Highlights:

- USD11bn green bonds in December

- City of Reykjavik issues first green bond from an Icelandic local government

- Republic of Seychelles issued first sovereign blue bond

- Fannie Mae publishes Green MBS and Credit Facility deals for December: USD1.8bn

Don’t miss:

Climate Bonds’ 2018 Green Bond Market Summary provides preliminary figures for 2018 issuance, trend analysis, underwriter & trading venue league tables and more! Download now!

> Climate Bonds Conference and 4th Annual Green Bond Pioneer Awards: 5,6,7th March London - Registrations Open – Don’t miss the biggest green bond event of the year. Book now!

Go here to see the full list of new and repeat issuers in December.

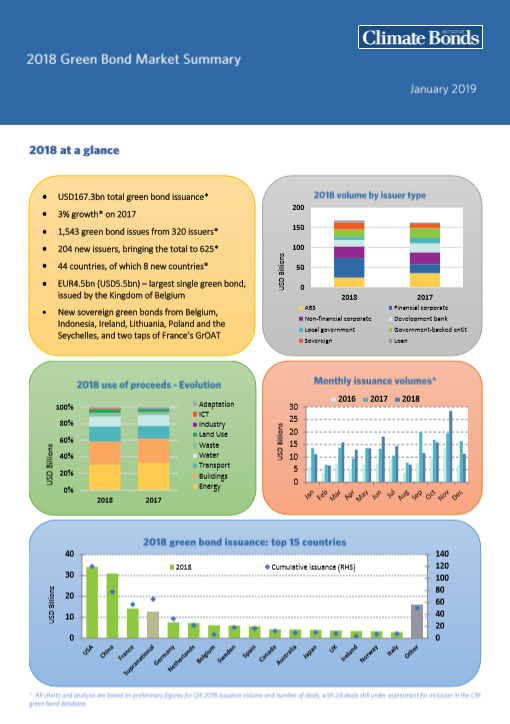

2018 Green Bond Market Summary

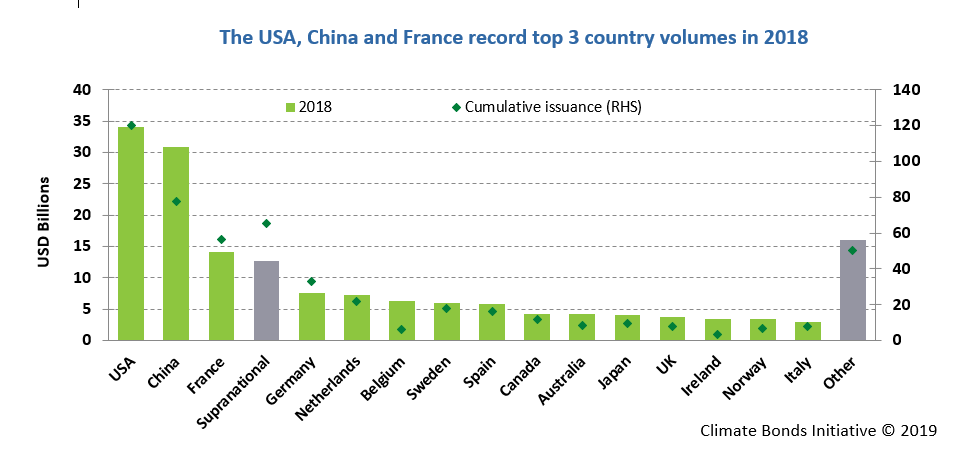

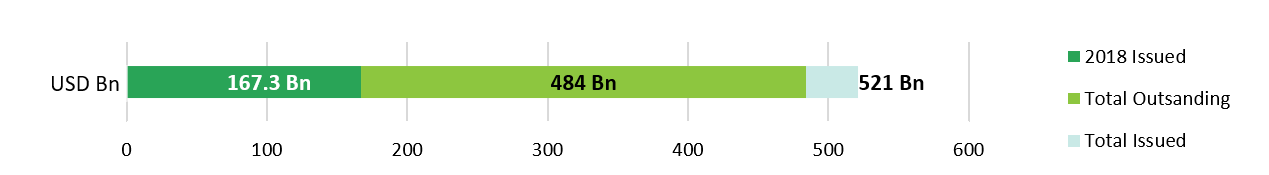

Preliminary end of year figures show 2018 global green bond issuance reached USD167.3bn, surpassing 2017 figures by 3%. 2018 has also seen the rise of sustainability, SDG and social bond issuance, which if added to the total green bond figure take 2018 volumes to USD202.5bn.

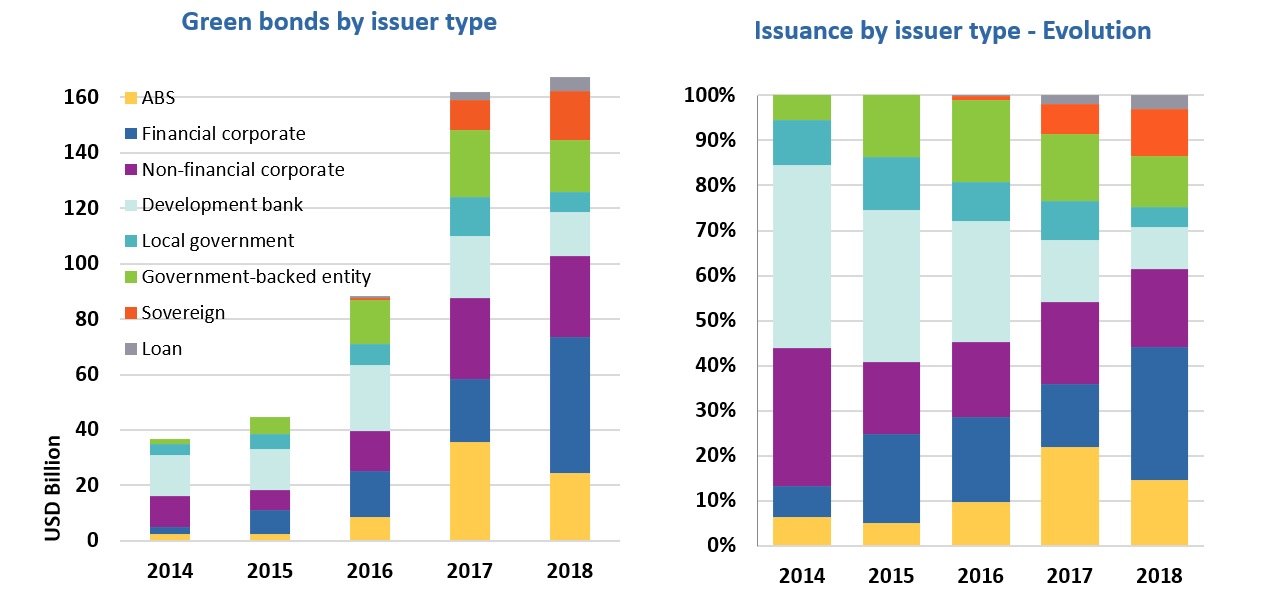

Financial corporates fuelled issuance with USD49bn worth of green bonds, or 29% of the annual total, up from 14% in 2017. This is the first time since market inception that financial corporates represent the largest share of annual volumes. Industrial Bank Co, ING and ICBC accounted for almost a third of the segment’s total. More broadly, greater volumes from banks bode well for the growth of the green loan market and green finance generally.

Sovereigns deals kept a strong pace throughout the year taking up a 10.5% share of the market, up from 7% last year. Deals came from Belgium, France, Ireland, Indonesia, Lithuania, Poland and the Seychelles.

Certified Climate Bonds totalled USD23.3bn and accounted for 14% of 2018 volumes, or on par with 2017. Almost half of Certified deals by volume were USD1bn or above in size - compared to just 25% in 2017 – with ING breaking the record for largest Certified Climate Bond with its USD2.95bn deal.

Download the full 2018 Green Bond Market Summary here.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

New issuers

Bank of Dalian Co., Ltd. (CNY2bn/USD290m), China, issued a 3-year green bond, which benefits from an EY Assurance (not publicly available). Proceeds will finance 11 projects in the transport and water treatment sectors. An example project identified by the issuer, is the manufacture of new energy vehicles and core components as well as charging and replacing operations. Another example, is the construction of a sewage treatment plant and supporting sewage collection pipe network.

Climate Bonds view: We encourage issuers to disclose more details on financed projects and make external reviews publicly available to enhance transparency.

Chongqing Three Gorges Bank (CNY3bn/USD436.9m), China, issued a 3-year green bond benefiting from a CECEP Second Party Opinion (not publicly available). Proceeds will be allocated to eligible projects in four categories: (1) energy saving, (2) pollution prevention, resource conservation and recycling, (3) clean energy and (4) ecological protection and adaptation.

Climate Bonds view: Eligible projects include hydropower. Since it accounts for just 3% of total proceeds and the other areas where the funds will be allocated are aligned with both the PBoC catalogue and CBI Taxonomy, the bond has been included in our database. Further analysis will be carried out when the quarterly green bond report comes out, and it will be excluded if the actual use of proceeds fails to meet our green bond definitions.

City of Reykjavik (ISK4,1bn (USD33m), Iceland, issued a 30-year senior unsecured green bond, becoming the first Icelandic local government issuer to come to market. The deal is also the first green bond to be listed on Nasdaq Iceland’s Sustainable Bonds List. CICERO provided the Second Party Opinion.

According to the Green Bond Framework, 70-100% of the first deal will be used to refinance recent eligible projects falling under various categories including buildings, transport, waste, land use and adaptation. As well as having obtained a BREEAM certification of 'Very Good' or above, green buildings are required to include a screening for climate risk and resilience in the property design, derive 100% electricity and heating from renewable sources, and present solutions for a car-free living and electric charging stations fuelled with 100% renewable energy sources.

Climate Bonds view: The City of Reykjavik has a good set of commendable targets, and its Green Bond Framework receives a Dark Green shading in CICERO’s SPO. In addition to green buildings, it would be good to see more quantifiable requirements for projects in other areas.

City of St Louis Park (USD43.7m), USA, issued a 34-year green US Muni bond. The proceeds will be used to finance the acquisition, construction and fit out of a multifamily housing project, which is expected to obtain a LEED Gold certification. It is estimated that energy bills for new tenants may decrease up to 45%. This investment will be made indirectly by the borrower PLACE E-Generation One, LLC and the construction phase should end by January 2020.

Climate Bonds view: LEED certified buildings are already representing a consistent amount of the projects financed through green bonds. With world population increasing, cities getting denser, and higher global environmental footprint, investments in energy efficient buildings are increasingly important.

Endesa, S.A (EUR335m/USD382m), Spain, came to market with a debut green loan – the first of its kind seeing the European Investment Bank (EIB) as the sole lender. The deal will finance the development of 15 wind farms with a capacity of 446MW and three solar photovoltaic plants with a capacity of 339MW. The loan follows Endesa being awarded 540MW of wind energy and 339MW of photovoltaic energy in the auctions for new renewable electricity generation facilities that took place in Spain in May and July 2017, which will involve an investment of over EUR800m until 2020.

Climate Bonds view: Given Iberdrola’s established presence in the green bond market, and following EDP’s inaugural green bond in October 2018 as well as Gas Natural Fenosa’s first in November 2017, Endesa’s green loan seems to be part of a shift towards green financing by Iberian electricity companies. We expect these issuers to continue accessing green financing, and potentially other similar issuers to do the same.

Enercity (EUR100m/USD113m), Germany, issued a 10-year digital green Schuldschein benefiting from a Vigeo Eiris Second Party Opinion. Proceeds from enercity’s first green and digital promissory note will refinance the acquisition of 17 operational wind farms, located across Germany. With a total of 142 turbines, the total combined output of the farms is around 219MW.

Climate Bonds view: This is the second Schuldschein to have been issued under a digital format after Verbund AG deal in April 2018. The use of blockchain technology in the execution of deals could be the next chapter, but more broadly the Schuldschein structure retains its appeal among corporate and financial sector issuers given the well-established debt format and its flexibility.

Power Construction Corporation of China (CNY747m/USD108.7m), China, issued a 3-year green bond. This is the second green ABS deal in the market that is backed by feed-in-tariff on renewable energy after State Power Investment Corporation’s deal issued in November 2018.

Climate Bonds view: We included this deal since the underlying cash flow is related to low-carbon assets. We will also keep tracking the use of proceeds when more information is available.

New deals issued prior to December 2018

Bank of Guiyang (CNY5bn/USD731.9m), China, issued a 3-year green bond in August 2018. Lianhe Equator provided the Second Party Opinion (not publicly available). All proceeds will be allocated to three categories that are eligible under PBoC’s green bond catalogue: (1) pollution prevention, (2) ecological protection and adaptation, and (3) resource conservation and recycling. All projects to be financed are expected to deliver climate and environmental benefits, such as reduction of chemical oxygen demand (COD) by 27000t/a, SOx emission reduction by 2.91t/a, etc. Sample projects include the construction of two sewage plants and supporting infrastructure, a project that aims to enhance wetland protection and restoration, and a hydropower project that will also provide irrigation and drinking water supply for the surrounding areas.

Climate Bonds view: Thinking around hydropower has evolved and the Climate Bonds Taxonomy published in September 2018 now identifies a power generation metric and controversies as aspects to consider in assessing bonds which finance hydropower generation. This deal has been included, as the hydro project falls under the ecological protection and adaptation category, and includes works such as drainage cleaning and flood control. Further, the hydroelectric power generation forms a relatively small component and only utilises surplus water released from the reservoir. However, proceeds will be used for resettlement, indicating potential controversies, so we will keep tracking the quarterly green bond report.

Bank of Ningbo Co., Ltd (CNY3bn/USD432m), China, issued a 3-year green bond in October 2018, which benefits from an EY Assurance Report (not publicly available). The proceeds will be allocated to 14 projects under four categories: low carbon transport (buses and public transport systems), waste water treatment (existing waste water treatment facilities expansion and new facility development), recycling and water management (flood defence and water treatment). The issuer has disclosed examples of eligible projects, as well as detailed impact metrics.

Climate Bonds view: The financed projects are aligned with the Climate Bonds Taxonomy and the issuer shows commitment to align to best practice by including expected impacts of projects at issuance.

Boston Properties (USD1bn), USA, issued a 10-year unsecured green bond in November 2018. The deal will finance recently completed or future properties that have or are expected to obtain a green building certification. Eligible projects include the Salesforce Tower development located in San Francisco, California, which has received LEED Platinum certification.

Climate Bonds view: The deal was previously classified as pending until the issuer confirmed that the green building certification is a requirement for all properties in the portfolio of eligible projects. Issuers are strongly encouraged to set up clear tracking and reporting systems, as well as seek for external reviews to comply with market best practice.

China Kangfu International Leasing (CNY1.856bn/USD267m), China, issued a 9-year green ABS in November 2018. There is limited disclosure on this green ABS. The 5-tranche deal is backed by leases on solar assets. Proceeds will be allocated to distributed solar and wind projects.

Climate Bonds view: The deal follows Shanghai Stock Exchange’s rule which requires at least 70% of proceeds to be used in green sectors. It appears that part of the proceeds is in cash. However, the deal is considered as eligible because the underlying cash flows relate to low-carbon assets, but also the proceeds from the deal are earmarked for investment in low-carbon assets. Still, we encourage the best practise where both collateral and use of proceeds are invested in green assets.

Region of Pays de la Loire (EUR75m/USD87m), France, issued a two-tranche green bond in October 2018 which benefits from a Vigeo Eiris Second Party Opinion (longest dated bond: 15 years). According to the Green Bond Framework, proceeds will be earmarked to finance eligible projects under three categories: energy, buildings and transport.

Renewable energy projects must be related to solar, wind, marine energy, biomass, geothermal, photovoltaic, electric, wood, biogas and ocean energies. To be eligible, public buildings must meet at least one of several standards, including the Réglementation Thermique 2012 (RT2012) – a standard requiring that new building work attains an energy efficiency performance three times greater than the existing standard – and a 'Very Good' HQE certification. Private buildings must also meet the RT2012 standard and renovations have to yield at least a 40% energy performance improvement. Eligible projects under the transport sector include electric and hybrid cars, rail transport and infrastructure for clean energy vehicles.

Climate Bonds view: The bond was previously placed as pending due to insufficient information involving biomass and biogas projects. However, as it is only one of several renewable energy technologies listed as eligible and as the examples of qualifying projects mainly involve solar and marine renewables, we assume that bioenergy projects represent a limited share of proceed allocations. Nevertheless, we will keep monitoring proceed allocation reporting to ensure that either biomass projects use exclusively sustainable feedstock or that financing allocated to the projects is at most 5% of the bond’s proceeds.

State Power Investment Corporation limited (CNY1801m/USD258.9m), China, issued a two-tranche green ABS (longest dated deal: 3 years). Information about the deal structure and use of proceeds is very limited. According to the news release, however, this is the first green ABS deal from China that uses feed-in-tariffs on renewable energy as collateral.

Climate Bonds view: As the deal is backed by feed-in-tariff linked to renewable energy, it is fully aligned with CBI’s definition of a green ABS, where the underlying cash flows relate to low-carbon assets. Further analysis will be done on the type of renewable energy and use of proceeds when more information becomes available through quarterly and annual reporting.

The Republic of Seychelles (USD15bn) issued the world’s first blue sovereign bond in October 2018 in the form of a private placement. As set out in the project appraisal document, proceeds will be allocated to eligible activities related to sustainable fisheries and marine projects, including the expansion of marine protected areas, improved governance of priority fisheries and development of the Seychelle’s blue economy. The bond is backed by a World Bank partial guarantee of USD5m, as well as by a USD5m concessional loan from the Global Environment Facility (GEF) to partially cover the deal’s interest payments. According to the World Bank, fisheries are the country’s second most important industry after tourism, employing 17% of the population and make up around 95% of the total value of domestic exports.

Climate Bonds view: The blue bond has been included in the CBI green bond database as the financed projects are aligned to the Land Use & Marine Resources sector of the Climate Bonds Taxonomy. As underlined by the World Bank, fisheries and marine resources are a key component of the Seychelles economy, as well as representing an example of valuable water resources at risk of being impacted by the effects of climate change. The world’s first blue bond is therefore a great example of how finance flows can be directed towards implementing resilience and adaptation measures to preserve fisheries and water ecosystems.

- The Fisheries & Aquaculture Criteria are in the process of being developed and will provide screening metrics and benchmarks to indicate low carbon and climate resilient fisheries.

- The Adaptation and Resilience Expert Group (AREG) was launched in November 2018 and the Adaptation and Resilience Principles are expected to be opened for public consultation in June 2019.

University Properties of Finland (EUR100m/USD114m), Finland, issued a 5-year green bond in November 2018, becoming the first Finnish issuer from the real estate sector to debut in the green bond market. CICERO provided the Second Party Opinion. Proceeds will be earmarked for the financing of new or existing buildings certified as BREEAM 'Very Good' and with energy use 15% lower compared to the Finnish national building code, energy efficiency projects yielding at least 25% reductions in energy use, renewable energy solutions to satisfy property energy needs and electric vehicle infrastructure.

Climate Bonds view: This is the only green bond to come to market from a Finnish issuer in 2018. With this deal, Finland’s cumulative issuance stands at USD1.4bn. The deal was previously classified as pending due to insufficient information related to energy efficiency projects. The issuer has now confirmed that energy efficiency improvements to fossil fuel technologies are not eligible under the green bond framework.

Yancheng City Haixing Investment Company, Ltd. (CNY100m/USD14.79m), China, issued a 5-year privately placed green bond in November 2018. According to the very limited disclosure, all proceeds will be used for a Water Environment Improvement Project in Xintan Area in eastern China’s Yancheng city.

Climate Bonds view: The project falls under the ‘Supply management & water treatment’ section of our green bond taxonomy therefore aligned with our definition. However, the disclosure of more details on the use of proceeds and impact reporting is strongly encouraged.

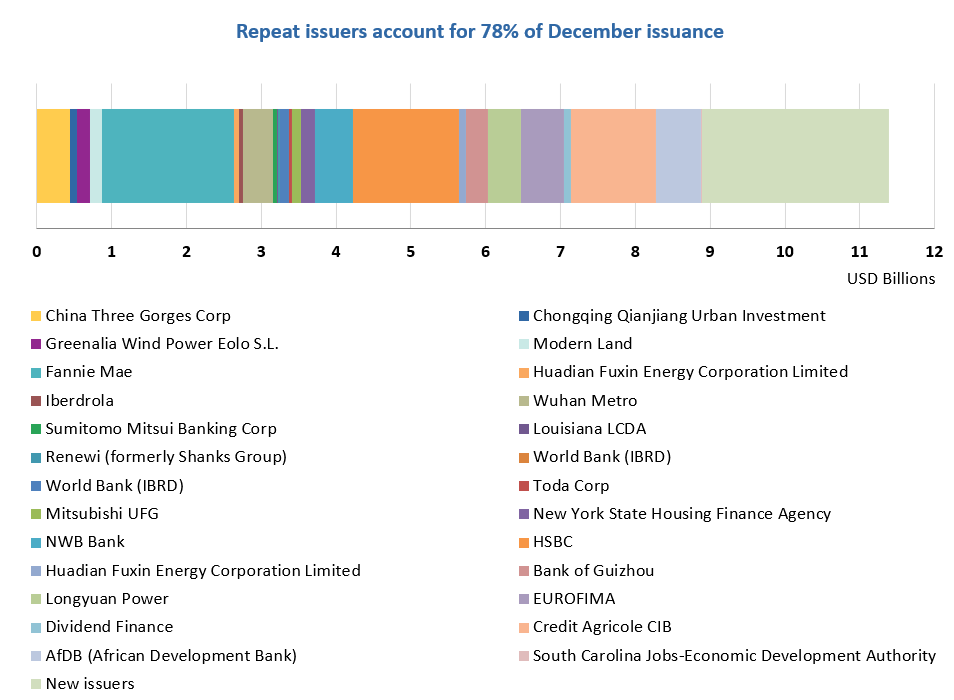

Repeat issuers

- China Three Gorges Corp: CNY3bn/USD436m - previously classified as pending due to insufficient information on hydro projects

- China Three Gorges Corp: CNY1bn/USD146m and CNY2.5bn/USD366m – issued in August 2018 and previously classified as pending due to insufficient information on hydro projects

- Chongqing Qianjiang Urban Investment: CNY700m/USD101m

- Fannie Mae: USD1.8bn

- Greenalia Wind Power Eolo S.L.: EUR156/USD177m

- Huaneng Tiancheng Financial Leasing: CNY600m/USD87m – issued in November 2018

- Iberdrola: USD50m

- IFC: USD100m – issued in October 2018

- Mexico City: MXN1.1bn/USD54m – issued in November 2018

- Modern Land: USD150m

- World Bank (IBRD): USD600m – issued in November 2018 and previously classified as pending due to insufficient information

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Naturgy Energy Group SA (formerly Gas Natural Fenosa) |

BRL130m/USD35m BRL135m/USD36m |

31/10/2018 |

Unlabelled |

|

Development Bank of Japan |

EUR700m/USD806m |

10/10/2018 |

Unlabelled |

|

Credit Agricole CIB |

USD4m |

28/09/2018 |

Unlabelled |

|

Credit Agricole CIB |

USD1m |

21/09/2018 |

Unlabelled |

|

Credit Agricole CIB |

USD1m |

28/09/2018 |

Unlabelled |

|

Credit Agricole CIB |

EUR5m/USD6m; SK10m/USD1m |

20/07/2018 |

Unlabelled |

|

Credit Agricole CIB |

INR354m/USD5m |

08/08/2018 |

Unlabelled |

|

Credit Agricole CIB |

USD1m; USD1m |

28/09/2018 |

Unlabelled |

|

AfDB |

BRL5m/USD1m; BRL5m/USD1m; IDR30bn/USD2m |

05/09/2018 |

Unlabelled |

|

AfDB |

INR96m/USD1m |

27/09/2018 |

Unlabelled |

|

Banco Galicia |

USD100m |

23/03/2018 |

Not aligned |

|

Asian Development Bank |

HKD200m/USD25m |

25/05/2018 |

Unlabelled |

|

MTR |

HKD348m/USD44m |

28/06/2018 |

Unlabelled |

|

Bank OCBC NISP |

USD150m |

01/08/2018 |

Not aligned |

|

South Carolina Jobs-Economic Development Authority |

USD11m |

16/08/2018 |

Not aligned |

|

Grand Forks County |

USD43m; USD18m |

28/08/2018 |

Not aligned |

|

Shinhan Bank |

KRW200m/USD0.2m |

30/08/2018 |

Not aligned |

|

Sinohydro Bureau 8 Co.,Ltd. |

CNY220m/USD32m |

27/12/2018 |

Working capital |

|

Hunan Expressway Co |

CNY2bn/USD307m |

26/10/2018 |

Not aligned |

|

Adelaide Airport |

AUD50m/USD36m |

20/12/2018 |

Sustainability/Social bond |

|

Corporacion Andina de Fomento (CAF) |

COP150bn/USD53m |

25/05/2018 |

Insufficient information |

|

Corporacion Andina de Fomento (CAF) |

USD30m |

21/08/2018 |

Insufficient information |

|

Fairfax County Economic Development Authority |

USD11m |

01/08/2018 |

Insufficient information |

|

Bank of Dongguan |

CNY2bn/294m |

22/08/2018 |

Not aligned |

|

AFD (Agence Française de Développement) |

EUR500m/USD584m

|

17/09/2018 |

Not aligned |

|

Masdar |

N/A |

11/10/2018 |

Insufficient information |

|

Bank of Chongqing |

CNY3bn/USD432m |

23/11/2018 |

Not aligned |

|

Bank of Chongqing |

CNY3bn/USD434m |

07/11/2018 |

Not aligned |

|

Beijing Enterprises Clean Energy Group Limited |

CNY1bn/USD144m |

27/11/2018 |

Working capital |

|

Hainan Tihierg Co., Ltd |

CNY300m/USD43m |

30/10/2018 |

Unlabelled |

|

Northern Arc Capital |

INR1bn/USD14m |

25/12/2018 |

Pending |

|

Tata Cleantech Capital |

INR1.8bn/USD26m |

18/12/2018 |

Pending |

|

Ping An Financial leasing |

CNY797m/USD114m |

30/10/2018 |

Pending |

|

Nippon Yusen Kaisha |

JPY2bn/USD18m |

27/12/2018 |

Pending |

|

California Pollution Control Finance Authority |

N/A |

19/12/2018 |

Pending |

Green bonds in January

- ADB: AUD1bn – closing January 17

- BNP Paribas: SEK12m – closed January 10

- CDL Properties (City Developments Limited): SGD125m - closing January 17

- Enel: EUR1bn – closing January 21

- MidAmerican Energy: two tranches totalling USD1.5bn – closed January 9

- Terna: EUR250m - closed January 10

Investing News

ResponsAbility-managed climate fund and Nam A Bank are teaming up to launch the bank’s green lending activities in Vietnam. This would enable Nam A Bank to become Vietnam’s first private commercial bank to launch green lending products for medium and small clients (SMEs and individuals).

New York State Common Retirement Fund has added USD3bn to its Sustainable Investment Program, raising its total to USD10bn. The fund integrates sustainable, social and governance (ESG) principles into its investment strategy.

The Asian Infrastructure Investment Bank (AIIB) announced that its board of directors has approved USD500m for a credit portfolio that invests in corporate bonds to finance infrastructure investment. The portfolio will comprise corporate bonds financing infrastructure projects, including quasi-sovereign and green bonds.

Ping An of China Asset Management (Hong Kong) plans to launch four new exchange-traded funds (ETFs) in 2019. The company is looking into environmental, social and governance (ESG) as a potential thematic area given the strong demand for Chinese green bonds

‘Till next time,

Climate Bonds