USD 106.7bn before end June. TEG to Open New 2020 Pathways towards vital first $1trillion in Green Finance.

Green bond issuance has surpassed the USD100bn mark for 2019. Climate Bonds expects that the impact of the EU TEG process will help open the 2020s path towards the vital first trillion in annual green finance investment.

The USD100bn benchmark was first met in November 2017 during COP23 and then in mid-September in 2018. Several bonds that settled late last week and three deals which settled on 24th June (Alliander – EUR300m [USD342m] Vattenfall – EUR500m [USD569m] and Korea Electric Power Corp – USD1bn) have taken Climate Bonds market data figures on cumulative labelled green issuance for 2019 to USD106.7bn, above the USD100bn mark.

Forecasts for final annual issuance in 2019 range from USD180bn through to USD240 bn to USD250bn.

Green Bond Issuance USD 100 billion Milestones 2017-19

|

Year |

$100bn Mark in Issuance |

Annual Green Issuance: (Initial Figure) - Adjusted Current Figure |

|

2017 |

November |

(USD 154.886) USD162.7bn |

|

2018 |

September |

(USD 163.665) USD169.6bn |

|

2019 |

June |

Forecast: USD 180-250bn |

Big Issuers to date in 2019

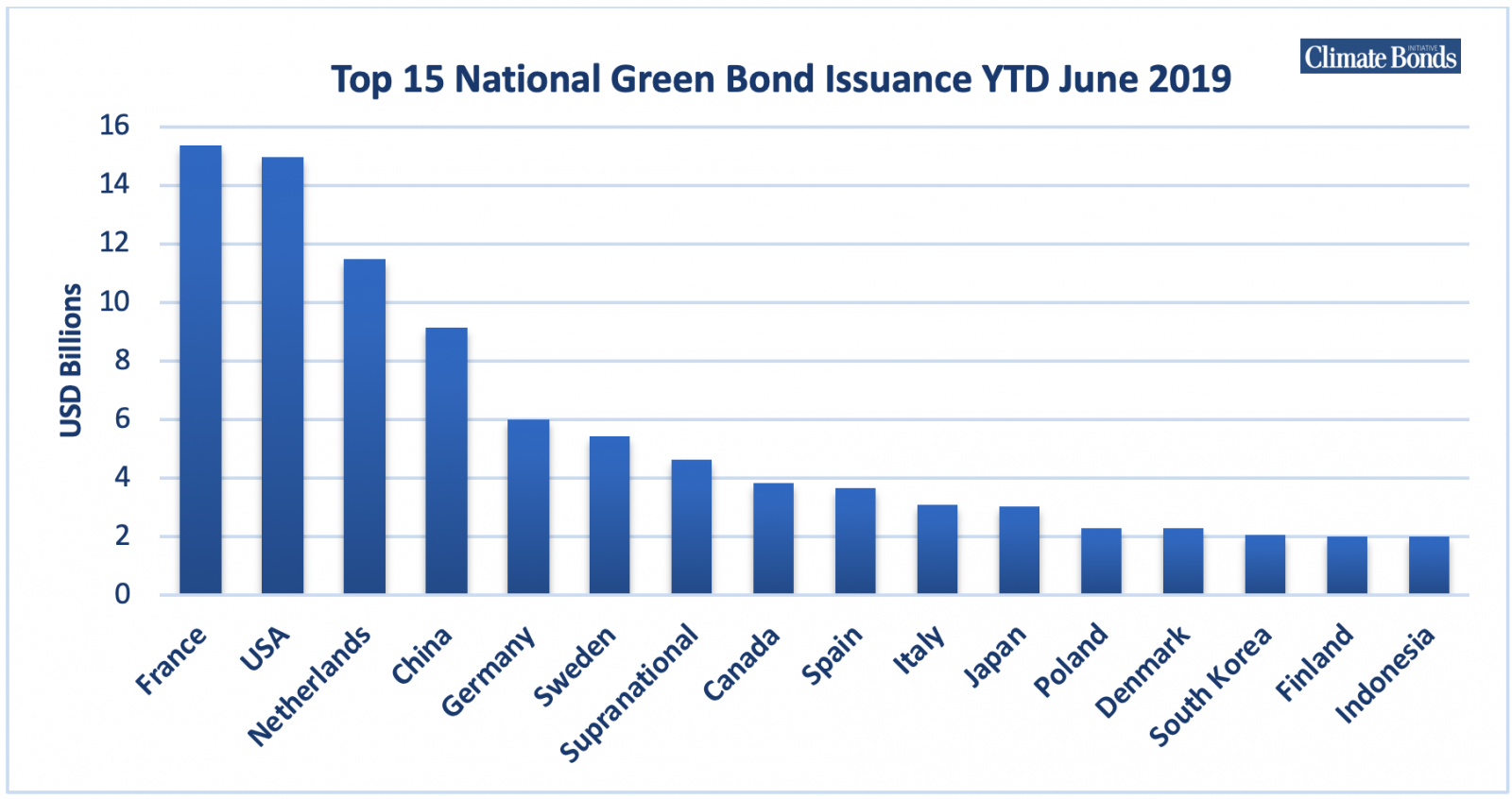

The largest corporate bonds issued to date in 2019 have been from Engie at EUR1.7bn, LG Chem at USD1.6bn, the Industrial and Commercial Bank of China (ICBC) and MidAmerican Energy, both at USD 1.5bn. The largest Sovereign green bond in 2019 to date has been a Climate Bonds Certified issuance from the Netherlands at USD6.7bn.

Top 15 National Green Bond Issuance YTD June 2019

The Last Word

We’ll leave with Sean Kidney’s comments:

“This is the first time this key milestone has been reached in the first half the year.”

“This is the first time this key milestone has been reached in the first half the year.”

“Reaching USD100bn in green issuance for the 3rd time and so early in the year is welcome; however, the global climate finance challenge is to reach a USD 1 trillion in annual green investment early in the 2020s. The EU TEG process, in particular the EU Taxonomy opens new pathways to achieve this critical climate investment goal.”

“The common definitions that the EU Taxonomy provide across broad sectors of the real economy, opens the door for brown-to-green transition of corporate assets and capex programs, and for banks and insurance companies to sizeably increase the availability of green capital.”

“It also provides pension funds with the increasing confidence of their role as long term supporters of the leaders in this economy wide shift towards zero carbon.”

“With the EU Taxonomy’s reach initially encompassing Manufacturing, Agriculture, Transport, Buildings, Electricity generation, Water, Waste & ICT, increased green bonds, green loans and green equity funding can be directed towards mitigation, resilience and adaptation.”

“Over the next few years, we would expect to see European nations cement their place in the Top 15 of global green bond issuers as the combination of the TEG outcomes, TCFD compliance and institutional investor expectations collectively influence transition-based investment and capital allocation decisions.”

‘Till next time,

Climate Bonds

Correction and Clarification:

A previous version of this Media Release had the Engie bond listed at USD 1.7bn. The correct denomination and figure are EUR 1.5bn (equiv. to USD1.7bn). Climate Bonds apologises for any confusion this error may have caused.

Figures for annual green bond issuance in 2017 and 2018 reflect Climate Bonds initial calculations as at December 31 each year and reported in early January and the adjusted figure reflects final assessment & calculations reported at end Q1 of the new year.