Climate Bonds Blog

European Commission announces new Platform on Sustainable Finance

Usability focus is key to unlock the potential of the EU Taxonomy

This week, the European Commission announced the members of the new Platform on Sustainable Finance, including Climate Bonds.

Resilience, SLB standards, sovereign issuance & transition tipping-point all in the mix for 2023

Climate Bonds’ Market Intelligence has revealed Green, Social, Sustainability, Sustainability-linked and transition bonds (GSS+) issuance held its market share despite a difficult year for fixed-income markets, in which GSS+ volumes fell year-on- year for the first time in a decade.

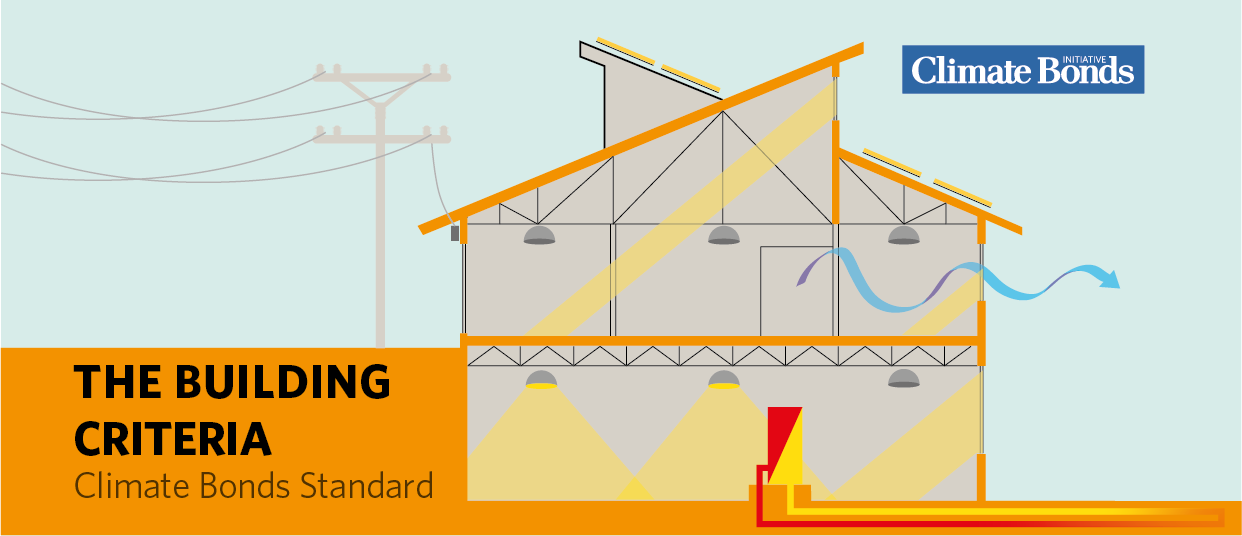

A call for ambitious building decarbonisation measures in Europe

Buildings account for over a third of the EU’s greenhouse gas emissions; the International Energy Agency estimates that 38% of the emission reductions we need to achieve by 2050 will have to come from the built environment.

Yet to date, making Europe’s buildings more energy efficient has been painfully slow. Most of the gains so far have been delivered through technological efficiencies – mainly more efficient boilers, switching to LED lighting and smarter heating controls.

A new umbrella Standard, Entity level & SLB Certification, focus on Heavy Industry & Agri-Food Systems: An ambitious transition programme for 2023

At a Glance

Building on the 2022 platform of extensive policy guidance, new industry standards and an expansion in criteria and certification avenues for investors will be the foundation of Climate Bonds transition programme for the year ahead.

From Mexico to India to Malaysia: While our staff will not be speaking at these in-person events, they will still be appearing.