Highlights:

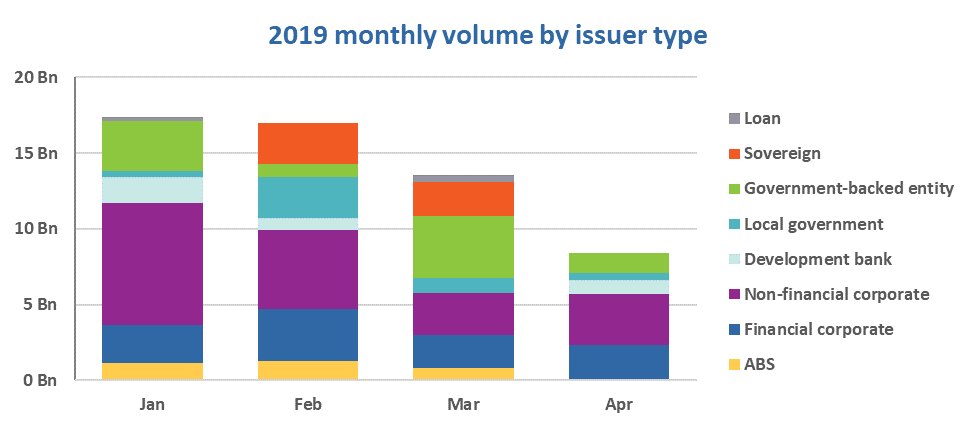

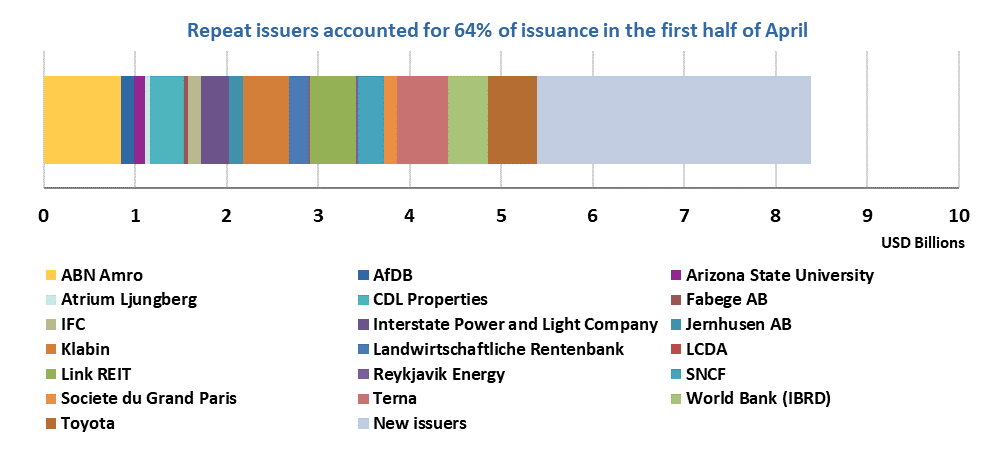

- April issuance at USD8.4bn to date

- Australia: Woolworths Group world’s first supermarket chain to issue a Certified green bond under new Supermarket segment of the Low Carbon Buildings Criteria

- Chile: government reportedly planning a sovereign GB

- Italy: GB from two energy companies and UBI Banca ’s debut GB place Italy in the lead for April

- Spain: Instituto de Credito Oficial enters GB market with a benchmark issuance

- USA: Fannie Mae’s Green MBS deals for March total USD680m, a 41% year-on-year decrease

Newly published - Q1 market updates:

Quarter 1 2019 Global Highlights

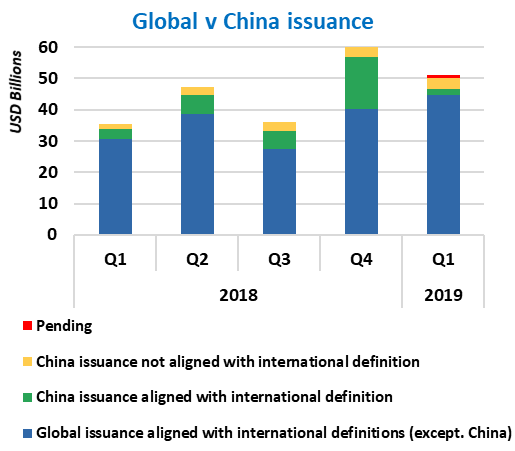

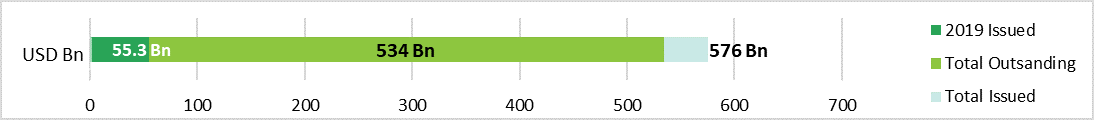

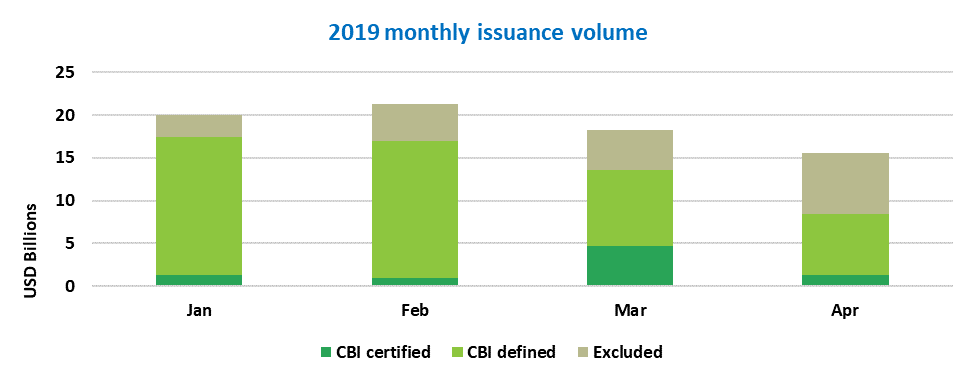

Green bond issuance reached USD47.9bn in Q1 2019, up 42% compared to Q1 2018: a clear upward trend.

A third of deals came from non-financial corporates, including the first from telecoms companies.

Almost 25% came from debut issuers: there were 43 new market entrants from 17 countries.

14% of deals were Certified Climate Bonds, including the largest single green bond of Q1 2019: Société du Grand Paris’s EUR2bn (USD2.3bn) deal using the Programmatic Certification route.

The report also provides a summary of post-issuance reporting findings and an update on issuance from the wider labelled universe. Including all labelled bonds, Q1 issuance reached USD59.4bn.

Quarter 1 2019 China Newsletter

Quarter 1 2019 China Newsletter

The USD6.9bn worth of overall green bonds from China represents a 44% surge year-on-year, and USD2.9bn of Q1 volumes from Chinese issuers is in line with international green bond definitions.

Government-backed entities dominated the market in Q1 2019 with USD2.7bn, or 39% of the Q1 total, and all 13 issuers are local government financing vehicles (LGFVs).

The China newsletter also provides details on the recently released China Green Industry Guiding Catalogue and important green finance policies update from Q1 2019.

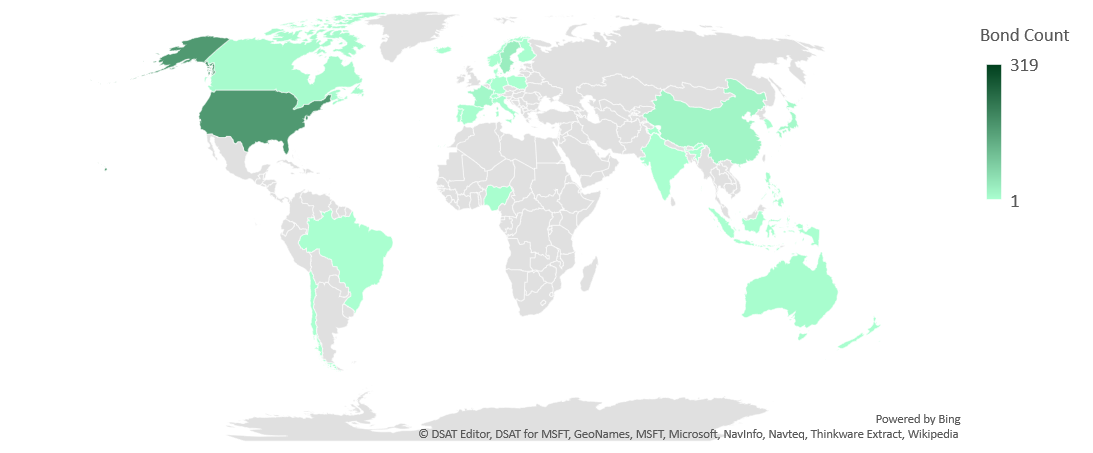

Green bond deals across the globe - 2019

Go here to see the full list of new and repeat issuers in April.

At a glance

As of April 23rd, monthly green bond issuance stood at USD8.4bn, with non-financial corporates contributing 40%of volumes. Issuance so far has been dominated by developed markets (DM), which account for 80% of volumes.

The largest corporate deals came from the Italian energy sector: energy producer ERG SpA issued its inaugural green bond and transmission system operator Terna completed its second deal, both sized at EUR500m.

Financial corporates contributed 28%, with deals from ABN Amro (EUR750m), UBI Banca’s benchmark debut green bond (EUR500m) and Link REIT’s green convertible (HKD4bn) accounting for 81% of volumes from Financials.

Among government-backed entities, numbers were fuelled by Spain’s Instituto de Credito Oficial, whose inaugural EUR500m green bond made it the second government-backed issuer after ADIF Alta Velocidad.

At this point in time, Italy leads the country rankings with the deals mentioned above contributing 20% of April issuance to date.

Emerging markets issuance was driven by Brazilian paper company Klabin, a repeat issuer whose USD denominated benchmark bond comprised 52% of EM volumes. The remainder originated in China (46%) and Iceland (2%).

To see how the country ranking changes over the rest of April, check back with us on the next Market Blog where we'll report on the total monthly volumes.

In April so far, we have seen a larger than usual volume of excluded deals, totalling USD5.6bn. With volumes covering just over half of the month, excluded issuance is already more than twice as large as the corresponding 2018 figure of USD2.6bn.

This has been driven for example by a large deal from China Three Gorges Group (CNY20bn/USD2.9bn), which was excluded as nearly a third of the proceeds were earmarked for working capital. Another large excluded bond came from Belgian local government Flemish Community, which issued a EUR750m/USD845m sustainability bond. As noted in our Green Bonds: State of the Market 2018 report (p. 23-24), we expect to see continued growth in both green bonds and other labelled issuance, particularly sustainability and SDG bonds.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Jiangsu Financial Leasing Co., Ltd. (CNY1bn/USD149m), China, brought to market a 3-year green bond. The proceeds will be used for nine projects financing PV panels and the construction of floating solar farms on freshwater bodies. This is the first Certified Climate Bond to finance such assets. Two of the solar facilities are built on land above abandoned and collapsed coal mines, which have since filled with rainwater. One facility is built over a freshwater fishpond. The latter is in fact the largest floating solar park in the world with an installed capacity of 150MW, is located in Huainan City, Anhui Province. The asset was developed by Three Gorges New Energy, a subsidiary of Three Gorges Corporation, which previously issued a wind energy-related Certified Climate Bond in July 2017.

The bond is expected to deliver several climate and environmental impacts, such as 88,000 tons of coal equivalent (TCE) avoided every year, 236,000 tons of CO2 avoided annually, and 2298.3 tons of sulphur dioxide (SO2) reduced per annum. A third-party agency will follow up on the issuer’s projects and their environmental benefits. The issuer will disclose use of proceeds to market on a quarterly basis, as well as annually before 30 April 2020.

This is the first Certified Climate Bond to be issued domestically in China. The climate impact metrics used by the issuer are consistent with findings from CBI’s post issuance reporting research, where electricity generation, carbon reduction and TCE avoidance are most frequently used for renewable energy assets. The issuer’s effort to list reporting metrics at issuance demonstrates best practice in the market.

Woolworths (AUD400m/USD284m), Australia, has become the first supermarket chain globally to issue a green bond and Certify it under the new metrics for supermarkets of the Low Carbon Buildings (Commercial) criteria. 83% of the 5-year bond’s proceeds will be used to finance investments made to construct free-standing supermarket buildings across Australia, which meet the Low Carbon Buildings eligibility requirements. The remaining 17% will finance energy efficiency improvements to supermarket buildings, as well as rooftop solar panel installation. Woolworths already has rooftop solar panels over their outdoor car parks, as well as supermarket and other buildings. In June 2018, the installed capacity of the installations amounted to 2.2 GW.

Annual reports on the use of proceeds will be made available publicly on the issuer’s website.

Issuers in Australia have been at the forefront of innovation in green bonds and Woolworths adopting the new type of building criteria is the latest example.

New issuers

Bank of Lanzhou (CNY2bn/USD298m), China, issued a 3-year green bond whose proceeds will finance six waste treatment projects ranging from WEEE (Waste Electrical and Electronic Equipment) to waste paper recycling, four projects with a focus on water supply and treatment, an urban public transit project, an energy efficiency project and one solar farm. The issuer has listed the expected environmental benefits of the investments: e.g. annual CO2 emission reductions of 20,600 tons, as well as 63,100 tons of scrap metal, 21,000 tons of plastic pellets, and 21,000 tons of waste cardboard recycled annually.

China Bond Rating awarded the deal a green bond rating of G3 (Medium Green) (assessment not publicly available). A third-party agency has been mandated to follow up on the eligible projects and their associated environmental benefits, and the issuer will publish a use-of-proceeds statement each quarter, and an annual report on before 30 April 2020.

Climate Bonds view: China Bond Rating’s green bond rating scheme, launched in December 2016, contains six grades ranging from the highest G1 (Dark Green) to NG (Not Green). We applaud the issuer’s structured and clear approach to disclosure of relevant information.

ERG SpA (EUR500m/USD564m), Italy, is an energy provider that recently launched a EUR1bn MTN programme to facilitate its transition to renewable energy. The proceeds of the initial 6-year bond will be used to finance or refinance renewable energy projects in Europe. For refinancing, solar projects must not be older than 24 months calculated from the issuance date and for wind projects, the equivalent time limit is 36 months.

ERG’s Green Bond Framework, reviewed by Vigeo Eiris, specifies that the issuer will produce an annual allocation report and impact report until proceeds have been fully allocated.

Climate Bonds view: Italy has already reached its 2020 target for the share of renewable energy, driven mainly by solar power (especially in the South). Significant investments have been made even after incentives ended in 2014. However, only 13 bonds have been issued by Italian energy companies, with 3 issues each from Enel and Terna. The issuance from ERG is, therefore, a welcome addition to the pool and helps with market diversification.

Illinois Finance Authority (USD450m), USA, issued revolving fund revenue bonds with various maturities, the longest of them being 22 years. The proceeds will refinance loans from the Illinois Environmental Protection Agency (IEPA) to local governments through the Illinois SRF (State Revolving Fund) Programs, which have been used to finance wastewater treatment, sanitary sewerage and drinking water facilities. The projects make a key contribution to advancing the Clean Water Act and the Safe Drinking Water Act in the state.

The issuer has not obtained an external review. However, IEPA will provide annual project-level updates, including each eligible project’s participant local government name, project name and description, loan amount and percentage disbursed, as well as the expected or actual completion date. The reporting will be published on the Illinois Financial Authority’s website.

Climate Bonds view: CBI commend the issuer’s approach to reporting on the use of proceeds at individual project level. This represents best practice in the market, particularly for US municipal / local government issuance, for which this level of granularity is extremely rare.

Instituto de Credito Oficial (EUR500m/USD560m), Spain, a repeat social bond issuer, has issued its inaugural green bond, a 5-year senior unsecured deal. The state-owned bank will use the proceeds to finance or refinance projects that provide environmental benefits and promote sustainable development. The Framework defines eligibility criteria for renewable energy, energy efficiency, clean transportation, pollution prevention and control, sustainable management of living natural resources and land use, as well as water and wastewater management.

As noted in the Second Party Opinion provided by Sustainalytics, ICO has committed to annual reporting of both allocation and impact until full allocation of the bond’s proceeds. Allocation reporting will be provided at the category level, while impact reporting will include relevant quantitative metrics.

Climate Bonds view: ICO had already issued social bonds, and it’s GB market entry marks the sixth green bond from a Spanish issuer in 2019 compared to 11 bonds were issued in 2018. The ICO deal is aligned to the intention of the Spanish Government to increase financing for projects with an environmental focus, as it seeks to make an “ecological transition” and become carbon neutral by 2050.

JACCS (JPY10bn/USD89m), Japan, issued a 5-year senior unsecured green bond which received a Green 1 rating from Japan Credit Rating Agency. JACCS plans to use the funds to refinance loans mainly used to fund the installation of solar power generation systems and highly energy-efficient equipment by its nationwide store network.

JACCS plans to regularly disclose the estimated power generation and estimated CO2 reductions from the solar power generation systems annually on its website after calculating environmental improvements for residential solar loans and industrial solar loans.

Climate Bonds view: This is the 10th green bond issued from a Japanese entity in 2019, and yet another example of a Japanese corporate operating in the credit business issuing a green bond to finance solar loans (others include Orient Corporation and AEON Product Finance), which has been less common in other countries.

Orient Corporation (JPY5bn/USD45m), Japan, is one of the largest consumer credit companies in the country. It issued a 5-year senior unsecured bond to refinance “Green Renovation Loans” to individual and corporate customers. The loan funds were spent on installing PV power generation systems and ancillary equipment. Most of the loan amounts are between JPY2m and JPY3m (ca. USD18k to 26k), with an average installed power output of 5.4 kW. Orient Corporation plans to use the proceeds to fund about 2,000 loans.

The bond received a Green 1 rating from Japan Credit Rating Agency, and will provide an annual third-party review of post-issuance reporting until the bond matures. Reporting on allocations is not expected as this is a refinancing deal, but Orient has committed to disclose the estimated amount of electricity generated and CO2 saved by installing solar systems on its website annually.

Climate Bonds view: It's a postive to see more consumer-focused green lending aggregation in the market, especially extending to residential loans. However, CBI would encourage issuers to disclose their project eligibility requirements in the form of a green bond framework, in keeping with market best practice.

UBI Banca (EUR500m/USD562m), Italy, issued a 5-year green bond, which benefits from a Second Party Opinion provided by ISS. The deal forms part of a EUR6bn Medium Term Note (MTN) programme, and the proceeds finance new or existing loans dedicated to renewable energy production. The bank’s reference portfolio comprises loans primarily for solar (63%), but also wind (23%), biomass (8%) and hydro (6%) power generation.

The issuer commits to reporting annually on use of proceeds and impacts until the full allocation of proceeds. Reporting will disclose proceeds allocated per Eligible Projects category, share of refinancing, and the amount of unallocated proceeds. If, after completion of the allocation period, some Eligible Projects are replaced, UBI Banca will publish an updated allocation report and an updated impact report. The impact metrics reported will include expected annual renewable energy generation (MWh) and the expected amount of energy saved (MWh).

Climate Bonds view: UBI is the third Italian commercial bank to come to market. Cassa depositi e Prestiti and Intesa San Paolo issued benchmark sized green bonds in 2018 and 2017, respectively. UBI’s bond takes the total from banks to EUR1.5bn, or 14% of Italy’s total issuance volume to date.

New issuers issued prior to April 2019

FMO (USD100m), the Netherlands, a repeat sustainability bond issuer, issued the first green bond from a national development bank in the Benelux region in February 2019. Sustainalytics provided a Second Party Opinion on FMO’s GB Framework, in which the climate-related categories are defined in line with the Multilateral Development Banks (MDBs) report for Climate Finance Tracking.

FMO commits to reporting to stakeholders annually and will be done in accordance with the Green and Social Bond reporting templates.

The proceeds of the 5-year senior unsecured bond will finance climate change mitigation and adaptation, but also other activities that do not directly target climate change mitigation or adaptation but still have a positive impact on the environment. A minimum 20% reduction in energy consumption or GHG emissions is required for energy efficiency projects related to in industrial equipment and buildings. Other eligible categories include renewable energy, transport, agriculture and forestry, waste and wastewater management. Examples of adaptation and resilience projects include climate-smart agriculture, increasing biological diversity, controlling overfishing, and adaptive land use management.

Climate Bonds view: We welcome MDB issuance from Europe. FMO’s framework is extensive and ambitious and includes specific definitions, targets and guidelines for each eligible project category. The issuer has also followed market best practice by obtaining an external review, as well as making the commitment to annual post-issuance reporting on both the use of proceeds as well as the impact of investments. For impact reporting, FMO has disclosed a methodology already at issuance, which is rare to see.

Clemens Kraft AS (NOK300m/USD38m), Norway, issued a 7-year green bond in February 2018 to exclusively finance small-scale hydro power plants (SSHPP’s) in Norway. Only run of river hydro plants without dam reservoirs are eligible. CICERO provided a Second Party Opinion.

The issuer illustrates commitment to sustainability by stating their intention to create a separate section for green bond reporting on their website. The disclosure will take place at least annually until full allocation of proceeds and reporting will include amount of unallocated proceeds, share of refinancing, energy generation (MWh), installed capacity (MW), and any negative deviations including regulations, guidelines or agreements breached.

Climate Bonds view: More hydro issuance from Norway is encouraging as the country has significant potential to leverage this form of renewable energy generation. In line with CICERO’s remarks, we also find the issuer’s reporting commitment commendable, in that it states that any instances where projects are non-compliant with regulations or guidelines will be highlighted. The issuer has also included Environmental Impact Assessments (EIAs) as a mandatory step in each project aimed at mitigating the possible negative social and environmental consequences that can arise even from small-scale hydro projects. This is laudable.

Repeat issuers – April

- ABN Amro: EUR750m/USD848m – Certified Climate Bond

- African Development Bank (AfDB): SEK1.25bn/USD135m

- Aguas Andinas: UF2m/USD83m (issued in March 2019)

- Arizona State University : USD125m

- Atrium Ljungberg: SEK500m/USD54m

- CDL Properties: SGD100m/USD74m

- CDL Properties: SGD400m/USD295m

- Fabege: SEK400m/USD43m

- IFC: EUR18m/USD20m

- IFC: EUR113m/USD126m

- Interstate Power and Light Company: USD300m

- Jernhusen: SEK1.5bn/USD161m

- Klabin: USD500m

- Landwirtschaftliche Rentenbank: SEK2bn/USD216m

- LCDA (Louisiana Community Development Authority): USD10.4m

- Link REIT: HKD4bn/USD510m (convertible)

- Reykjavik Energy: ISK2.11bn/USD18m

- SNCF: EUR250m/USD282m (tap) – Certified Climate Bond (Programmatic Certification)

- Societe du Grand Paris: EUR70m/USD79m – Certified Climate Bond (Programmatic Certification)

- Societe du Grand Paris: EUR55m/USD61m – Certified Climate Bond (Programmatic Certification)

- Terna: EUR500m/USD562m

- Toyota Finance: JPY60bn/USD536m

- World Bank: EUR250m/USD281m

- World Bank: AUD200m/USD154m (tap)

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Yorkshire Water |

GBP350m/USD455m |

18/04/2019 |

Excluded (sustainability bond) |

|

Shandong Iron and Steel Company Ltd |

CNY2bn/USD298m |

18/04/2019 |

Excluded (working capital) |

|

Bank of Guangzhou |

CNY5bn/USD745m |

16/04/2019 |

Excluded (not aligned) |

|

Beijing Capital Co. Ltd |

CNY1bn/USD149m |

12/04/2019 |

Excluded (not aligned) |

|

Bank of Qinghai |

CNY1.5bn/USD224m |

12/04/2019 |

Excluded (not aligned) |

|

China Three Gorges Group |

CNY20bn/USD2.9bn |

10/04/2019 |

Excluded (working capital) |

|

Otto Group |

EUR250m/USD282m |

10/04/2019 |

Excluded (sustainability bond) |

|

Hunan Expressway Co |

CNY890m/USD133m |

09/04/2019 |

Excluded (not aligned) |

|

Bank BRI |

USD500m |

28/03/2019 |

Excluded (sustainability bond) |

|

Lidl Austria |

CHF300m |

15/05/2019 |

Pending (waiting for more information) |

|

The Nature Conservancy |

USD400m |

16/04/2019 |

Pending (waiting for more information) |

|

Electronica Finance Limited |

INR696m/USD10m |

16/04/2019 |

Pending (waiting for more information) |

|

Consorcio Transmantaro S.A. |

PEN1.3bn/USD400m |

16/04/2019 |

Pending (waiting for more information) |

|

LG Chem |

EUR750m/USD845m CNY600m/USD95m JPY33.5bn/USD302m |

15/04/2019 |

Pending (waiting for prospectus) |

|

Indiana Finance Authority |

EUR2.25bn/USD2.55bn |

10/04/2019 |

Pending (waiting for prospectus) |

|

EBRD |

EUR100m/USD112.5m |

08/04/2019 |

Pending (waiting for prospectus) |

|

EBRD |

EUR115m/USD129m |

05/04/2019 |

Pending (waiting for prospectus) |

|

IFC |

EUR10m/USD11m |

03/04/2019 |

Pending (waiting for more information) |

Green bonds in the market

- Sogn og Fjordane Energi: NOK200m – closed April 24

- La Banque Postale: EUR750m, closed April 24

- ICBC Singapore – Closing April 25

- Midsummer: SEK200m – closed April 25

- ADIF Alta Velocidad: EUR600m – closed April 25

- Sogn og Fjordane Energi: NOK200m – closing April 26

- Asian Development Bank: SEK500m (tap) – closing April 29

- City of Starkville, MS – closing May 1

- Royal Bank of Canada – closing May 2

- Lidl Austria: CHF300m (3 tranches, each 100m) – closing May 15

- Dutch State Treasury Agency: EUR4-6bn – Certified Climate Bond – closing May 23

- United Urban Investment Corporation: JPY10bn – closing May 23

- UGE International

Investing News

The Nature Conservancy (TNC) has launched its plan to help island and coastal nations address their debt challenges, positively affect over 40 million people and conserve 15% more of the world’s oceans than at present in the next five years. TNC’s Blue Bonds for Conservation plan works through leveraging USD40.5m in philanthropic funding to catalyse up to USD1.6bn of financing for ocean conservation.

Chicago, IL has passed legislation that commits the city to using 100% renewable energy by 2040. The city council’s resolution was signed into law on April 10th, and requires a transition plan outlining strategies, progression milestones, and a timeline for reaching “an equitable clean energy transition”, be put in place by December 2020. New York City’s Mayor announced the “OneNYC 2050” plan to cut carbon emissions by 30% by 2030, while Washington State aims to be fully carbon neutral by 2030.

The Bank of England (BoE) became the first central bank to issue guidance for insurers and banks on how to manage the financial risks of climate change.

Elsewhere, BoE Governor Mark Carney and his colleagues from the Network for Greening the Financial System (NGFS) issued a stark warning for banks ignoring climate change. Mr Carney called it existential threat to the global financial system, and urged industry actors to take immediate steps to reform.

The Finance Ministers of more than 20 countries have come together to combat climate change. Co-led by the Ministers of Finance of Finland and Chile, the group convened in Washington, DC on April 13th at the Spring Meetings of the World Bank and the IMF to launch the Coalition of Finance Ministers for Climate Action. The group also endorsed the new “Helsinki Principles” aimed at promoting climate action through fiscal policy and public finance.

Oil firm Saudi Aramco, the world’s most valuable company, issued its first ever public debt in the form of USD10bn corporate bonds. In the prospectus, Saudi Aramco names climate change as the key risk for its business going forward, in part as the company expects that it may result in lawsuits against the firm. Yet the firm does not see “peak oil” happening in the next decade, and aims for the “last barrel of oil to come from the [Arabian peninsula] region”, according to its CEO’s comments at the World Economic Forum in Davos this February.

Expected annualised returns from sustainable and impact forestry funds range from 7% to 18%, with a median of 8%, according to the Global Impact Investing Network (GIIN). In another market sizing study GIIN finds that the impact investment universe currently stands at approximately USD502bn, managed by over 1,340 organisations globally. The figure is more than twice as large as previously thought, which sends an overwhelmingly positive signal on the growth of sustainable investing.

Green Bond Gossip

The Dutch government will require potential investors to pre-qualify with their ESG credentials before being considered for priority allocation for its upcoming sovereign green bond. Prospective investors will need to have a dedicated internal Environmental, Social and Governance (ESG) analysis team, specific ESG requirements and criteria related to Green Bonds, as well as the intention to purchase Dutch sovereign bonds to fulfil targets on green bond amounts. Investors must also transparently report on their investments in Green Bonds in an annual report or specific sustainability/responsible investment report.

Reuters reported the Chilean government’s ambitions to issue the first Latin American sovereign green bonds. The deal size could be up to USD1.5bn, which is the amount of foreign currency debt that Chile is expected to raise in 2019. The issue would allow the country to widen its investor base as well as comprise part of a wider environmental and strategic effort by the government. Chile will also host COP 25 in Santiago in December.

Danish bank Nykredit is preparing to issue a green covered bond, which is intended to finance green mortgages on energy efficient buildings across Denmark. The company obtained a Second Party Opinion for its Green Bond Framework from Sustainalytics.

The Egyptian Ministry of Finance announced that its planned sovereign green bond issuance has been postponed to the following fiscal year to allow the government to adequately prepare and comply with Euroclear regulations. Minister of Finance Mohamed Ma’it commented to Bloomberg: “We will make sure that next year we will be more ready to issue Panda, Samurai and Green bonds”.

Belarusian Belinvestbank intends to issue green bonds to finance projects related to renewable energy, energy efficiency and low carbon transportation. The bank wants to grow the share of green projects in its portfolio significantly from the current 10% to ultimately transform itself into “Ecobank”.

Readings & Reports

The bad news:

- Man-made CO2 emissions trap heat in the atmosphere that is the equivalent of 400,000 Hiroshima-sized bombs every day, states Bill McKibben of 350.org. In this article he outlines how this is causing the impacts of climate change that are being felt here and now, from Houston to Calcutta and everywhere in between.

- A new report by the European Commission’s Directorate General for the Environment found that by failing to implement legislation to limit air pollution, the EU incurred EUR24bn of costs in 2018 alone.

The good news:

- The International Renewable Energy Agency (IRENA) has found that by 2050, renewables could meet 86% of global power demand. IRENA’s new report titled “Global Energy Transformation: A Roadmap to 2050” states that to make this a reality, investors, companies and regulators will need to collaborate globally to electrify key sectors, such as transport and heavy industry. Renewable energy production will also need to grow six times faster than at present.

- A new study conducted by consulting firm PwC finds that harnessing artificial intelligence (AI) in key sectors, including energy, transport, water and agriculture, could result in a drop in of up to 4% in global greenhouse gas emissions by 2030. Embedding AI in these sectors could also help to create up to 38 million jobs worldwide, the report finds.

Proposed actions:

- The most effective ways to curb climate change might surprise you, says the CNN. The paper published a climate change-themed quiz based on the solutions ranked by Project Drawdown on its website, allowing quizzers to test themselves in prioritising some of the proposed solutions.

- A report produced jointly by the Urban Land Institute and real estate asset manager Heitman finds that physical and transitional risks from climate change can be disastrous for property investors, if left unmitigated. The study outlines strategies that investors can employ to be more prepared, including for example mapping the physical risks for existing portfolios and potential acquisitions, incorporating climate change risk into due diligence, as well as engaging with policymakers on city-level resilience initiatives.

Finally, a new civil society movement to fight climate change, Extinction Rebellion, occupied many of London’s landmark sites in protest for the last week, garnering unprecedented support for its cause. The Financial Times interviewed people within the climate resistance to shed light on the goals of the movement.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.