Highlights:

-

AC Energy issues second Certified Climate Bond from the Philippines

-

Citigroup issues first EUR-denominated green bond from a US commercial bank

-

SCBC comes to market with the second green covered bond from a Swedish issuer

-

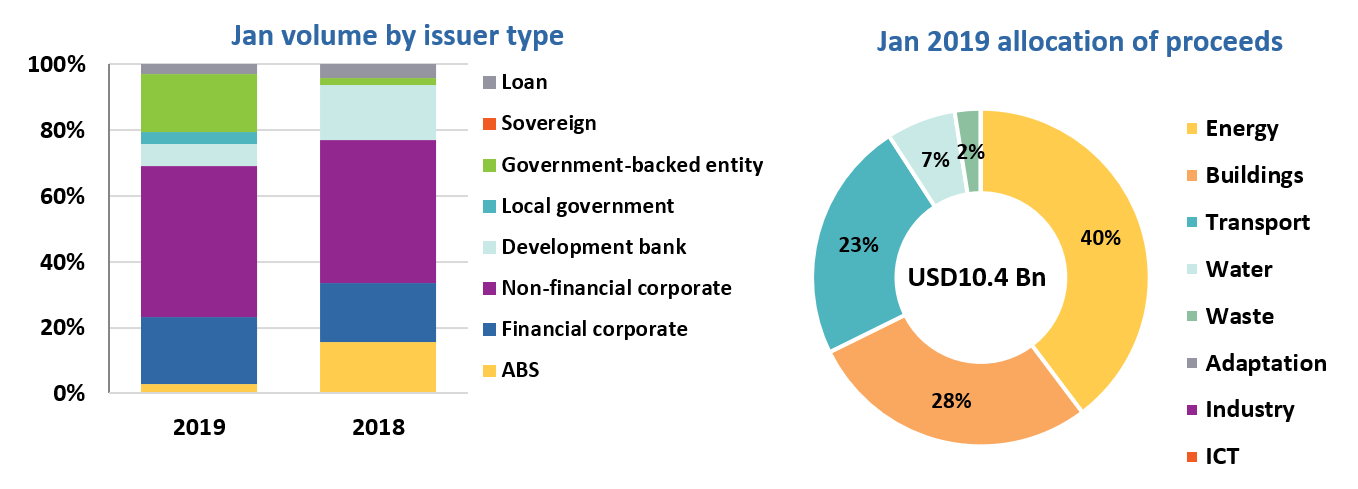

Corporates dominate issuance at 46%

Don’t miss:

-

Climate Bonds Conference just 4 weeks away! 5-7th March, London. Book your spot at the Green Bond Boot Camp, don’t miss the Awards night, more details and registration here

-

Sean Kidney writes in IPE on the outlook for 2019

Climate Bonds’ new reports:

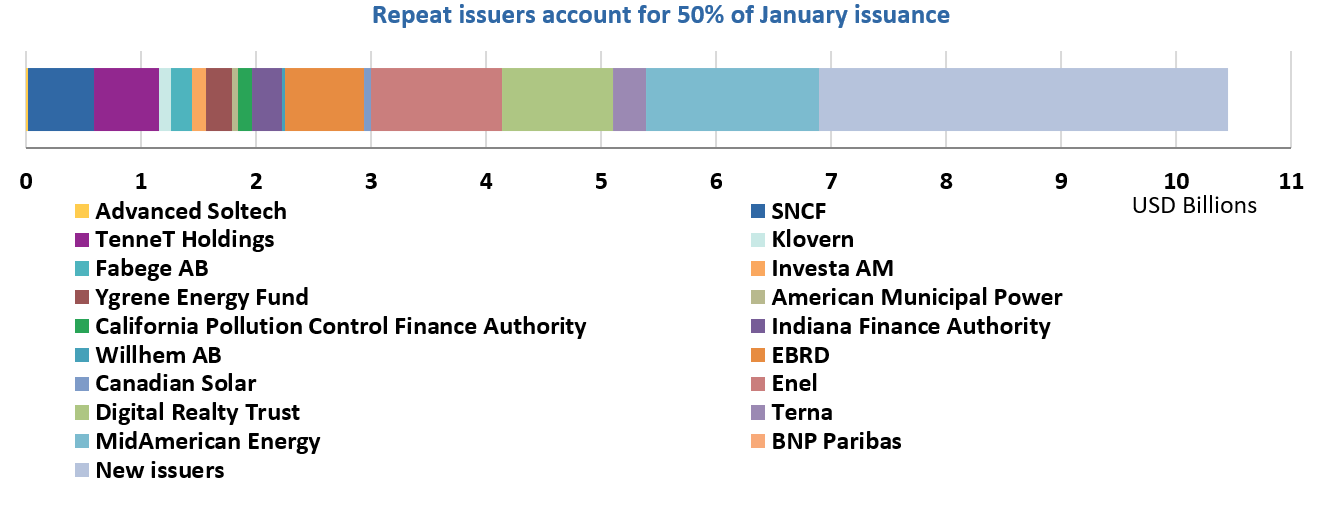

Go here to see the full list of new and repeat issuers in January.

January at a glance

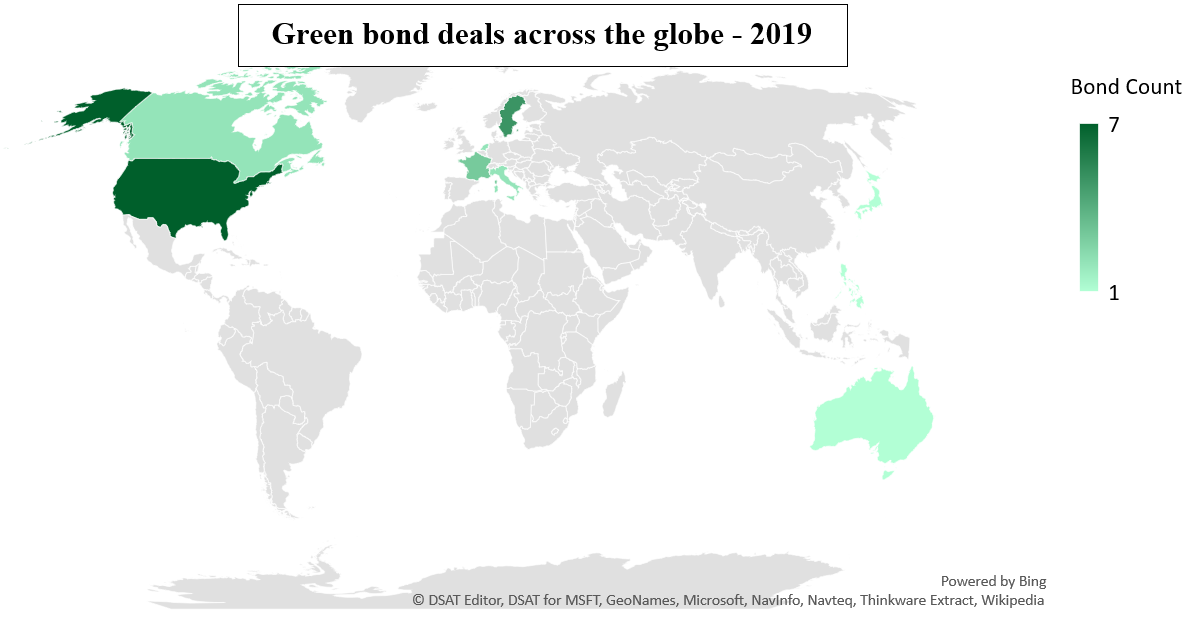

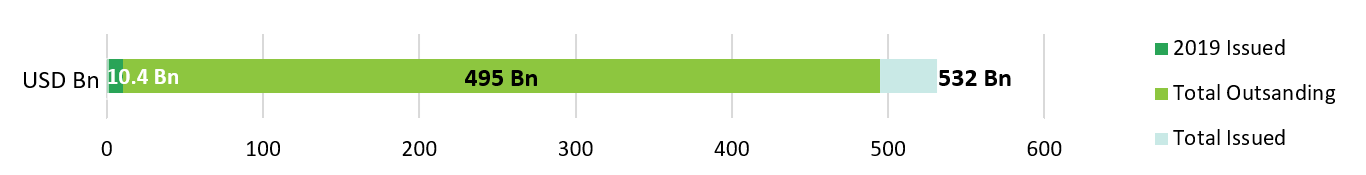

January green bond issuance reached USD10.4bn. This is 7% lower than the corresponding 2018 figures. However, Fannie Mae has yet to report its green MBS and credit facility deals.

The US took lead in the first month of green bond issuance, accounting for 41% of volume. Over a third of the share came from MidAmerican Energy’s USD1.5bn green bond – the largest deal in 2019 so far. This bond contributed to taking corporate issuance to the first spot at 46%, with benchmark sized deals also coming from Algonquin Power & Utilities Corp (Canada), Enel (Italy) and LISEA (France).

Monthly trends show renewable energy dominating use of proceeds at 40% of allocations, with low-carbon buildings at 28%.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

AC Energy (USD225m), Philippines, issued a 5-year senior unsecured Certified Climate Bond, which obtained Certification under the Solar, Wind and Geothermal Criteria of the Climate Bonds Standard. Due to high demand for the deal, the issuer reopened the bond for an additional USD75m, which was provided by IFC as an anchor investment and is expected to close on February 12.

This is the second Certified Climate Bond issued from the Philippines following AP Renewable’s PHP10.7bn (USD226m) Certified Climate Bond in February 2016, supported by the Asian Development Bank (ADB). AC Energy is also the third green bond issuer to obtain certification under the Geothermal Criteria of the Climate Bonds Standard. Proceeds will be used to finance a mix of new and existing onshore wind, solar and geothermal assets across Southeast Asia and Australia.

The issuer has already returned to market with a second Certified green bond with a 10-year tenor expected to close on February 12. The Asian Development Bank (ADB) acted as one of the main investors with USD20m.

Sustainalytics provided the Pre-Issuance Verification Report.

New issuers

Algonquin Power & Utilities Corp (CAD500m/USD377m), Canada, issued a 10-year private placement, and obtained a Second Party Opinion from Sustainalytics. Proceeds are earmarked for solar, wind, existing hydro and storage assets/projects. The development of new hydroelectric facilities with a capacity exceeding 25MW is explicitly excluded from eligible projects.

Climate Bonds view: Canada’s green bond market has been driven by financial corporate and local government issuance to date, which account for 66% of cumulative issuance. We welcome the entry of a new corporate in the market and hope to see more companies capitalising on the value of the green label.

For hydropower, it would be good to see issuers reporting on power density ratio or annual emissions (gCO2/kWh) of the asset, rather than focusing on power plant capacity.

> Keep an eye out for our upcoming Canada update report due in late February.

BNG Bank (AUD25m/USD18m), Netherlands, issued a 10-year senior unsecured renewable energy bond. According to the press release, the bond is intended to finance a wind energy project based in the Netherlands.

Climate Bonds view: BNG Bank’s debut deal in the green bond market follows two sustainability bonds issued in 2016 and 2018. We encourage issuers to disclose details of the financed projects and reporting practices in a publicly available framework.

Citigroup (EUR1bn/USD1.14bn), USA, issued a 3-year senior unsecured green bond, which benefits from a Sustainalytics Second Party Opinion. This is the first EUR-denominated green bond from a US commercial bank and second largest following Bank of America’s USD2.25bn deal in May 2018. Proceeds are earmarked for lending on renewable energy, buildings, transport and water projects.

To be eligible, geothermal and biofuel projects are required to emit less thank 100gCO2/kWh. Financing and refinancing of property-related energy efficiency loans are also eligible under the Green Bond Framework.

Climate Bonds view: With its debut deal, Citi joins Bank of America and Morgan Stanley as the third US commercial bank to enter the green bond market. Geothermal eligibility criteria reflect market best practice. The issuer has confirmed that all other assets included in the portfolio are compliant with the Climate Bonds Taxonomy.

LISEA (EUR905m/USD1.04bn), France, issued a two-tranche green project bond (longest dated bond: 35 years). Vigeo Eiris provided the Second Party Opinion (not publicly available). Proceeds are expected to refinance part of the High Speed South Europe Atlantic Line between Tours and Bordeaux (LGV SEA).

Climate Bonds view: Transport sector allocations from French green bond issuers have been increasing, reaching 35% of proceed allocations in 2018. Amongst rail companies, both SGP and more recently SNCF have adopted the streamlined Climate Bond Programmatic Certification process which is particularly suited to large multiple green bond issuers. This deal also contributes to the upward trend of investment flows in railway infrastructure. We encourage issuers to make external reviews publicly available to enhance transparency.

Odakyu Electric Railway Co (JPY10bn/USD92m), Japan, issued a 3-year senior unsecured green bond, becoming the first Japanese debut issuer of 2019. Sustainalytics provided the Second Party Opinion and Japan Credit Rating Agency (JCR) awarded the deal a Green 1 Green Bond Evaluation. The deal is expected to finance new or renewed electric trains, multiple double track projects and renovation of stations.

Climate Bonds view: As of end of 2018, Japan’s green bond market reached a cumulative total of USD9.7bn with 2018’s issuance volume representing 22% growth year-on-year.

Swedish Covered Bond Corporation (SCBC) (SEK6bn/USD663m), Sweden, issued a 5-year green covered bond – the second covered bond from a Swedish green bond issuer after Landshypotek Bank’s deal in May 2018. CICERO provided the Second Party Opinion. Proceeds will be allocated to financing mortgages on energy efficient buildings which have obtained an EPC A, B or C, Miljöbyggnad “Silver”, Svanen, Passivhus, or Green Building certificate, and on energy efficiency upgrades yielding at least 30% decrease in final energy use per m2/year. The issuer’s Green Bond Framework includes a detailed list of eligibility criteria for retail and corporate customers.

Climate Bonds view: This deal takes cumulative volumes of green covered bonds to USD8.3bn. As the market continues to mature, bond structure diversification is expected to continue.

New deals issued prior to 2019

Pepper Group (EUR110m/USD125.1m and AUD75m/USD54.1m), Australia, issued an AUD1.25bn multi-currency RMBS, which includes two green tranches (longest dated tranche: 2.7 years) in December 2018.The green tranches benefit from a Sustainalytics Second Party Opinion.

Eligible projects include green mortgages for properties using building codes from New South Wales, Victoria, and Tasmania combined with BASIX, NatHers and NCC BCA third-party standards. This ensures that the buildings are in the top 15% of the market in terms of building energy performance.

To be eligible, properties located in Queensland, South Australia, Western Australia, Australian Capital Territory and the Northern Territory must comply with the New South Wales’ properties eligibility criteria. According to Sustainalytics, there are limitations to this approach as “applying the same building codes across different regions may not lead to the same energy efficiency improvement because of variation [regional] in climate.” However, the SPO provider considers this eligibility proxy a valid approach to identify top-performing buildings in terms of energy efficiency in the absence of suitable region-specific criteria.

Climate Bonds view: Pepper Group is the second Australian issuer to come to market with an RMBS which includes green tranches, after NAB’s Certified AUD300m green RMBS tranche in February 2018.

Eligibility criteria for buildings located in New South Wales, Victoria, and Tasmania are aligned with market best practice. We agree with Sustainalytics that the use of a proxy to identify top performing buildings for regions where specific eligibility criteria cannot be applied yet demonstrates the issuer’s commitment to ensuring financed buildings have sound green credentials.

Repeat issuers

-

Advanced Soltech Sweden AB: SEK17m/USD19m

-

American Municipal Power: 21 tranches for a total of USD55m

-

BNP Paribas: SEK12m/USD1m

-

Canadian Solar: JPY6.3bn/USD58m

-

California Pollution Control Finance Authority: 2 tranches for a total of USD117m

-

Digital Realty Trust: EUR850m/USD968m

-

EBRD (European Bank for Reconstruction and Development): EUR600m/USD690m

-

Enel: EUR1bn/USD1.1bn

-

Fabege AB: SEK1.6bn (USD177m)

-

Indiana Finance Authority: 14 tranches for a total of USD114m

-

Investa Commercial Property Fund: AUD170m/USD122m – Certified Climate Bond

-

Klovern: SEK1bn/USD110m – reopening

-

Modern Land: USD130m – issued in June 2017

-

SNCF: EUR500m/USD568m – Certified Climate Bond

-

TenneT Holdings: 3 tranches for a total of EUR500m/USD565m

-

Terna: EUR250m/USD288m - reopening

-

Willhem AB: SEK200m/USD22m

-

Ygrene Energy Fund (GoodGreen): 2 tranches for a total of USD225m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though, we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Kookmin Bank |

USD450m |

01/02/2019 |

Sustainability/Social bond |

|

RSB HMAO |

RUB1.1bn/USD16.3m |

19/12/2018 |

Not aligned |

|

Itaú Argentina |

USD50m |

04/12/2018 |

Not aligned |

|

ADB |

AUD1bn/USD719m |

17/01/2019 |

Pending |

|

CDL Properties |

SGD125m/USD92m |

17/01/2019 |

Pending |

|

Korea Midland Power Co |

USD300m |

22/01/2019 |

Pending |

|

Vasakronan |

SEK100m/USD11m |

24/01/2019 |

Pending |

|

Vasakronan |

SEK500m/USD55m |

01/02/2019 |

Pending |

|

Engie |

EUR1bn/USD1.1bn |

28/01/2019 |

Pending |

|

Japan Housing Finance Agency |

JPY10bn/USD91m |

21/01/2019 |

Pending |

|

EBRD |

SEK2.5bn/USD280m |

11/01/2019 |

Pending |

|

Ontario Power Generation |

CAD500m/USD377m |

18/01/2019 |

Pending |

|

Region Skane |

SEK700m/USD77m; SEK300m/USD33m |

05/02/2019 |

Pending |

Green bonds closed in February

- RCBC (Rizal Commercial Banking Corporation): PHP15bn – February 1

- NIB (Nordic Investment Bank): SEK2bn – February 2

- Jernhusen AB: SEK150m – February 4

- NRW.BANK: EUR500m –February 4

- Telefónica: EUR1bn – February 5

- CPPIB (Canada Pension Plan Investment Board): EUR1bn – February 6

- New York MTA: USD191m – Certified Climate Bond, February 6

- Klovern – SEK400m – February 6

Green bonds in the market

- Verizon Communications Inc: USD1bn – closing February 8

- AC Energy: USD75m (reopening); USD110m – Certified Climate Bonds, closing February 12

- Canton of Basel Stadt: two tranches for a total of CHF200m – closing February 22

- Korea Western Power: CHF200m – closing February 27

Investing News

FTSE Russell has launched a China Green Bond Index series.

HSBC used ESG scores to identify 17 attractive sovereign bond issuers.

Moody's and S&P predict another record-breaking year for green bonds, while BlackRock forecasts sharp growth in sustainable funds.

Dublin-based asset manager KBI Global Investors (KBIGI) has announced three fossil-free equity funds on the back of a ballooning divestment movement.

Green Bond Gossip

France prepares fifth tap of green bond at auction.

Climate Investment Funds plans to issue USD500m green bond in 2019 or 2020 to finance renewable energy projects.

South Korean bank, KEB Hana Bank, developed a ‘Sustainable Financing Framework’ which obtained a Sustainalytics Second Party Opinion.

Sustainalytics provided a Second Party Opinion on Flanders’ Sustainability Bond Framework.

Natural gas utility, Korea Gas Corporation, established ‘Sustainability Bond Framework’ under which it is planning to issue sustainability bonds. The framework obtained a Sustainalytics Second Party Opinion.

Nobina, the leading bus operator in the Nordic region, is looking into issuing a debut green bond.

Orkuveita Reykjavíkur (Reykjavik Energy) will conduct an auction of a new inflation linked green bond series on February 13. We’re particularly chuffed about this one having identified the Incelandic energy sector as a potential source for green bonds in our Nordic and Baltic Public Sector Green Bond report from February 2018.

Readings & Reports

The Centre for International Governance Innovation recently launched a new paper: Green Bonds: Current Development and Their Future

The Harvard Business School published an article exploring why green bonds may be our best bet for environmental damage control.

IPE’s February issue has a special green finance section on Portfolio Strategy: Green Bonds.

Climate Bonds articles and reports

Leading viewpoint: 2019's green investment picture, an article by Sean Kidney, included in IPE’s special green finance section

Financing low carbon buildings and energy efficiency in the green bond market

ASEAN Green Finance State of the Market 2018

ASEAN Green Financial Instruments Guide

Opportunities for Sustainable Infrastructure Investments at City Level in Brazil

Spanish version: Bonds & Climate Change - The State of the Market 2018

‘Till next time,

Climate Bonds