We have made some tweaks to our Market Blog format to make it easier for readers to keep up with the very latest. Click here to see the full list of new and repeat issuers.

And don’t forget! Early bird registration for our March Conference and 3rd Annual Green Bonds Awards closes this week. Details here.

Highlights

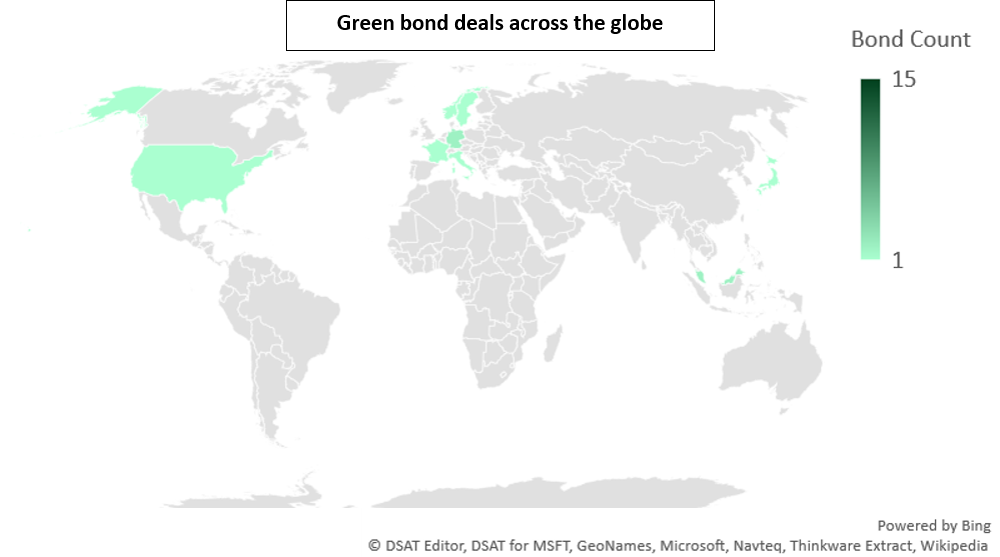

- Five new issuers from Norway, Malaysia, Singapore and Hong Kong in January

- January trends: Renewable Energy dominates Use of Proceeds; Non-Financial Corporates lead Issuer Types

- Two more Certified Climate Bonds from Nordex SE & LBBW closed, and Australia’s NAB with a certified green RMBS closing soon

- February is shaping up as month of the Sovereign green bond with Poland closing its second green bond, and Belgium marketing its first Green OLO

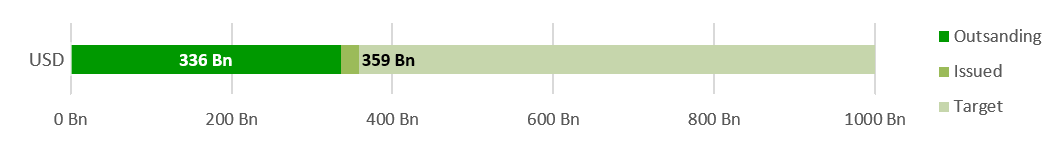

Our ultimate target is to get to USD1tn issuance per annum by 2020. Let’s start by getting cumulative green bond issuance to USD1tn.… and then we’ll move the goalpost!

At a glance

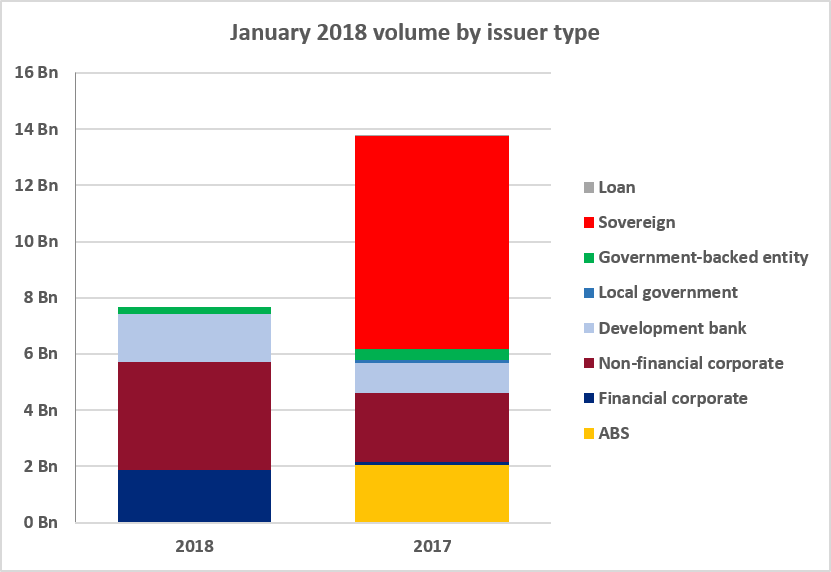

Green bond issuance kept up the pace from a strong finish in December, with January’s issuance amounting to USD7.7bn. This value is 44% lower compared to January 2017 issuance, which was significantly boosted by France’s EUR7bn debut sovereign green bond.

If the big French sovereign bond were excluded from the figures, January 2018’s issuance would be 23% higher than 2017, confirming a healthy start to 2018.

Among the debut deals is the first green residential covered bond of EUR1bn and the first green sukuk of 2018.

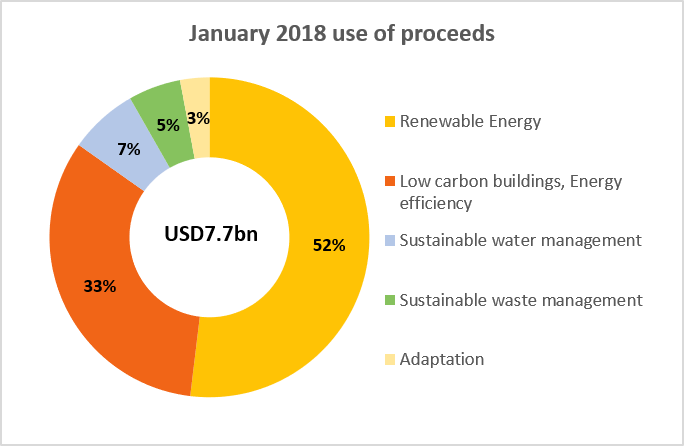

Monthly trends show that renewable energy dominates use of proceeds at 52% of allocations, with Low Carbon Buildings / Energy Efficiency at 33%. Non-Financial Corporates take the lead among issuer types.

>See the full list of new and repeat issuers here.

Certified Climate Bonds

Nordex SE (EUR275m / USD337m)

Germany’s Nordex SE, a global developer, manufacturer and provider of onshore wind turbine systems, issued its second Certified Climate Bond for an amount of EUR275m. Proceeds will be used to partially refinance the Certified Green Schuldschein issued in 2016 and to finance the development of the Delta400 Wind Turbine series. Both of Nordex’s green bonds obtained Certification under the Wind Criteria of the Climate Bonds Standard.

DNV GL provided the Pre-issuance Verification Report.

Landesbank Baden-Württemberg (EUR750m / USD884m)

German lender Landesbank Baden-Wuerttemberg (LBBW) issued the bond in December and we had covered it in our December Market Blog. The bank has now completed the certification process under the Climate Bonds Standards for Low Carbon Buildings (Commercial): more details can be found here. The verification was performed by Oekom.

An energy efficiency assessment was provided by Drees & Sommer.

>See the full list of Certified Climate Bonds here.

New Issuers

Mudajaya Group Berhad (Sinar Kamiri), Malaysia, issued a MYR245m (USD63m), 18-year green sukuk, the first in 2018 and fourth since Tadau Energy’s first green sukuk from July 2017. Proceeds will finance a largescale 49MW solar photovoltaic plant in Sungai Siput, Perak (Malaysia). RAM Holdings assigned the green SRI sukuk a Tier-1 Environmental Benefit rating, the highest of three rating levels which indicates that: “Project is an important component of low carbon future and has clear, demonstrable environmental benefits. Project directly contributes towards substantial and sustainable reductions of greenhouse gas emissions.”

Climate Bonds view: We agree.

Segi Astana Sdn Bhd, Malaysia, issued a MYR415m (USD104m), 10-year ASEAN Green MTN Facility. Segi Astana is a JV between engineering and construction group WCT and Malaysia Airport Holdings. The bond will finance a property certified as LEED Silver. RAM Holdings assigned the bond a Tier-3 Environmental Benefit rating, the lowest of three rating levels indicating the “project has minimal contributions towards a low carbon future and has minimal demonstrable environmental benefits.”

Climate Bonds view: The market best practice threshold is LEED Gold and what we want to see is more ambition and more Green Buildings achieving best-in-class certification levels.

Sindicatum Renewable Energy, Singapore, issued an INR2.5bn (USD40m), 7-year green bond. Parent company Sindicatum Sustainable Resources is a developer, owner and operator of clean energy projects. This is the first international green bond to comply with both the GBP and the new ASEAN Green Bond Standards. The deal benefits from a Sustainalytics Second Party Opinion.

The proceeds will be used to finance a bagasse-cogeneration project. Bagasse is the residue that remains after juice has been extracted from sugar cane. Agricultural waste from sugar mills will be utilised to generate heat and power for use by the sugar mills, with surplus generation to be exported.

Climate Bonds view: The project will exclusively use sustainable biomass, so it complies with the Climate Bonds Taxonomy. Recycling waste productively is a good thing.

SpareBank 1 Boligkreditt, Norway, issued a EUR1bn (USD1.2bn), 7-year green covered bond. The company is a Norwegian covered bond issuer jointly owned by the saving banks under the SpareBank 1 brand. The jumbo bond is the largest green covered bond to date. Proceeds will finance mortgages for residential properties built under Norwegian building codes TEK07 (2007), TEK10 (2010) or TEK17 (2017) or energy efficient housing built under older codes, but compliant with an A, B or C EPC rating. Until EPC ratings become available to the issuer, only new properties will be eligible. Multiconsult estimates that 8% of residential buildings in Norway are compliant with the three most recent building codes. The deal benefits from a Second Party Opinion from DNV GL.

Climate Bonds view: Norwegian building codes have made energy efficiency threshold levels progressively more stringent. We like to see green bonds funding buildings with energy efficiency in the top 15% for their location.

Swire Properties, Hong Kong, issued a USD500m, 10-year green bond. This is the first green bond in Hong Kong to obtain a pre-issuance certification under the Hong Kong Quality Assurance Agency’s (HKQAA) Green Finance Certification Scheme. For Energy Efficiency, a 10% efficiency improvement is well below the market’s best practice set at 20-30%. However, as noted in Sustainalytics’ second opinion, Swire Properties have already achieved 18.9% energy efficiency improvements (compared to 2001 levels) in its Hong Kong asset portfolio and 32% energy intensity reductions in its Mainland China asset portfolio.

Climate Bonds view: Achieved energy efficiency improvements are commendable, so good work from Swire, but we would prefer to see future energy efficiency improvements in the order of 20-30%.

>See the full analysis for each new issuer here, or click on the issuer names above.

Repeat issuers – January

- EIB: SEK1.5bn/USD190m; AUD175m/USD139m (tap); CAD700m/USD563m; AUD750m/USD594m

- KfW: SEK1bn/USD125m

- NWB Bank: SEK2bn/USD252m

- Invenergy: USD64.8m

- Engie: EUR1bn/USD1.2bn

- Enel: EUR1.25bn/USD1.5bn

- Vasakronan: SEK200m/USD25m

- Mitsubishi UFG: EUR500m/USD621m

New bonds – pending and excluded

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds taxonomy in our green bond database. If issuers do not provide sufficient information on the use of proceeds, the bonds are tagged as “pending”. If and when satisfactory additional information becomes available, we may include them in our database.

- Hitachi Capital Management China (USD100m) – Excluded: use of proceeds is wide-ranging, including circular economy, sustainable development and quality of life improvement in the region. Insufficient detail available on projects with emissions reductions potential and limited public disclosure.

- Iberdrola (EUR5.3bn), Green Syndicated Loan – Pending: amendment and extension of existing loan is conditional on fulfilment of a sustainability indicator, which will be independently assessed by Vigeo Eiris.

Trends of the month

Green bonds in the market

Closed in February:

- EIB: AUD400m/USD321m (tap)

- MidAmerican Energy: USD700m

- Province of Ontario: CAD1bn/USD813m

- Republic of Poland: EUR1bn/USD1.2bn

- KfW: SEK5bn/USD632m

In the market:

- NAB – NRMBS 2018-1: AUD300m/USD233m green tranche (Certified Climate Bond) of AUD2bn / USD1.6bn RMBS – priced, closes 15 February

- Ligonier Valley School District: USD10m – priced, closes 22 February

- Kingdom of Belgium – Green OLO roadshow started 8 February

- Republic of Indonesia – sounding out investors

NAB’s green tranche in the National RMBS Trust 2018-1 securitisation is a new first for Certification under the Climate Bonds Standard for Low Carbon Buildings. Well done! More on the deal to follow in our next blog.

March of the Sovereigns

February is shaping up as the month of the Sovereign green bond. Poland has closed its second sovereign green bond, while Belgium is marketing its first to investors. Proceeds from Belgium’s Green OLO are expected to fund rail investments.

News on an Indonesian sovereign green bond emerged in January. This would be an Asian first. Our Gossip section below covers several other nations mulling their options.

Investor News

Chinese bank ADBC listed on the Luxembourg Green Exchange to improve visibility for its offshore issuance and gain increased investor access.

Lyxor’s Green Bond ETF, launched in March 2017, has cross-listed on Frankfurt’s XETRA. Lyxor’s index ETF tracks the performance of Solactive’s Green Bond Index.

Foresight’s first Italian infrastructure green bond fund completed its first close at EUR70m in January 2017. It is expected to start investing in the first quarter in solar, wind, waste-to-energy, biomass and energy efficiency projects. Foresight is a UK fund manager in the renewable energy sector.

Green Bond Gossip

Potential green sovereign issuers keep coming. Expectations for Sweden rose following recommendations of a government inquiry. Hong Kong once again signalled its intention to issue a green sovereign, as we noted last November. The government of Kenya has pushed the floating of its sovereign green bond to the 2018-2019 financial year, while waiting for regulatory frameworks to be put in place.

Is India's first green muni bond on the horizon? Our Mumbai report from August 2017 gives some of the wider local muni back story.

Reading and Reports

The Climate Bonds Initiative and the China Central Depository & Clearing Co. Ltd (CCDC) just published their China Green Bond Market 2017 report, supported by HSBC.

Here in English. Here in Chinese: 点击下载中文报告.

If you haven’t read it yet, check out the Executive Summary of the Final Report of the EU HLEG on Sustainable Finance

Our US green muni highlights for 2017. Last year’s record $11.05bn issuance reflects “a growing interest in leveraging green bonds as a valuable tool for States and cities to finance their climate strategies” says Justine Leigh-Bell.

The Jakarta Post reports Climate Bonds signing a MoU with PINA a part of BAPPENAS, the State Development Planning Authority and PT.EBA Indonesia to promote green infrastructure investment.

Sean Kidney in the New Straits Times on Malaysia’s potential to lead green finance in ASEAN.

Green bond: c’è anche l’Italia nel 2017 dei record. L'articolo di Sean Kidney per RiEnergia.

Moving Pictures

You can watch our Seven Super Trends for 2018 on YouTube. 1:01secs.

We’ve only just come across this intriguing clip of the potential for fossil free steelmaking from SSAB. HYBRIT is the term. 2:08secs. Of course, there’s a Swedish version.

The California Treasurers Office has released a new video exploring green bonds and US infrastructure investment in advance of the big Green Bond Symposium in Santa Monica on the 27th and 28th February. Our own Justine Leigh-Bill is participating in the Innnovations Lab & is one of the Conference speakers. 3:48 secs for the Treasurers new clip.

And as an extra treat for Market Blog readers here's our latest Climate Bonds Partner, the Indonesia Stock Exchange (IDX) in Special Dialogue with Sean Kidney.

At a 23:21secs with a mix of Bahasa & English it's a long haul reflecting the the importance the IDX is placing on green finance. You can skip to 3:26sec, 11:11secs or 17:18secs for the English segments and to see Sean in his best batik shirt.

That's enough for the first month in what we hope to be a monster 2018!

‘Till next time,

Climate Bonds

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.