Highlights:

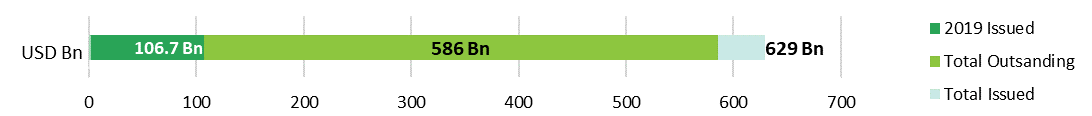

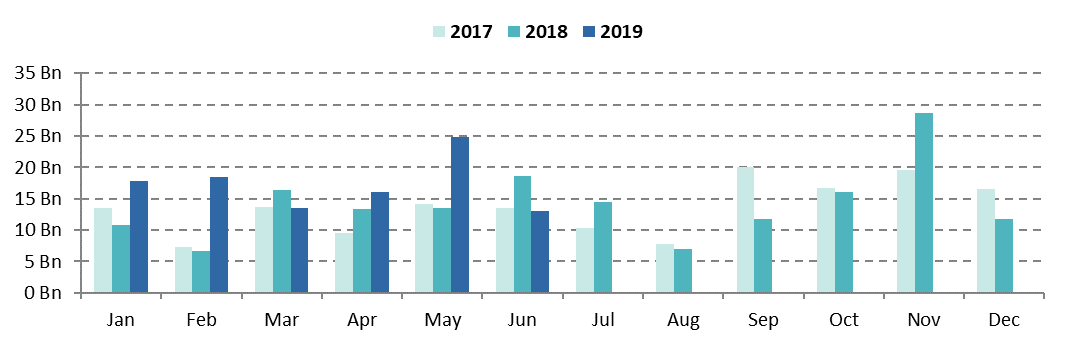

- Over USD106bn issued in 2019 year to date - June figures at USD13.1bn so far

- Chilean sovereign green bond, a Certified Climate Bond, makes history

- Spotlight on the future of cities: resilient, smart and sustainable

Don’t miss!

![]() The Hydropower Criteria under the Climate Bonds Standard are out for public consultation! Join the conversation by using your chance to review and provide feedback by 2 August 2019.

The Hydropower Criteria under the Climate Bonds Standard are out for public consultation! Join the conversation by using your chance to review and provide feedback by 2 August 2019.

![]() The public consultation for the Waste Management Criteria under the Climate Bonds Standard is also ongoing and will close on 2 August 2019. We're looking forward to receiving your feedback.

The public consultation for the Waste Management Criteria under the Climate Bonds Standard is also ongoing and will close on 2 August 2019. We're looking forward to receiving your feedback.

The European Union Technical Expert Group (TEG) on Sustainable Finance published its long-awaited final reports last week. The reports outline a proposed EU-wide Taxonomy for sustainable finance across sectors, a voluntary green bond standard, as well as climate benchmarks and ESG disclosures. For more on the topic, have a read through our special blog post and other correspondence.

The European Union Technical Expert Group (TEG) on Sustainable Finance published its long-awaited final reports last week. The reports outline a proposed EU-wide Taxonomy for sustainable finance across sectors, a voluntary green bond standard, as well as climate benchmarks and ESG disclosures. For more on the topic, have a read through our special blog post and other correspondence.

In the press: Articles on green finance in Singapore and India, co-authored by regional CBI staff members.

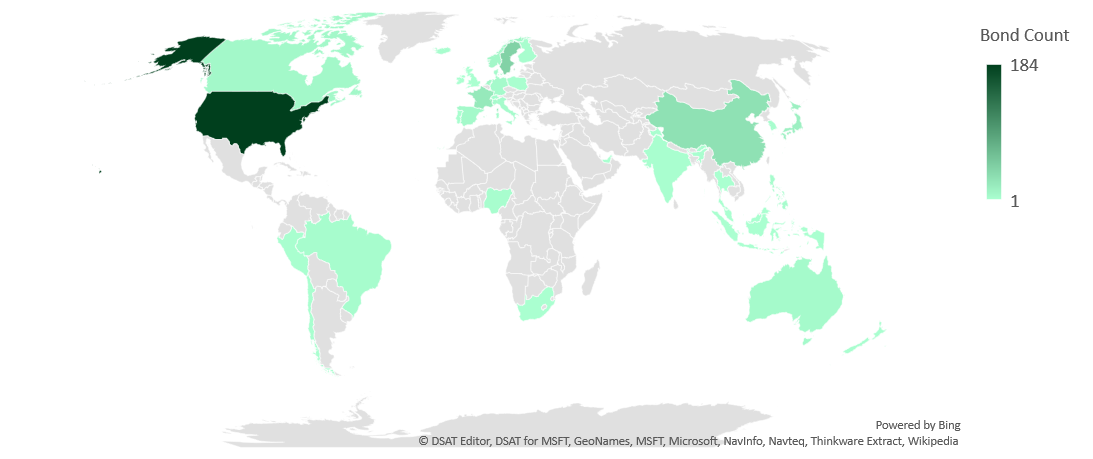

Green bond deals across the globe – 2019

Go here to see the full list of new and repeat issuers in June.

At a glance

The USD100bn milestone was passed last week, for the first time in the first half of the year! Estimates for 2019 range from USD180bn through to USD240 bn to USD250bn but Climate Bonds is looking further afield. We think the EU TEG will open new 2020 pathways towards the critical USD1tn in annual green finance. Read Sean Kidney’s special comments on the milestone.

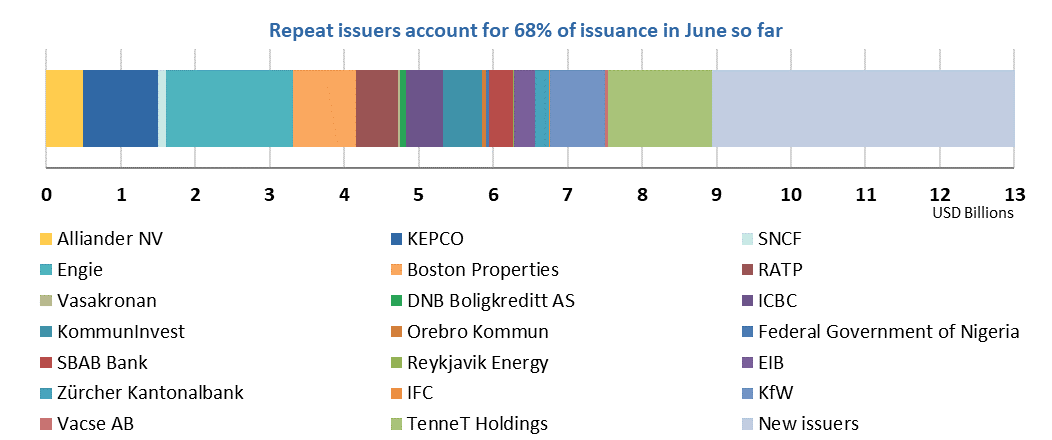

After a record May, green bond issuance momentum has continued into June. So far we’ve seen USD13.1bn of labelled green bond issuance. With more large deals closing in this week, it is possible that the total figure will exceed last year’s USD18.6bn for the month.

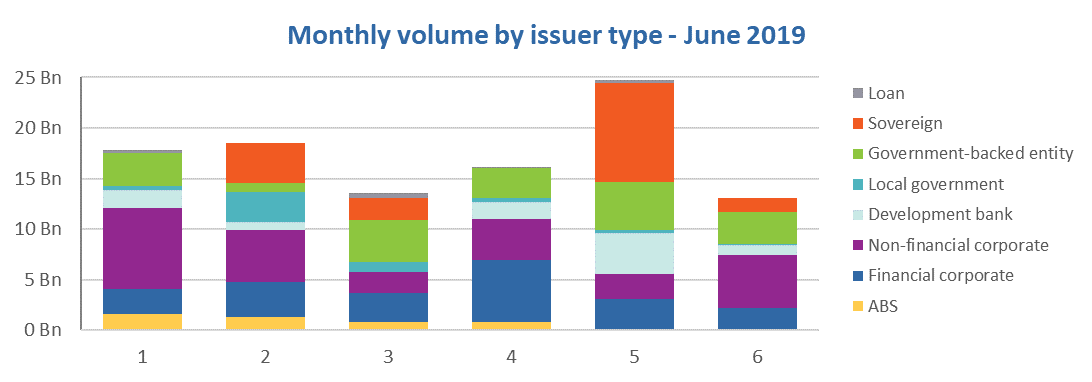

The June issuer type mix is dominated by non-financial corporates at 39%, up from 10% in May. The largest deal of the month so far is French energy mammoth Engie’s EUR1.5bn (USD1.7bn) return to the market with its sixth green bond. There have been three new entrants from the energy sector – Swedish Vattenfall AB (EUR500m), Danish European Energy A/S (EUR140m) and Indian Adani Green Energy (USD500m) – and more from repeat issuers Reykjavik Energy, Korea Electric Power Corporation and Dutch grid operator Alliander NV.

Government-backed entities have contributed about a quarter of monthly volume with repeat deals from Dutch grid operator TenneT (EUR1.25bn), French railway operators RATP (EUR500m) and SNCF (EUR100m), and Sweden’s Kommuninvest (SEK5bn).

The largest June deal from a financial corporate came from US-based real estate investment trust (REIT) Boston Properties at USD850m: its second green bond, and the 14th green bond from a US REIT. Poland’s PKO Bank debuted with a PLN250m (USD66m) covered bond, a Certified Climate Bond, as previously mentioned. The London branch of ICBC provided a USD400m boost with a green loan, making it the first Chinese green loan to be compliant with the Green Loan Principles.

Sovereign issuance was back in the news making up 11% of this month’s total so far. The USD-denominated bond (USD1.4bn) of the much-anticipated debut sovereign Certified Climate Bond from COP25 host Republic of Chile closed last week, making it the first sovereign issuer from the Americas! The EUR-denominated bond is in the market. Read here more on Chile’s successful entry into the market.

The Federal Government of Nigeria also returned to the market this month with a NGN15bn (USD42m) green bond.

Check back with us next time for the final country rankings for June!

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Republic of Chile (USD1.4bn) became the first government of the Americas to issue a sovereign green bond when the first stage in its debut offering closed. A second EUR-denominated bond is in the market. Chile is the third country to issue Sovereign Certified Climate Bonds, after Nigeria (December 2017) and the Netherlands (May 2019). Vigeo Eiris provided the Pre-Issuance Verification.

The proceeds of the inaugural bond will be used to finance and refinance urban electric trains (metro), electric buses and dedicated infrastructure for electrified public transport, solar projects, low-carbon buildings and water distribution network monitoring equipment. The requirements for buildings are based on the Chile national building certification scheme "Certificación Edificio Sustentable" (CES). Building construction and retrofits with an associated 30% CO2 emissions reduction target are eligible.

The Chilean Government will publish an annual proceed allocation report every April until the proceeds of the bond have been fully allocated. It will include details on funded projects, the balance of unallocated proceeds, the percentage split between refinancing and new financing, and the share of co-financing per project. The reports will be reviewed by an independent external verifier. An impact report including qualitative descriptions and quantitative impact indicators will also be produced annually.

This issuance is a huge step forward for the Latin America region. In April 2018, the Santiago Exchange introduced a Green and Social Bonds Segment. The Government of Chile’s intention is that this will kickstart the green bond and wider green finance markets in Chile and the region.

Brookfield Property (USD408m), Australia, issued the fourth loan globally to receive Certification against the Climate Bonds Standard. The Certification was verified by EY. Brookfield Property has committed to making confidential reporting on the loan’s proceeds available to the lenders when required. Confidential reports will also be made available to the Climate Bonds Secretariat annually.

The loan funds will be used to refinance existing bank debt linked to Brookfield Place Tower 1 and Tower 2. Brookfield Place is a large office and mixed-use development in Perth, Australia. Both Towers received a high energy rating (4.5/5 stars) through the NABERS scheme, as well as a Green Star 5 rating.

New issuers

ABC Financial Leasing Co., Ltd (CNY3bn/USD434m), China, brought to market a 3-year senior unsecured green bond. The proceeds will be fully allocated to 6 wind farms with a total installed capacity of 882MW. Deloitte provided an assurance report. The issuer will publish an annual report on the proceeds before April 30 of each year until the bond matures.

Climate Bonds view: Leasing equipment offers an alternative to asset ownership and loan financing for integrating renewable energy and low-carbon technology into a company’s operations.

Akademiska Hus AB (SEK1.5bn/USD159m), Sweden, issued a debut green bond to finance primarily new and existing university properties. New properties must reach Miljöbyggnad Gold and existing buildings – Miljöbyggnad Silver, and be at least 30% more energy efficient than the Swedish building regulations. Energy efficiency projects must achieve a minimum 20% improvement.

Other eligible categories include renewable energy (solar, wind, hydro and geothermal), low-carbon transportation infrastructure (for bicycles, public transport and electric vehicles) and sustainable urban areas. The latter has been classified by the issuer as “Environmentally sustainable management of living natural resources and land use” and focuses on creating green urban areas, such as green roofs, walls and parks.

CICERO provided a Second Party Opinion for the bond. Akademiska Hus will report on the bond’s proceed allocation and environmental impact indicators for projects funded annually via a public report on its website, which will be made available in English.

Climate Bonds view: Akademiska Hus is the first academic property investor in the Swedish market to issue, and was identified as a potential green bond issuer in the specialised property sector in our The green bond market in the Nordics report from February 2018. Their Finnish equivalent (University Properties Oy) entered the market earlier this year. In general, Swedish property sector green issuance shows no signs of slowing down. We applaud the issuer base for leading the way in showing that all kinds of properties can be financed through green debt with a robust framework in place.

ESB (EUR500m/USD556m), Ireland, issued an 11-year senior unsecured bond whose proceeds will be allocated to finance or refinance eligible wind and solar projects, grid connection for renewables, smart meters and other demand-side response applications which can improve building energy performance, electric vehicles and supporting infrastructure, and green buildings.

The bond received a SPO from Sustainalytics. The issuer is committed to reporting on the bond’s proceeds and impact at least annually through a dedicated report or integrated into ESB’s annual sustainability report, available via its website.

Climate Bonds view: This is only the third green bond to be issued in Ireland, the first one in 2019 and the first from a government-backed entity. We hope this issuance will encourage other Irish enterprises to raise funds via green bonds.

European Energy (EUR140m/USD159m), Denmark, issued a 4-year debut green bond. Part of the proceeds will fund new wind, solar and energy storage projects, while the remainder will be used for an early redemption of the company's outstanding 2021 bonds which fund similar projects.

Climate Bonds view: European Energy is a pureplay renewable energy company and a good addition to Denmark’s issuer pool, which has thus far been dominated by energy company Ørsted, albeit featuring also issuance form local government financing agency KommuneKredit and more recently covered bond issuer Nykredit. EE’s bond brings Danish green issuance total to USD5.8bn. However, we would encourage all issuers to seek external reviews and, where applicable, commit to reporting publicly on the use of proceeds and impact of their financing.

City of Saint Paul Minnesota (USD7m), USA, entered the market with a 20-year green municipal bond to finance capital improvements to the City’s Sewer System. The City’s Office of Financial Services will track the bond’s use of proceeds and post an annual update on the EMMA platform until the funds are fully spent.

Climate Bonds view: This green bond shows that even smaller projects can benefit from the green label. We encourage other US municipalities to take advantage of such opportunities to finance capital upgrades to essential infrastructure.

Xinjian New Energy (Group) Co., Ltd (CNY200m/USD28.9m), China, issued its first green bond. The 3-year bond’s proceeds will be used to refinance the development of three wind farms and five solar farms that are now operational, as well as a hazardous waste treatment centre in the Xinjiang Zhungdong Economic and Technological Development Zone. A SPO was provided by Lianhe Equator.

Xinjian will report on the bond’s use of proceeds and impact semi-annually on China Foreign Exchange Trade System and National Association of Financial Market Institutional Investors designated websites. The issuer will use a third-party verifier for the reporting.

Climate Bonds view: While renewable energy projects are quite common allocations for green bonds, the management of hazardous waste is not commonly seen. CBI recently launched a public consultation on its Waste Management Criteria.

Bonds issued before June 2019

Taesa (Transmissora Aliança de Energia Elétrica) (BRL210m/USD52m), Brazil, issued a 25-year green bond in May 2019. The deal, which comprises 44 tranches, will finance or refinance investments in three transmission projects: Mariana (Minas Gerais State), Miracema (Tocantins State) and Sant’ana (Rio Grande do Sul State). Whilst these are not limited to renewable energy connections, only 16% of energy transmitted in Brazil's national system is from fossil fuels. More details about the projects can be found in the SPO produced by Sitawi.

Taesa will disclose the allocation of proceeds (confirming they have been spent on the selected projects) and some environmental impact indicators annually until full allocation. Sitawi will evaluate the reporting up to a year after issuance.

Climate Bonds view: We believe the projects will further support the growth of renewable energy production and distribution in Brazil. In addition, it is good to see 2019 LatAm issuance picking up. However, it would be good to see issuance from other sectors, as 3 of Brazil’s 4 bonds issued in 2019 financed only energy.

Consorcio Transmantaro S.A. (USD400m), Peru, issued a 15-year green bond in April 2019. Eligible projects include the installation of electricity transmission lines to facilitate the connection of renewable energy sources to the general network, as well as energy efficiency improvements to transmission infrastructure. The latter includes smart grid projects, smart sensors, and automation systems.

Most proceeds will be used to refinance several operational projects, with the remainder used to finance two projects currently under construction. Two of the company’s operational projects – Planice Industriales and Subestación Orcotuna – are not considered green and do not form part of the eligible project pool.

The bond received two ratings: GB2 (Moody’s) and E2/62 (S&P). Consorcio will provide annual, independently verified reporting on the bond’s proceeds and environmental impact.

Climate Bonds view: We welcome this deal from an issuer that is committed to increasing the share of renewable energy usage in Peru and the first green bond from the country to finance energy transmission projects. Peru’s green bond market also seems to be growing, with three of its four bonds issued since October 2018.

Shenzhen Energy Environmental Engineering (Group) (CNY980m/USD124m), China, issued a 6-year green ABS deal in April 2019. The deal is composed of seven tranches and backed by cash flows from waste-to-energy plants. According to the prospectus, all proceeds will be used for new plants.

Climate Bonds view: This deal further diversifies the collateral types in the Chinese green ABS market. We will keep tracking the post issuance reporting.

Banco Galicia (USD100m), Argentina, issued its first green bond in June 2018. The private placement’s financing pipeline is composed of solar, wind, biomass and related energy efficiency projects according to the issuer. However, eligible assets also include clean transport and waste management.

Climate Bonds view: It is very positive to see the first corporate issuance from Argentina. However, likely due to the nature of this deal as a private placement, public information is lacking. We strongly suggest that Banco Galicia disclose more information about this deal on its website, especially on the use of proceeds.

Owing to their scale and reach, large financial corporates have the power to significantly support the transition to a green, low-carbon economy. Yet issuance from LatAm financial corporates has been weak. We hope others will follow.

UmweltBank (EUR40m/USD47m), Germany, issued a 6-year junior green bond in April 2018. The deal explicitly targeted retail investors with a minimum denomination of EUR2500. It was the first labelled retail green bond from Germany.

The bond funds the bank’s lending portfolio. At year-end 2017, the portfolio was split between solar projects (35.7%), ecological and social construction financing, including local renewable energy installations on buildings used for secured loans (35.2%) and the financing of wind and hydro projects (25.3%).

Climate Bonds view: It is encouraging to see the retail finance side jump on the green bond bandwagon. There is significant potential for this segment to grow and meet the increasing consumer demand for such retail products.

Repeat issuers – June

- Korea Electric Power Corp: USD500m

- Korea Electric Power Corp: USD500m

- Alliander NV: EUR300m/USD340m

- SNCF: EUR100m/USD113m – Certified Climate Bond (Programmatic Certification)

- Engie: EUR1.5bn/USD1.7bn

- Boston Properties: USD850m

- RATP: EUR500m/USD565m

- Vasakronan: SEK283m/USD30m

- KommunInvest: SEK5bn/USD524m

- ICBC: USD400m

- DNB Boligkreditt AS: SEK700m/USD75m – Certified Climate Bond (Programmatic Certification)

- Orebro Kommun: SEK500m/USD53m

- Federal Government of Nigeria: NGN15bn/USD42m

- SBAB Bank: SEK3bn/USD317m

- Reykjavik Energy: ISK1.9bn/USD13m

- EIB: AUD400m/USD278m

- Zürcher Kantonalbank: CHF200m/USD198 m

- IFC: COP35bn/USD11m

- KfW: SEK7bn/USD742m

- TenneT Holdings: EUR1.3bn/USD1.4bn

- Vacse AB: SEK300m/USD32m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Obayashi Corporation |

JPY10bn/USD93m |

20/06/2019 |

Excluded (Sustainability/Social bond) |

|

Caisse des Depots et Consignations |

EUR500m/USD570m |

19/06/2019 |

Excluded (Sustainability/Social bond) |

|

Korean Housing Finance Corporation |

EUR500m/USD570m |

18/06/2019 |

Excluded (Sustainability/Social bond) |

|

Great Wall Guoxing Financial Leasing Co., Ltd |

CNY2bn/USD291m |

17/06/2019 |

Excluded (proceeds not aligned) |

|

BYD Company Limited |

CNY1bn/USD146m |

14/06/2019 |

Excluded (50% working capital) |

|

Landsea Green Group |

USD200m |

20/06/2019 |

Pending (waiting for more information) |

|

Republic of Korea |

USD1.5bn |

19/06/2019 |

Pending (waiting for more information) |

|

Ahold Delhaize |

EUR600m/USD434m |

19/06/2019 |

Pending (waiting for more information) |

|

Neoenergia |

BRL1.3bn/USD336m |

11/06/2019 |

Pending (waiting for more information) |

Green bonds in the market

- Sunseap: June 20 (green loan)

- Ørsted: June 20 (green loan)

- Vattenfall AB: closed June 24

- Japan Retail Fund Investment Corporation: closing June 25

- Republic of Chile: closing June 25

- Westpac New Zealand: closing June 25

- BayWa: closing June 26

- Freddie Mac: closing June 28

- Telekosang Hydro One Sdn Bhd: closing July 15

Investing News

The central bank of Italy, Banca D’Italia, is set to launch a new EUR7bn sustainable investing scheme at the end of June. The plan will provide companies that act on environmental issues and climate change access to the Bank’s portfolio of shareholdings. A later complementary part will see the Bank acquire EUR1bn in corporate bonds from the companies that meet its criteria. The Bank of Italy is a member of the Network for Greening the Financial System.

The Bank of England will start stress-testing the UK financial system by 2021 to understand its exposure to the “unprecedented” risks posed by climate change, says BoE Governor Mark Carney. The test, which will start in autumn 2019, is the first to integrate climate scenarios into macroeconomic models.

The Hungarian Central Bank Magyar Nemzeti Bank announced it will create a dedicated foreign reserve green bond portfolio. The Bank said it will also publish ideas for expanding the range of financial products that support environmental sustainability and hopes this will help speed up the process of creating a domestic green bond market.

Experts are pinning China as the new leader in ESG disclosure, partly due to a favourable policy environment. The country looks to attract more foreign investment by improving disclosure and its average ESG ratings, which are currently low.

Australia’s prudential regulator APRA has joined the growing chorus of central banks and financial regulators to point to the structural risks to global finance of climate impacts. Speaking in Singapore, the regulator has also pointed to the opportunities that green finance represents for Australia’s fast growing finance and retirement savings sector.

The Bombay Stock Exchange’s international arm India International Exchange (INX) launched a trading platform exclusively for green, sustainable and social bonds. The Global Securities Market (GSM) Green segment is the first of its kind in the country. INX’s taxonomy is modelled after the Climate Bonds Taxonomy and ICMA’s Green Bond Principles.

The multi-stakeholder renewAfrica initiative was launched recently in Rome. The aim of the group is to accelerate the transition to sustainable energy in Africa and to boost private European investments in African renewable energy. The initiative will help facilitate regulation and policies, offer financing and de-risking tools for investment, and enable capacity-building and knowledge-transfer.

Major global asset manager Legal & General Investment Management (LGIM) dumped its shares of five US-based companies, including oil giant ExxonMobil. LGIM said the firms are laggards in addressing the climate crisis. The portfolio changes follow similar moves from last year, when LGIM sold off its holdings in 8 other companies for the same reason.

AXA Investment Management launched the Transition Bond Guidelines to help define a sustainable pathway for brown-to-green transition debt. The draft guidelines are intended for greenhouse gas-intensive industries and those that do not have enough green assets to finance but need funding to cut the GHG footprint of their operations, products and services. The proposed transparency requirements follow those of the Green and Social Bond Principles.

Green Bond Gossip

South American development bank CAF revealed its plan to become the first development bank in the region to issue EUR-denominated green bonds. The 7-year notes will be worth up to EUR500m and will likely to come to market in H2 2019.

Canadian Bank of Nova Scotia (Scotiabank) has issued a green bond framework, for which Sustainalytics provided a SPO. The planned green bond will finance several different sectors, the most innovative being “terrestrial and aquatic biodiversity conservation”.

The South Central Connecticut Regional Water Authority plans to issue USD14m of green bonds in 11 tranches. The bonds will finance existing water infrastructure. Sustainalytics provided a second party opinion.

Washington State University plans to join the growing number of academic institutions to issue green debt. The University aims to raise a USD66.5m green US muni bond. The proceeds will be spent on refinancing existing debt on three LEED Silver- or Gold-rated campus buildings.

Vietnamese private bank VPBank said it aims to issue USD120m of green debt in the form of a private placement. The funds would reportedly be raised during 2019 and 2020 and would have a three-year term.

Readings & Reports

Central Banking and Amundi published the results of a survey of central banks and climate change. They found that 59% of the banks surveyed are considering undertaking climate stress tests, and 69% of respondents think that reserve managers should view assets’ green credentials as a precondition for asset selection.

The UNFCCC hosted climate change talks in Bonn, Germany. Here are five things to watch as the action unfolds.

The green debt market is diversifying, argues the Financial Times. They explored the potential of extending securitisation from the well-known green building space, such as Fannie Mae’s mortgage-backed securities, into other sectors. The green and sustainable loan market is also growing rapidly, as reported by Refinitiv.

Maybe you may have overlooked Van Steenis “Future of Finance" UK report? Don't miss the just published Bank of England response. Priority 3 "Support an orderly transition to a carbon-neutral economy" is good reading.

For the long read of the month, dig in to the EU TEG reports.

In the press: articles co-authored by CBI staff

- “The near future of green bonds in Singapore” Writing in The Business Times, Cedric Rimaud, CFA, CBI’s ASEAN Program Manager, and Dr Chang Young Ho from the Singapore University of Social Sciences (SUSS) examine the potential for the domestic green bond market and Singapore as green finance hub in Asia.

- “Unlock India’s green funding potential” Megha Jain from the University of Delhi and Sandeep Bhattacharya, CBI’s India Projects Manager, ponder India's intertwined climate and development goals and examine what’s needed to unlock the optimum mix of domestic and offshore capital in The Pioneer.

Spotlight: Cities

The issue

Cities are focal points of human population. An estimated 55% of humans currently live in cities and the UN forecasts this to grow to a whopping 68% - more than two-thirds of the global population – by 2050. The world currently houses 31 megacities, each with a population of more than 10 million. The number of megacities is predicted to grow to 34 by 2030 with New Delhi poised to surpass Tokyo’s current 34 million to become the world’s largest city as early as 2028.

The mounting pressures from increased urbanisation rates and climate change are being felt all over the world. Iconic Venice experienced severe flooding in November 2018, for example. It is estimated that cities account for more than two-thirds of the world's energy consumption and produce over 70% of global CO2 emissions. Other urban problems include the growing global slum population, which grew by nearly 10% between 2010 and 2014 reaching 883 million. Furthermore, over half of the urban population worldwide was exposed to air pollution levels at least 2.5 times higher than the WHO safety limit, resulting in the deaths of an estimated 4.2 million in 2016 alone. This infographic from C40 highlights the problems in more detail.

In line with the UN Sustainable Development Goal #11, cities will need to step up to ensure a decent quality of life for their residents. The contribution of urban hubs is also essential in the fight against climate change for the global low-carbon transition to be realised.

Possible solutions

Many actors across the globe are tackling the issues around resilient, smart and sustainable cities. We’ve highlighted a few examples below.

International initiatives

- The Rockefeller Foundation’s 100 Resilient Cities helps cities around the world to become more resilient to the challenges of the 21st century. These include being prepared for earthquakes, fires and floods, but also issues such as inefficient public transportation systems; high unemployment; endemic violence; or chronic food and water shortages.

- C40 Cities is an initiative connecting 94 cities globally to act on the climate crisis and build sustainable, healthy urban areas. Its members represent 700+ million citizens and a quarter of the global economy. Their climate actions are estimated to result in CO2 savings of 2.4Gt – enough to cover the annual energy use of nearly 300 million homes.

- The Covenant of Mayors is an EU-led initiative that connects thousands of local governments voluntarily committed to implementing EU climate and energy objectives.

- Smart Sustainable Cities is a UK-led collaborative initiative bringing select European cities together to share knowledge and case studies on sustainable city projects. Case studies range from Milan to Milton Keynes and Belfast to Budapest.

City-level initiatives

- Boston, MA, USA is enacting a zero-waste plan, requiring the city to grow its recycling rate from the current 25% to 90% in 2050, and ultimately 100%. As part of this, the city is planning to launch curb side food waste and textile collection. Boston is one of the 25 cities taking part in the American Cities Climate Challenge.

- Medellín, Colombia’s second largest city, overhauled its public transportation system. In addition to saving more than 117 Mt of CO2 every year, the system allows residents of the “favelas” (mountainside squatter communities) to access the city in a 25-minute ride to get basic access to commerce, education and healthcare. The project was co-financed with the national government, highlighting that collaboration is key.

- Milan, Italy: Its Vertical Forest is a great example of urban (re)forestation. To learn more about similar projects and the links between resilience and urban forestry, check this article (in Italian).

- Melbourne, Australia: The Plan Melbourne project has envisaged “20-minute neighbourhoods” – suburbs where most of the daily needs of residents are met within a 20-minute walk, cycle ride or public transport journey from home. Other cities encouraging walking and car-free areas include Barcelona, Hamburg and New York.

- Taiyuan, the capital of Shanxi province in northern China, electrified its entire 8,000-unit fleet of taxis in the space of one year in 2016.

- Further cities, such as Cape Town, South Africa and Mexico City, have committed to doing the same to their bus fleets from 2025 onwards.

Lastly, tune in to this BrightTalk webinar on financing and building smart and sustainable cities.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.