Highlights:

- USD7.2bn green bonds in December so far

- B.Grimm issues first Certified Climate Bond from Thailand

- City of Columbia comes to market with first Certified US Muni bond from South Carolina

- Bank Windhoek issued first green bond from Namibia

- Fannie Mae publishes Green MBS deals for November: USD2.1bn

Go here to see the full list of new and repeat issuers in December.

At a glance

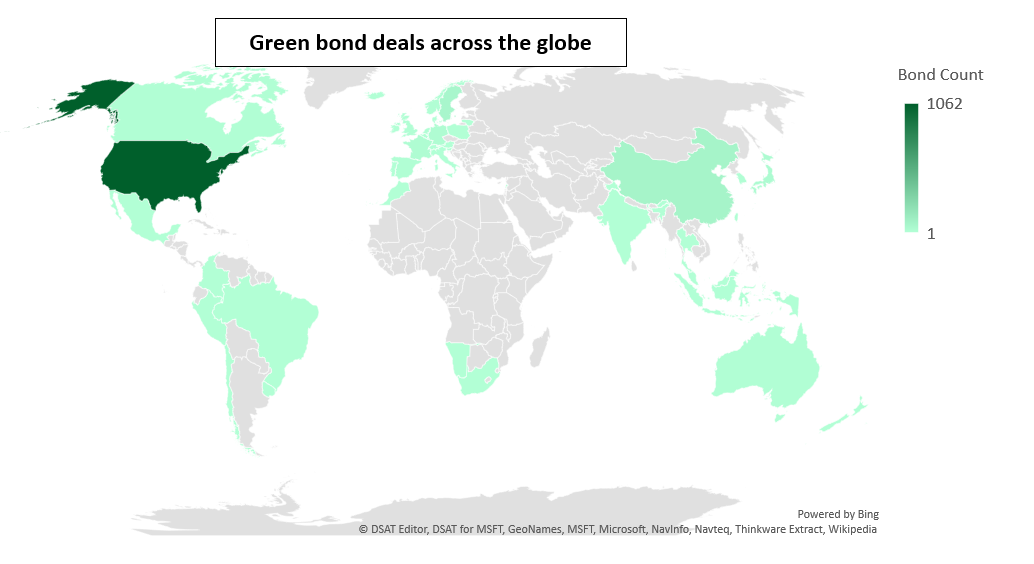

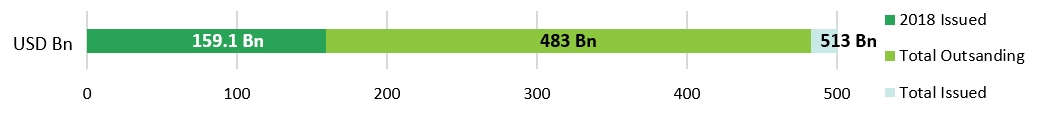

As of 21 December, cumulative 2018 volumes would reach USD159.1bn, with monthly issuance at USD7.2bn so far and an abundance of global firsts: the first Certified Thai bond from B.Grimm Power Public Company Ltd, the first Certified US Muni bond outside of New York state or California from City of Columbia and the first Namibian green bond from Bank Windhoek.

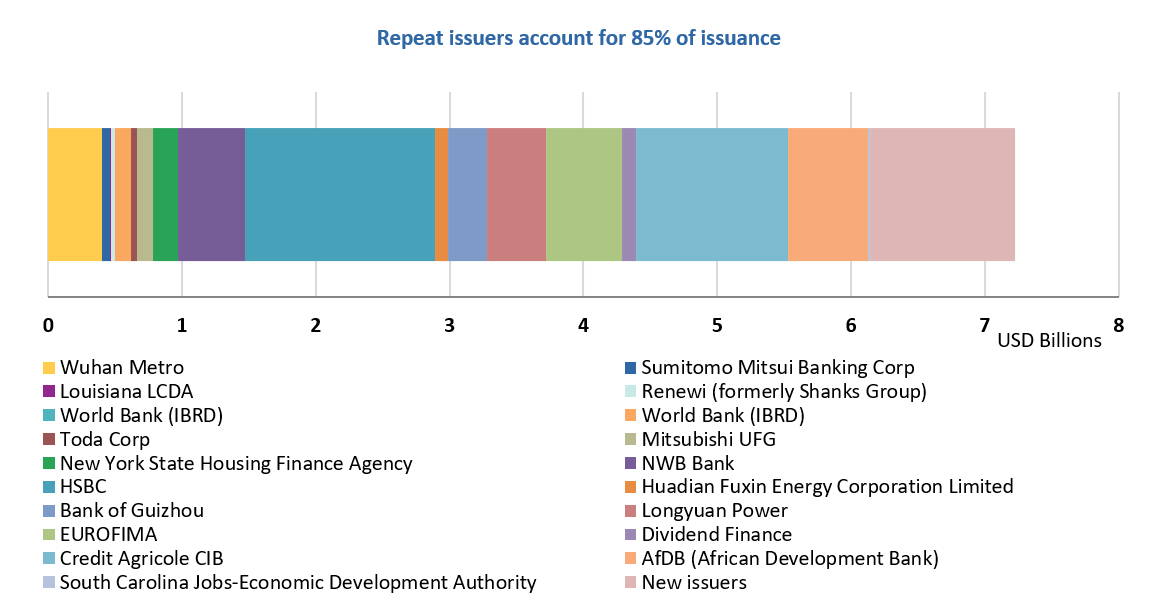

China led monthly issuance at 22%, with repeat issuers Bank of Guizhou, Huadian Fuxin Energy Corporation Limited, Longyuan Power and Wuhan Metro accounting for four fifths of the country’s volumes.

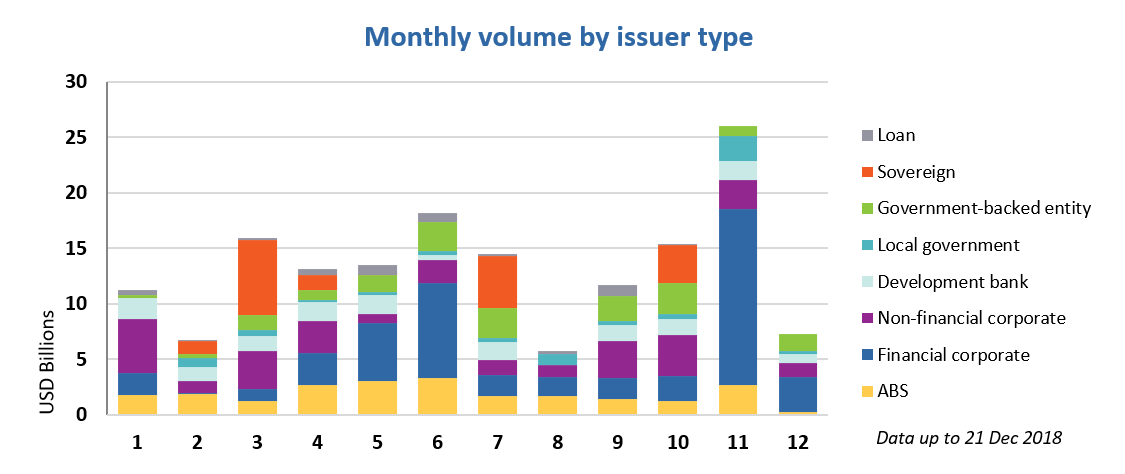

HSBC’s EUR1.25bn green bond and Credit Agricole’s EUR1bn senior preferred green bond are the largest December deals so far and are major contributors to driving financial corporate issuance to 45% of total monthly volume.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

B.Grimm Power Public Company Ltd (THB5bn/USD153m) issued a Certified Climate Bond which was privately placed with the Asian Development Bank (ADB) and Certified under the Solar Criteria of the Climate Bonds Standard. The deal is the first Certified green bond from a Thai issuer, and B.Grimm Power is the country’s first non-financial corporate issuer. This is also the third Certified Climate Bond from the ASEAN region following AP Renewable’s green bond in 2016 and CDL Property’s in 2017. Proceeds will be allocated to financing and refinancing 7 new and 9 existing solar generation assets in Thailand, with a capacity of 31.5MW and 67MW respectively.

DNV GL provided the Pre-Issuance Verification Report.

City of Columbia (USD37.9m), SC, USA, issued a 22-tranche US Muni green bond (longest dated bond: 30 years) Certified under the Water Infrastructure Criteria of the Climate Bonds Standard. The deal is the first Certified Climate Bond from a US local government outside the states of New York and California. This is also the first Certified Climate Bond that contains both Engineered and Nature-Based water assets. Proceeds will finance and refinance stormwater assets that fall under the Engineered or Nature-Based Water Infrastructure Criteria.

Sustainalytics provided the Pre-Issuance Verification Report.

As highlighted in our US Muni briefing earlier this year, the water sector accounts for 64% of the identified climate-aligned bond universe for US municipal agencies. This points to a significant opportunity for US agencies to leverage the green bond market to finance water-related projects. This Certified deal sets a benchmark for other US Muni issuers to follow.

New issuers

Bank of Huzhou (CNY500m/USD73m), China, issued a 3-year green bond which obtained an EY Assurance report (not publicly available). The issuer states that the proceeds will be allocated to pollution prevention, clean transport, and adaptation & resilience. The 10 nominated projects range from rooftop solar panels to water treatment projects. The issuer has disclosed the timing for proceed allocations relative to each selected project, with fill disbursement expected to be achieved within a year of the deal’s closing.

Climate Bonds view: Clear commitments on the timing of proceeds allocation at project level are encouraged as it helps investors track the progress of allocations at the post issuance stage.

Bank Windhoek (NAD66.6m/USD4.8m), Namibia, closed a green private placement. This is the first green bond from a Namibian issuer and the second from a commercial bank in the South African region after Nedbank (2012). According to the Green Bond Framework, proceeds can finance eligible projects under a wide range of categories such as renewable energy, buildings, transport, water, waste, land use, adaptation, green trade and non-energy GHG emission reductions. The criteria comply with the IFC Definitions and Metric for Climate Related Activities.

Fossil fuel energy generation and coal mining are among the list of excluded project types. However, projects leading to emissions reductions of fossil fuel-related operations, such as gas flaring and fugitive methane emissions in existing oil and gas industry installations, are allowed under the non-energy GHG emission reductions category.

Climate Bonds view: There are multiple red flags that arise from the issuer’s eligibility categories. The possibility of financing energy efficiency improvements and emission reductions to fossil fuel-based technologies is one of the areas of biggest concern. Furthermore, the eligibility criteria for several categories are not stringent enough, such as for the Buildings and Energy Efficiency which allow proceeds to be allocated to buildings achieving any level of the listed green certifications and to energy efficiency technologies achieving a minimum of 15% energy savings. Several areas lack clarity on eligibility requirements. For bioenergy and biomass projects, for instance, there is no explicit requirement for sources to come from sustainable feedstocks.

However, given the vast number of projects listed in the framework relative to the small size of the bond and the issuer’s commitment to reporting – publicly, on its website – both proceed allocations and environmental impacts on a project level(!), we are including the bond and will keep monitoring post-issuance disclosure to gain more clarity on actual investment project allocations and their alignment to the Climate Bonds Taxonomy.

Chengdu Rail Transit Group Co., Ltd (CNY2bn/USD292.5m), China, issued a 5-year green bond, which benefits from a Lianhe Equator Second Party Opinion (not publicly available). The proceeds will refinance 6 metro lines in the city of Chengdu, in southwest China. The expected environmental and climate impact of the bond includes avoidance of 15,600t of standard coal equivalent (tec) per year, 2,200t of unburnt hydrocarbon per year, 11,200t of carbon monoxide per year, 2,900t of nitrogen oxides per year and 100t of particular matter 10 per year.

Climate Bonds view: We have seen a number of government-backed metro and rail companies in China financing local metro lines in their cities, including Wuhan Metro, Nanjing Metro, Beijing Infrastructure and Tianjin Rail Transit. With its debut issuance, Chendu Rail Transit joined the list as another low carbon transport issuer.

City of Bloomington (USD10.8m), MN, USA, issued a 15-tranche US Muni green bond (longest dated bond: 16 years). According to the prospectus, proceeds will be allocated to the Penn American Linear Storm Water Storage Project. The project provides flood protection, helps to facilitate redevelopment of infrastructure and provides water quality benefits to areas that are receiving storm water runoff.

Climate Bonds view: This is the second green US muni bond from a Minnesota issuer in short order from the City of Minneapolis’ October deal. The deal is a welcome step that highlights the City’s commitment to enhancing its resiliency to floods as part of its ten-year capital improvement plan.

GLP J-REIT (JPY5.1bn/USD45m), Japan, issued a 10-year senior unsecured green bond, which obtained a Green 1 Green Bond Evaluation from Japan Credit Rating Agency. The deal will refinance a loan used to acquire a logistics facility which obtained a CASBEE B+ (Good) certification.

Climate Bonds view: CASBEE B+ is the third out of four ranks of the CASBEE certification system. We strongly encourage issuers to aim at top levels within green building certifications to ensure a close correlation between the ranking and the energy efficiency credentials of the property.

Invesco Office J-REIT (JPY5.5bn/USD48m), Japan, issued a 5-year senior unsecured green bond, benefiting from a Sustainalytics Second Party Opinion. According to the issuer’s first allocation report, proceeds will be fully allocated to refinancing a portion of the loan used to acquire the Ebisu Prime Square by 28 December 2018. The property obtained a 3 star DBJ Green Building Certification and achieved a 15% CO2 emissions reduction in the last fiscal year.

Climate Bonds view: Disclosing an allocation report at issuance, which specifies the projects to be financed, greatly enhances the deal’s transparency. We note that the general eligibility requirements are not very stringent, especially for property refurbishments where issuers should aim at a minimum of 20% energy efficiency improvements. Achieving top-level rankings within green building certifications should also be targeted to ensure the property’s high energy performance.

New World China Land Limited (USD310m), Hong Kong, issued a 5-year green bond benefiting from a Sustainalytics Second Party Opinion (not publicly available), as well as from a HQAA Environmental Method Statement. The proceeds will be primarily used to finance two LEED certified buildings in the Greater Bay Area in China. The Qianhai CTF Finance Tower is a mixed-use twin-tower with total area of 180,100 sqm. Due for completion by the end of 2021, the Qianhai CTF Finance Tower has already earned LEED Gold-level Pre-certification and expects to earn a WELL healthy building standard’s Gold-level Pre-certification and a three-star rating under the China Green Building Evaluation Standard in 2019. The New World Zengcheng Comprehensive Development Project is a large-scale residential and commercial complex of 250,000 sqm. The project will be completed in 2021 and is currently undergoing LEED Gold pre-certification assessment and expects to attain a two-star rating under the China Green Building Evaluation Standard next year.

Climate Bonds view: When it comes to green buildings, we strongly encourage issuers to aim at highest levels of green building certification as part of their eligibility criteria and to disclose the achieved certifications. The two projects finance by the deal have and are expected to achieve both LEED Gold and China’s domestic Green Building Evaluation Standard (3-star and 2-star respectively), which strengthens their green credentials.

SID Banka (EUR75m/USD85.1m) closed a 5-year green private placement, becoming the second Slovenian green bond issuer after Gen-I Sonce and the first from the financial sector. The Green Bond Framework includes a wide range of sectors – renewable energy, buildings, transport, water, waste, land use and industry – and all fossil fuel-based assets are explicitly excluded. Sustainalytics provided the Second Party Opinion.

Eligible projects under the transport category include electrified light aircraft for passenger transport. Geothermal power plants must meet an emissions threshold of 100gCO2/kWh at most. Cogeneration power plants are eligible only if they run on biomass sourced from waste products. Afforestation and reforestation of PEFC/FSC certified forests, certified organic agriculture, biological crop protection and drip irrigation are eligible land use project types.

Commercial buildings need to be within the top 15% of the country’s energy efficient non-residential properties, while residential buildings must have a maximum energy consumption of 35 kWh/m2 per annum. According to Sustainalytics, this energy performance threshold is significantly lower than the average energy use for heating in Slovenian buildings of 122.81 kWh/m2.

Climate Bonds view: The eligibility criteria for each project type are clearly set out, with stringent targets for several categories. This is the first time we see electrified light aircrafts being included in the eligibility projects. As aviation accounts for 2% of GHG globally, developing low carbon solutions within the sector will be an essential component of meeting emissions reductions at both a country and global level.

Zhejiang Deqing Rural Commercial Bank Co.,Ltd. (CNY200m/USD29m), China, issued a 3-year green bond, benefiting from a G1 green bond rating from CCX (not publicly available). The proceeds will be used for wastewater treatment, high efficiency automatic irrigation systems, management of water resources, water system management and remediation, waterfront restoration and associated infrastructure, as well as recycling and reuse of waste parts from car manufacturing and industrial processes.

Climate Bonds view: We strongly support the clarity on the use of proceeds provided for the deal through the prospectus and green rating. We look forward to seeing a post-issuance report, which providing the same level of transparency around funded projects.

Repeat issuers

- AfDB (African Development Bank): two tranches for a total of USD600m

- Bank of Guizhou: CNY2bn/USD292m

- Credit Agricole CIB: EUR1bn/USD1.13bn

- Dividend Finance: four tranches for a total of USD103m

- EUROFIMA: EUR500m/USD571m

- HSBC: EUR1.25bn/USD1.42bn

- Huadian Fuxin Energy Corporation Limited: 2 tranches for a total of CNY675m/USD98m

- Longyuan Power: CNY3bn/USD439m

- Louisiana Local Government Environmental Facilities and Community Development Authority: USD8m

- Mitsubishi UFG: USD120m

- New York State Housing Finance Agency: 28 tranches for a total of USD188m (Certified Climate Bond)

- NWB Bank: USD500m

- Renewi (formerly Shanks Group): 2 tranches for a total of EUR25m/USD28m

- South Carolina Jobs-Economic Development Authority: 2 tranches for a total of USD13m

- Sumitomo Mitsui Banking Corp: AUD83m/USD60m

- Toda Corp: JPY5bn/ USD45m (closing December 21)

- World Bank (IBRD): INR160m/USD2m

- World Bank (IBRD): SEK1.1bn/USD121m

- Wuhan Metro: USD400m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Qinghai Xining Rural Commercial Bank Co.,Ltd |

CNY170m/USD24.9m |

04/12/2018 |

Not aligned |

|

Quantum Pacific Shipping |

USD40m |

28/11/2018 |

Not aligned |

|

Beijing Capital Co., Ltd. |

CNY2bn/USD287.7m |

27/11/2018 |

Working capital |

|

Henkel

|

EUR1.5bn/USD1.7bn |

14/12/2018 |

Sustainability/Social bond |

|

Henan Jinkai Chemical |

CNY190m/USD27.6m |

19/12/2018 |

Working capital |

|

Yichang High Tech Investment |

CNY3bn/USD435m |

17/12/2018 |

Working capital |

|

China Three Gorges |

CNY3bn/USD436m |

03/12/2018 |

Pending |

|

World Bank (IBRD) |

MXN10m/USD0.5m |

28/11/2018 |

Pending |

|

Vasakronan |

SEK300m/USD33m |

30/11/2018 |

Pending |

|

Tokyo Metropolitan Government |

USD89m |

17/12/2018 |

Pending |

|

Korea land and Housing Corporation |

HKD1.25bn/USD159.8m |

20/12/2018 |

Pending |

Green bonds in the market

- California Pollution Control Finance Authority: expected to close December 19 (not priced yet)

Investing News

China is set to exclude “clean coal” from its green bond guidelines as it seeks to align its green definitions more closely to the Climate Bonds Standard.

The Bank of England is planning to introduce climate change impacts as part of its UK bank stress test known as exploratory scenario in 2019.

French asset manager Ecofi Investissements launched a multi-asset “green growth” fund – the Ecofi Acting for Climate fund – open to both institutional and retail investors. The fund will have at least 60% of its assets in equities and up to 35% in fixed income instruments. Priority will be given to green bonds within the fixed income allocation.

The European Union agreed on Monday to a goal of cutting emissions from cars by 37.5% and vans by 31% by 2030 compared with 2021 levels.

Germany’s last coal mine – Prosper Haniel – closed, ending the mining history in the Ruhr region.

Green Bond Gossip

The Dutch State Treasury Agency is looking to issue a debut green sovereign bond in the second quarter of 2019 of around EUR4bn-EUR6bn and a maturity of at least 15-years. ABN Amro Bank, HSBC and Nordea have been appointed as advisors for the upcoming Dutch Direct Auction (DDA) of the green bond.

Telecommunications and digital services company Telefónica developed an SDG Framework setting out eligibility criteria for Green, Social and Sustainability bonds. Sustainalytics provided the Second Party Opinion on the framework. Eligible categories under the green bond criteria include: energy efficiency of network infrastructure, generation and purchase of electricity from renewable energy sources, and energy efficiency of digital services solutions for the environment.

Japanese real estate investment trust Sekisui House REIT obtained a Sustainalytics Second Party Opinion on its new Green Bond Framework. The issuer plans to finance and refinance the acquisition of new or existing buildings that have obtained a ranking of 3, 4 or 5 under DBJ Green Building Certification (5 is the highest) or A or S under CASBEE (S is the highest).

Reading and Reports

The Carbon Brief recently published a comprehensive summary of the key COP24 outcomes.

White & Case, S&P Global Ratings and Skandinaviska Enskilda Banken (SEB) published a white paper “Towards a sustainable infrastructure securitisation market: the role of collateralised loan obligations (CLO)” commissioned by the G20 Sustainable Finance Group. The paper promotes the development of a sustainable CLO market as an essential source of funding for financing sustainable projects at the scale required to achieve the Paris Agreement goals.

The Grantham Research Institute and the Initiative on Responsible Investment launched a new report focused on the just transition: Climate change and the just transition: a guide for investor action.

The IEA published a commentary on “How Northwest Europe can shape a clean hydrogen market”.

Moving Pictures

Hear the powerful TED talk on climate change urgency, delivered by 15-year old school girl Greta, who also gave a shorter talk at COP24 about why she carried out the school strike.

Take 2:45 mins to listen to Sean Kidney’s impressions from COP24.

In case you’ve missed it:

- Watch the Technical Exert Group on Sustainable Finance’s (TEG) webinar recording providing background and guidance for stakeholders interested in participating to the feedback process on the EU Taxonomy for Green Finance.

- Watch the city-focused webinar on ‘Pooled Green Bond Financing for Municipalities’ and learn more on how PFMs can mobilise private financing for urban infrastructure, reduce project costs, and enhance creditworthiness and project quality.

‘Till next time,

Climate Bonds