Climate Combatant Finance Ministries are using green bonds as a sustainable economic policy tool

With sovereign green issuance reaching USD24.6bn in 2019, almost 10% of the record $258bn…we take a closer look

Chile goes to market with 3rd round

Climate Combatant Finance Ministries are using green bonds as a sustainable economic policy tool

With sovereign green issuance reaching USD24.6bn in 2019, almost 10% of the record $258bn…we take a closer look

Chile goes to market with 3rd round

On the BGFI 2020 agenda: Pricing sovereign and corporate risk, international market trends in green finance and release of the new Agriculture Criteria.

São Paulo sets the scene

Na primeira reunião do ano, discussões sobre precificação de risco soberano e corporativo, tendências do mercado internacional em finanças verdes e o lançamento de Critérios para o setor agrícola.

Do que se trata?

Expansion of the Climate Bonds Standard into Sustainable Agriculture

Twin Webinars outlining the Criteria. Your chance to make comments and ask questions.

2019 Summary & 2020 Market Predictions

More information & registration is here.

Welcome to the new Markets Monthly!

We have changed the format slightly and would love to hear your feedback…

In January, authors from several institutions under the aegis of BiS, published The Green Swan[1] Central banking and financial stability in the age of climate change setting out their take on the epistemological foundations for, and obstacles against, central banks acting to mitigate climate change risk.

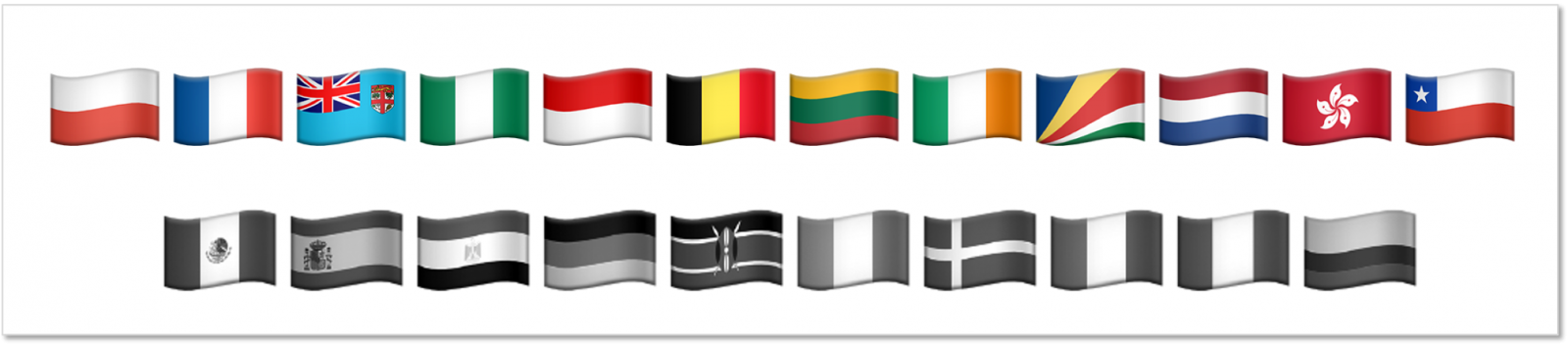

Milestones aplenty in 2019: More issuers, more jurisdictions: US, China, France lead national rankings: Europe heads regional market momentum and France heads Europe

At a Glance- The 2019 numbers

Chile now accounts for a total of $6.228 billion in Certified SGB issuances (in dollars and euros)

The Government of Chile has continued its sovereign green program into 2020 with total green issuances reaching US$ 6.228 billion.