Highlights:

- USD116bn issued in H1 2019 – On track for USD200bn+ year?

- First Italian Certified Climate Bond from state rail operator Ferrovie dello Stato

- US green MBS market grows with Freddie Mac’s debut foray

- Germany to issue Sovereign Green Bund in 2020

Don’t miss!

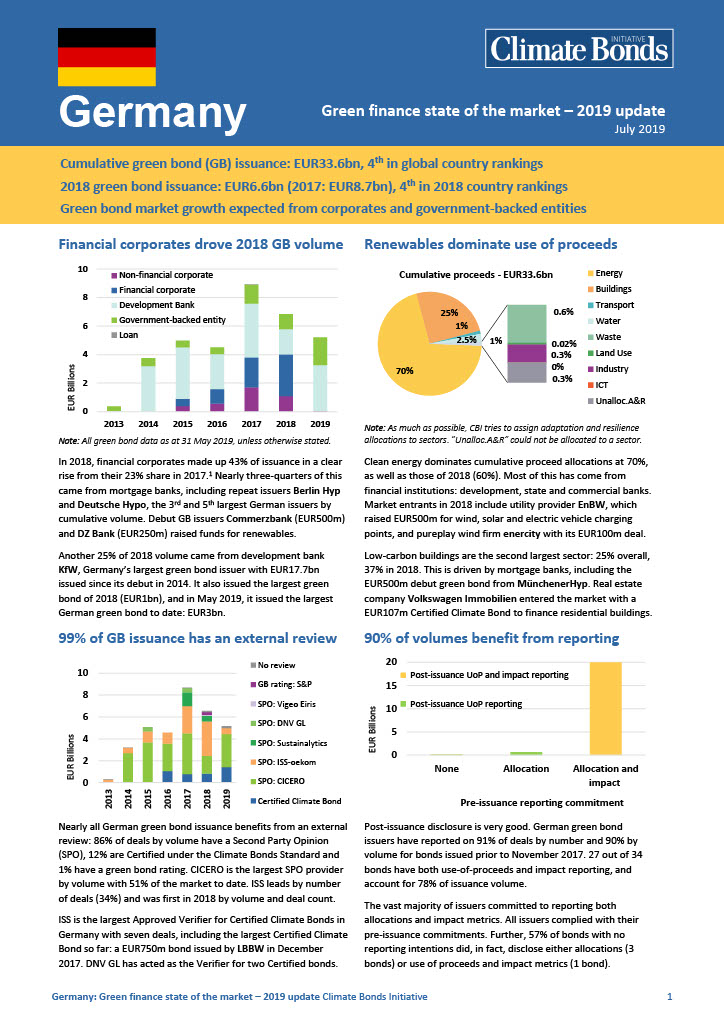

Germany: Green Finance State of the Market - 2019 update provides a detailed overview of recent developments in the German green bond market. It analyses the developments in the private and public sector for industries with green growth prospects, including energy, low carbon buildings, transport and automotive. It identifies climate-aligned issuers that are already financing green assets.

Germany: Green Finance State of the Market - 2019 update provides a detailed overview of recent developments in the German green bond market. It analyses the developments in the private and public sector for industries with green growth prospects, including energy, low carbon buildings, transport and automotive. It identifies climate-aligned issuers that are already financing green assets.

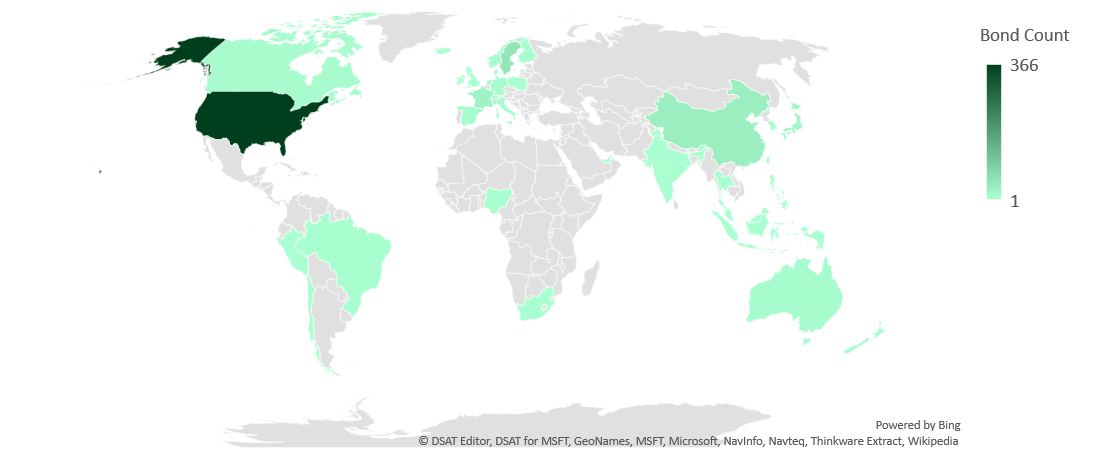

Green bond deals across the globe – 2019

Go here to see the full list of new and repeat issuers in July.

June at a glance

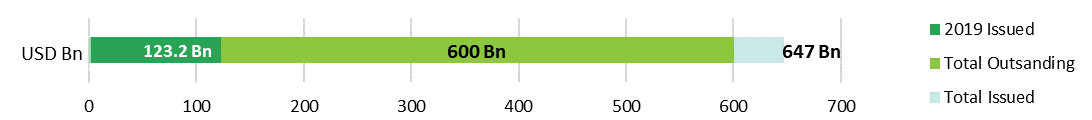

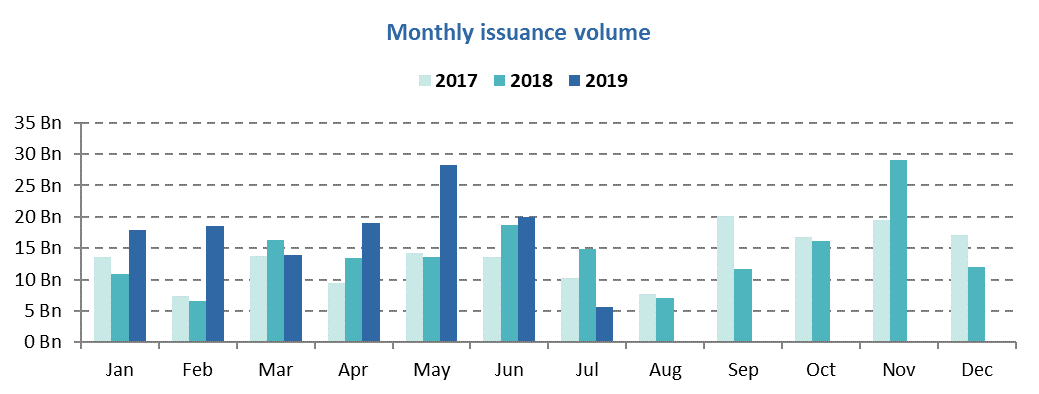

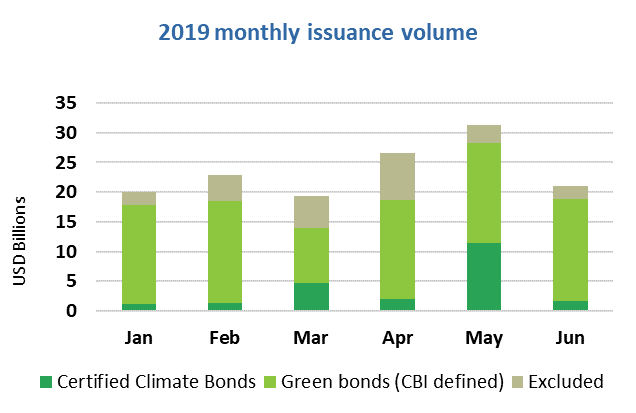

Total green bond volume for this year as at July 12 stood at USD123.2bn, putting the market at just under half of CBI’s target annual issuance of USD250bn.

June issuance reached USD20bn, exceeding the 2018 figure of USD18.6bn as foreshadowed last market blog. Our preliminary figure for total volume for the first half of 2019 is USD117.6bn, 48% higher than in H1 2018.

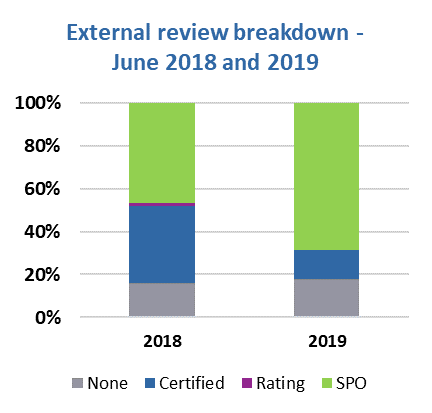

83% of June’s issuance was reviewed by a third party, out of which 86% included a Second Party Opinion. CICERO was the most popular SPO provider with 41% of reviewed volume. May 2019 remains the record month for deals with Certification under the Climate Bonds Standard with over USD11bn of Certified Climate Bonds (CCB). June CCB volume was USD2.4bn. The largest issuer was the Chilean debut sovereign green bond, followed by taps from programmatic issuers SNCF (France), DNB Boligkreditt (Norway) and New York Housing Finance Agency (USA), as well as debut issuer PKO Bank (Poland). Vigeo Eiris verified the majority (82%) of Certified, including the Chilean sovereign GB.

Note: USD1.5bn Certified deals from June 2019 also benefit from a Second Party Opinion.

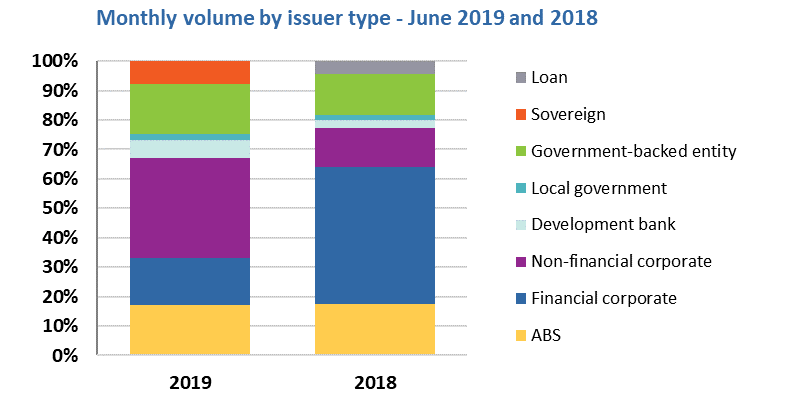

Over a third (34%) of issuance came from non-financial corporates, whose share grew by 21% year-on-year. The top deal in this category – and of the whole month – remained French energy giant Engie’s EUR1.5bn (USD1.7bn) their sixth green bond. On the other hand, the share of financial corporates dropped from 47% to 20%, while issuance from government-backed entities grew by 2% to 16% of monthly volume and ABS decreased by 4% to 14%. In the latter category, Fannie Mae’s USD2.3bn June issuance was complemented by Freddie Mac, which entered the market with a USD435m debut (see below for details). Sovereign issuance ended up with a 7% contribution.

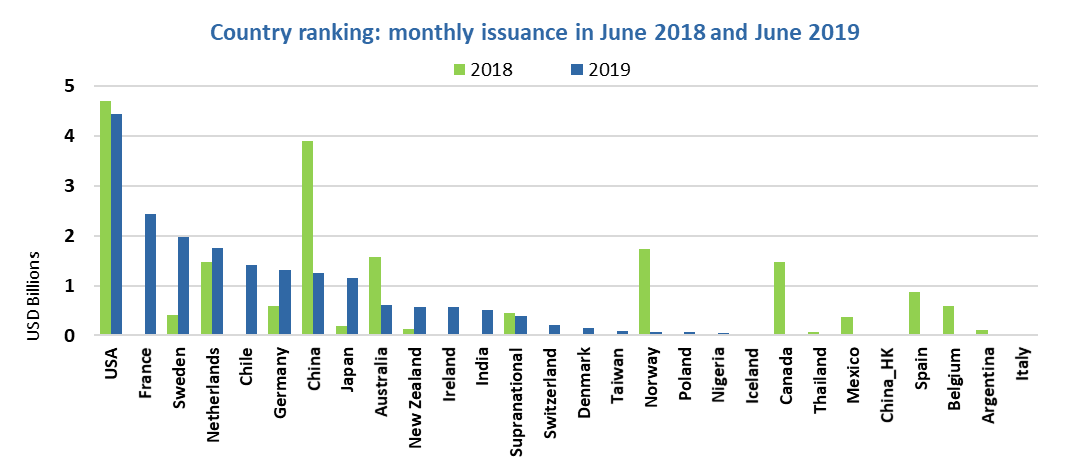

The US kept the top spot with 23% of monthly volume, a decrease of 2% versus June 2018 (25%). France ranked second at 13% of the market (in June 2018 China claimed that spot). Sweden (10%), the Netherlands (9%) and Chile (7%) make up the rest of the month’s top 5.

Similar to June 2018, developed markets dominated, contributing 80% of total volume, with the top 3 – USA, France and Sweden – accounting for more than half (58%) of June DM issuance. On the emerging markets side, Chile and China made up 87% of the month’s EM issuance. Smaller contributions came from Indian Adani Green Energy (USD500m), the Federal Government of Nigeria (NGN15bn/USD42m), Poland’s PKO Bank (PLN250m/USD66m) and Iceland’s Reykjavik Energy.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Ferrovie dello Stato (EUR700m/USD788m) became the first Italian issuer of a Certified Climate Bond with its 7-year green bond. Sustainalytics provided the Pre-Issuance Verification. Ferrovie will use all the proceeds to refinance a loan provided to Trenitalia to procure up to 600 new passenger and freight rolling stock. The trains, which will be up to 30% more energy efficient than the old stock, began entering service earlier in 2019. The replacement program will take 5 years in total.

The issuer will provide annual public reporting on the green bond as part of its company-wide sustainability reporting. The report will include the number of trains financed by the proceeds. Quantitative impact indicators, such as the estimated electricity saved and the corresponding amount of CO2 emissions avoided, will also be disclosed.

Climate Bonds view: A massive modal shift of passengers and freight from fossil fuel powered individual vehicles to a fully electrified rail network is an essential part of the low carbon transition. It is great to see this modal shift taking place in Italy and across the world, as we discussed in our special blog post.

New issuers

BayWa (EUR500m/USD560m), Germany, brought to market a 5-year senior unsecured green bond benefitting from an ISS Oekom Second Party Opinion. The proceeds will be fully allocated to funding renewable energy projects, which aim to increase the production, connection and distribution of renewable energy, particularly PV solar and onshore wind. The issuer will publish a report on their website disclosing the allocation of net proceeds and associated impact metrics within one year from issuance, and annually until the proceeds have been fully allocated.

Climate Bonds view: BayWa is a large corporate with activities in many countries. It can have a significant positive environmental impact, which is not limited to renewable energy projects. We hope that BayWa’s successful debut will prompt the company to issue green bonds to finance projects in other areas of its business. A green issuance focusing on agriculture, which represents 66% of BayWa’s total revenue would be a positive.

Freddie Mac (USD435m), USA, completed its eagerly-awaited market entry in late June. Proceeds will refinance Green Up and Green Up Plus loans provided under its Multifamily Green Advantage scheme. Freddie Mac requires that qualifying borrowers invest in efficiency improvements that result in a minimum of 30% savings in energy or water consumption savings, with a minimum of 15% being for energy savings for loans originated in 2019 (or later), as listed under the issuer’s Green Bond Framework, and a minimum of 25% savings for loans originated in 2018.

According to CICERO’s Second Party Opinion, Freddie Mac will report on use of proceeds and performance and impact indicators regularly, both through its website as well as Bloomberg and also via the designated Multifamily Securities Investor Access Tool and its Security Lookup.

Climate Bonds view: The US Agency MBS-market is estimated to be worth USD8.4tn. It a welcome development to see additional issuers join Fannie Mae in this space to leverage some of the value of this market segment to energy and water efficient properties. It is also heartening that both Agencies have raised their minimum thresholds on savings recently and introduced a specific minimum for energy efficiency improvements. We look forward to future issuances from Freddie Mac and will monitor its post-issuance reporting.

California Municipal Finance Authority (USD165m), USA, recently issued PACE notes with a 36-year tenor, rated by KBRA. The bond is secured by 3,166 PACE assessments levied against 3,152 residential properties and 14 commercial properties in 18 California counties. The average Assessment is approximately USD33,717 with an average annual payment of approx. USD3,368 with a total balance of approx. USD150m.

Climate Bonds view: PACE programs facilitate the financing of renewable energy and energy efficiency projects on privately owned residential and commercial properties with local government support. A total of 46 California counties are approved under the two PACE Programs. This is the 30th PACE ABS issuance from California, indicating healthy growth in energy efficiency financing in the state. The issued total now amounts to USD5.6bn.

Imperial Irrigation District (USD65.2m), USA, issued a 22-year green US Muni bond whose proceeds will refinance the purchase of the Sun Peak 1 PV solar project. This follows the execution of a power-purchase agreement (PPA) for approximately 23MW of energy from Sun Peak 1 in 2010, which the District purchased with the proceeds of a prior bond.

Climate Bonds view: The Imperial Irrigation District’s purchase of Sun Peak 1 is a great example of a District becoming more self-reliant and able to source renewable power securely for the future. It is also good to see the green US Muni universe continuing to expand. Green issuance from Californian agencies has been especially strong, and the state is sending a powerful message to the rest of the country. We look to additional government agencies to follow, particularly in other states.

Nissen Kaiun (JPY2.8bn/USD26m), Japan, issued a 10-year debut green loan with a Green1 rating from JCR. The funds will be used for the installation of two types of scrubbers. The open-loop system cleans exhaust gases and particulate matter (PM) containing sulphur oxides (SOx) emitted from ships’ engines using seawater and discharges the seawater into the sea. The hybrid scrubber system can be switched to a closed-loop system.

Loan drawdown amounts will be disclosed to participating banks at the same time as financial statements are submitted. The issuer will also report to the banks on the reduction of pollutants per scrubber and the number of scrubbers installed.

Climate Bonds view: Shipping is still a highly polluting industry and requires more investment to reduce its emissions. The installation of scrubbers is one of the measures for complying with IMO regulations that will become mandatory beginning in 2020. This is also the first green loan from Japan and the first one in 2019 to focus exclusively on waste projects.

RethinkWaste (USD48.8m), USA, issued its first green bond. The 15-year US Muni’s proceeds will be partly used to refinance the issuer’s solid waste enterprise revenue bonds from 2009, which funded improvements to the Shoreway Environmental Center, including a new 70,200sqft materials recovery facility, and expansion of the station’s capacity to handle organic waste. New efficiency improvements form the second part of the use of proceeds. Kestrel Verifiers produced a SPO for the bond.

The issuer will publish information on the bond annually until the bond matures on the EMMA, the Electronic Municipal Market Access web platform provided by the Municipal Securities Rulemaking Board. The disclosure will include a list of projects and their descriptions; amounts allocated, and expected impact. Kestrel Verifiers will provide a post-issuance Use of Proceeds report, which will also be posted on EMMA.

Climate Bonds view: It is good to see increasing levels of issuance from US Munis. With RethinkWaste’s deal, California’s green Muni bond total reached USD6.4bn. This is the fifth deal that finances waste management projects, and only the third one to do so fully. Climate Bonds’ Waste Management Criteria are out for public consultation until August 2.

Rongshi International Finance (USD500m), China, issued its first green bond, which benefits from a Sustainalytics SPO. The 5-year benchmark USD-denominated bond will exclusively finance and/or refinance eligible projects that provide clear environmental and sustainability benefits. The project categories include sustainable water and wastewater management and renewable energy. The latter comprise two wind farms in the United Kingdom: Beatrice Offshore Wind Power Project and Afton Wind Power Project.

Climate Bonds view: This deal is another example of a Chinese green bond financing wind farms in the UK. The issuer also promised to provide more information on the impacts resulting from these projects. We hope to see more bonds of this nature as the UK continues towards its zero carbon by 2050 goal.

South Central Connecticut Regional Water Authority (USD13m), USA, issued a 29-year green US Muni bond. The proceeds will refinance a bond that funded the Great Hill Tunnel & Pipeline restoration project: a public water supply tunnel and pipeline conducting water from a 58.5bn-litre reservoir to customers in New Haven, CT and 9 surrounding towns. Sustainalytics provided a SPO for the bond.

RWA will publish a report on the EMMA website, which will include the amount allocated to the eligible project and a description of the project funded. Potential ramifications prevented/avoided will be disclosed as an impact metric.

Climate Bonds view: We are pleased to see more US muni issuers follow market convention by commissioning external reviews for their instruments, as RWA has done. This is also the seventh green muni bond from the State of Connecticut, bringing total issuance to USD843m.

Vattenfall AB (EUR500m/USD570m), Sweden, entered the green bond market with a 7-year senior unsecured green bond. The utility company will use the proceeds to finance renewable energy projects and infrastructure, energy-sector energy efficiency (e.g. smart grids, energy recovery), the electrification of transport and heating, and industry projects, which enable the transformation to fossil-free production, such as the HYBRIT3 project. Nuclear and fossil fuel-based production projects are explicitly excluded.

CICERO provided an external review for the bond. Vattenfall is committed to publicly reporting on the bond’s proceeds and impact until maturity. A list of impact metrics is included in the Appendix of the issuer’s Green Bond Framework.

Climate Bonds view: This benchmark-sized bond is the largest to date from the Nordic utilities sector. Vattenfall joins its Norwegian and Danish peers Eidsiva Energi, Sogn of Fjordane Energi and European Energy in the market, bringing the issued total to 860m USD equivalent. We hope Vattenfall’s deal will stimulate further issuance from Nordic utilities firms.

Bonds issued before June 2019

BDO Unibank (USD150m), Philippines, issued a private placement to the IFC in January 2018. The proceeds are being used to finance climate-smart projects in the areas of renewable energy, green buildings, and energy-efficient equipment in the Philippines.

Climate Bonds view: The bond was previously Excluded but the IFC has recently confirmed to Climate Bonds that none of the proceeds would be allocated to fossil fuel power generation technologies, equipment or infrastructure, even if they were to improve energy efficiency. We encourage issuers to clearly state the sectors energy efficiency measures relate to and confirm that there are no allocations to fossil fuel power generation.

The Philippines has been able to grow its green bond market significantly in the last couple of years. This was a landmark issuance, the first from the domestic banking sector, where there is significant potential to increase the reach and visibility of green bonds more than other issuer types.

China Banking Corp (USD150m), Philippines, issued an IFC private placement in October 2018. The proceeds will finance climate-related projects in renewable energy, green buildings, energy efficiency and water conservation, in accordance with the Green Bond Principles.

Climate Bonds view: As only the second issuance from a bank, the deal has the potential to increase the reach and visibility of green bonds, likely more so than of other issuer types. The Philippine government has put in place key national policies to fight climate change. China Banking Corp’s green bond – similar to BDO Unibank’s debut green bond – will see the CBC scale up its investments in environmental projects, supporting the government’s target of 70% reduction in GHG emissions by 2030.

Mill City Solar Loan 2019-1 (USD241m), USA, issued a 4-tranche ABS in March 2019. The notes, rated by KBRA, have a legal final maturity in March 2043 and are backed by a pool of mostly prime-quality residential consumer solar loans provided by Loanpal to finance solar energy systems, including systems with energy storage.

MCSLT 2019-1 has large geographic concentrations, with California borrowers representing 32.17% of the outstanding principal balance as of the January 31, 2019 cutoff date. The next largest state concentrations are in Texas (14.16%), Nevada (10.15%), Arizona (8.10%) and Colorado (5.89%).

Climate Bonds view: US Solar ABS keeps attracting new issuers as more homeowners are installing residential solar. While California remains in the lead in terms of installations and popularity, it is good to see increasing adoption in other sunshine states. The transaction contributes to just over USD1bn of Solar ABS issuance in 2019, and USD6.2bn in total.

Pasukhas Group (MYR200m/USD49.2m), Malaysia, issued its debut green sukuk in February 2019. The issuer will use the proceeds to grow its portfolio of green assets. Eligible categories include renewable energy and energy efficiency, sustainable land use, biodiversity conservation, remediation/redevelopment of contaminated sites, water infrastructure and waste management.

As the first asset to be financed via the sukuk, Pasukhas has identified a small hydropower plant with an installed capacity of 3.2MW at Sungai Rek, Kelantan. The issuer will disclose information on the use of proceeds, project evaluation and selection and management of proceeds to investors in a memorandum. It will also aim to provide annual use of proceeds and impact reporting on its website, according to the Second Party Opinion by RAM.

Climate Bonds view: Growth in Malaysia’s green bond market is good to see. To date, there have been no repeat issuers from Malaysia. This deal is especially positive given that the issuer is a large corporate with operations in several sectors.

It will be interesting to see which assets Pasukhas Group decides to finance, and whether it will issue more green bonds to fund other business areas in the future. As the first green sukuk guaranteed by Danajamin Nasional, it could also open doors to more issuers (and investors) for whom risk is a key concern.

SHREC ABS 1 LLC (USD38.6m), USA, issued a 2-tranche ABS in April 2019. The notes, rated by KBRA, have a legal final maturity in June 2044 and are backed by the proceeds from the sale of solar renewable energy credits (“SHREC Receivables”), generated under Connecticut Green Bank’s Solar Home Renewable Energy Credit (“SHREC”) program to Connecticut’s two investor-owned utility companies, The Connecticut Light and Power Company, a.k.a. Eversource Energy and United Illuminating Company under two Master Purchase Agreements (MPAs).

The SHRECs will be generated from solar PV systems participating in Connecticut Green Bank’s Residential Solar Investment Program. The bank aggregates these SHRECs into annual tranches and sells them to the utility companies at a fixed, predetermined price over a 15-year period. The SHRECs in this transaction will be generated from 6,788 PV Systems in Tranche 1 and 7,250 PV Systems in Tranche 2. Under the two MPAs, Eversource is required to purchase 80% of the SHRECs created within each tranche and United Illuminating is required to purchase the remaining 20%.

Climate Bonds view: This transaction presents a new approach to funding residential solar. The fixed price of the credits provides certainty to the utility companies and investors. It also demonstrates how local government can incentivise a shift to solar: the Green Bank provides incentives to homeowners and third-party system owners to deploy residential PV Systems, and acquires the renewable energy certificates pursuant to Public Act No. 16-212 and Public Act No. 15-194.

Vodafone (EUR750m/USD840m), UK, issued a 7-year senior secured green bond in May 2019, for which Sustainalytics provided an external review. Proceeds are being allocated to energy efficiency, renewable energy and green buildings. Sharing economy aspects, such as electric vehicle sharing and industry automation, are also included.

- Energy efficiency includes support for the roll-out of Internet of Things (IoT) technologies and efficiency in Vodafone’s operations. IoT examples include smart metering, smart parking and other smart city applications.

- Renewable Energy includes solar, wind, biofuel and absorption cooling.

- The Green Buildings category includes new buildings or retrofits of existing buildings with third-party certification standards such as LEED (Gold or higher) and BREEAM (Very Good or equivalent). Green buildings will need to be in the top 15% most efficient buildings in the region, aligned with CBI’s Low Carbon Buildings Criteria.

Vodafone will report annually on the allocation of proceeds and on the impact of the green project portfolio until proceeds have been fully allocated. The reporting will be published on Vodafone’s corporate website.

Climate Bonds view: As the need for data and connectivity increases and bumps up energy demand, it is important to engage the ICT sector in emission reductions through green financing. Vodafone is the first UK ICT company to enter the green bond market. The cumulative issuance from the sector globally now amounts to USD6.1bn.

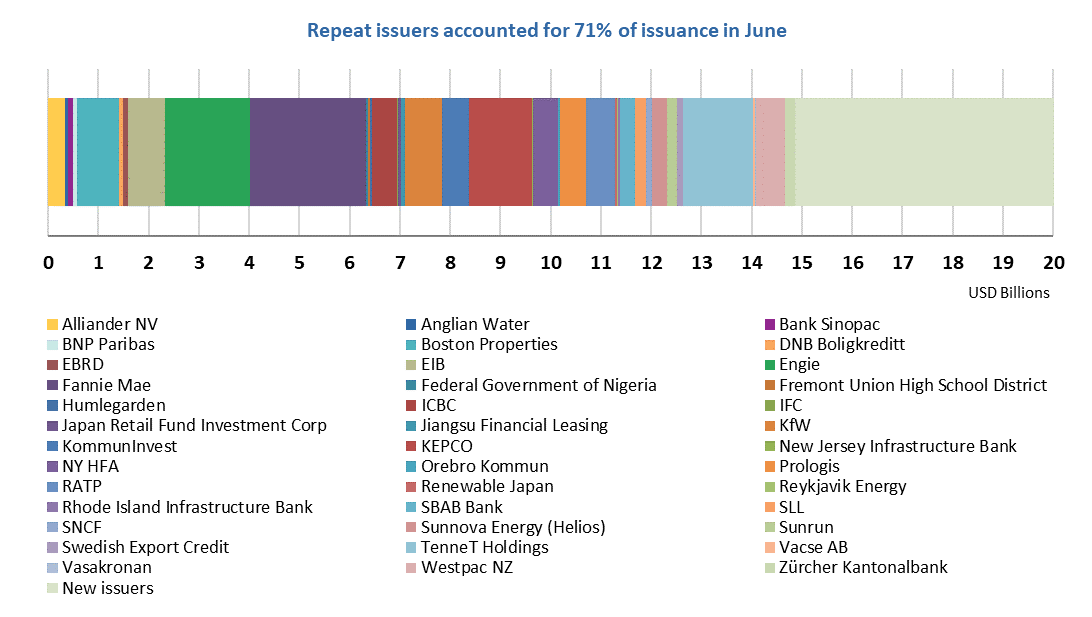

Repeat issuers – June

- Alliander NV: EUR300m/USD342m

- Anglian Water: JPY7bn/USD65m

- Bank Sinopac: TWD3bn/USD96m

- BNP Paribas: EUR60m/USD68m

- Boston Properties: USD850m

- DNB Boligkreditt: SEK700m/USD75m – Certified Climate Bond (Programmatic Certification)

- EBRD: HUF29bn/USD100m

- EIB: AUD400m/USD278m

- Engie: EUR1.5bn/USD1.7bn

- Fannie Mae: USD2.3bn

- Federal Government of Nigeria: NGN15bn/USD42m

- Fremont Union High School District: USD30m

- Humlegarden Fastigheter: SEK450m/USD49m

- ICBC: USD500m

- IFC: COP35bn/USD11m

- Japan Retail Fund Investment Corp: JPY7bn/USD65m

- KfW: SEK7bn/USD742m

- KommunInvest: SEK5bn/USD524m

- Kepco: USD500m

- Kepco: USD500m

- New Jersey Infrastructure Bank: USD8m

- NY State HFA: USD49m

- Orebro Kommun : SEK500m/USD53m

- RATP: EUR500m/USD565m

- Renewable Japan: JPY5.7bn/USD53m

- Republic of Chile: USD1.4bn

- Reykjavik Energy: ISK1.9bn/USD13m

- Rhode Island Infrastructure Bank: USD32m

- SBAB Bank: SEK3bn/USD317m

- SNCF: EUR100m/USD114m – Certified Climate Bond (Programmatic Certification)

- Stockholms Lans Landsting: SEK1bn/USD106m

- Stockholms Lans Landsting: SEK1bn/USD106m

- Sunnova: USD302m

- Sunrun: USD204m

- TenneT Holdings: EUR1.3bn/USD1.4bn

- Vacse AB: SEK300m/USD32m

- Vasakronan: SEK283m/USD30m

- Westpac: EUR500m/USD568 m

- Zürcher Kantonalbank: CHF200m/USD198m

Repeat issuers before June

- Dividend Finance: USD235m – July 2018

- Sunnova Energy (Helios 2): USD262.7m – November 2018

- Sunrun Athena: USD445.4m – December 2018

- Beijing Guozhong Biological Technology: CNY650m/USD89m – April 2019

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Standard Chartered |

EUR500m/USD565m |

02/07/2019 |

Excluded (Sustainability/SDG bond) |

|

Ahold Delhaize |

EUR600m/USD678m |

02/07/2019 |

Excluded (Sustainability/Social bond) |

|

Kookmin Bank |

USD500m |

02/07/2019 |

Excluded (Sustainability/Social bond) |

|

Yancheng South District Development and Construction Investment Co., Ltd. |

CNY1bn/USD145m |

26/06/2019 |

Excluded (25% working capital) |

|

Shenzhen Energy Group Co., Ltd. |

CNY1.15bn/USD167m |

24/06/2019 |

Excluded (proceeds not aligned) |

|

Huaneng Tiancheng |

CNY500m/USD72m |

20/06/2019 |

Excluded (30% working capital) |

|

Credit Agricole CIB |

SDG150m/USD110m |

09/07/2019 |

Pending (waiting for more information) |

|

The Swedish Covered Bond |

SEK6bn/USD640m |

23/02/2019 |

Pending (waiting for more information) |

|

Caisse Française de Finance |

EUR1bn/USD1.1bn |

19/02/2019 |

Pending (waiting for more information) |

Green bonds in the market

- Activia Properties Inc: closed July 9

- Prologis: closed July 10

- Sekisui House REIT: closed July 11

- Telekosang Hydro One Sdn Bhd: closing July 15

- Posco: closing July 15

- A2A: closing July 16

- Japan Housing Finance Agency: closing July 16

- Société Générale: closing July 17

- IFC: closing July 17

- Orix JREIT Inc: closing July 18

- BKW Group: closing July 29

- New York State Housing Finance Agency (USD9m tranche - Certified Climate Bond)

Investing News

The UK Government passed its net-zero 2050 target into law in late June. As part of London Climate Action Week last week, it launched a Sustainable Finance Strategy. As a further show of its climate leadership aspirations, the UK is bidding to host COP26 in 2020 jointly with Italy.

Another initiative launched last week is the United Nations and UK Government-backed Responsible Commodities Facility. The Facility will issue USD1bn of green bonds in the next 4 years to finance farmers and producers who commit to using degraded land as opposed to expanding into existing grasslands. The investment is expected to yield 180mt of responsibly produced soy and corn in the first decade. Climate Bonds CEO Sean Kidney spoke at the launch on July 4.

FTSE Russell has created the world’s first index to incorporate climate risk in government bond portfolios. The FTSE Climate Risk-Adjusted World Government Bond Index (Climate WGBI) aims to quantify the physical and transition risk and resilience implications from climate change to sovereign debt.

Asset manager Amundi and the European Investment Bank have teamed up to develop a green credit market for Europe. The programme, titled the Green Credit Continuum, will initially involve setting up a fund investing in high-yield corporate green bonds, green private debt and green securitised credit. A scientific expert group will develop guidelines in line with the EU Commission’s Sustainable Finance Action Plan.

The Santiago Stock Exchange in Chile reports that growing interest in green and social bonds, as instruments listed in this segment of the exchange have now surpassed USD560m since mid-2018. The segment is the first of its kind in South America, and its listing requirements are modelled after the Climate Bonds Standard.

Green Bond Gossip

The Financial Times reports that the widely anticipated Green Bund issuance from the Federal Government of Germany is nearing completion. A person with knowledge of the discussions remarked that green German government bonds could draw in particularly good investor demand due to the country’s strong standing in the capital markets and the added benefit of green assets.

German development bank KfW has stated that it plans to issue more green bonds in H2 2019. The planned additional amount could take its total issuance to more than EUR20bn (USD22.5bn). Under current conditions, KfW would become the 3rd largest issuer globally, surpassing the Republic of France.

Colombia’s green bond market may see more activity this year with Energy companies Celsia and government-owned ISA poised to be the next to tap green market, according to analysts.

The Portland Water District plans to issue USD6.5m in green bonds to finance improvements to public water supply, service lines and other infrastructure in its 360km2 service area.

The University of Vermont and State Agricultural College is preparing to include USD40m of green bonds in a forthcoming USD102m fund-raising. The proceeds of the green bond will be used to finance a new event centre that will be built to LEED Silver specifications and designed to conserve water and energy.

Readings & Reports

The new TPI State of Transition Report 2019 from the Transition Pathway Initiative estimates that as few as 1 in 8 companies in highly emitting industries are reducing emissions in line with keeping temperature rise limited to 2 degrees. Nearly half (46%) of companies are failing to integrate climate change into business decision-making.

A new survey conducted by UBS involving more than 30 central banks and sovereign institutions found that over 60% of these entities do not want to exercise more active ownership on engaging with companies on climate change. The report also found that more than half of them do not incorporate climate change as a risk in their portfolios beyond an ESG framework – most cited a lack of and poor quality of data as the reason.

For more positive reading: an article in the latest issue of Anthropocene Magazine covers energy-positive buildings in Norway, including a hotel. Examples of this new form of architecture can be found as far north as the Arctic Circle. The creators hope to expand their projects across the world including the US.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.