A new umbrella Standard, Entity level & SLB Certification, focus on Heavy Industry & Agri-Food Systems: An ambitious transition programme for 2023

At a Glance

Building on the 2022 platform of extensive policy guidance, new industry standards and an expansion in criteria and certification avenues for investors will be the foundation of Climate Bonds transition programme for the year ahead.

Expanding the Standard - Entity-Level, SLB / SLL Certification

The overarching Climate Bonds Standard sees a major evolution in 2023 from the current Version 3. This will allow for certification of Sustainability-Linked Bonds (SLBs), Sustainability-Linked Loans (SLLs) and entire entities.

The overarching Climate Bonds Standard sees a major evolution in 2023 from the current Version 3. This will allow for certification of Sustainability-Linked Bonds (SLBs), Sustainability-Linked Loans (SLLs) and entire entities.

Essentially, those corporates that are aligned with 1.5-degree pathways or will be by 2030 will be eligible for Certification.

This includes those whose emissions are already ‘near-zero’ and those that are not, so long as the corporate entity has suitably Ambitious Performance Targets and Credible Transition Plans for the delivery of those Targets, i.e., it is undergoing an ambitious and credible transition.

Although this work originated from our previous development work on ensuring credible transitions, and ‘no greenwashing’ as the transition concept and label emerged, these new certification offerings are applicable more broadly than purely transitioning corporates and SLBs.

See here for further details.

Heavy Industry - New Sectors For 2023

The Climate Bond Standard Transition Sectors will expand to Criteria for:

- Hydrogen Infrastructure

- Energy Utilities

- Metals and Mining

- Commodities Supply Chain

Work on new Criteria for the transition of energy utility companies, hydrogen infrastructure, and mining have also started with Criteria scheduled for completion later in in 2023.

An important part of transition is the early phase out of stranded assets, with coal power as the priority for engagement. Guidelines for financing a credible coal transition have been initiated in this workstream, with more engagement planned in the coming year.

The focus on heavy industry builds on the 2022 launches four new of Criteria for industrial transition, that expanded reach of Certification scheme Cement, Basic Chemicals, and steel sectors, and established ground breaking Criteria for Hydrogen Production.

Agri-Food Systems

With support from New Venture Fund, we launched the Agri-Food Systems Transition project to support the transition of agri-food systems toward net-zero. Crop and Livestock Criteria proposed for 2023 will build upon existing Agriculture Criteria already being used to certify assets and activities. The updated Criteria will, however, include an expanded scope allowing for the certification of entities and Sustainability Linked Bonds (SLBs) in the crop and livestock production sectors.

Policy Guidance – Gas, Steel and Global Resilience

Providing Guidance to policymakers and regulators remains a priority in 2023.

Providing Guidance to policymakers and regulators remains a priority in 2023.

Rapid and credible transition requires continued engagement on the role of gas in global energy systems. “Accelerating the Fossil Gas Transition to Net Zero” provides guidance for policymakers on how best to phase out fossil gas from energy production, especially in the wake of the decision to allow fossil gas to be labelled green under the EU Taxonomy.

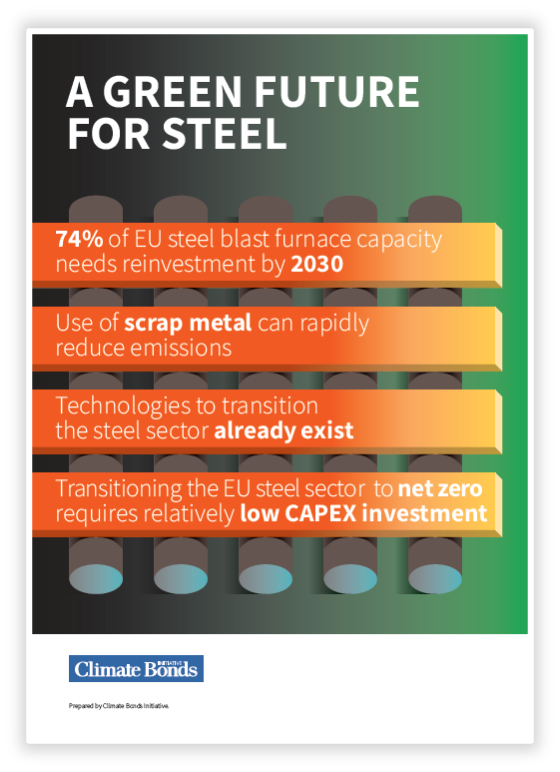

Similarly, the papers “A Green Future for Steel” and “A Fork in the Road for the Global Steel Sector” provide regulators with guidance on how best to capitalize on the reinvestment requirements in the global steel industry. Seventy four percent of EU steel blast furnace capacity needs reinvestment by 2030, and blast furnaces have a life span of several decades. These papers provide policymakers with the tools they need to guide industry and investors onto a climate-aligned pathway for steel.

|

|

Engagement with government, industry and investors on transition pathways for both these sectors will be high on our agenda in 2023.

Building Resilience in the Age of Volatility

In 2022 Climate Bonds launched our new Global Resilience Programme, aimed at mobilising capital markets to accelerate the urgent and necessary transition to resilient societies.

It sets out three goals for the Global Resilience Programme:

- to identify credible, science-based investment opportunities that build resilience,

- to mobilise finance towards credible resilience measures, and

- to accelerate the speed and growth of resilience investments through a supportive policy and regulatory environment.

2023 will see Climate Bonds providing training, technical assistance, and investment tools to develop markets and create global movement around resilience finance.

In addition, Climate Bonds will strategically engage investors and aim to embed resilience definitions into national and regional taxonomies building on the work to mobilise markets, including actionable policy recommendations to policymakers and regulators.

Credible Transition Plans and Training

The new Transition Criteria are among the first Climate Bonds sector criteria to be able to certify more than just Use-of-Proceeds bonds.

Transition criteria are built on the Five Principles for a credible transition, originally established in Climate Bonds’ pioneering Financing Credible Transitions paper from October 2020.

These Principles laid the early groundwork for a Transition label and Certification that will move investment and enable investors to easily find climate-robust investments (and avert potential criticism of greenwashing).

As noted above this expands our standard setting beyond Use of Proceeds bonds to examine whole entity transition and developing guidance for issuing and assessing sustainability-linked bonds (SLBs) and loans (SLLs).

These performance linked instruments are underpinned by the existence of a credible transition plan, which identifies sources of emissions, sets science-based performance targets, develops the business plans and governance structures needed to drive change and provides for public disclosure.

To help guide the market, Climate Bonds published guidance for a credible corporate transition plan in 2021. We see transition plans as fundamental for reaching net zero and expect regulations mandating these and establishing minimum content and disclosure to increase in the coming years.

Climate Bonds is also working on a Sustainability-Linked Bond Database, recording SLBs that demonstrate alignment and credibility with a sector-specific 1.5°C pathway, in line with the Five Hallmarks. We encourage issuers to adopt market best practice, as we continue our work on screening and building market guidance on issuing an SLB.

For capacity building, we will be bringing to market opportunities for bespoke training on transition and on how to assess transition plans, see here for more.

The first in a series of transition plan case studies has already been published. We will work with and engage stakeholders globally during 2023 to provide guidance and support needed for them to understand and assess credible transition plans.

The Last Word

While 2022 was a year of building momentum in the transition programme. 2023 will be a year of expansion says Sean Kidney, CEO, Climate Bonds:

“Transition roadmaps are central to the challenges that we have to address. We're now developing the long-term pathways for steel, chemicals, shipping and other industry sectors and establishing new guidance for investment in sustainable agriculture.”

“2030 emissions targets can’t be met without significantly higher investment and finance in clean technology, industry and agriculture. The global stocktake at COP later this year will reflect how far behind we are on emissions reduction timetables.”

“Putting robust transition solutions to policymakers and expanding transition investment pathways for global capital across the whole economy are amongst our priorities for 2023 to address the climate crisis. This is what the transition story is now about: tackling the hard stuff.”

‘Till next time,

Climate Bonds