Resilience, SLB standards, sovereign issuance & transition tipping-point all in the mix for 2023

Climate Bonds’ Market Intelligence has revealed Green, Social, Sustainability, Sustainability-linked and transition bonds (GSS+) issuance held its market share despite a difficult year for fixed-income markets, in which GSS+ volumes fell year-on- year for the first time in a decade.

In 2021, the share of GSS+ issuance reached record volumes of over $1trillion and held a 5% share of the global bond market. However, challenging macroeconomic factors witnessed in 2022 have contributed to a drop in debt volumes across the board. 2022 saw GSS+ issuance hold its 5% share of the global bond market despite the tough terrain leading volumes to fall to USD863.4bn.

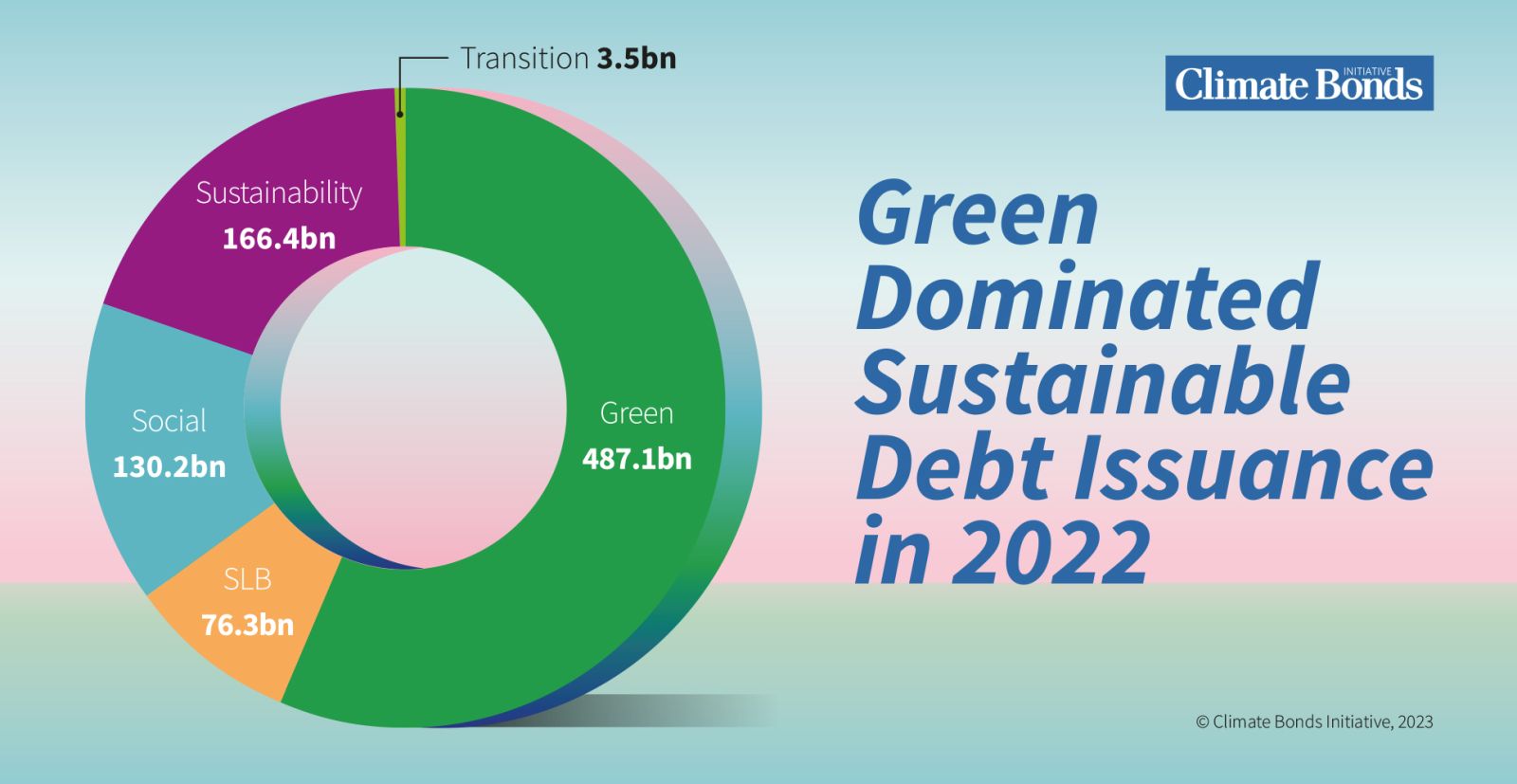

Green bond issuance comprised just over half of labelled issuance in 2022, with USD487.1bn issued. Sustainability bonds contributed USD166.4bn, Social bonds totaled USD130.2bn, SLBs saw USD76.3bn, whilst transition bonds saw just USD3.5bn

Lifetime GSS+ volumes had topped USD3.7tn by the end of 2022.

Historically, demand for green investments has outstripped their supply. This became more pronounced in 2022 as lenders were reluctant to lock-in high credit rates in a challenging macroeconomic landscape.

The attraction towards GSS+ bonds has nonetheless shone through a foggy fixed-income landscape. We look ahead to what we can expect from sustainable finance in 2023. Here are 5 developments not to miss:

- Rise of Resilience Investments - Another path towards $5trillion by 2025?

More than USD2tn of green bonds have been issued to date and this number has the potential to grow to our target of USD5trn of per year by 2025.

Demand far outstripping supply remains a key obstacle to reaching this target. There is a tremendous opportunity to tap this demand by scaling-up capital flows towards investments in resilience.

By providing the market with clear definitions and rulesets, the current universe of green investment can be expanded to include those that build resilience.

This expansion will move beyond investments that reduce direct physical impacts of extreme weather and include investments that address the underlying vulnerability of people and ecosystems to climate change.

Last year, Climate Bonds set out three goals for the Global Resilience Programme:

· to identify credible, science-based investment opportunities that build resilience,

· to mobilise finance towards credible resilience measures, and to

· accelerate the speed and growth of resilience investments through a supportive policy and regulatory environment.

In 2023, we aim to support the first green investments into resilience, unlocking additional climate capital that has been side-lined by supply scarcity.

- Rigour in the SLB market- Climate Bonds Certification

Sustainability Linked Bonds (SLBs) have emerged on the sustainable finance scene in recent years. By the end of 2022, Climate Bonds has recorded lifetime SLB market volumes of USDUSD204.1.

SLB’s popularity owes itself to the innovative structure of the investment that offers investors real impact on climate performance at the company level.

However, as with all early years of new thematic instruments, legitimate concerns over ‘greenwashing’ have been raised due to varying ambition levels of the KPIs central to SLB issuance.

Climate Bonds’ coming expansion of its Standard and Certification Scheme to SLBs in early 2023 seeks to redress this issue. These efforts will provide rigour in the market, and signal to prospective investors and regulators SLBs that meet best practice against an internationally recognised standard.

Look out for the world’s first Climate Bonds Certified SLB to appear later in 2023. This will be a catalysing moment for SLB credibility and lay another foundation for future market growth on to the 2025 target of $5trillion sustainable investment annually.

- Government support to green industry grows

From the pain of the pandemic, the instability of soaring inflation, to the financial sting being felt over energy security, it’s clear, the world feels it has a lot to recover from. One trend being witnessed amongst global policymakers is that climate considerations must take centre stage in these recoveries.

Climate forecasting group, Inevitable Policy Response (IPR) calculates the combined total of public money now available in the US for clean energy and climate investment via the Inflation Reduction Act (IRA), Infrastructure and Investment Jobs Act (IIJA) and the CHIPS & Science Act is nearly $1 trillion.

This is being supplemented by the Bipartisan Infrastructure Laws (BILs), which will provide tax cuts and grants for clean energy. The BILs represent a government enabled but private sector led tool to facilitate a new raft of investment to green projects.

Across the Atlantic, Europe is responding with EU Commission President Ursula von der Leyen announcing the ‘Green Deal Industrial Plan’ at Davos, which includes the Net Zero Industry Act. The aim is to increase the funding of clean energy technologies.

Investors, get ready! Or get moving, on green and climate projects that will now be attracting a range of new subsidies, credit guarantees, tax offsets or other financial incentives.

- 2023: Transition tipping point?

It is hoped that 2023 can bring forth a transition tipping point, a much-needed moment for greening the hard-to-abate sectors and aligning heavy industry with global efforts towards net-zero. The nascent transition bond market has trailed in volumes when compared to other labels but there are signs of change.

Japan has embraced transition bond issuance after the Ministry of Economy, Trade, and Industry (METI) published Basic Guidelines on Climate Transition Finance in May 2021. This framework led to a quick uptake in transition bonds in 2022; Japan was the source country of 21 of the 54 transition bonds recorded by Climate Bonds.

However, if other nations adopt similar frameworks that throw endorsement behind credible transition financing, this tipping point can soon be a reality. Encouragingly, the UK’s FCA mandated a Transition Plan Taskforce (TPT) to work on a gold-standard transition frameworks which are now open for public consultation.

The EU supporting transition finance with a framework of its own could help materialise the principles of the European Green Deal, which currently loosely nods to transition amidst its climate principles.

Meanwhile, Climate Bonds is developing its own transition standards to help these efforts and inform future frameworks. The announcement expected early in 2023 will complement the coming SLB standards.

- Sovereign issuance full steam ahead!

Climate Bonds called it… and countries delivered it! In late 2021, we called for the number of sovereign labelled bond issuers to double from where it then sat at 20, to beyond 40 nations.

As CEO Sean Kidney noted in 2021: “Doubling the number of sovereign GSS issuers to forty and supporting initial emerging market transactions should be amongst the immediate climate finance objectives for governments, central banks and development finance institutions.”

At the end of 2022, Climate Bonds had recorded GSS+ bonds from 43 sovereigns with combined volumes of USD323.7bn.

Sean noted the importance of sovereign issuance to local markets: “Sovereign green issuance sends a powerful signal of intent around climate action and sustainable development to governments and regulators. It catalyses domestic market development and provides impetus to institutional investors.

This momentum is expected to continue into 2023 already Israel and India have come to market with green bonds. Could the market hit 50 sovereign issuing nations by the end of 2023? We think so!

The Last word

Stay tuned for our forthcoming announcements as our Transition projects and SLB’s get best-practice guidance as a new Climate Bonds Standard is launched.

We’d like to thank all our readers, advocates and especially our partners for their contributions and support. Together we can add conviction and urgency to market and policy action on climate in 2023.

Til’ next time,

Climate Bonds