Climate Bonds Certified USD152 million Taxable Municipal Green Bond Offering

Climate Bonds Certified USD152 million Taxable Municipal Green Bond Offering

We're warming up for our Annual Conference 5-7th March in London.

Meantime some opportunities to meet the Climate Bonds team in events across Europe, Asia and Central America.

TEG briefings and a host of activities in China, Hong Kong and Japan are all on the radar.

Here's what's on the agenda for February!

|

Helsinki

|

5th |

Manuel Adamini |

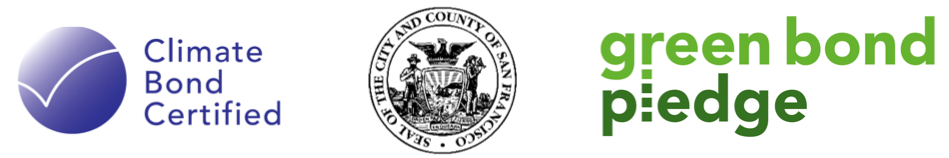

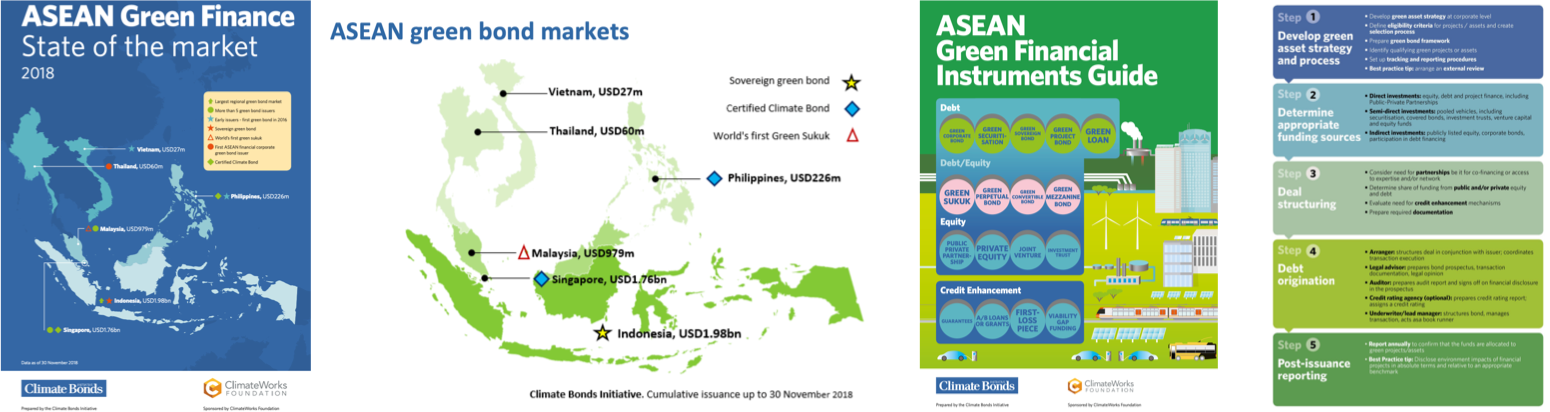

Green finance markets in ASEAN: Foundations for green growth and low carbon infrastructure

Opportunities emerge

Since the initial 2016 green bond deals in the Philippines and Vietnam, ASEAN green bond market stakeholders have laid some solid foundations, culminatining in total issuance of USD5bn as of the end of November 2018.

Highlights:

*Originally posted by the Grantham Research Institute on 9 January 2019.

Meet the Climate Bonds team in events across Europe, Asia and North America!

If you're in Mexico City on the 22nd, come talk to our director Justine Leigh-Bell at the Green Finance Seminar for Central Banks and Supervisors of North, Central and South America.

And don't miss a discussion about taxonomies for sustainable finance with CEO Sean Kidney in Toronto on the 31th.

Here's what's in the agenda for the second half of January!

|

Where? |

MARKET

Bonds&Loans, Green Bond Additionality: The Big Picture, Sean Kidney

Sean Kidney’s answer to returning questions of green bonds’ additionality. CEO of Climate Bonds Initiative explains the broad-ranging successes of the green bonds market in creating pre-conditions for large capital shifts to low-carbon and climate-resilient economy, larger systemic impact of this burgeoning market and how green bonds have been ‘catalyst for a wider green finance expansion’.

Highlights: