We’re looking for a Policy Manager.

Here's the key points:

Job: Policy Manager

Location: London Bridge (Central London)

Salary: NGO Competitive

Position: Full Time

Closing date: Friday 15th March 2019

We’re looking for a Policy Manager.

Here's the key points:

Job: Policy Manager

Location: London Bridge (Central London)

Salary: NGO Competitive

Position: Full Time

Closing date: Friday 15th March 2019

Global Institutions reflect commitment to a 2020s green finance growth agenda

The Climate Bonds Initiative has announced major Sponsors and Media Partners for the 2019 Conference and 4th Green Bond Pioneer Awards to be held in London, March 5 – 7.

Let's talk green trillions into the 2020s: Green deals, green finance, green investment and green markets.

Emerging economies, green growth paths, green cities, infrastructure and energy projects on the agenda.

Only 3 weeks away! London, March 5-7, the largest green bonds event of the year.

"Lack of standards is not a hinderance to green bond issuance. Pressure on corporates to finance transition will intensify," writes Sean Kidney

(Orginal published by Investment & Pensions Europe (IPE)

In this month’s media digest: green bond market forecast by Moody’s, HSBC, S&P and Climate Bonds Initiative, 2018 sustainable debt products performance by Bloomberg New Energy Finance, City’s first green bond, planned green bond from Egypt, FTSE index tracking Chinese green bonds, Climate Bonds Standard certified bonds and much more market and Asia news.

MARKET

Moody’s latest report forecast 20% green bonds market growth in 2019 - to $200 billion. HSBC predicts $180 in line with S&P Global Ratings.

Moody’s

Climate Bonds Certified USD152 million Taxable Municipal Green Bond Offering

We're warming up for our Annual Conference 5-7th March in London.

Meantime some opportunities to meet the Climate Bonds team in events across Europe, Asia and Central America.

TEG briefings and a host of activities in China, Hong Kong and Japan are all on the radar.

Here's what's on the agenda for February!

|

Helsinki

|

5th |

Manuel Adamini |

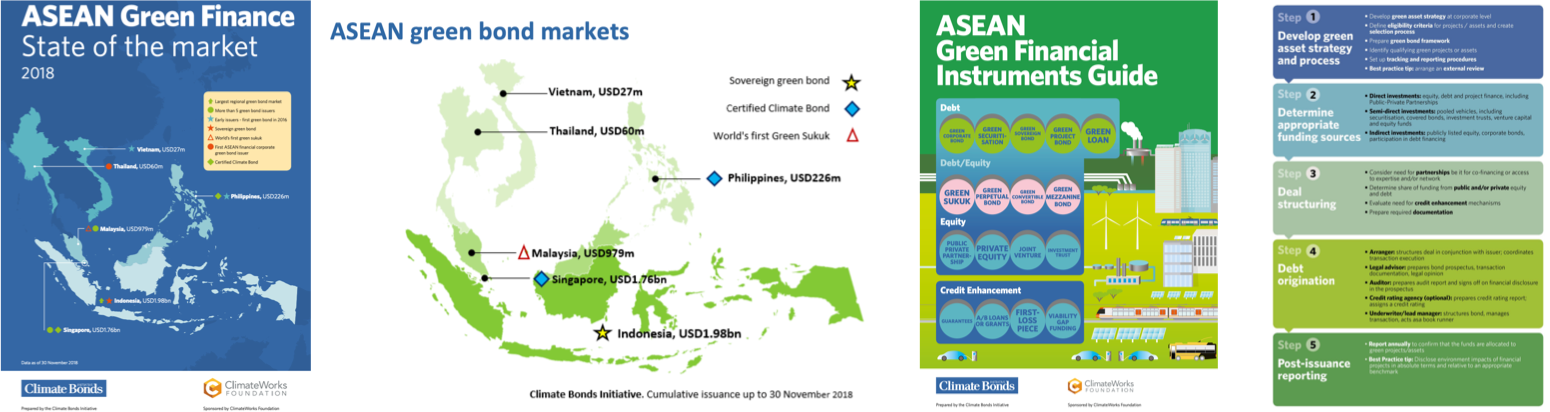

Green finance markets in ASEAN: Foundations for green growth and low carbon infrastructure

Opportunities emerge

Since the initial 2016 green bond deals in the Philippines and Vietnam, ASEAN green bond market stakeholders have laid some solid foundations, culminatining in total issuance of USD5bn as of the end of November 2018.