São Paulo: Climate Bonds Certification, Green Taxonomy and Sector Criteria in the spotlight

São Paulo: Climate Bonds Certification, Green Taxonomy and Sector Criteria in the spotlight

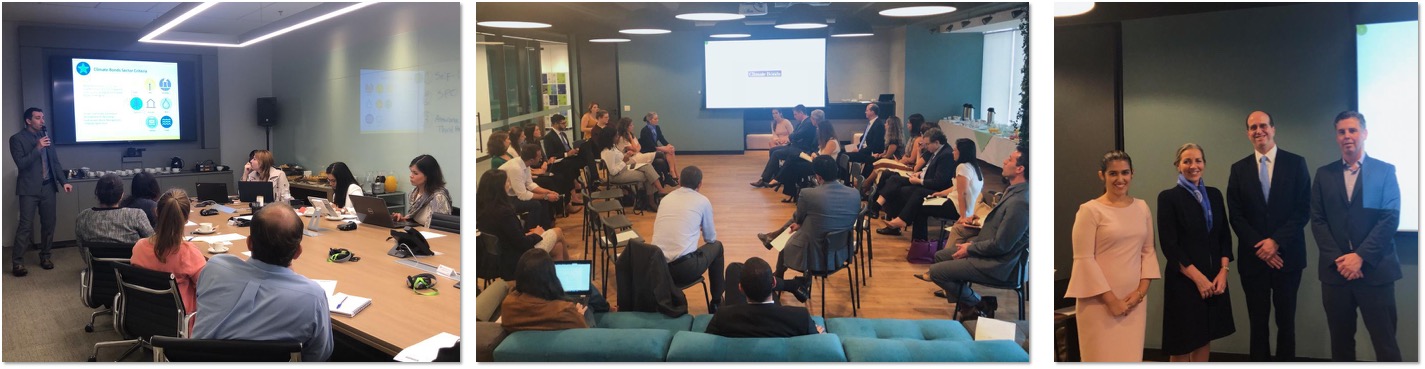

Strong demand marks Woolworths move to green network of supermarkets: Australia continues innovation and best practice in green finance

Newest addition to the multiple region Low Carbon Buildings Criteria: More Proxies becoming available for Green Building Bonds to be Certified under the Climate Bond Standard

Low Carbon Buildings Criteria

Highlights:

Reviewers Sought

CBI Certification means “Dark Green” says Finance Minister: Long term DSTA target of EUR10bn in GBs: Issuance in May

The DSTA Statement

(First published March 2019 in Pensioen Pro: Opinie | Nodig grijze bedrijven uit voor het groene obligatiefeest) Published April 2019 (IPE Magazine)

In a move to help advance green infrastructure development in South Africa, Fedgroup has become a signatory to the international Green Bond Pledge

Expert groups convene to begin first round of discussions for the development of new Criteria

Brazil’s Agriculture Industry will need to leverage private capital. There's an urgent need to change the way the agri sector is financed in Brazil.

What’s it all about?