USD500m), USA, came to the market with a 24-year senior secured deal Certified against the Solar Criteria of the Climate Bonds Standard. Goldman Sachs Renewable Power is owned by Goldman Sachs Asset Management, which has over USD1.7tn in assets under management. It was set up to acquire and operate renewable energy projects across the US and is one of the largest owners of distributed solar generation assets in the country. The proceeds will refinance the acquisition of solar assets across the US with over 1MW of combined capacity. There will be public reports on a yearly basis, including confirmation that the proceeds are being allocated and managed appropriately, information on the solar assets and impact indicators such as installed capacity and amounts of energy generated.

Santander Consumer Bank AS (SEK1bn/USD104m), Norway, completed its inaugural green bond issuance with a 3-year senior unsecured note. It is Certified against the Low Carbon Transport Criteria of the Climate Bond Standard and also benefits from an SPO issued by Sustainalytics making this one of few green bonds to receive two third-party reviews. The instrument will refinance the bank’s private vehicle consumer finance loans. Reports will be publicly available on an annual basis. The disclosure will include details of the allocation of proceeds, as well as quantitative indicators related to the assets, such as the estimated avoided emissions of the passenger vehicles. An impact report with estimated impacts of the bond has been produced at the time of issuance.

Tohoku Electric Power Company (JPY5bn/USD45.4m), Japan, joined the green bond market with a 10-year bond that is Certified against the Wind, Marine Renewable Energy and Geothermal Criteria of the Climate Bonds Standard. The proceeds will finance the company’s developments of onshore and offshore wind projects and geothermal energy generation plants. Annual reports will be produced disclosing information on the projects financed by this issuance. This marks the first green bond from a Japanese power utility to receive Certification.

New issuer spotlight

Solar Systems LLC (RUB5.7bn/USD92m), Russia, issued its debut green bond: a 10-year secured instrument that benefits from an SPO issued by RAEX. One of the largest producers of solar energy in Russia, the company specialises in the construction of new solar plants as well as managing and operating them. The project will finance the acquisition, construction and operation of solar energy projects that can be selected from the company’s overall project portfolio extending to its subsidiaries and joint ventures. The projects should have established quantitative targets, such as reduction of CO2 emissions and/or generating electricity from renewable sources.

There will be reporting on both the use of proceeds as well as the impact of the projects on an at least annual basis until all funds are invested. The use of proceeds reports will include at least a list of approved eligible green projects financed and the balance of the unallocated proceeds. The impact report will include at least the amount of electricity generated from renewable sources (kWh) and the reduction/prevention of greenhouse gas emissions (tons of CO2).

Climate Bonds view: This is the third green bond from a Russian issuer and the first one to fully dedicate proceeds towards renewable energy projects. The share of renewables in Russia’s energy mix is small since the country mainly relies on natural gas. This instrument can help develop the domestic green bond market and take the next step to offer investment opportunities to international investors. So far only one instrument has been issued in a foreign currency via Russian Railways – EUR (Certified against our Low Carbon Transport Criteria). The month of issuance also coincides with the publication of the Competence and Green Expertise Center CoLTI’s first register of green bonds for Russian issuers.

San Diego County Regional Transportation Commission (USD75m), USA, issued its first green Muni bond maturing in 28 years. The proceeds will go towards the Regional Bike Plan Early Action Program, which comprises 40 projects with a total of around 77 miles of new bikeways. The project aims to enhance neighbourhood connections to schools, shopping centres and parks, as well as transit stations and other major regional destinations. Many of the projects include bikeways that are physically separated from vehicle traffic. The bikeways are also intended to make walking safer and more comfortable where possible. Until fully expended on the project, there will be annual reporting available on the Electronic Municipal Market Access (EMMA) website and in the issuer’s annual report.

Climate Bonds view: This is the first project of its kind funded by a green bond in the state of California. Transportation plays an important role in cutting emissions and encouraging cycling and walking in cities – especially in states like California that suffer from a relative lack of public transport options and congestion as a result of reliance on personal cars – is a part of that. We hope this prompts more cities and local governments to encourage and facilitate cycling and support bicycle infrastructure.

Japan Finance Organisation for Municipalities (EUR500m/USD556m), Japan, completed its inaugural issuance with a senior unsecured green bond maturing in 7 years and benefitting from an SPO issued by Vigeo Eiris. The organisation is a joint funding organisation, the objective of which is to provide Japanese local governments with long-term funding at low interest rates. The net proceeds will be used for loans to local municipalities to finance or refinance existing or future sewerage projects.

Japan Finance Organisation for Municipalities (JFM) Green Bond Working Group will conduct a survey of its local government borrowers with respect to the environmental impact of the sewerage projects JFM finances. Projects with positive responses will form the ‘Effective Portfolio’. JFM will earmark green bond funds towards such projects and will report the amount of proceeds allocated to each project in the portfolio along with a breakdown by project type annually on its website. It is also committed to disclosing project-related KPIs, such as total project costs and population of the covered area.

Climate Bonds view: Climate Bonds welcomes green bonds such as the one issued by JFM as they allow municipalities to obtain cheap loans to finance projects with positive environmental impacts. We hope to see more funding organisations come to the market with similar deals, especially to provide funding to entities which might not be able to raise debt in the debt capital markets. Climate Bonds also supports JFM’s very good level of commitment in terms of reporting – this is crucial for increasing market transparency.

Arthaland (PHP3bn/USD59m), Philippines, joined the green bond market with a senior unsecured 5-year bond which has an SPO from Vigeo Eiris. Arthaland provides real estate services in the Philippines and will use the green bond for financing or refinancing green buildings. This includes the development of new buildings as well as the acquisition and renovation of completed buildings (commercial and residential).

To qualify, the assets must be rated highly against a credible standard such as LEED Gold or BREEAM Excellent. New and existing commercial and residential buildings that belong to the top 15% of low carbon buildings in their respective category and local context can also be financed.

Arthaland will provide allocation and impact reports. The allocation report will include the amount or percentage of allocation to the green portfolio; the share of financing and refinancing reported at the category level; examples of projects being financed; and the amount of unallocated proceeds. The impact report will include the type of certifications and the number of buildings with each type. There will also be estimated annual reduced and/or avoided emissions (in tons of CO2e vs. the city/country benchmark).

Climate Bonds view: Despite being the smallest issuance from the Philippines so far, it’s encouraging that another entity seeks green funds in SE Asia. Arthaland is the first real estate company from this country to issue a green bond. Until now, proceeds had been allocated mainly towards renewable energy projects.

Vena Energy (USD325m), Singapore, made its green debut with a senior unsecured bond maturing in 5 years. It was assigned a ‘Green 1’ rating by JCR. The bond will finance projects in the renewable energy space. This includes projects related to solar energy (including infrastructure, manufacturing and transmission), wind power (offshore and onshore wind farms, infrastructure and manufacturing, transmission) as well as hydropower.

There will be an annual allocation report on the website until funds are fully allocated, which will be audited by a third-party each year. It will include information based on asset type, such as the allocated amount per asset category, the geographic split per country, and the weighted average age of the project being financed or refinanced including the stage of the project (construction or operation), among others. The impact report will include installed capacity (MW), GHG emissions avoided (CO2e) annually, annual renewable energy production (MWh) and number of households powered per year.

Climate Bonds view: Non-Financial Corporates from Singapore have not issued many green bonds as yet: Vena Energy marks the third one, whilst also being the largest by far from this issuer type as well as the first one denominated in USD. This deal offers international investors the chance to participate in the Asian EM corporate bond market. Finally, this is the first green bond out of Singapore for which the issuer has acquired a green bond rating.

New issuers continued...

Public Sector

- Bell County Municipal Utility District (USD4m), USA, 21.9Y original term, assured by BAM GreenStar.

- Chengdu Rail Transit Group Co.,Ltd (CNY100m/USD42m), China, 5Y original term, no third-party review.

- Jiangsu Communications Holding Co.,Ltd (CNY300m/USD44m), China, 5Y original term, no third-party review. - issued in January 2020.

- Southside Public Water Authority of the State of Arkansas (USD17m), USA, 30Y original term, assurance by BAM GreenStar.

Financial Corporates

- Bankinter (EUR750m/USD834m), Spain, 7.7Y original term, SPO provided by Sustainalytics.

- Dream Private REIT (JPY2bn/USD18m), Japan, 3Y original term, Green 1 rated (JCR). - issued in January 2020.

Non-financial Corporates

- Ghelamco Invest (EUR20m/USD22m), Belgium, 7Y original term, SPO provided by Sustainalytics. - issued in January 2020.

- Kajima Corporation (JPY10bn/USD92m), Japan, 5Y original term, SPO and green bond rating (GA1) provided R&I.

- Telia Co (EUR500m/USD556m), Sweden, 61Y original term, SPO provided by Sustainalytics.

ABS

- River Green Finance 2020 DAC (EUR196m/USD218m), France 12Y original term, SPO provided by Sustainalytics.

Loans

- Japan Infrastructure Fund Investment Corporation (JPY4.9bn/USD45m), Japan, 10Y original term, SPO and green bond rating (GA1) provided R&I.

Visit our Bond Library for more details on February deals and a full history of debut green issuances going back to 2017.

Green bond outlook

|

Issuer Name |

Country |

Closing Date |

Source |

|

Reykjavik Energy (2 deals) |

Iceland |

03/03/2020 |

|

|

Atlas Renewable Energy |

Uruguay |

04/03/2020 |

|

|

Hypo Vorarlberg |

Austria |

05/03/2020 |

|

|

California Infrastructure and Economic Development Bank |

USA |

10/03/2030 |

|

|

Mitsui-Soko |

Japan |

10/03/2030 |

|

|

Prudential Financial |

USA |

10/03/2020 |

|

|

New Jersey Educational Facilities Authority |

USA |

11/03/2030 |

For March, eight deals have been announced already (see table above). These are mainly from repeat issuers. One of them is Atlas Renewable Energy, a Non-Financial Corporate from Uruguay. New to the market and scheduled for the 10th March is Mitsui-Soko, a transportation company from Japan.

In its latest budget, Hong Kong has assigned funds for green projects after joining the green bond market last year in May and is continuing to position itself as a green finance hub for the region. The government plans to raise funds for green transportation projects and to issue green bonds worth HK$66bn over the next five years.

Egypt has started procedures for issuing sovereign green bonds. Under the current market outlook, completing the issuance on schedule would make Egypt the first sovereign from MENA to do so. Another potential new member of the Sovereign Green Bonds Club is Hungary. It is currently in talks with investors from Japan and China about a potential green bond. The green bond framework is planned to be published later in 2020.

German carmaker Volkswagen Group has established its first green bond framework, under which it is getting ready to issue green bonds to finance e-mobility projects, including a multimodal electric vehicle platform. The instruments are planned to receive Certification against the Climate Bonds Standard. Swedish real-estate developer Bonava has also created a green bond framework to issue green debt in the future.

Data and references

Repeat issuers in February

Repeat issuers: January 2020 (not previously included)

- ADB (Asian Development Bank): EUR40m/USD44.5m - January 2020

- AEON Product Finance (Mitsubishi UFJ Trust and Banking Corporation - SPV): JPY5.9bn/USD54m - January 2020

- China Longyuan Power Group Corporation Limited: CNY713m/USD103.4m - January 2020

- National Grid Electricity Transmission (National Grid): HKD422m/USD54.3m - January 2020

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Excluded |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Bluehub Loan |

USD18.8m USD56.3m |

30/01/2020 30/01/2020 |

Sustainability/Social bond Sustainability/Social bond |

|

Ecuador |

USD400m |

30/01/2020 |

Sustainability/Social bond |

|

Grupo Rotoplas |

MXN23bn/USD1.2bn |

11/10/2018 |

Sustainability/Social bond |

|

JetBlue |

USD550m |

23/02/2020 |

Sustainability/Social bond |

|

Jinjiang Industrial Park Development & Construction Co., Ltd. |

CNY760m/USD108.6m |

19/02/2020 |

Working capital |

|

Korea Housing Finance Corporation |

EUR1bn/USD1.1bn |

05/02/2020 |

Sustainability/Social bond |

|

Madrid |

EUR1.3bn/USD1.4bn |

27/02/2020 |

Sustainability/Social bond |

|

Otto |

EUR40m/USD44.5m |

30/01/2020 |

Sustainability/Social bond |

|

Republic of Indonesia |

USD167.9m USD1.1bn |

20/02/2019 20/02/2019 |

Not aligned (regular bond) Not aligned (regular bond) |

|

Suining Hedong Development Construction Investment Co., Ltd. |

CNY600m/USD87m |

15/01/2020 |

Working capital |

|

Sydney Airport |

AUD100m/USD68.6m |

19/02/2020 |

Sustainability/Social bond |

|

Sysco Corp |

USD500m |

13/02/2020 |

Sustainability/Social bond |

|

The Community Preservation Corporation |

USD150m |

03/02/2020 |

Sustainability/Social bond |

|

Tonglu Luci Slow Life Experience Zone Tourism Development Co., Ltd. |

CNY620m/USD88.5m |

04/02/2020 |

Working capital |

|

Yichang Traffic Investment Co.,Ltd. |

CNY1bn/USD145.3m |

17/01/2020 |

Working capital |

|

Pending |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

AGENCE FSE DE DEVELOPPEMENT |

EUR1bn/USD1.1bn |

17/02/2020 |

Insufficient information |

|

Aruhi Corp |

JPY5.2bn/USD47.9m |

29/01/2020 |

Insufficient information |

|

California Pollution Control Financing Authority |

USD15.12m |

31/12/2019 |

Insufficient information |

|

CPPIB |

EUR511m/USD568m |

12/02/2020 |

Insufficient information |

|

Crédit Agricole |

USD15m |

26/02/2020 |

Insufficient information |

|

Crédit Agricole CIB |

ZAR25m/USD1.8m TRY8.4m/USD1.4m ZAR140m/USD9.8m |

19/02/2020 10/02/2020 10/02/2020 |

Insufficient information Insufficient information Insufficient information |

|

Cyfrowy Polsat |

PLN1bn/USD262m |

14/02/2020 |

Insufficient information |

|

Eco Research Institute Ltd |

JPY3bn/USD27.6m |

25/02/2020 |

Insufficient information |

|

Entra ASA |

NOK450m/USD50.8m |

07/02/2020 |

Insufficient information |

|

EUROFIMA |

EUR75m/USD83.4m |

04/02/2020 |

Insufficient information |

|

GS Caltex |

KRW80bn/USD68.5m KRW50bn/USD42.8m KRW130bn/USD111.4m KRW140bn/USD119.9m |

13/02/2020 13/02/2020 13/02/2020 13/02/2020 |

Insufficient information Insufficient information Insufficient information Insufficient information |

|

Guizhou Water Investment Group Co., Ltd. |

CNY800m/USD116.6m |

20/01/2020 |

Insufficient information |

|

Hangzhou Youxing Technology Co., Ltd. |

CNY1bn/USD142.2m |

25/02/2020 |

Insufficient information |

|

Hemso Fastighets AB |

EUR55m/USD61.1m |

18/02/2020 |

Insufficient information |

|

HSBC France |

EUR20m/USD22.2m |

18/02/2020 |

Insufficient information |

|

Hunan Dongting Resources Holding Group Co.,Ltd |

CNY1.2bn/USD218m |

17/01/2020 |

Insufficient information |

|

IBRD |

GBP1.8bn/USD2.3bn |

21/02/2020 |

Insufficient information |

|

IFC |

SEK100m/USD10.6m |

19/02/2020 |

Insufficient information |

|

Korea South-East Power Co |

USD500m |

03/02/2020 |

Insufficient information |

|

Landsea Green Properties Co., Ltd. |

USD200m |

21/01/2020 |

Insufficient information |

|

Lasalle Logiport REIT |

JPY3bn/USD27.6m |

20/02/2020 |

Insufficient information |

|

Mid Valley School District Lackawanna County |

USD6.35m |

27/02/2020 |

Insufficient information |

|

Modern Land (China) Co., Limited |

USD200m |

26/02/2020 |

Insufficient information |

|

Nanjing Metro Group Co.,Ltd |

CNY2.8bn/USD398.1m |

26/02/2020 |

Insufficient information |

|

Province de Quebec |

CAD500m/USD384.1m |

13/02/2020 |

Insufficient information |

|

Shwe Taung Group |

USD44m |

05/02/2020 |

Insufficient information |

|

Société Générale |

EUR1bn/USD1.1bn |

11/02/2020 |

Insufficient information |

|

Telefónica |

EUR500m/USD555.8m |

05/02/2020 |

Insufficient information |

|

VF Corp |

EUR500m/USD555.8m |

25/02/2020 |

Insufficient information |

News and reports links

|

Content |

Source and Link |

|

Atlas Renewable Energy issues green bond for projects in Chile |

|

|

Bonava publ: establishes Green Financing Framework |

|

|

Breman: How the Riksbank can contribute to climate policy |

|

|

JetBlue signs loan linked to ESG goals |

|

|

Egypt to issue sovereign green bonds |

|

|

Hong Kong Eyes Green Transport in New Budget |

|

|

How An Asset Manager And A Bank Revolutionized Impact Investing With Sustainability-Linked Credit Risk Transfer |

|

|

Hong Kong: The 2020-21 Budget |

|

|

Hungary in Talks with Investors in Japan, China on Sovereign Green Bond Issue |

|

|

NN IP unveils corporate green bond fund |

|

|

Prudential prices inaugural US insurance green bond |

|

|

Q&A with Mr. Sandeep Bhattacharya |

|

|

Rise of controversial transition bonds leads to call for industry standards |

|

|

Sustainable Finance in Asia Pacific: Regulatory State of Play |

As always, your feedback is welcome!

Watch this space for market developments and any if you have any data requests please send them to dataenquiries@climatebonds.net.

‘Till next time,

Climate Bonds