Highlights:

- Market growth with July total of USD16.7bn – up 11% year-on-year

- Japanese REIT issuance accelerates, 6 deals in July

- US Green Munis sprout from Texas to Washington, D.C.

- Sweden to issue Sovereign Green Bond by 2020

Don’t miss!

California Treasurer Fiona Ma is continuing her green finance leadership. Fresh from establishing a high powered Green Bond Market Development Committee, she’s now rolling out a 3 part Webinar Series: Green Bonds in the Golden State: A Practical Path for Issuers. First one is Wed 14th August 10:00am-12:00pm PDT. Resource page and registration here.

Green bonds market summary – H1 2019 provides an overview of recent developments in the global green bond market. It looks at trends and spotlights a few topics of interest, including sovereign issuance, green asset-backed securities and green bond trading venues.

Green bonds market summary – H1 2019 provides an overview of recent developments in the global green bond market. It looks at trends and spotlights a few topics of interest, including sovereign issuance, green asset-backed securities and green bond trading venues.

China Green Bond Market Newsletter H1 2019 / 中国绿色债券市场季报 2019 上半年度 looks at recent developments in the Chinese green bond market. It covers the latest issuance trends and highlights policy progress and upcoming events.

China Green Bond Market Newsletter H1 2019 / 中国绿色债券市场季报 2019 上半年度 looks at recent developments in the Chinese green bond market. It covers the latest issuance trends and highlights policy progress and upcoming events.

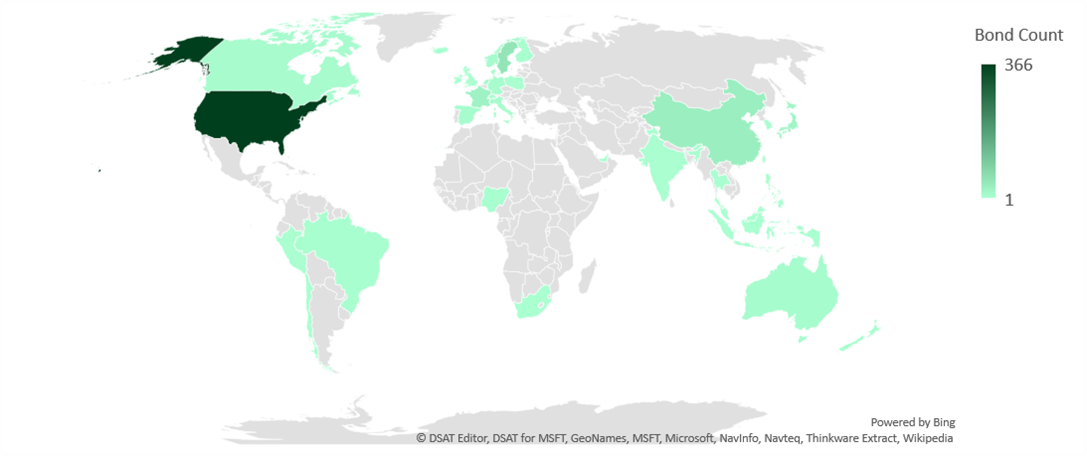

Green bond deals across the globe – 2019

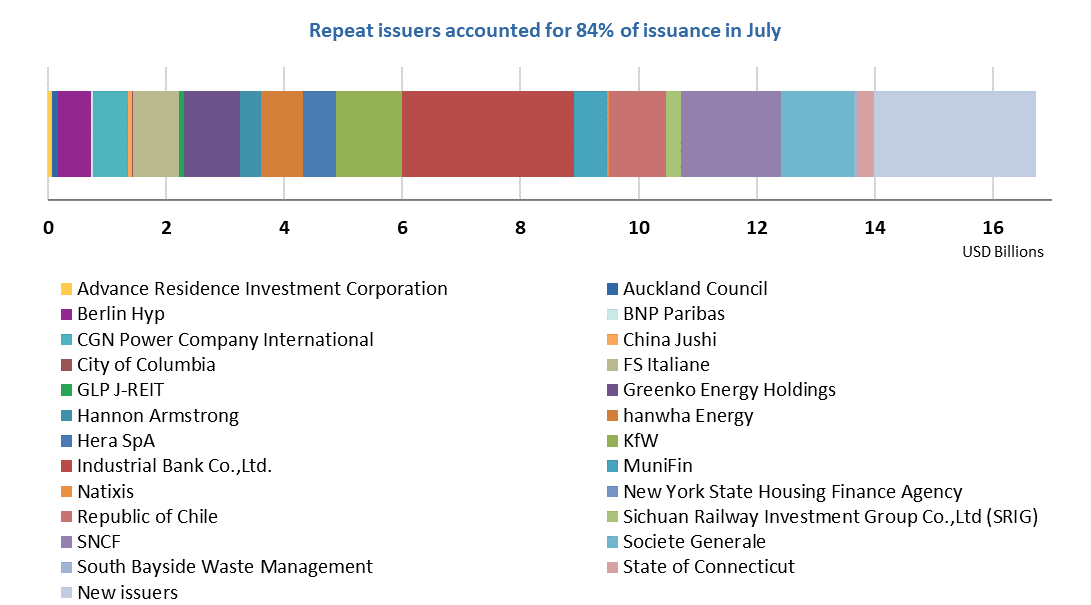

Go here to see the full list of new and repeat issuers in July.

July at a glance

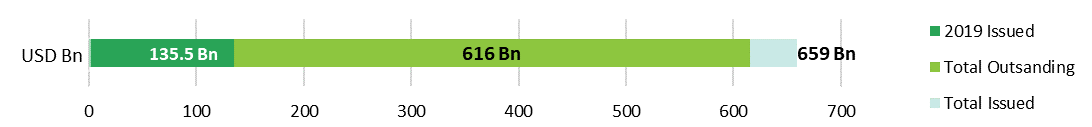

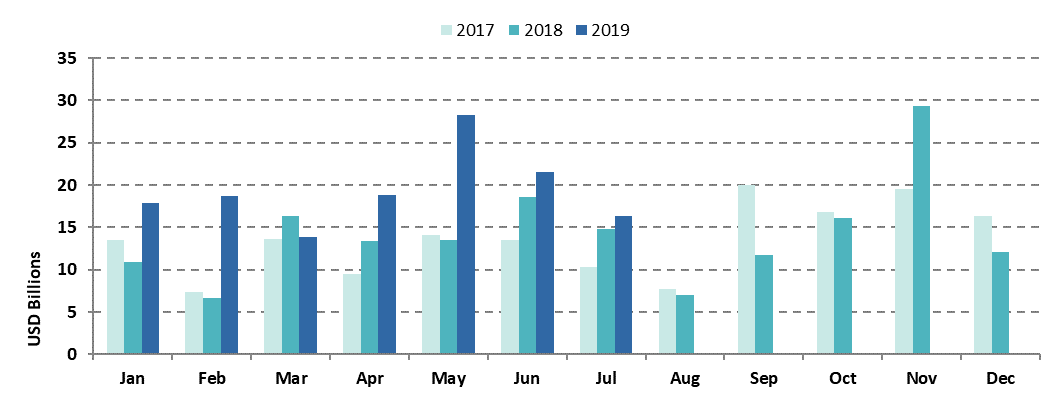

Total green bond issuance volume for July reached USD16.7bn, translating into approximately 11% growth year-on-year.

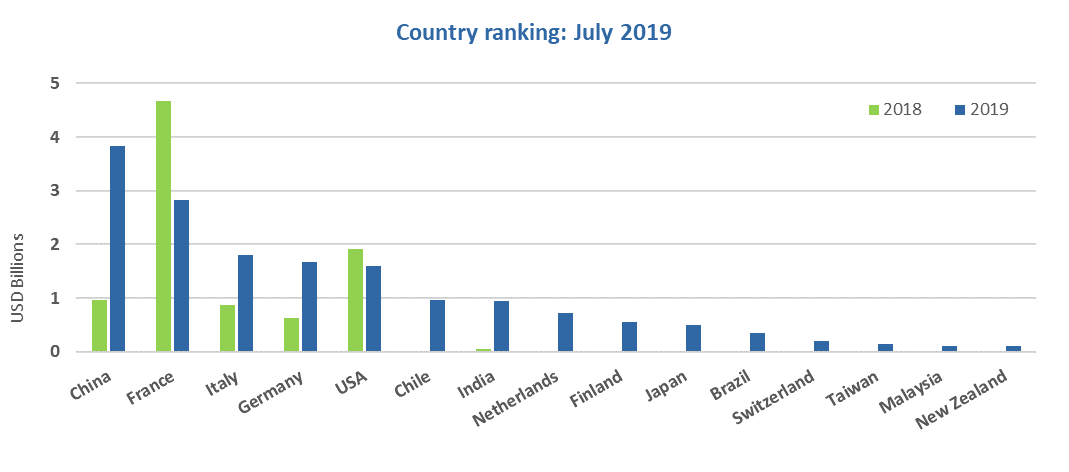

Emerging markets account for 31% of the month’s issuance figures. China, which made up 60% of EM volumes, led the month’s overall county rankings with nearly a quarter of issuance (USD3.8bn or 24%), up from third place in July last year. Chile placed 6th in July country rankings with its second sovereign GB of EUR861m. Smaller contributions on the emerging markets side came from debut issuers Neoenergia from Brazil (BRL1.3bn/USD343m), China’s GCN Power Company (USD600m) and Malaysian Telekosang (MYR470m/USD114m).

Overall, there was issuance from 15 markets in July. Four developed markets slot in between China and Chile. France, the top issuer in July 2018, took second place this year with USD2.8bn, contributing 17% to the monthly total. Italy (11%), Germany (10%) and the USA (10%) took 3rd, 4th and 5th places, moving slightly from their positions in July 2018 (4th, 8th and 2nd). While ranked 10th by volume, Japan recorded the second highest number of deals (10) after the USA (12).

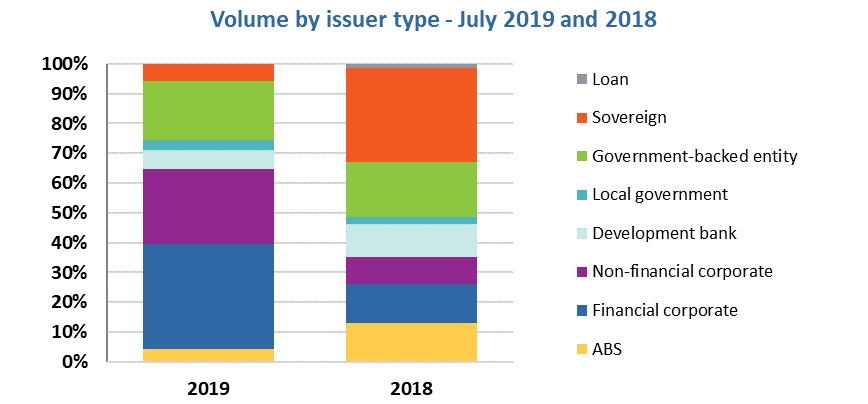

Issuance was dominated by financial corporates, whose share nearly tripled from 13% last July to 35% this time. The month’s largest deal – Chinese Industrial Bank’s sixth green bond (CNY20bn/USD2.9bn) – falls into this category. Another key contribution to this segment came from Japanese REITs, which we have highlighted below in the New Issuers section.

Similarly, the share of non-financial corporates reached nearly three times its July 2018 share of 9%, ending up at 25% this month. The growth was driven mainly by energy companies, including India’s Greenko Energy Holdings (USD950m) and two deals from Italian utilities: repeat issuer Hera SpA (EUR500m/USD564m) and new entrant A2A SpA (EUR400m/USD453m).

July issuance from government-backed entities grew by 2% to 20% of monthly volume, whereas ABS issuance decreased from 13% to 4%. In the former category, railway companies dominated with France’s SNCF returning to the market for the 8th time as part of their Certified programmatic issuance and Italy’s Ferrovie dello Stato debuting with the country’s first Certified Climate Bond (see MB #29 for details).

Sovereign issuance contributed 6%, with Chile’s EUR-denominated second sovereign (USD972m equivalent) being the only deal to hit the market in July.

> The full list of new and repeat issuers is here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Meidensha Corporation (JPY6bn/USD55.5m), Japan, issued a 5-year bond Certified against the Solar and Low Carbon Transport Criteria of the Climate Bonds Standard. The proceeds of the bond will finance and refinance the expansion and construction of existing and new EV facilities at three manufacturing sites across Japan. The facilities will be solely dedicated to manufacturing motors and related components of electric and hybrid vehicles. There will also be investments into rooftop solar. The factories are due to be completed and operational later in 2019.

DNV GL provided verification for the issuance, which also received a Green1 rating from Japan Credit Rating Agency. Meidensha will report on the allocation of proceeds as well as brief details of the three factories. They will also include estimated avoided CO2 emissions that will be verified by DNV GL.

Read more in our special Meidensha Blog.

Société Générale (JPY6bn/USD55.5m), France, issued a 10-year Positive Impact Covered Bond that is certified against the Low Carbon Buildings Criteria of the Climate Bonds Standard. The proceeds will be used to finance and refinance French residential mortgages originating from Société Générale’s retail banking arm. These are linked to the top 15% best performing homes, in terms of CO2 emissions, based in mainland France. The homes have been constructed with the government’s thermal regulation “RT 2012”, meeting the Criteria requirement. There are 21,237 eligible loans. 35% of these homes are in Ile de France, the area around Paris.

According to the verification document and SPO from Vigeo Eiris, the issuer will make annual reports related to the bond available on its website. The reports will include information on the number of eligible mortgages, estimated annual energy savings, and estimated avoided emissions of CO2. Third-party assurance reports will also be provided.

New issuers

A2A SpA (EUR400m/USD453m), Italy, brought to market a 10-year senior unsecured green bond that benefits from a SPO by Vigeo Eiris. The bond’s proceeds will finance and/or re-finance eligible green projects related to:

- Circular economy in the context of pollution prevention and control and sustainable water management;

- Energy efficiency through operations decarbonization, smart networks and services, network upgrades and energy storage systems;

- Renewable energy development, and

- Sustainable mobility and transportation.

Projects, assets, expenditures and investments (including unallocated proceeds) related to fossil or nuclear energy generation will be excluded. A2A will report on use proceeds and a select set of impact reporting indicators to the market on an annual basis. Detailed lists of reporting indicators can be found in A2A’s Green Bond Framework.

Climate Bonds view: A2A is the third Italian utility company to enter the market, bringing cumulative issuance volume from the sector to USD2.3bn. We commend the company and hope others in the region will follow suit.

Bank of Nova Scotia (Scotiabank) (USD500m), Canada, came to market with a 4-year debut green bond, whose proceeds will be allocated exclusively to finance or refinance eligible new or existing loans that Scotiabank has made to businesses, assets or projects. A business will be considered eligible only if it derives 90% or more of its revenues from a list of specified project categories in Scotiabank’s Green Bond Framework (see pp.4-5).

In addition to the more typical financing categories, such as green buildings, renewable energy and transport, Scotiabank has also included terrestrial and aquatic biodiversity conservation.

The bond benefits from a SPO by Sustainalytics. The bank will publish its first post-issuance report a year after the Green Bond’s issue date, and every year thereafter until full allocation of proceeds. This will include both use of proceeds and impact information. The details are outlined in the Framework.

Climate Bonds view: We welcome additional financial corporate issuance from Canada and commend Scotiabank for its robust framework and extensive post-issuance transparency commitment to the market. This is only the third commercial bank from Canada after TD Bank and the RBC to issue green debt. With lots of latent potential in the country’s financial sector, we hope to see others follow the example.

BKW Group (USD165m), Switzerland, recently issued an 8-year senior unsecured green bond to finance small hydropower plants (12%) and wind plants (88%) in Norway, France and Switzerland. However, the framework allows financing under a much wider range of categories:

- Renewable Energy: projects aimed at increasing the production, connection and distribution of renewable energy;

- Energy Efficiency: investments in smart grids/meters, grid infrastructure improvements and storage systems;

- Green Buildings: New, existing or refurbished buildings which must meet a certain set of criteria, and

- Terrestrial Biodiversity Conservation: Land preservation and grid improvements through the replacement of overhead power lines with efficient underground cable.

The bond benefits from a SPO from ISS-Oekom. The issuer has committed to reporting annually on both the use of proceeds as well as certain impact indicators for the financed projects on an annual basis.

Climate Bonds view: We’re happy to flag the first green bond issued by a utility company from Switzerland. We hope this will act as a positive example and lead to more Swiss issuance.

Bruntwood SciTech (GBP185m/USD233m), United Kingdom, has taken out a 3-year loan to finance a specialist property portfolio under the terms of Lloyds Bank’s Green Lending initiative which underpins its Sustainability Bond Framework. The assets include existing assets (the UK’s largest bioscience campus, Alderley Park in Cheshire, Manchester Science Park, Manchester Technology Centre and Platform in Leeds) as well as a new 400,000 sqft property in Manchester, which is aiming to achieve a BREEAM Excellent rating for the three new buildings on their expected completion in 2021.

Bruntwood SciTech will secure a discount on the investment loan by agreeing to fulfil bespoke Green Covenants and delivering an investment of £3.5m into sustainably-linked improvements across its estate, covering things such as combined heat and power, storage batteries and small-scale renewable energy. It has also pledged to reduce the energy intensity of its portfolio by more than 10% over the lifetime of the loan.

Climate Bonds view: The eligibility criteria for energy efficient buildings under Lloyd’s Green Lending programme are specified as either a minimum of BREEAM Very Good (provided a minimum score of 70% is achieved in the energy category) or EPC B for commercial buildings. Both are ambitious levels for building certification and energy efficiency.

The transaction is a good example how banks can leverage their position as lender to promote investment in green assets and projects. The introduction of green covenants is a positive feature as it allows for effective compliance monitoring by the lender to determine if the deal qualifies for improved lending terms. Green bonds generally do not have such covenants, so their emergence in lending (green loans and ESG-linked loans) is a market positive, too.

Etrion (JPY16.7bn/USD155m), Japan, recently issued a green loan with a 17-year term to finance the construction of the 45MW Niigata solar project located in the Niigata prefecture in northern Japan. The project is expected to be fully operational by Q4 2021 and is expected to produce approximately 47GWh of solar electricity per year, enough to supply more than 13,000 households.

Climate Bonds view: Only a minority of Japan’s energy is produced from renewable sources, but the country has intentions to grow this significantly over the next decade as part of its NDC under the Paris Agreement. In addition, another green loan points to the potential of green lending to complement green debt as a source of investment in climate solutions.

Fuzhou Water Affairs Investment and Development Co., Ltd (CNY500m/USD73m), China, issued 5-year green MTN bond, which benefits from an SPO from The iGreen Bank (not public). Proceeds are intended to be used to repay or replace the loans taken from Bank of Communications, China CITIC Bank and China Development Bank to expand and renew water supply systems in three locations in Fuzhou.

It is expected that the improved system will deliver an increase of 136.9m m3 in water supply per year and an alternate water source of 72m m3 per year as well as saving 12m m3 of water per year.

The issuer states that the use of proceeds and progress of the projects in the previous year will be disclosed before April 30th of each year, as well as half yearly disclosure before August 31st of each year.

Climate Bonds view: The issuer has given comprehensive detail on the use of proceeds, including information on the loans for each project, reporting plan, as well as possible environmental risks and the associated prevention and control measures that are in place for the construction period. We encourage other government backed utility companies to benchmark towards such practices.

Hanwha Energy (USD300m), an affiliate of South Korea’s Hanwha Group, issued its debut green bonds through its North American subsidiary Hanwha Energy USA Holdings. The deal, which benefits from a Sustainalytics SPO, will finance the development, construction, installation and maintenance of solar energy production units and related transmission and distribution networks. The look-back period for refinancing projects is 36 months prior to issuance.

The company has stated it intends to report on the portion of financing vs refinancing in an annual proceed allocation report. An impact report will also be produced and will include key indicators, such as installed capacity of renewable energy (MW), annual CO2 emission reduced or avoided (tons) and annual renewable energy production (MWh).

Climate Bonds view: The deal is a welcome addition to the market. Despite being a pureplay issuer, it is encouraging to see Hanwha’s dedication to post-issuance transparency through allocation and impact reporting.

Montgomery County Utility District (USD4m), USA, issued a 16-year green US Muni bond whose proceeds will finance and refinance improvements to the county’s water distribution, wastewater collection and storm drainage (flood protection) systems.

Climate Bonds view: Montgomery County’s bond brings cumulative US Muni issuance volume from Texas to USD390m. It is the 14th issuer from the state to enter the green bond market.

Neoenergia (BRL1.3bn/USD343m), Brazil, issued a 10-year debut green bond to finance and refinance investments in one hydro, 15 wind and 10 renewable energy transmission projects, respectively representing 32%, 16% and 52% of proceeds. Some are under construction, others planned, and others already operational.

Although Neoenergia opted not to employ a third party for an external review, the issuer will confirm the allocation of proceeds annually until these are fully allocated. It will also report annually on the environmental impacts of the projects, including on energy generation and GHG emissions avoidance, until maturity.

Climate Bonds view: As energy is the most funded use of proceeds category, we are not surprised to see further issuance in the sector. Not many transmission projects have been funded in Latin America, it’s a positive to see some investment to green the grid in the region (although a significant share of these has been in Brazil, e.g. Taesa’s earlier in the year).

The disclosure channel(s) for post-issuance reporting on the use of proceeds and impacts is not clear. We would encourage the issuer to provide online reporting if possible.

Tagasako Thermal Engineering (JPY5bn/USD46m), Japan, issued its debut 7-year green bond, which benefits from a Green 1 rating from JCR. The proceeds will go towards the construction of the “Innovation Center”, which will be conducting R&D and experiments for environmental engineering. This Zero Energy Building is planned to receive LEED Gold certification.

Takasago Thermal Engineering will disclose information on the use of proceeds until full allocation, which is anticipated by March 2020. The company will publish an impact report outlining the effect of environmental improvements, including reduced GHG emissions and other ESG indicators, once a year until the redemption of the bond.

Climate Bonds view: A zero energy building, good disclosure and an issuer in the construction space. What’s not to like? Japan leading the way. We hope to see similarly ambitious projects financed by other construction companies, too.

Telekosang Hydro One Sdn Bhd (MYR470m/USD115m), Malaysia, issued an 18-year green Sukuk to finance the construction of a 24MW run-of the-river hydro plant. The issuer signed a 21-year Renewable Energy Power Purchase Agreement (REPPA) with Sabah Electricity, with a scheduled Feed-in Tariff commencement date for the project of 31 July 2021, after a 24-month construction period.

This is the world’s first mini-hydro Sukuk (other Sukuks have financed hydro but not exclusively, and not for a mini project). It is also the largest Malaysian bond since December 2017. The deal benefits from an AA3 rating from RAM.

Climate Bonds view: Hydro already constitutes a significant proportion of Malaysia’s renewable energy mix, but renewables must grow further for the country to meet its NDC climate goals.

Telekosang’s green Sukuk is the world’s first for a mini-hydro project that is aligned with the requirements of Securities Commission Malaysia’s Sustainable and Responsible Investments Sukuk Framework, the ASEAN Green Bond Standards, and the Green Bond Principles. That’s a nice trifecta!

Washington State University (USD65m), USA, entered the green bond market with a 15-year green Muni earmarked to finance buildings in Vancouver and on the Pullman campus, which have received LEED Gold and Silver certifications or LEED Silver equivalent building standards. The University does not expect to provide any additional disclosure relating to the green bond.

Climate Bonds view: Green bond issuance from another US educational institution. . However, we do encourage post issuance disclosure on the progress of the projects that are funded with this bond.

Six Japanese Real Estate Investment Trusts (REITs) completed 7 green issuances in July. Only 8 green bonds had come to market from Japan’s REIT sector prior to July. Last month’s activity took the size from the equivalent of USD432m to USD720m thanks to the seven deals issued by:

- GLP J-REIT (JPY8bn/USD74m), 10Y bond, rated Green 1 by JCRA;

- ORIX JREIT Inc. (JPY7bn/USD65m), 5Y bond, rated Green 1 by JCRA;

- Sekisui House REIT (JPY6.5bn/USD60m), 10Y bond, which benefits from a Sustainalytics SPO;

- Advance Residence Investment Corporation (JPY5bn/USD46m), 5Y bond and (JPY3bn/USD28m), 10Y loan, rated Green 1 by JCRA;

- Fukuoka REIT Corporation (JPY2.2bn/USD20m), 10Y loan, rated Green 1 by JCRA;

- Japan Hotel REIT Investment Corporation (JPY2bn/USD18m), 5Y bond, rated Green 1 by JCRA;

The proceeds financed assets across several property asset classes, including housing (Advance Residence Investment Corp.) and hotels (Japan Hotel REIT Investment Corp.). Fukuoka REIT Corporation’s green bond proceeds are allocated solely to Canal City Hakata, a 15-storey commercial retail building in Hakata-ku, Fukuoka, which benefits from a 5-star DBJ Green Building Certification under the Development Bank of Japan’s certification scheme.

The most common eligibility criteria relate to high standards of green building certification. Widely used certifications include Japan’s own CASBEE (Comprehensive Assessment System for Built Environment Efficiency) and BELS (Building Energy Efficiency Labelling System). Among the well-established international schemes, LEED was the most popular.

Visit our Bond Library for more details on all July deals.

Bonds issued before June 2019

Electrolux (SEK1bn/USD150m), Sweden, issued a 5-year senior unsecured green bond benefitting from a SPO by CICERO in March 2019. The proceeds will finance projects relating to four of Electrolux’s nine sustainability promises, and aim to:

- Improve product performance and efficiency, which relates to reducing the environmental impact resulting from the use of products. Eligible R&D projects will aim to improve the energy efficiency (weighted average) at least 15% compared to the current average;

- Make better use of resources, which relates to improving the efficiency of materials that the Group uses and increasing the use of recycled materials;

- Eliminate harmful materials, which relates to phasing out substances that could have a negative impact on health and/or the environment including refrigerants and foam blowing agents with high greenhouse warming potential;

- “Achieve more with less”, which relates to reducing the impact from the Group’s operations on the environment related to energy, water, waste and emissions;

- Climate targets, which relates to reducing greenhouse gases produced by the Group (factories, warehouses and offices) through the generation of renewable energy (geothermal, wind power, solid or gas bio-based energy, solar collector or photovoltaic panels).

Electrolux does not exclude financing or re-financing of processes using fossil fuel-based energy generation in the case that either the percentage is smaller than 5% or a technically and economically viable solution for renewable energy does not exist. An annual Green Bond report including use of proceeds and impact information will be published.

Climate Bonds view: Electrolux is a household name, issuing their first green bonds a further sign of mainstreaming in green finance. They are the second green bond issuer in Sweden in the consumer discretionary industry (of roughly 40 issuers in total) the example has now been set.

Repeat issuers – July

- Auckland Council: NZD150m/USD100.6m - Certified Climate Bond

- Berlin Hyp: EUR500m/USD561.5m

- BNP Paribas: TWD1bn/USD32.2m

- CGN Power Company International: USD600m

- China Jushi: CNY500m/USD72.6m

- City of Columbia: USD10.4m - Certified Climate Bond

- FS Italiane: EUR700m/USD785.4m - Certified Climate Bond

- GLP J-REIT: JPY8bn/USD73.8m

- Greenko Energy Holdings: USD950m

- Hannon Armstrong: USD350m

- Hera SpA: EUR500m/USD564.2m

- Industrial Bank Co., Ltd.: CNY20bn/USD2.9bn

- KfW: GBP650m/USD799m

- KfW: AUD450m/USD315. 7m

- MuniFin: EUR500m/USD564.6m

- Natixis: EUR19.21m/USD21.7m

- New York State Housing Finance Agency: USD9.6m

- Obvion: EUR641.3m/USD719.4m - Certified Climate Bond

- Republic of Chile: EUR861m/USD972.4m - Certified Climate Bond

- Sichuan Railway Investment Group Co., Ltd (SRIG): CNY1.7bn/USD247.1m

- SNCF: EUR1.5bn/USD1.7bn - Certified Climate Bond (Progammatic Certification)

- Societe Generale: TWD3600m/USD115.4m

- Societe Generale: EUR1bn/USD1.1bn - Certified Climate Bond

- South Bayside Waste Management: USD16.9m

- South Bayside Waste Management: USD48.8m

- State of Connecticut: USD29.8m

- State of Connecticut: USD250m

Repeat issuers before July

- BBVA: EUR1bn/USD1.1bn - June 2019

- East Bay Municipal Utility District: USD161.8m - June 2019

- EIB (European Investment Bank): DKK3bn/USD456.7m - June 2019

- Jiangsu Financial Leasing Co., Ltd.: CNY520m/USD75.2m -June 2019

- Prologis European Logistics Fund: EUR450m/USD512.5m -June 2019

- Swedish Export Credit: SEK1bn/USD107.8m - June 2019

- CAF (Corporacion Andina de Fomento): USD50m - November 2018

- CAF (Corporacion Andina de Fomento): USD30m - August 2018

- CAF (Corporacion Andina de Fomento): COP150bn/USD52.5m - May 2018

- Ence Energia SLU: EUR43m/USD48.7m -November 2018

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Low income investment fund |

USD100m |

25/07/2019 |

Excluded (Sustainability/Social bond) |

|

Jinan Rail Transit Group Co.,Ltd |

CNY2bn/USD291m |

23/07/2019 |

Excluded (Working capital) |

|

Guangzhou Metro Group Co.,Ltd. |

CNY2bn/USD291m |

17/07/2019 |

Excluded (Working capital) |

|

KOGAS |

USD500m |

16/07/2019 |

Excluded (Sustainability/Social bond) |

|

POSCO |

USD500m |

15/07/2019 |

Excluded (Sustainability/Social bond) |

|

PUBLIC FINANCE AUTHORITY, WISCONSIN |

USD93m |

12/07/2019 |

Excluded (Missing prospectus) |

|

China Huadian Corporation Ltd. |

CNY3bn/USD437m |

02/07/2019 |

Excluded (Proceeds not aligned) |

|

Lu'An Mining Industry Group Co.,Ltd. |

CNY3bn/USD437m |

02/07/2019 |

Excluded (Proceeds not aligned) |

|

Shinhan Group Financial Group |

EUR500m/USD557m |

30/07/2019 |

Pending (Waiting for more information) |

|

IFC |

SEK65m/USD69m |

17/07/2019 |

Pending (Waiting for more information) |

Green bonds in the market

- EnBW – closed August 5

- Mitsui Fudosan Co., Ltd. – closing 1 September

Brazilian beef company Marfrig is closing a USD500m “sustainable transition bond” this week. Earlier in the year, Italian gas grid operator Snam issued a “climate action bond”. In both cases, the issuers have chosen a label different than “green bond” to identify investments in assets and projects that do not quite meet existing green definitions.

Investing News

The Guardian reports that the EU’s lending arm (EIB) has drafted plans, which propose cutting support for energy infrastructure projects which rely on oil, gas or coal by barring companies from applying for loans beyond the end of 2020.

The Bank of England is asking British insurers to gauge how global warming might impact the value of the stocks and bonds they hold -- and its potential to upend financial markets.

Chile and Luxembourg have signed an agreement that would allow securities listed in either market to be traded on both their stock exchanges.

An analysis by CRU suggests carbon prices could reach about €40 a tonne by 2028, as the EU pushes for deeper and increasingly costly reductions in emissions, and the FT’s The Commodities Note opines that rising EU carbon prices could push energy-intensive industry (e.g. steel) to less regulated countries.

Green Bond Gossip

Colombia is exploring the possibility of issuing a green bond as part of its 2020 debt issuance strategy:

The Swedish National Debt Office (Riksgälden) has announced it was tasked by the Government with issuing green bonds in 2020, at the latest.

The City of London Corporation has agreed to raise debt totalling £450m under its Green and Sustainable Financing Framework for City’s Cash to help fund an ambitious programme of major projects in the Square Mile.

Sustainalytics has provided an SPO on the GB Framework of Welltower Inc., a health care infrastructure company headquartered in Toledo, Ohio.

Ergon Peru S.A.C., which is 90% owned by the Italian company Tozzi Green SpA, has obtained a Green Evaluation from S&P for solar PV projects in off-grid rural areas in the north-central and southern regions of Peru.

The planned sale of a USD50m rhino impact bond in 2020 is being run by the Zoological Society of London and Conservation Capital. The bond is aimed at growing the population of the endangered black rhino, is seen by its backers as a test for the creation of a conservation debt market that could be used for everything from protecting species facing extinction to preserving wildlife areas.

Readings & Reports

UNEP FI partnered with Climate Finance Advisors to deliver a report on Driving Finance Today for the Climate Resilient Society of Tomorrow to the Global Commission on Adaptation. It identifies the main barriers in the financial system to accelerated investment in adaptation-related programmes and projects and proposes six sets of recommendations to unlock financing. Adaptation needs are estimated at USD140-300bn by 2030, according to the UN.

UN-Water launched an update of its Policy Brief on Climate Change and Water at during the High-level Political Forum on Sustainable Development (HLPF) 2019. The global climate crisis is inextricably linked to water. Climate change increases variability in the water cycle, inducing extreme weather events, reducing the predictability of water availability, affecting water quality and threatening sustainable development and biodiversity worldwide.

Twenty institutional investors, convened by UNEP FI and supported by Carbon Delta, worked throughout 2018–2019 to analyse, evaluate, and test, state-of-the-art methodologies to enable 1.5°C, 2°C, and 3°C scenario-based analysis of their portfolios in line with the TCFD’s recommendations. The outputs and conclusions are captured in Changing Course: A Comprehensive Investor Guide to Scenario-based Methods for Climate Risk Assessment.

The Network for Greening the Financial System (NGFS) published a technical supplement Macroeconomics and Financial Stability: Implications of Climate Change to the April 2019 NGFS Comprehensive report. The supplement provides an overview of existing approaches for quantitatively assessing climate-related risks and identifies key areas for further research. It also sets out a menu of options for central banks and supervisors.

The Basel Agency for Sustainable Energy (BASE) has produced a Manual of Financing Mechanisms and Business Models for Energy Efficiency. It looks at innovative financing mechanisms and business models from around the world and aims to spur new investments in energy efficiency.

The International Energy Agency (IEA) has released The Future of Hydrogen, a report which finds that for hydrogen to make a significant contribution to clean energy transitions, it needs to be adopted in sectors where it is almost completely absent, such as transport, buildings and power generation.

And finally some viewpoints on green bonds and climate financing:

- The Federal Reserve should act aggressively to reduce that risk, a leading economic historian argues.

- International Financial Review released a special report covering the IFR Green Financing Roundtable 2019 held in May in London.

Correction: In Market Blog #29, we stated inaccurately that the cumulative green US Muni volume issued in the State of California at the time of publication (July 12) was USD6.4bn. The correct figure is USD8.5bn, and issuance volume remains at this level today (August 6).

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.